Home / 10 Common Invoice Errors You Can Easily Avoid

10 Common Invoice Errors You Can Easily Avoid

- Last updated:

- Blog

It is only human to resist change and stick to tools and workflows that are familiar to us. However, there are always possibilities for change and improvement. Nowadays, many CFOs and finance executives are eager to digitise processes. That is because they see the potential, especially in terms of reducing Accounts Payable (AP) costs. And if more money and resources are not convincing enough, here are some numbers that should make you reconsider traditional, more manual workflows.

The Association for Intel Information Management reports that 7.5 per cent of documents are lost and another 3 per cent are misfiled. This highlights a significant problem with physical documents: they are inefficient to manage. When AP teams have to search for one out of every ten documents, they waste valuable time that could be used for more critical tasks. Moreover, your business is at risk – just imagine the issues that might occur in an audit process. These unnecessary problems can be avoided with AP automation, as digitised documents are much less likely to be misplaced, helping teams remain organised and efficient.

To us, it is not surprising that so many documents are misplaced, as it underscores the inefficiencies of manual invoicing processes. That is why we want to delve deeper into common invoicing mistakes that can easily be avoided. But before we go into further detail, let us clarify some terms.

Invoice Management as we have long known it

Invoice management involves handling and processing invoices from vendors and suppliers in a systematic way. This process includes receiving, verifying, approving, and recording invoices to ensure smooth Accounts Payable operations. Efficient invoice management helps reduce errors, avoid late payments, and prevent financial discrepancies. Moreover, it is vital for maintaining good supplier relationships, optimising cash flow, and ensuring accurate financial reporting.

What the traditional invoicing process looks like

The traditional invoicing process, or manual invoicing, involves several labour-intensive steps requiring human intervention at multiple stages.

Here’s a breakdown:

Suppliers manually create invoices or use basic software, detailing the date, invoice number, description of goods/services, quantities, prices, total amount due, and payment terms.

Invoices are sent to the buyer via postal mail, fax, or email, leading to delays and the risk of invoices getting lost or misplaced.

Upon receiving an invoice, the Accounts Payable department logs it into a tracking system, such as a physical ledger or spreadsheet.

The received invoice is then matched against related documents like purchase orders and delivery receipts to ensure accuracy. Discrepancies are flagged for investigation.

The invoice is routed to the appropriate personnel for approval, often involving multiple authorisation levels that can be time-consuming.

Once approved, the invoice is scheduled for payment according to agreed terms, involving preparing payment methods such as checks or bank transfers.

Payments are made and recorded in the accounting system, which can involve mailing physical checks or processing electronic payments through banking platforms.

Copies of invoices and related documents are filed for future reference and auditing.

While this process has been the norm for decades, businesses now have plenty of options to improve and streamline the invoicing process. We consider them essential as the traditional way has proven to be time-consuming, prone to errors, inefficient and costly. On top, tracking the status of invoices through the approval and payment process can be difficult without a centralised system.

Common human errors in invoicing and how to fix them

From our daily experience with smart automation, we can say: By identifying common human errors in invoicing and implementing fixes, your business can significantly improve its AP processes. Automated processes, standardisation, and regular reviews are key strategies to reduce errors, enhance accuracy, and maintain good supplier relationships.

Here we want to highlight common problems and an easy fix for them:

1. Missing invoices

Invoices can be lost or misplaced during transit or within your company’s processing system, leading to payment delays and potential strain on supplier relationships.

Fix: Implement an automated invoice capture system that uses scanning, OCR (Optical Character Recognition), and Artificial Intelligence to digitise paper invoices and directly import electronic invoices into the AP system. This ensures that all invoices are accounted for and easily retrievable.

2. Duplicate invoices

Duplicate invoices occur when the same invoice is processed more than once, often due to manual data entry errors or vendor resubmission.

Fix: Use invoice management software with duplicate detection features. This software can automatically flag potential duplicates by comparing key invoice details such as invoice number, amount, and vendor information. Also establish clear guidelines for vendors on invoice submission to prevent resubmission of the same invoice.

3. Invoice fraud

Invoice fraud involves submitting fake or altered invoices for payment, leading to unauthorised financial losses.

Fix: Implement stringent verification processes, including cross-checking invoices against purchase orders and delivery receipts. Use fraud detection tools within your invoicing software to analyse patterns and flag suspicious activities. Regularly train employees to recognise signs of fraudulent invoices.

4. Incorrect data

Incorrect data entry, such as wrong invoice amounts, vendor details, or dates, can lead to payment errors and financial discrepancies.

Fix: Use automated data entry tools to extract and validate invoice information. Typically this would reference your ERP or other systems where vendor details are maintained, so your invoice processing tool has the most up to date information to work from.

5. Missing data

Invoices missing essential information such as invoice number, date, or itemised charges can delay processing and payments. Furthermore, if you’re operating in Europe, a recent EU Directive on electronic invoicing outlined the data that must be included on an invoice, making data accuracy a compliance issue, too.

Fix: Create a standardised invoice template that specifies all required fields and communicate this template to all vendors. Implement software that automatically checks for missing fields and prompts for completion before the invoice can be processed further.

6. Complex approval processes

Complex and lengthy approval processes can slow down invoice processing, leading to delayed payments and potential late fees.

Fix: Simplify and streamline approval workflows by using automated invoicing software that routes invoices to the appropriate approvers based on predefined rules. Set up parallel approval processes where multiple approvals can occur simultaneously rather than sequentially.

7. Duplicate payments

Duplicate payments occur when an invoice is paid more than once, often due to duplicate invoices or manual processing errors.

Fix: Implement automated payment controls within your invoicing software to flag potential duplicate payments. Reconcile accounts regularly and ensure that payment authorisations are tracked and audited to prevent duplicates.

8. Late payments

Delayed processing or missed due dates can result in late payments, damaging supplier relationships and incurring late fees.

Fix: Use automated reminders and alerts within your invoicing system to notify accounts payable staff of upcoming due dates. Implement a centralised dashboard to monitor invoice statuses and ensure timely processing and payments.

9. Manual invoicing process

Manual invoicing processes are prone to errors, slow, and labour-intensive, leading to inefficiencies and mistakes.

Fix: Transition to an automated invoicing system that handles invoice capture, data entry, approval routing, and payment processing. This reduces human error, speeds up the process, and enhances accuracy.

10. Missing invoicing software

Not using invoicing software means relying on manual processes, which are error-prone and inefficient.

Fix: Invest in robust invoicing software that offers features like automated data capture, approval workflows, duplicate detection, and real-time tracking. Ensure that the software integrates seamlessly with your existing accounting systems for a smooth transition and enhanced efficiency.

Investing in the right invoicing software is crucial to achieving your business goals and ensuring a streamlined, efficient invoicing process.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

How Yokoy and AI eliminate inaccuracies in Invoicing

It is safe to say that artificial Intelligence (AI) has revolutionised many business processes by automating repetitive tasks and significantly reducing the susceptibility to human errors. In the context of invoicing, AI can help:

automate data entry

ensure data accuracy

detect and prevent fraud

streamline approval workflows

reduce duplicate payments

de-risk compliance with invoicing regulations

Yokoy’s functionality: Feature by feature

Yokoy provides a comprehensive suite of tools to intelligently manage invoice, leveraging AI to automate and streamline these processes while helping to reduce the potential risk of human error.

Automated data capture: Yokoy uses AI to automatically capture and extract data from invoices, reducing manual entry and invoice errors.

Smart matching: The system matches invoice data against purchase orders and delivery notes to ensure accuracy and prevent discrepancies.

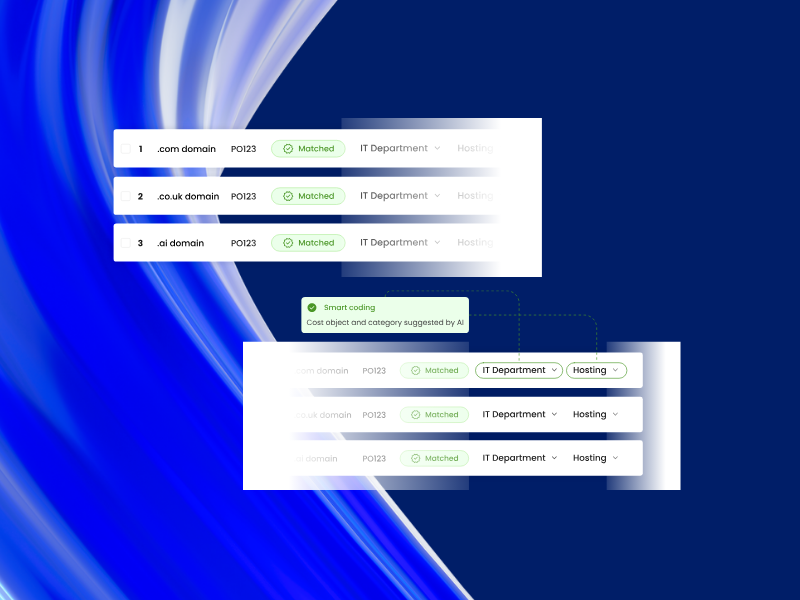

Smart coding: AI learns how your teams code line items in your invoices and then automatically replicates it as new invoices come in.

Approval workflows: AI-driven workflows route invoices to the correct approvers based on customisable rules, expediting the approval process.

Duplicate detection: The system double-checks for you and flags potential duplicate invoices, preventing them from being processed more than once.

Compliance and audit trail: Yokoy ensures all invoices comply with relevant regulations and maintains a detailed audit trail for transparency and accountability.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Are you ready to make your invoice management smarter? Get in touch with us and experience for yourself, how Yokoy can help you reduce the risk of common invoicing errors.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.