Home / How to Mitigate Financial Risk Through Smart Expense Management

How to Mitigate Financial Risk Through Smart Expense Management

- Last updated:

- Blog

When speaking of financial management, we don’t just mean keeping tabs on spending. There is so much more to it, as it helps protect your organisation from hidden risks that can erode profitability. From inadvertent manual errors to deliberate expense fraud and non-compliance issues, the complexities of traditional expense management systems often lead to avoidable inefficiencies, lost productivity, and increased exposure to financial risks. But luckily, there are smart solutions to help your company do better!

This article will take you through the common financial pitfalls associated with expense management and how smart solutions powered by automation and artificial intelligence can transform your approach. Let’s dive into the steps you can take to safeguard your business through smart expense management and uncover the benefits that come with embracing technology in finance.

Common financial risks in expense management

Implementing a robust expense management system involves several strategic steps that help your business (re)gain effective financial control, reduce risks, and streamline operations. Each step focuses on optimising different aspects of the expense management process. Let’s have a look at typical financial risks that can threaten a company’s stability:

Expense fraud

Inflated claims or falsified receipts are common in traditional systems.

Manual review processes are inefficient and unreliable in detecting fraudulent activities.

Manual errors

Manual data entry increases the risk of errors such as incorrect amounts or misclassification of expenses.

These errors can disrupt accurate record-keeping and skew financial reports.

Inefficient workflows

Manual routing of expense reports causes delays and increased administrative overhead.

Inefficiencies can lead to employee dissatisfaction due to delayed reimbursements.

Lack of transparency

Without real-time visibility, companies struggle to track spending patterns and detect anomalies.

Lack of oversight can result in unauthorised spending and resource misallocation.

Non-compliance risks

Companies must adhere to local and international regulations to avoid penalties.

Key features of smart expense management solutions

Modern expense management solutions use advanced technologies like automation, artificial intelligence (AI), and real-time analytics tools to smoothen processes and improve financial stability. Let’s explore these features in detail and explain how your business can profit from them.

Automation and AI

Automation forms the foundation of any smart expense management system nowadays as it significantly reduces manual intervention and minimises errors. AI-driven tools can automatically categorise expenses, read receipts using Optical Character Recognition (OCR), and detect patterns that indicate fraudulent behaviour. For instance, machine learning algorithms can analyse historical data to identify unusual spending patterns, flagging them for review. This proactive approach can help you detect fraud attempts and also enables finance teams to forecast future expenditure trends based on past data.

Expense policy enforcement

Expense policy enforcement is a critical component of any effective expense management software. Automated systems can enforce these policies consistently by flagging out-of-policy expenses and requiring additional approvals when necessary. This immediate intervention reduces policy breaches and facilitates a smoother audit process. The automated enforcement of policies means that companies can reduce the risk of non-compliance without adding a significant administrative burden.

Real-time analytics

Real-time analytics enable companies to gain immediate insights into expense data and spending patterns. With dashboards and visualisation tools, finance teams can detect anomalies as they happen rather than weeks or months after the fact. This capability helps address potential issues before they escalate into significant financial problems. Moreover, real-time visibility can improve decision-making by highlighting areas of excessive spending, inefficiencies or budget variances, enabling more strategic resource allocation.

Integration capabilities

Integration with existing financial systems like Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) software is essential for a unified view of financial data. Seamless integration reduces data redundancy and improves accuracy by ensuring that all systems are synchronised and up-to-date.

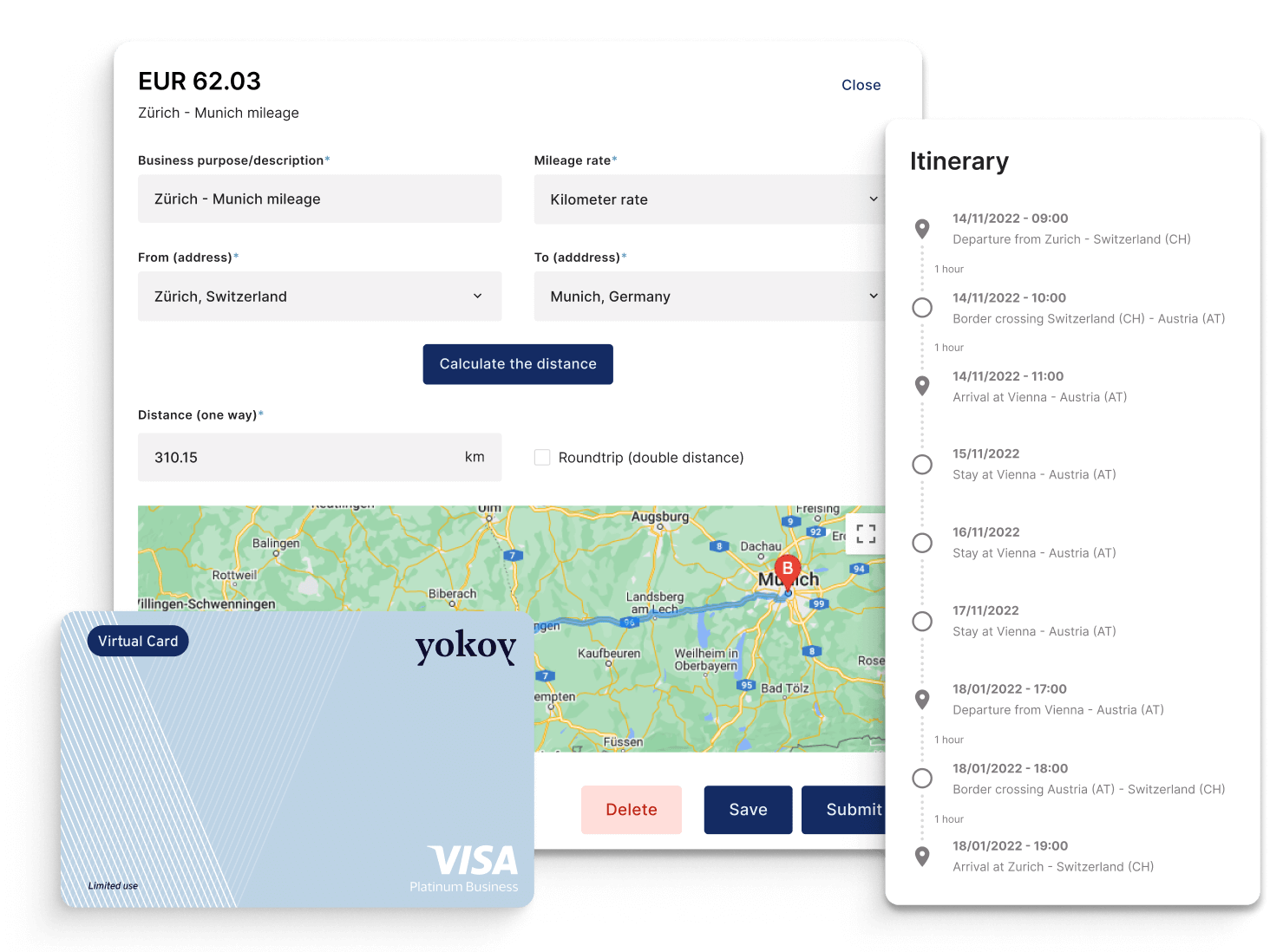

Mobile capabilities

Mobile-enabled expense management solutions offer flexibility and convenience, allowing employees to submit expenses from anywhere. This feature speeds up the submission process so expense reports are completed accurately and on time. Mobile apps often include features like receipt scanning and categorisation, leveraging AI to capture and validate data instantly. This real-time capability means that managers can approve expenses promptly.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Steps to mitigate financial risks through smart expense management

Our recommendation: Your company should adopt a systematic approach that integrates technology, policies, and regular oversight. Here are the essential steps to implement such a strategy:

Step 1: Implement automation in the expense workflow

Automated workflows streamline data entry, categorisation, and approval processes, ensuring accuracy and efficiency. Moreover, automation can incorporate OCR technology to automatically extract and categorise information from receipts. This eliminates the need for manual entry and improves the accuracy of data capture. As a result, the finance team is freed from routine administrative tasks and can concentrate on more strategic activities like financial planning and risk management.

Step 2: Enable real-time monitoring of expenses

Real-time monitoring provides immediate visibility into spending patterns, helping your organisation quickly identify discrepancies or anomalies. By implementing dashboards that display key metrics in real time, the finance team can track business expenses as they are submitted and approved, making it easier to spot potentially fraudulent activity or budget overruns. This visibility supports more informed decision-making and allows your business to respond proactively to emerging risks rather than reacting to issues after they have occurred.

Step 3: Define clear expense policies and automate compliance checks

Establishing clear and enforceable expense policies is the foundation of an effective expense management strategy. These policies should outline permissible expense types, spending limits, and approval workflows. Once defined, they can be integrated into the expense management system, allowing for automatic policy enforcement. Automated compliance checks can instantly flag non-compliant expenses, reducing the risk of policy violations.

Step 4: Integrate with financial systems and use data analytics

Integrating expense management solutions with existing financial systems, such as ERP platforms, ensures a seamless data flow across your organisation. This integration allows for a unified view of financial information and prevents data silos. Additionally, using data analytics provides deeper insights into spending trends, helping your business identify cost-saving opportunities and make data-driven decisions. Analytics can also highlight areas where expenses deviate from the norm, enabling quick intervention to prevent further losses.

Step 5: Conduct regular audits and reviews

Regular audits are essential for maintaining financial integrity and identifying potential risks in the expense management process. Smart expense management systems offer automated audit trails that record every step of an expense’s lifecycle, making it easier for auditors to identify irregularities. Regular reviews ensure compliance and provide insights for continuous improvement, allowing your company to refine its policies and processes over time.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

How AI can reduce financial risks

Automated expense management processes can profit from AI significantly. Artificial intelligence streamlines tasks such as data entry, categorisation, and compliance checks. By automating these repetitive activities, companies can substantially reduce errors and improve processing times. This approach also ensures consistent policy enforcement and frees employees to focus on strategic, value-adding activities. On top, this approach eliminates the potential for human error, making the entire process more reliable and less time-consuming.

AI-powered fraud detection models go beyond traditional rule-based systems by continuously learning from historical data to identify suspicious patterns. Unlike conventional methods that generate a high number of false positives, AI can discern more nuanced patterns, significantly reducing false alarms and identifying actual cases of fraud. This reduces investigation time and helps companies proactively prevent financial losses.

Predictive analytics models use historical data to forecast future expense trends, allowing companies to manage budgets more effectively and anticipate potential financial risks. By providing insights into evolving expense patterns, predictive powers can adjust a company’s strategy in real time, ensuring optimal resource allocation and mitigating potential overspending. Predictive capabilities, therefore, help organisations transition from reactive to proactive expense management to enhance financial planning and business resilience.

Yokoy’s AI in action

The following case illustrates how adopting a smart expense management system can lead to significant cost savings and improved efficiency: Healthcare company MedSkin streamlined its travel and expense management using Yokoy and TravelPerk’s AI-powered solution. By integrating these technologies, MedSkin saw a 26 per cent decrease in overall costs by saving 251 work hours per year. The processing time per report for its finance team could be reduced from 25 minutes to 2 minutes, which is 12 times faster than before. This way, the average processing time from submission, over approvals and reviews to export could drop to only 1.96 days, with all expenses being processed in under 24 hours.

Key Benefits:

Harmonised booking, payment, and expense processes

Automatic matching and evaluation of all TravelPerk invoices

AI-driven accuracy in reading individual expenses at 99 per cent

Elimination of out-of-pocket expenses

100 per cent data synchronisation between HR, travel, and expense tools

The automated compliance checks ensured adherence to internal policies, while real-time monitoring provided greater transparency and control over expenses.

Next steps

From our constant exchange with clients and our continuous efforts to further improve our solutions, we at Yokoy know that mitigating financial risk requires a blend of smart technology and strategic planning. By adopting AI-powered expense management tools, businesses can streamline processes, reduce errors, and proactively manage compliance and fraud risks. Companies interested in transforming their expense management practices should explore solutions like Yokoy’s AI-powered platform for greater control and efficiency.

Learn how Yokoy’s solution can work for your business!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.