Home / Expense Policy Essentials: A Complete Guide

Expense Policy Essentials: A Complete Guide

- Last updated:

- Blog

Managing business expenses can be a headache if there aren’t clear guidelines in place. That is why a well-crafted expense policy is so important— it takes the guesswork out of what employees can spend, how they can claim it, and what the company will reimburse. Whether for travel, meals, or setting up a home office, having a clear policy helps avoid confusion, keeps costs in check, and ensures everyone is on the same page. In this guide, we will explain the basics of creating a strong expense policy, why it is essential, and how modern AI technology can make the process even smoother for your team.

Why is it important to have a clear expense policy?

A clear expense policy helps businesses control spending by limiting what employees can claim, ensuring costs stay within budget. This promotes transparency and accountability, so employees know what is allowed and management can track spending easily. A well-defined policy saves your business plenty of time by simplifying the submission and reimbursement process. It also ensures compliance with legal and tax regulations, reducing the risk of penalties. And, of course, it boosts employee satisfaction by providing clarity and fairness around reimbursable expenses.

What are the key components of a good expense policy?

A solid expense policy should cover a few essential areas to keep things clear and organised. Here is a breakdown of what to include:

Eligibility

Your policy should spell out which types of expenses are eligible for reimbursement. Common categories are travel, meals, office supplies, and client entertainment. Just as important is outlining what is not covered—such as personal expenses or luxury upgrades—so there is no confusion.

Documentation requirements

Make sure employees know what proof they need to provide. Usually, this means receipts, invoices, or other records that confirm the expense. Setting this expectation ensures everything is legitimate and easy to verify when it’s time to process claims.

Submission deadlines

To keep things running smoothly, set a clear deadline for submitting expenses. A standard timeframe is within 30 days of the expense. This ensures that claims are processed promptly and no one is left waiting too long for reimbursement.

Approval process

Clarify who needs to sign off on expenses. Whether it is a direct manager or a department head, having an approval process in place helps avoid delays and ensures the right people are authorising the spending.

Reimbursement process

Transparency is key to employee satisfaction: Lay out how and when employees can expect to be reimbursed. Clear steps and timelines—like a direct deposit within two weeks—make the process predictable and hassle-free, keeping everyone happy.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Important expense categories

Creating a company expense policy is helpful for every company, but you may wonder how to start. So, first things first: It is helpful to break things down into different categories so employees know exactly what they can claim and how much they can spend. These are common expense categories to include in your company’s policy:

Travel expenses: This covers corporate travel costs like flights, trains, car rentals, and accommodations when employees travel for work. To keep costs for business trips under control, you might set limits on things like airfare class (economy versus business) or hotel star ratings. It is also good to include guidance on local transportation, like whether employees can use ride-share apps or if public transport is preferred.

Meals: When employees are on the road or attending business meetings, meals are necessity. However, your policy should set clear rules about what is covered, such as per diem meal allowances or daily spending caps. You can also specify if things like alcohol are allowable expenses and under what circumstances—such as during client dinners.

Entertainment: Sometimes business relationships are built over dinner or at events, and that is where entertainment expenses come in. This could include taking clients out for meals, attending events, or participating in other business-related activities. Your policy should define what qualifies as a legitimate entertainment expense and what kind of documentation is required, such as a list of attendees and the business purpose.

Home office and remote work expenses: As remote work becomes more common, many companies now cover certain home office expenses. These could include items like office furniture, a portion of the employee’s internet bill, or necessary equipment like monitors or printers. Be sure to clearly outline what can be reimbursed, whether there are spending limits, and any specific conditions (e.g., only after working remotely for a certain period).

Training and development: Investing in employee growth often means covering the costs of conferences, courses, or certifications. Your policy should explain which training opportunities are eligible for reimbursement and what limits apply. For example, some companies might fully cover job-related training but cap reimbursements for optional courses.

Miscellaneous expenses: Some business expenses do not neatly fit into the other categories. This section of your policy could cover smaller, deductible day-to-day costs like office supplies, postage, or software subscriptions. However, we recommend defining what counts as a “miscellaneous” expense and setting a reasonable limit to keep things consistent and fair to create an effective expense policy and keep employee spending under control.

Compliance with tax laws

Managing business expenses efficiently also means making sure your business complies with tax laws. If your expense policy does not align with the rules set by tax authorities, you could face fines, audits, or lose out on potential tax deductions.

HMRC guidelines

In the UK, the HMRC sets clear guidelines on what constitutes a legitimate business expense. These rules help determine which expenses can be deducted from your company’s taxable income. For example, if one of the following employee expense occurs, you should check: Is it strictly business-related?

Office supplies

Travel costs—including public transportation fares, mileage for business use of personal vehicles (with appropriate mileage rates), and overnight stays

Reasonable accommodation

Meals and refreshments

However, certain expenses are not deductible under HMRC rules:

Personal expenses: Any expenditure that is personal in nature, such as holiday trips or home utilities not related to a home office, cannot be claimed

Fines and penalties: Costs incurred from breaking the law, such as parking fines or court penalties, are not deductible

Tax implications

While many business expenses are deductible, some expense claims might be considered taxable benefits even if they do not fit HMRC’s criteria. The cost of entertaining clients is generally deductible, but if it includes personal benefits or exceeds reasonable limits, it might not be fully deductible.

Moreover, if your company agrees to reimburse employees for home office costs, ensure these expenses are reasonable and necessary. There may be specific rules on how these can be claimed and what documentation is required.

Our tip: A well-documented expense policy, combined with careful record-keeping and smart categorisation, makes it easier for the company to prove that expenses are legitimate business costs, especially during an audit.

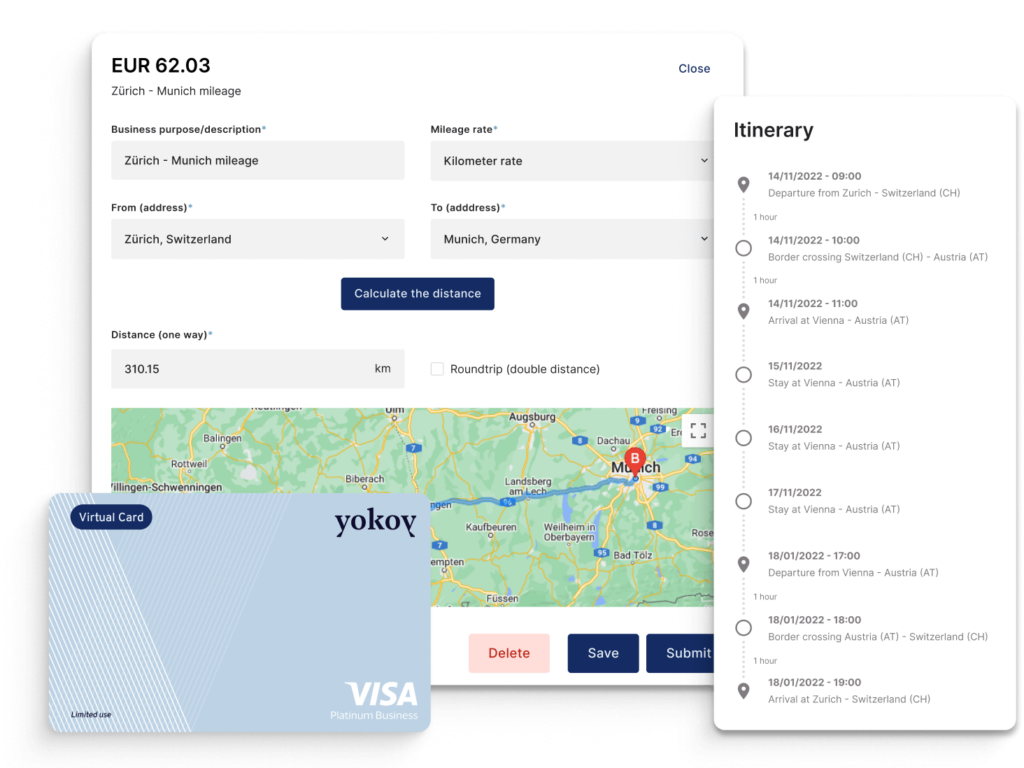

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

How to implement a clear expense policy with AI-driven technology

Implementing a clear expense policy seems quite easy, but managing it effectively can be challenging. Modern technology, especially AI-driven solutions, can make this process much smoother. Yokoy can be a game-changer and supports your finance team with smart, AI-powered technology to streamline your expense management.

Why use a holistic spend management solution like Yokoy?

Let us describe the benefits and what AI-driven technology can do for your team:

AI that plays by your rules

Yokoy’s AI is designed to adapt to your specific policies and regulations. You set the rules for expense submissions, approvals, and reimbursements, and the AI ensures that every transaction adheres to these guidelines. This means that your expense policy is automatically enforced without needing constant manual oversight. The AI verifies each expense against your rules in real time, flagging any discrepancies or non-compliance issues immediately.

Agile by design

Traditional expense management systems can be rigid and difficult to adapt. Yokoy, on the other hand, is built with agility in mind. Its AI is flexible and can dynamically adjust to changes in your policy or workflow. Whether you need to update spending limits, add new categories, or modify approval processes, Yokoy’s system can handle these changes smoothly and efficiently. This agility ensures that your expense management remains up-to-date and responsive to your business needs without requiring extensive reconfiguration.

Country-specific controls

Managing expenses across multiple countries can be challenging due to varying regulations and compliance requirements. Yokoy addresses this by offering country-specific controls. The platform can be customised to adhere to local laws and regulations, including per diem rates, tax rules, and reporting standards for each country where your business operates. This means you can confidently manage international expenses, knowing that Yokoy is handling the complexities of local compliance.

Custom workflows

Every organisation has its own unique workflows and approval processes. Yokoy allows you to create and manage custom workflows that fit your company’s specific needs. You can set up automated approval paths, define exception-handling procedures, and configure routing rules based on your expense policy. This customisation ensures that your expense management process is aligned with your organisational structure and operational requirements.

Built-in compliance

Compliance is a critical aspect of expense management, and Yokoy makes it easier to maintain. The platform is designed with built-in compliance features that help ensure adherence to both internal policies and external regulations. From automated VAT calculations and fraud detection to real-time policy enforcement, Yokoy helps mitigate risks and maintain accuracy. This built-in compliance reduces the chances of errors and ensures that your expense management processes are transparent and reliable.

Key features of Yokoy at a glance

Purpose-built AI: Developed in-house, Yokoy’s AI handles everything from receipt scanning to data extraction and policy enforcement, ensuring high accuracy and efficiency.

Real-time insights: Get detailed reports and dashboards that provide valuable insights into spending patterns and compliance.

Flexible integration: Easily integrates with existing systems, including travel booking tools and ERP solutions, for seamless expense management.

User-friendly interface: An intuitive mobile app and easy-to-navigate interface make it simple for employees to submit expenses and for managers to approve them.

Next steps

Are you interested in seeing how Yokoy can transform your expense management? Get in touch to experience the benefits firsthand.

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.