Home / Boost Expense Accuracy: Properly Accounting for Tips in Spending

Boost Expense Accuracy: Properly Accounting for Tips in Spending

- Last updated:

- Blog

Accurately accounting for tips is compulsory for maintaining transparency and compliance within business finances, particularly in the hospitality and service industries. With the introduction of new regulations in October 2024, businesses must update their practices to ensure tip distribution is fair and follows legal obligations. In this article, we’ll explore the importance of accurate tip accounting, the new UK legal framework, best practices, and how technology can streamline this process.

Importance of accurately accounting for tips

Tips and service charges are a significant part of employee earnings in sectors like hospitality. Failing to account for them correctly can lead to financial discrepancies, tax issues, and reputational damage for businesses. Properly reporting tips can support accurate cash flow forecasting and expense management, ensuring that businesses stay compliant and avoid costly penalties. It also helps to maintain clear and precise financial statements, which is essential for making informed business decisions and satisfying stakeholders.

Potential financial implications for incorrect tip reporting

Incorrect tip reporting can result in fines from HMRC, inaccurate payroll, and issues with financial reporting that may harm your business’s profitability and financial health. This is especially true for small businesses that operate on tighter margins and must ensure that all expenses, including tips, are correctly tracked to avoid overspending and discrepancies in expense reports.

Legal obligations for the correct accounting of tips

The UK’s Employment (Allocation of Tips) Act 2023 introduces new regulations that will come into effect in October 2024, mandating that employers must pass on 100 per cent of tips to staff without any deductions for administrative fees or credit card charges. These rules apply to both cash and card tips and require that tips be paid to employees by the end of the following month in which they were received.

The Act applies across England, Wales, and Scotland. Employers are also required to keep detailed records of tips and their distribution for at least three years, making them available to employees on request.

Moreover, businesses must have a written tipping policy outlining how tips are allocated, ensuring transparency and fair distribution among workers. Tips must be paid to workers by the end of the month following the month the customer paid them.

Service charges vs. different types of tips

Understanding the different types of tips and how they should be accounted for is essential for compliance. Here, we explain them in detail:

Service charges:

Mandatory service charges, added to a customer’s bill, are considered part of the employer’s revenue and must be processed through payroll. They are subject to VAT and must be fully distributed to employees without deductions.

Cash tips:

Cash tips, directly handed to employees by customers, are also subject to tax, and businesses must ensure proper reporting. Under the new law, if cash tips are pooled or influenced by the employer, they fall under the same regulations as card tips.

Credit card tips:

When tips are left on credit cards, the full amount, including the tip, must be distributed to employees without any deductions for transaction fees. These tips must be paid via payroll and are subject to tax and National Insurance deductions.

Pooled tips:

Many businesses use a tronc system to pool tips and distribute them among employees. A troncmaster, typically an independent party, manages this system to ensure compliance with tax regulations. Under a properly operated tronc, National Insurance contributions are not required. This provides savings on both employer and employee NIC payments.

For a tronc to be considered “properly operated”, the following conditions typically apply:

Independence of the troncmaster

Transparent and fair distribution

Compliance with HMRC guidelines and tax laws (tips should be processed through PAYE but are exempt from NIC if the independence of the tronc is maintained).

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Best practices for tracking tips

Your financial management is doing alright, but your company is struggling to implement practical tip tracking? Let’s help you in your decision-making process by explaining some best cases that have proven to be effective.

Tip reporting systems

Implementing an integrated expense management system that tracks tips in real time can reduce errors and improve overall compliance. Moreover, a smart system allows for real-time visibility of tips received to help your finance team make informed decisions, helping your business streamline workflows and maintain transparency. It also assists in receiving optimal tax returns and much more.

Daily tip logs

Recording daily tip logs, whether from cash, card, or pooled tips, ensures that all amounts are accounted for properly. Regularly updating logs also provides an extra layer of oversight, making it easier to identify and correct discrepancies.

Employee training

We recommend you ensure that employees understand how tips are accounted for and what their responsibilities are regarding reporting. Training employees on the legal implications of underreporting tips can help avoid potential legal issues.

Regular audits

Conducting periodic audits of tip distribution systems ensures that policies are being followed correctly. These audits can also help identify areas where discrepancies in financial statements may arise, allowing businesses to correct them before they become a larger issue.

How to handle tips in payroll

Effectively managing tips for professional services within payroll is not just about tracking and recording the amounts in your management software. As we have mentioned before, it’s also about ensuring compliance with tax laws and fair distribution practices.

Withholding taxes: Employers must withhold appropriate taxes, such as PAYE and National Insurance, from tips processed through payroll. Whether tips are given in cash or via credit card, they must be subject to tax before distribution.

Allocating tips: Tips must be allocated fairly, according to the written policy, which may take factors like the number of hours worked, role, and seniority into account. Businesses should ensure that this process is designed transparently and follows the current or upcoming legal guidelines to avoid disputes.

Tipped employees and payroll: Employers must ensure that employees receiving tips still meet National Minimum Wage requirements. If tips are not enough to cover the minimum wage, businesses must supplement the employee’s wages accordingly.

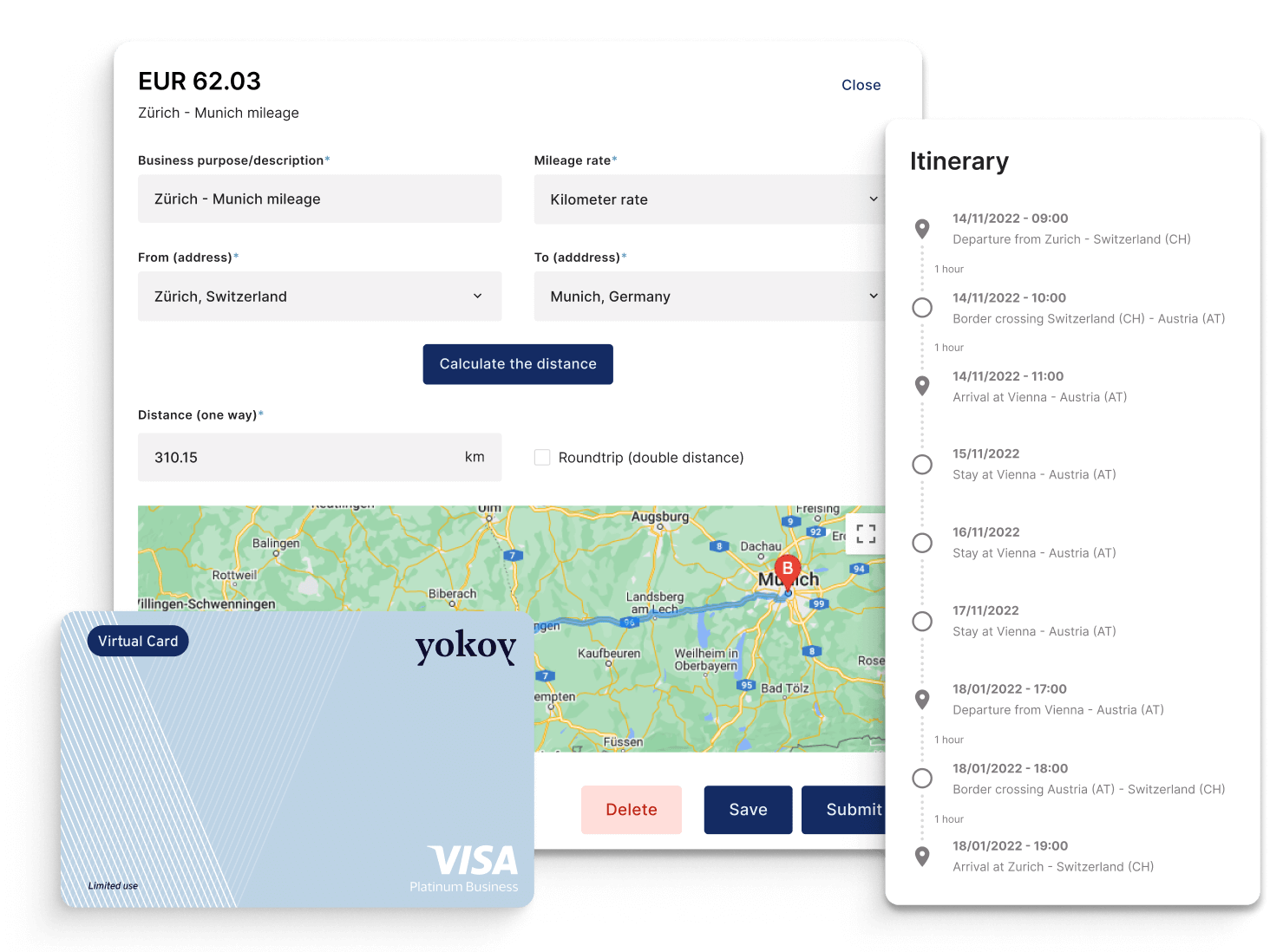

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Common mistakes to avoid in handling tips

Knowing possible mistakes can prevent errors from happening. So here is a heads-up on what you and your team members should avoid in handling tips:

Underreporting tips: Failing to report all tips correctly can lead to significant penalties from HMRC. Businesses must track non-cash tips and ensure these are reported alongside cash tips.

Miscalculating tip credits: Although there is no direct system for ‘tip credits’ in the UK, as in the US, miscalculating or underreporting tips can affect payroll, leading to inaccuracies in financial reporting.

Overlooking non-cash tips: Non-cash tips, such as gifts or other gratuities, must also be accounted for properly. Businesses should include these tips in payroll records to avoid discrepancies.

Technology solutions for accurate tip accounting

Luckily, you can rely on smart systems to allow for accurate tip accounting. This way, small business owners and large enterprises alike can reduce administrative burdens and maintain compliance with evolving regulations—all while gaining valuable insights into cash flow and profitability.

POS integration

Modern point-of-sale (POS) systems can automatically track and report tips, providing real-time data that reduces the risk of errors. POS systems that integrate with accounting software can simplify the management of business expenses and ensure compliance with the new regulations.

Mobile apps

Mobile apps for expense tracking can help employees log their daily tips and ensure accurate reporting. These apps can integrate with accounting software to streamline the process, making it easier for businesses to maintain compliance.

Accounting software

Investing in accounting software allows businesses to automate tip tracking and payroll reporting, reducing administrative burdens and minimising errors in financial planning.

Next steps

Ensuring accurate and compliant tip accounting is now more important than ever with the introduction of the Employment (Allocation of Tips) Act 2023. By updating your systems and implementing best practices, you can ensure fairness, transparency, and legal compliance while supporting your business’s financial health. Take the next step towards effective expense management by exploring automation tools that can improve tip accounting.

Find out how Yokoy can help streamline your business’s financial processes.

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.