Home / Green Finance: Sustainable Expense Management Practices

Green Finance: Sustainable Expense Management Practices

- Last updated:

- Blog

Pleasant news for planet Earth: What started as a nice-to-have strategy has become a must for nearly every company. Green finance has shifted from a niche approach to a core component of corporate planning in recent years. It is now more than just another buzzword, as the concept represents a holistic approach to managing expenses and investments that align with sustainability objectives. Its goal is to mitigate climate change, improve corporate responsibility, and ensure long-term financial stability. This article discusses how green finance has come about, its significance in modern business, and practical ways in which organisations can reduce their environmental footprint through sustainable expense management. Let’s dive in and learn more!

Why green finance matters

The global consciousness around environmental sustainability and corporate responsibility is undeniable and has made green finance an essential part of most corporate strategies. Nowadays, environmental, social, and governance (or ESG) metrics have become key performance indicators that investors and businesses monitor closely. They reflect how well a company is balancing its financial performance with its environmental responsibilities, social impacts, and governance frameworks.

Moreover, investors increasingly favour organisations that are committed to sustainable business practices. Green finance supports this shift by directing capital towards projects and practices that prioritise sustainability. That is why companies that integrate green finance principles are likely to have a competitive advantage, as they can attract investors who prioritise sustainable investment and demand transparency in corporate governance.

The business case for green finance

Beyond environmental stewardship, green finance offers tangible business benefits. Many companies now recognise that their long-term profitability depends on their ability to address the risks that climate change poses to humanity and nature. As consumers become more conscious of a brand’s environmental footprint, those who adopt green initiatives often see improved brand loyalty and can open doors to new market opportunities.

Furthermore, green finance enhances risk management by mitigating the impact of potential regulatory changes, carbon taxes, and supply chain disruptions due to environmental factors. Rather than just reacting to future regulations, companies can improve their financial performance by proactively incorporating sustainability goals and anticipating upcoming changes.

Green procurement and how it impacts expense management

Green procurement has proven to be one of the most immediate ways to incorporate green finance principles into expense management. This includes making deliberate choices to purchase goods and services with minimal environmental impact throughout their lifecycle—from production to disposal.

Adopting green procurement can significantly influence every company’s carbon footprint and expenses. By prioritising vendors and suppliers who operate sustainably, use renewable energy sources, or offer eco-friendly alternatives, your business can reduce emissions while simultaneously managing costs more effectively—definitely a win-win situation.

Sustainable supply chains

The supply chain often gets overlooked when talking about green finance. A company may make sustainable commitments internally, but if its suppliers do not align with these values, it can offset potential environmental gains. By ensuring suppliers adhere to sustainable practices, companies can aim to extend their initiatives beyond their direct control. Depending on a company’s influence, this effort can create a ripple effect that is able to impact an entire economic ecosystem.

Even if your business doesn’t have the means to implement big initiatives, there is a way to create a significant internal impact. For example, procuring energy-efficient equipment may involve an upfront investment but will likely lead to lower energy expenses over time. Similarly, opting for sustainable materials often saves costs if they are designed for durability and longevity.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Carbon footprint tracking for expenses

Of course, companies should also develop robust systems for tracking their carbon footprint to take green finance seriously. This goes beyond merely calculating emissions from manufacturing or transportation; it involves fully understanding how every aspect of the business contributes to its environmental impact.

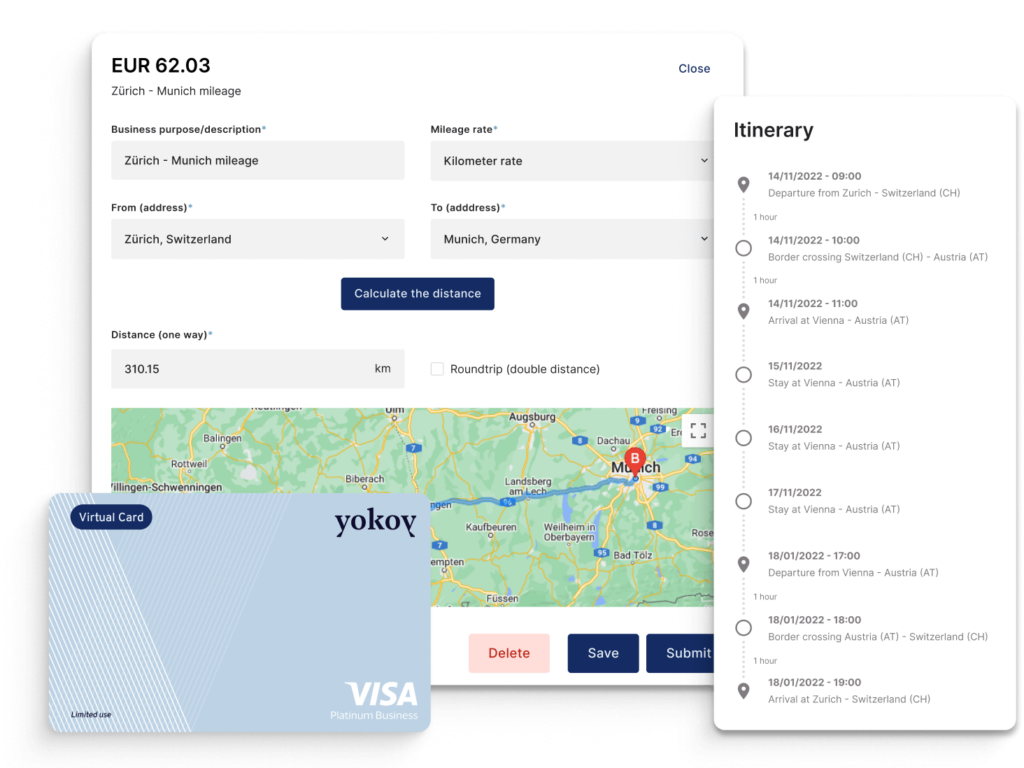

Companies are now using advanced tools to track and quantify the environmental costs of their day-to-day operations. Expense management software with integrated carbon tracking capabilities allows businesses to assess the ecological impact of each expenditure, from employee travel to office energy use. By tracking this data, organisations gain valuable insights into areas where they can make more sustainable choices.

Monitoring carbon emissions in real time also provides actionable insights into your company’s environmental performance. For instance, you can track which departments or activities contribute the most to the carbon footprint. As a result, you can adjust policies or behaviours accordingly. Companies can also use data to report their environmental impact to investors, stakeholders, and consumers.

How to reduce the company’s carbon footprint

Reducing a company’s carbon footprint requires both strategic planning and practical action. Below are several fundamental approaches businesses can adopt to minimise environmental impact while maintaining cost-effective expense management.

Implementing a corporate sustainability programme

A comprehensive corporate sustainability programme lays the foundation for long-term environmental improvements. Instead of empty promises that make a company appear committed, it should include measurable targets for reducing energy consumption, emissions, and waste. Corporate social responsibility (CSR) initiatives that align with green finance can also provide a framework for integrating sustainability into all business areas. By establishing sustainability goals, companies can embed green finance principles into their decision-making processes, ensuring that environmental impact is considered at every stage of operations.

Remote work to reduce travel expenses

Most might call it a no-brainer nowadays: Remote work has proven to be one of the most effective ways to reduce a company’s carbon footprint. However, many businesses bounced back to office duty after COVID-19, even though they could significantly reduce travel-related emissions by allowing employees to work from home. Even a hybrid model, where employees split their time between remote and office work, can substantially reduce carbon emissions associated with commuting. And of course, remote work can also translate into cost savings by reducing the need for office space, utilities, and other expenses to maintain a physical workspace.

Sustainable travel policies

Implementing sustainable travel policies can make a significant difference for organisations where travel is essential. This could involve selecting energy-efficient modes of transport, such as trains over flights for shorter journeys. Moreover, a business can implement rules for when meetings should be held online.

Carbon offsetting

Although the focus should always be on reducing emissions directly, carbon offsetting can help companies address any remaining environmental impact while further aiming for economic growth. Many businesses are investing in low-carbon technologies or contributing to renewable energy sources and green projects to counterbalance their carbon output.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Digital transformation for sustainable finance

The digital revolution has created a host of opportunities for businesses to adopt sustainable finance practices, especially in expense management. So why not use technology to streamline operations, reduce waste, and automate sustainable decisions? This approach can significantly enhance a company’s environmental performance while improving efficiency.

Virtual meetings

The shift to virtual meetings has become a permanent fixture for many businesses. Not only does this reduce the need for time-consuming business travel, but it also cuts the associated costs, including airfare, accommodation, and dining. More importantly, virtual meetings lower the carbon footprint.

Paperless expense management

Another major step towards environmental sustainability is the transition to paperless expense management. By eliminating paper invoices, receipts, and expense reports, companies can reduce waste and streamline their financial processes. Digital platforms offer seamless expense tracking, approval workflows, and secure cloud storage, contributing to both cost savings and environmental benefits.

Automating sustainable decisions

AI-powered expense management software can help companies make sustainable decisions more easily by automating suggestions for environmentally friendly options. For example, when booking business travel, the software can recommend low-carbon options like eco-friendly hotels or hybrid car rentals. Similarly, it can highlight sustainable procurement options, encouraging employees to choose vendors that align with the company’s green finance policies.

Expense management software with AI

Modern expense management software now incorporates AI and machine learning to provide companies with valuable insights into their spending patterns and environmental impacts. These tools enable companies to track expenses with greater accuracy, identify areas for cost reduction, and understand the full environmental impact of their purchasing decisions. AI-driven solutions can also automate tasks such as carbon footprint reporting, making it easier for businesses to comply with ESG requirements.

Next steps

You see, green finance is about so much more than simply reducing costs—it helps you create a business model that thrives and supports a world where environmental responsibility is becoming increasingly important. Do you want to explore how your company can optimise its expense management while contributing to a more sustainable future?

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.