Home / Efficient Travel Expense Management: Pre-Trip, On-Trip, and Post-Trip Recommendations

Efficient Travel Expense Management: Pre-Trip, On-Trip, and Post-Trip Recommendations

- Last updated:

- Blog

Co-founder & CCO, Yokoy

The past few years have brought significant changes in the business travel segment. The biggest impact was certainly the Covid pandemic, which threw a wrench in travel plans for companies around the world.

But beyond that, there are other factors – both external and internal – that are making business travel management more challenging than it used to be.

In this article, we’ll explore some of the key steps that companies can take to fix an inefficient T&E management program and achieve greater efficiency, accuracy, and control over their travel expenses.

Main challenges in travel and expense management

Time-consuming administrative tasks

It is still common practice in many mid-sized to large companies for employees to collect their paper receipts, prepare expense reports by hand and then have to wait a long time for reimbursement.

The finance department, on the other hand, has to check every single expense report manually – a process prone to error. In addition, companies often do not have a complete overview of all the expenses incurred by their employees during a trip, as the reporting is often done at the end of the month.

In a survey conducted by Forrester Consulting, 30% of respondents stated that T&E management tasks are predominantly or completely manual in their organization, causing strain on employees, management, and accounting.

In addition, the survey shows that the situation is exacerbated by the lack of integration between travel tools, expense tools and other systems. This makes the T&E process lengthy and inefficient, with the end-to-end process taking an average of 13.6 hours per trip.

Fenaco standardized their expense management with Yokoy

“With Yokoy, we have opted for a uniform and group-wide expense management solution that unifies our different expense processes on one platform and automates them across organizations, for increased efficiency.”

Marianne Schluep, Head of Finance and Accounting

Poor user experience

Another common challenge in T&E management is the use of outdated and cumbersome travel and expense management systems, which offer a poor user experience. This may cause employees to become frustrated and work around the travel expense tools, leading to non-compliance with company policies.

In addition, employees may be required to use a variety of payment methods, such as credit cards or cash, to pay for their expenses, and to manage expenses in different currencies and comply with foreign regulations.

Companies need to have a system in place that can handle currency conversions and comply with local regulations, without overcomplicating the reporting of business travel expenses for employees.

Increased risk of error and fraud

Manual data entry is prone to errors, which can lead to inaccurate expense reporting and potential compliance issues.

For example, employees may mistakenly submit a receipt twice, or may add the wrong amount when reporting their travel expenses. Next to this, companies often have specific policies regarding business travel and expense management, such as limits on the amount that can be spent on meals or accommodations.

Expense fraud can easily occur if, for example, employees decide to pocket a portion of their daily allowance, instead of using their per diems in full. Milleage padding, fake expenses and unused airline tickets are other forms of travel fraud commonly affecting companies today.

Ensuring that all employees comply with these policies can be challenging, and failure to do so can result in unnecessary expenses and compliance issues.

Blog article

How to Prevent Expense Fraud with AI-Driven Compliance and Custom Workflows

Expense fraud is a pervasive problem that continues to plague companies of all sizes and industries. In fact, a recent survey by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being one of the most common types of fraud.

Lars Mangelsdorf,

Co-founder and CCO

Inefficient expense reporting

Inefficient expense reporting can be a major headache for businesses, particularly those with employees who frequently travel and incur expenses. Without a streamlined process in place, reporting can quickly become overwhelming, leading to errors, discrepancies, and even financial losses.

To ensure accurate and timely expense management, companies need to implement an efficient system that can capture all the relevant data and provide detailed reports for accounting and reimbursement purposes.

This may involve leveraging digital tools such as expense management software, which can automate many of the manual processes associated with expense reporting.

Blog article

Automated Expense Reporting: Simplify Expense Tracking and Maximize Compliance

Automated expense reporting helps you simplify expense tracking, enforce compliance, and streamline your expense management workflows. See how it works.

Lars Mangelsdorf,

Co-founder and CCO

Lack of visibility and control

One of the major challenges faced by companies in managing travel and expenses is the lack of visibility and control over business spend.

Many companies use different systems for different aspects of travel and expense management, such as booking travel, submitting expense reports, and processing reimbursements.

This can lead to siloed data, ineffective workflows and approval processes, and a lack of visibility, making it difficult to get a comprehensive view of expenses.

Without proper visibility, companies cannot accurately track expenses and identify potential cost-saving opportunities. Additionally, the lack of control can lead to employees making unauthorized purchases or exceeding their spending limits.

Maintaining security and privacy

Finally, with sensitive financial information being shared and stored, it is essential for companies to maintain security and privacy. This includes ensuring that employees have access only to the information they need and that all data is securely stored and transmitted.

White paper

The Future of Travel and Expense Management

After massive slumps caused by the pandemic, business travel is finally recovering. However, macroeconomic challenges are slowing the catch-up effect, forcing finance and travel leaders to cut costs by limiting business trips.

How can companies adapt?

How to fix an inefficient T&E management program

Fortunately, there are steps that companies can take to fix an inefficient T&E management program and improve the overall process.

1. Take a holistic approach and build an integrated process

An inefficient T&E management program often stems from a disjointed process caused by data and system silos. To fix this, companies should take a holistic approach and consider the entire T&E process from end to end.

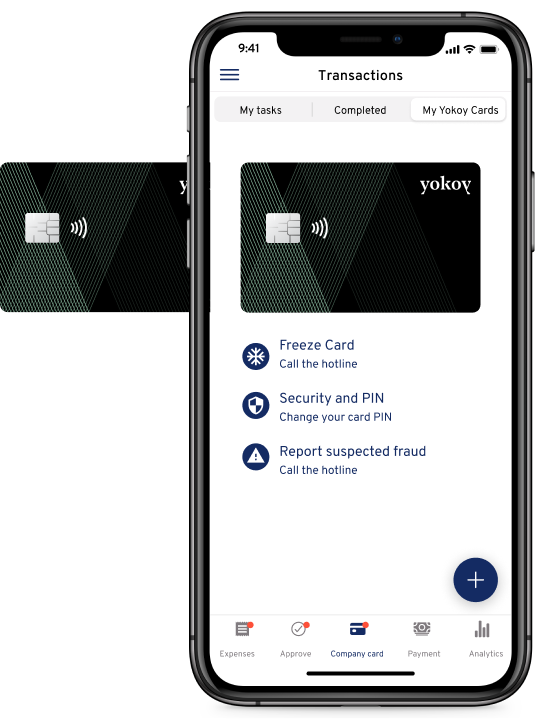

This includes evaluating everything from travel booking to expense reporting and reimbursement, and consolidating all the business expenses into once central spend management platform.

By bringing all the process steps into one central tool, companies can achieve a seamless data flow, accurate tracking, and efficient expense management workflows, while identifying inefficiencies and opportunities for improvement across the entire process with ease.

2. Set clear travel policies and guidelines

Next step in fixing an inefficient T&E management program is to establish clear travel policies and guidelines. This provides a framework for managing travel expenses and helps ensure compliance with company policy and regulations.

Clear travel policies should cover a range of topics, including travel booking procedures, allowable expenses, spending limits, reimbursement procedures, and more. By setting clear guidelines for how employees should book and manage their travel, companies can ensure that all expenses are accounted for and that employees are not exceeding their budgets or submitting inappropriate expenses.

To be effective, these policies should be communicated clearly to all employees and enforced consistently across the organization. This may involve providing training or resources to help employees understand the policies and guidelines, as well as using software that enforces compliance through built-in rules.

3. Use smart corporate cards and dedicated travel expense software

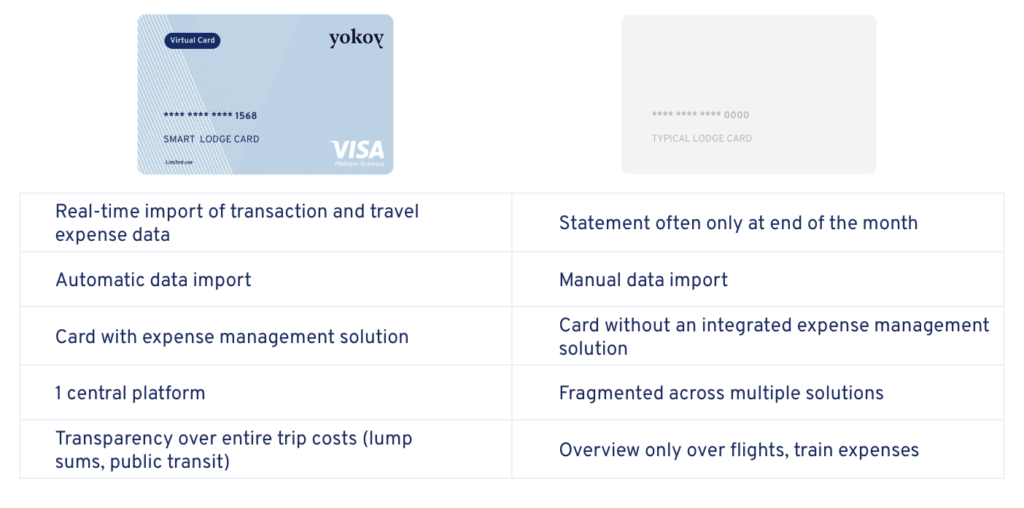

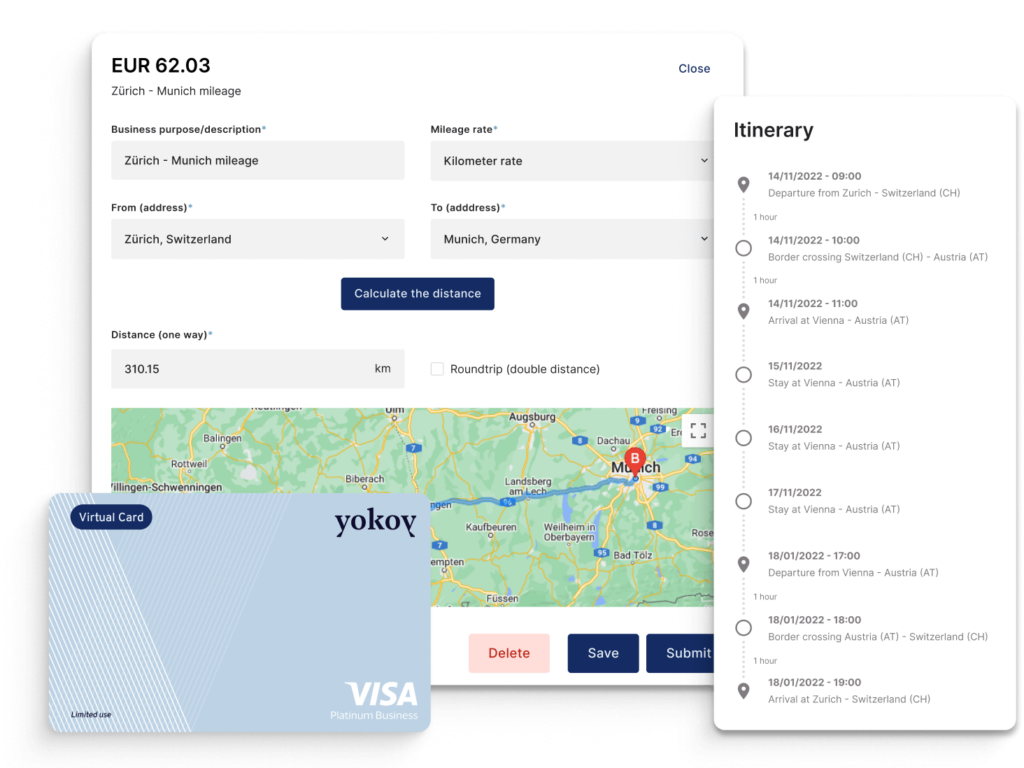

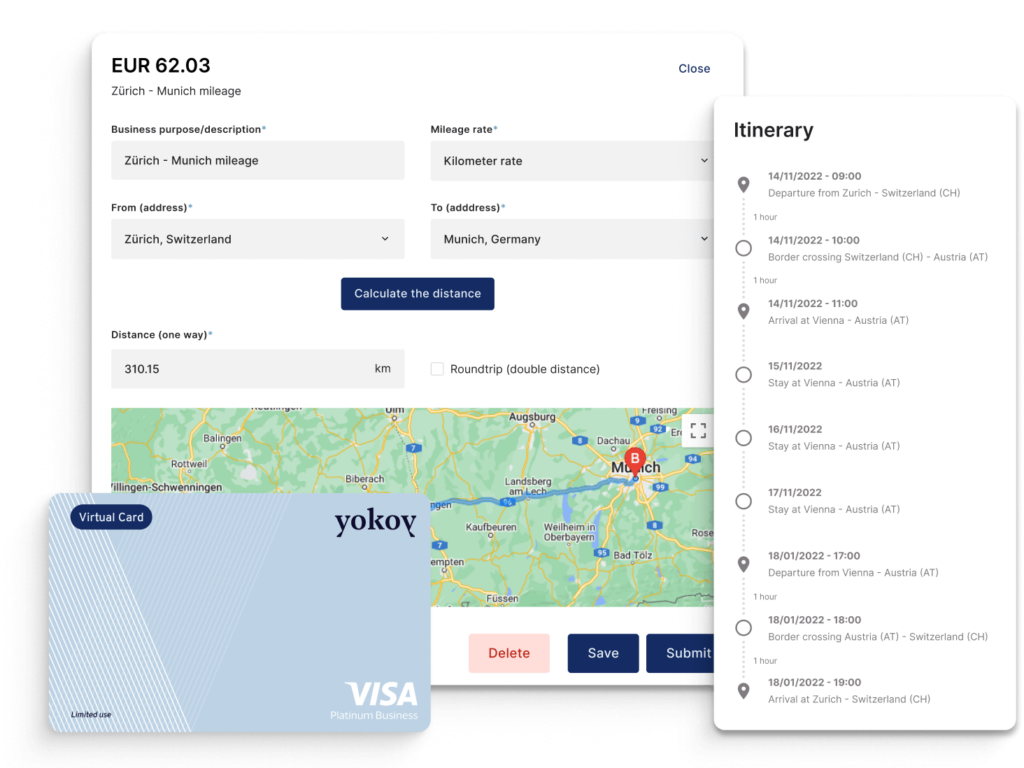

Smart corporate cards and lodge cards provide organizations with better control over employee expenses, greater visibility into T&E spending, enhanced data analytics capabilities, streamlined expense management, and improved employee satisfaction.

Moreover, they eliminate the need for paper receipts, and can be issued as virtual cards or typical corporate cards. These cards can be programmed with specific spending limits and merchant categories, and they can generate transaction data that can be analyzed to identify spending trends and outliers.

Using smart corporate cards helps companies simplify administration and streamline the expense management process by automating data capture and reporting. Unlike traditional lodge cards, the issuing and tracking of smart cards requires very little human intervention.

In combination with spend management software such as Yokoy, such cards are powerful tools for fully automating the travel expense management process, from end to end. We’ll cover this in the last section of the article.

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

4. Enforce compliance with AI and automation

Even with clear policies and guidelines in place, non-compliance can still occur. To fix an inefficient T&E management program, companies should enforce compliance with the help of technology.

AI-powered automation can help not only in reducing errors, simplifying workflows, and speeding up the reimbursement process, but can also prevent policy breaches by identifying errors, outliers, and potentially fraudulent activity in real time.

This can help to ensure that all employees follow the policies and guidelines set forth by the company, and that overspending is minimized.

For example, with Yokoy, admin users can receive notifications in real time when a lump sum is exceeded, or if a submitted receipt is a duplicate. Also, items such as alcoholic beverages can be automatically detected by AI technology, and specific workflows or pre-approval flows can be automatically activated when policy breaches occur.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

5. Remove system and data silos through integrations

We’ve mentioned this already, but siloed systems can lead to data inconsistencies and inaccuracies.

By consolidating all aspects of the travel and expense management process into one platform, companies can ensure that all data is up-to-date and accurate, and that all employees have access to the same information.

This can improve visibility and control over travel spend, reduce the risk of errors, and simplify the overall process.

To ensure seamless data flow and accurate tracking, companies should integrate their T&E management tools with their financial systems and other relevant platforms. This integration helps to ensure that all data is up-to-date and accurate, and that all employees have access to the same information.

On processes 10k expenses monthly with Yokoy

“Yokoy has played a pivotal role in revolutionizing our expense management as we experience rapid global growth. The automation rate of nearly 90% is impressive, allowing us to handle a vast number of expenses with ease.”

Christoph Kühne, Group Finance, On

6. Monitor and analyze expenses in real time

Finally, regularly monitoring travel expenses can help companies identify areas for improvement and cost-saving opportunities.

By analyzing travel and expense data, companies can identify patterns, such as areas where overspending is occurring, or categories where expense policies are constantly misinterpreted, and develop strategies to address these issues and optimize their travel spending.

In summary, fixing an inefficient corporate travel management program requires a holistic approach that involves setting clear policies, removing silos, enforcing compliance, and monitoring and analyzing expenses.

So what does a fully optimized travel expense management process look like?

The ideal travel expense management process

To future-proof their operations in a challenging market environment, companies need an end-to-end travel and expense management process that offers a seamless experience to all stakeholders – same as booking a private trip.

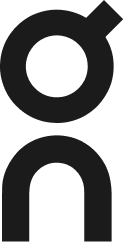

Yokoy’s expense management solution addresses this need by enabling a fully automated process. Through partnerships with travel management solutions such as TravelPerk, our platform helps companies centralize all travel expenses in one tool, for easier expense tracking and reporting.

Pre-trip: One smart lodge card for all business expenses

To streamline business travel, companies require an integrated T&E solution even before the trip commences. Such a solution not only enhances the traveler’s convenience but also minimizes administrative tasks while offering transparent booking and spending information.

The Yokoy Smart Lodge Card is a virtual card that is stored with the travel agency and can be used by the travel program manager or by the employees to book their business trips collectively. Yokoy partners with travel management tools to fully streamline pre-trip payments.

The Lodge Card is smart not only thanks to fully automatic, real-time data imports: Billing also works without manual intervention. Invoices are received centrally and can be automatically reconciled with bookings and posted.

This significantly reduces the administrative workload for both submitters and approvers, and makes the expense reporting process extremely straightforward: Employees no longer need to pay upfront for costly items like flights or hotels and avoid the manual uploading of invoices, leading to a smoother travel experience.

The card also benefits finance teams, providing them with complete visibility of pre-trip expenses and allowing them to prevent overspending and enforce company policy compliance.

You can learn more about the Smart Lodge Card below.

Yokoy Smart Lodge Card

One card for all your travel bookings

Securely pay for flights, rail, hotel, and travel services with one central Smart Lodge Card. No transaction fees, no foreign exchange fees, no card fees.

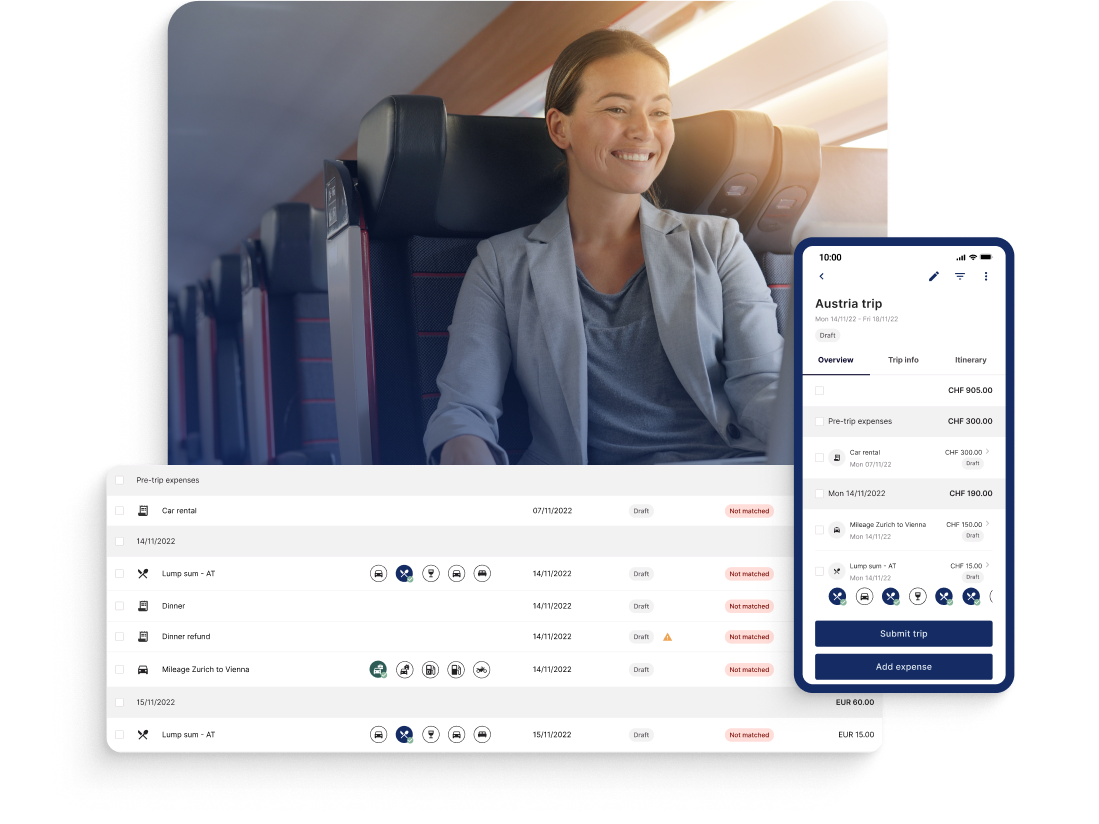

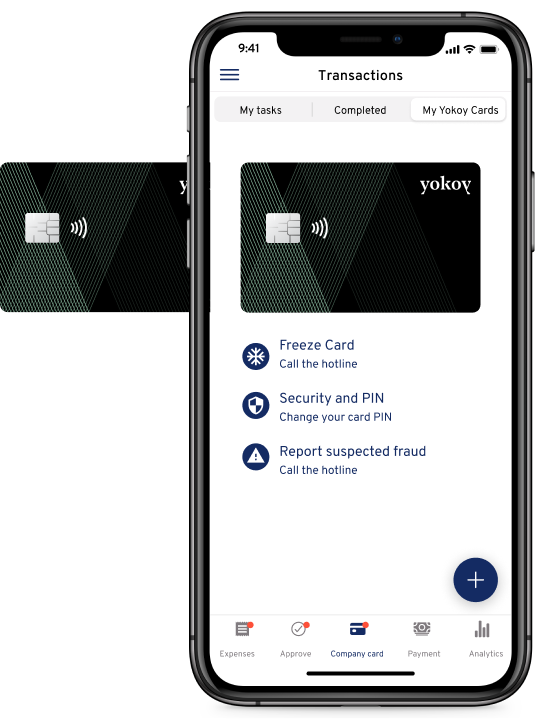

On-trip: Smart corporate cards for flexibility

To simplify payment processes and minimize organizational efforts during a business trip, payment solutions must be convenient to use.

Yokoy’s Smart Corporate Cards are an excellent solution available in both physical and virtual formats. These cards facilitate the direct recording of expenses incurred during a trip on the platform, minimizing administrative tasks.

Employees can use the Smart Corporate Cards to pay for their expenses while on the road, and the system automatically adds them to the platform, eliminating the need for manual intervention from the finance department or travel management.

Furthermore, these cards eliminate the need for travelers to advance expenses, and the automated booking process saves company resources while reducing errors. The transparent expense data provided ensures increased visibility of expenses, promoting compliance.

You can learn more about our Smart Corporate Cards below.

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Post-trip: Fully automated reporting

To minimize the administrative workload and expedite the completion of a business trip, a highly automated travel and expense management system is necessary.

Yokoy provides a fully automated spend management system that includes the posting of VAT. The AI technology generates an expense report in just three seconds, requiring a manual check only for outliers. Approved expenses are then automatically transferred to the financial system, eliminating the need for manual intervention.

Furthermore, Yokoy’s Analytics module assists companies in identifying expense patterns and trends and potential cost savings. Our platform enables easy expense analysis for specific periods, with personalized and overall data sets available for maximum transparency.

Next steps

If you’d like to learn more about Yokoy’s expense management tool, or are curious in seeing our full spend management suite in action, you can book a demo below.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.