Home / Compliance Center / Compliance in Luxembourg

Compliance in Luxembourg

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

In Luxembourg, compliance stands as a cornerstone within the domain of spend management.

Luxembourg organizations involved in spend management face a meticulous and intricate web of legal requirements. Conforming to these compliance standards is not solely a legal obligation, but a testament to Luxembourg’s commitment to upholding transparent and principled financial operations.

Navigating this landscape effectively is imperative for businesses aiming to optimize expenditure practices while upholding a reputation for unwavering ethical conduct.

Download for later

No time to read right now? Get the .pdf version of the guide below.

Proof of Receipt

Regulations in place

According to Luxembourg regulation, companies can process and store receipt electronically and doesn’t have to store physical receipts. However, the government also requires the expense management tools to acquire PSDC certification from the certified provider to store expense receipts digitally.

If the expense management tool is not compliant and certified by PSDC, companies must collect and store physical receipts for a valid business expense reimbursement.

Yokoy's solution

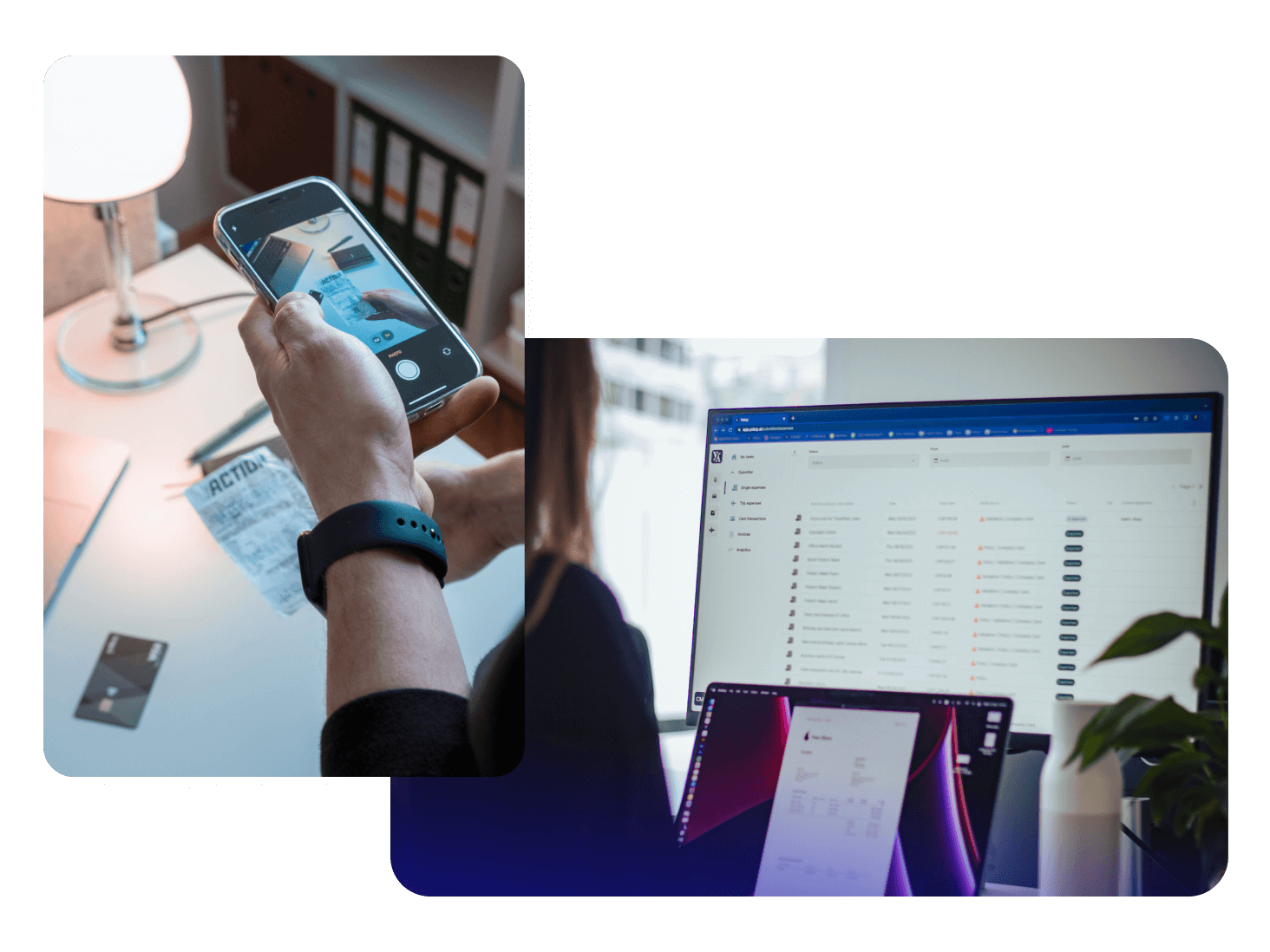

Yokoy enables employees to take a picture of the receipt or upload digital expense receipt and submit them via Yokoy mobile or web application. Once uploaded, Yokoy processes and extracts all receipt and automatically prepares the expense report in seconds. With any potential frauds or policy breaches, Yokoy immediately triggers a warning to highlight specific event.

Depending on the specific workflow and company policy, expense report can be checked by multiple parties before being approved and booked into the ERP or Finance tool, ensuring correctness and completeness of the receipt.

Yokoy adheres to GDPR regulations and stores receipts securely for the statutory retention period on it’s servers hosted in EU. However, to comply with local Luxembourg regulations Yokoy recommends companies to store physical receipts.

Per Diem

Regulations in place

Per Diems are fixed amount paid to employees for expenses incurred during a business trip such as meal, lodging and incidental expenses without needing to have an expense receipt as a proof of expense.

Employees in Luxembourg are entitled to receive Per Diem for their business trip. Per Diem rates are defined by the Luxembourg government which outlines the permissible limit for meal and lodging reimbursement that has no tax implications. However, any amounts surpassing the limits are regarded as taxable income for the employee.

Domestic Per Diem

The Luxembourg government categorises Per Diem as a Day allowance and Night allowance.

For the expenses relating to day allowance, employees don’t have to submit a proof of receipt; for the night allowance such as accommodation and breakfast employees are required to submit a proof of receipt.

If the employee fails to submit the proof of receipt, the employee can only be granted with the 20% of the full daily allowance. As per regulation, employees are entitled to receive

- €14 as day allowance

- €56 as night allowance

Foreign Per Diem

Per Diem for foreign business trip depends on the country the employee is travelling. For countries presiding in the Council of European Union, the applicable night Per Diem is increased by 10% during the period of presidency.

Check the list of Per Diem rates for each country defined by the Luxembourg government here.

Yokoy's solution

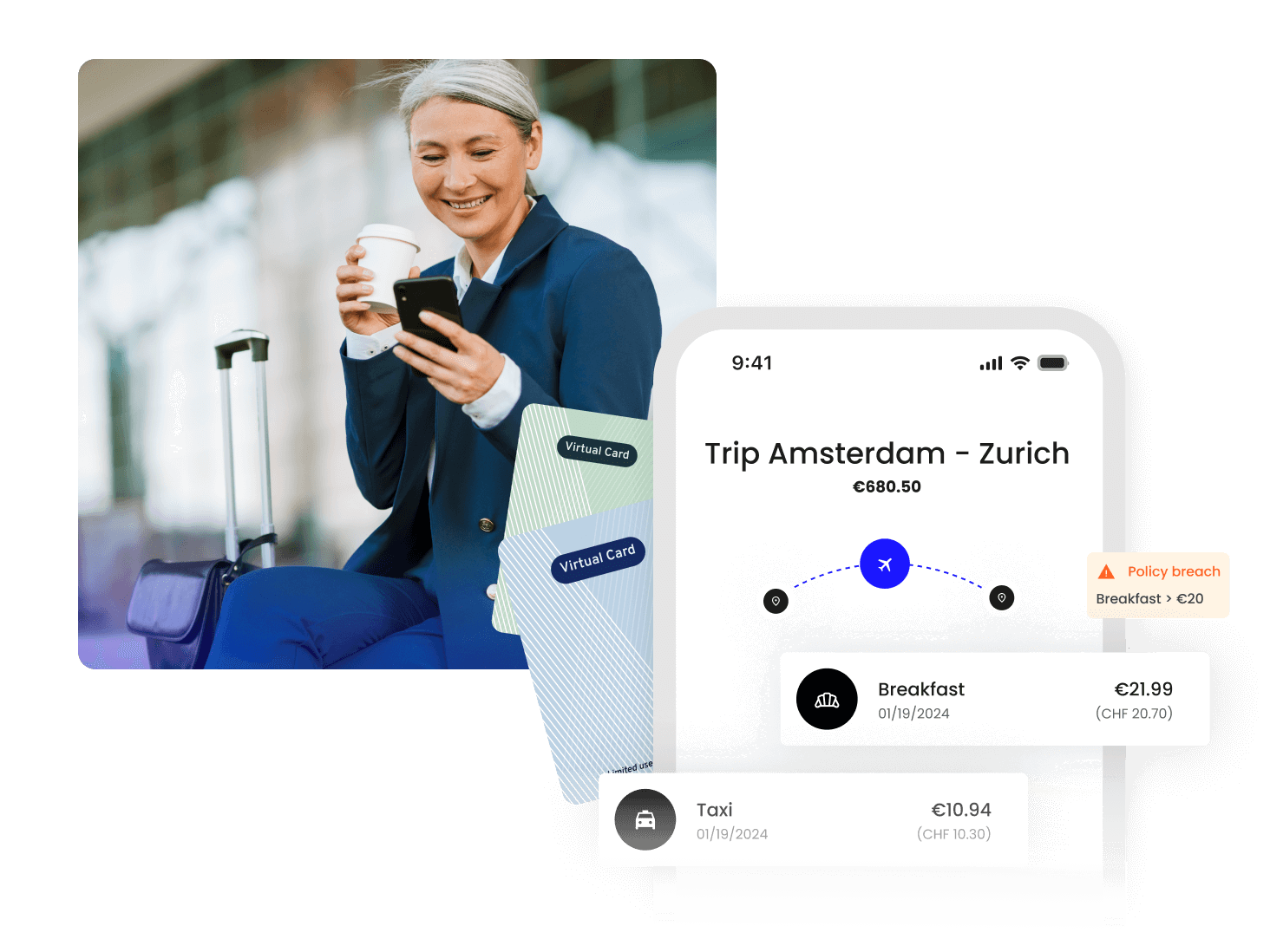

Yokoy can automatically calculate Per Diem rates based on the business trip requiring any manual work from the employees. If the user receives allowance higher than the governmental rate, the difference can be booked and exported differently in the Finance tool.

For the night allowance where employees are required to submit a proof of receipt, upon booking a trip or accommodation, depending on the travel platform Yokoy imports invoice and other related travel information from the travel provider and creates a trip automatically.

Additionally, with Yokoy employees can take a picture of the receipt or upload digital expense receipt and submit them via the Yokoy mobile or web application.

Once imported/uploaded, Yokoy processes and extracts all required information from the receipt and automatically prepares the expense report in seconds. This allows you to easily reimburse employees and stay compliant without any efforts.

Mileage Allowance

Regulations in place

Mileage allowances are intended to cover the employee’s travel cost for business trips when using a private vehicle.

According to Luxembourg regulation, employers are allowed to reimburse a maximum of €0,30 per kilometer for any number of kilometers accumulated for a year. Any amounts surpassing the maximum limit should be subject to income tax.

Yokoy's solution

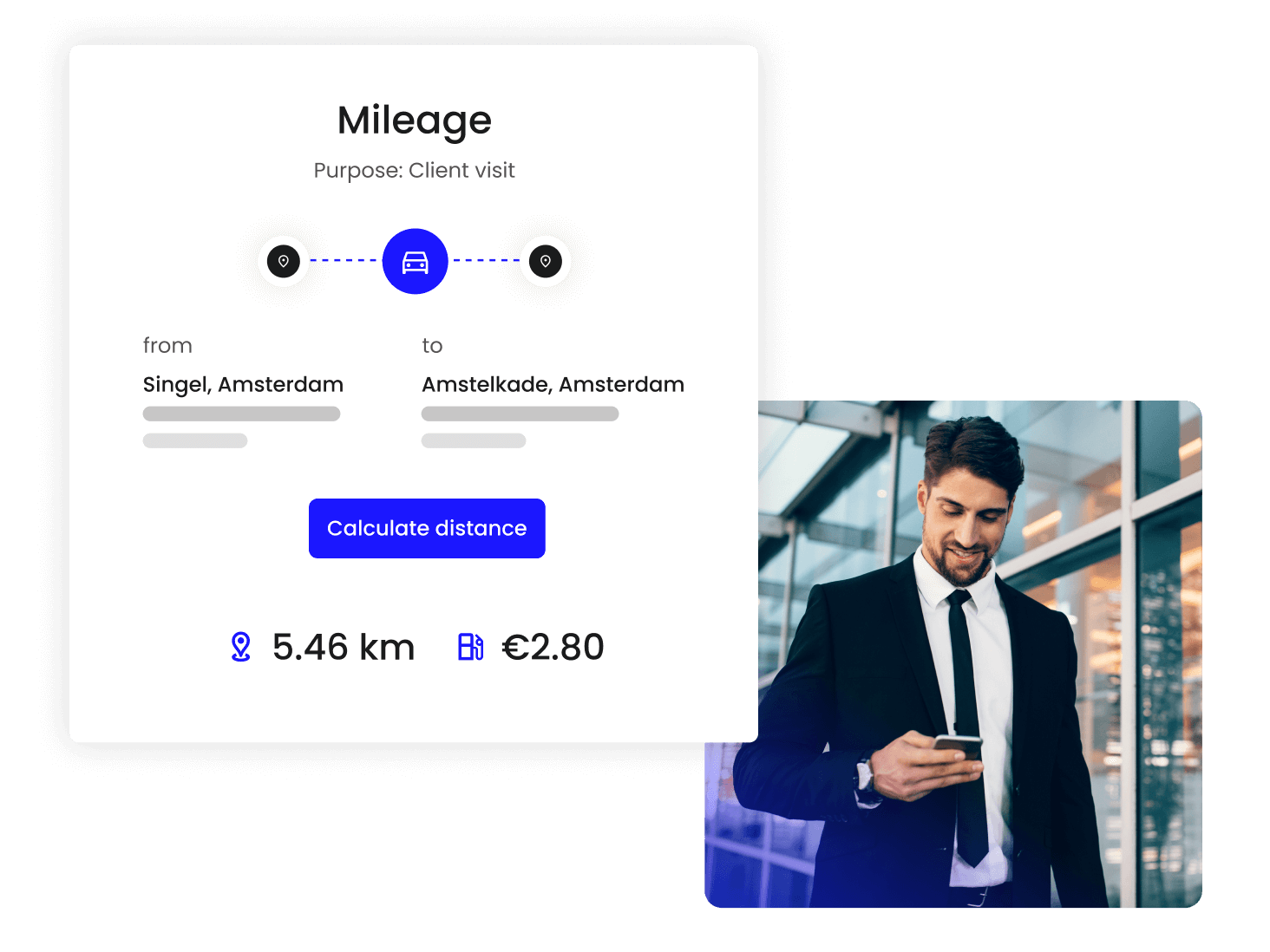

Yokoy recognises all the official rates defined by the government and therefore can automatically calculate mileage expenses based on the distance travelled. If a company decides to pay more than the rates defined by the government, Yokoy can export/book the excess amount separately in the Finance tool.

VAT Rate

Regulations in place

Luxembourg government levies VAT rates for exchange of goods and services. There are five different VAT rates relevant for expense management

- Standard VAT rate of 17% – applies to all major goods and services

- Intermediate VAT rate of 14% – applies to certain Wines, washing and cleaning products, advertising pamphlets, management and safekeeping of securities, heating, ventilation and air conditioning; flammable solid minerals, mineral oil and firewood used as fuel.

- Reduced VAT rate of 8% – applies for Supply of gas and electricity, private household cleaning services, hairstyling, repairing bicycles, shoes and leather, cut flowers and plants used for decoration, etc.,

- Reduced VAT rate of 3% – applies for certain foods and drinks; medical and pharmaceutical products for disabled person, certain books and newspapers, radio and television broadcasting service, agricultural supplies, transport, amusement parks, hotel accommodations, restaurants, etc.,

- Zero VAT rate of 0% – applies to intra-community supplies of goods, exports

Applicable for the year 2023

From 1st January 2023 to 31st December 2023, the government of Luxembourg reduced the VAT rates and will be applied for the specific period as follows

- Standard VAT rate from 17% to 16%

- Intermediate VAT rate from 14% to 13%

- Reduced VAT rate from 8% to 7%

The Reduced VAT rate of 3% would still be applicable without any change.

Please Note: The former VAT rates of 17%, 14%, 8% and 3% will be reinstated on 1st January 2024.

Yokoy's solution

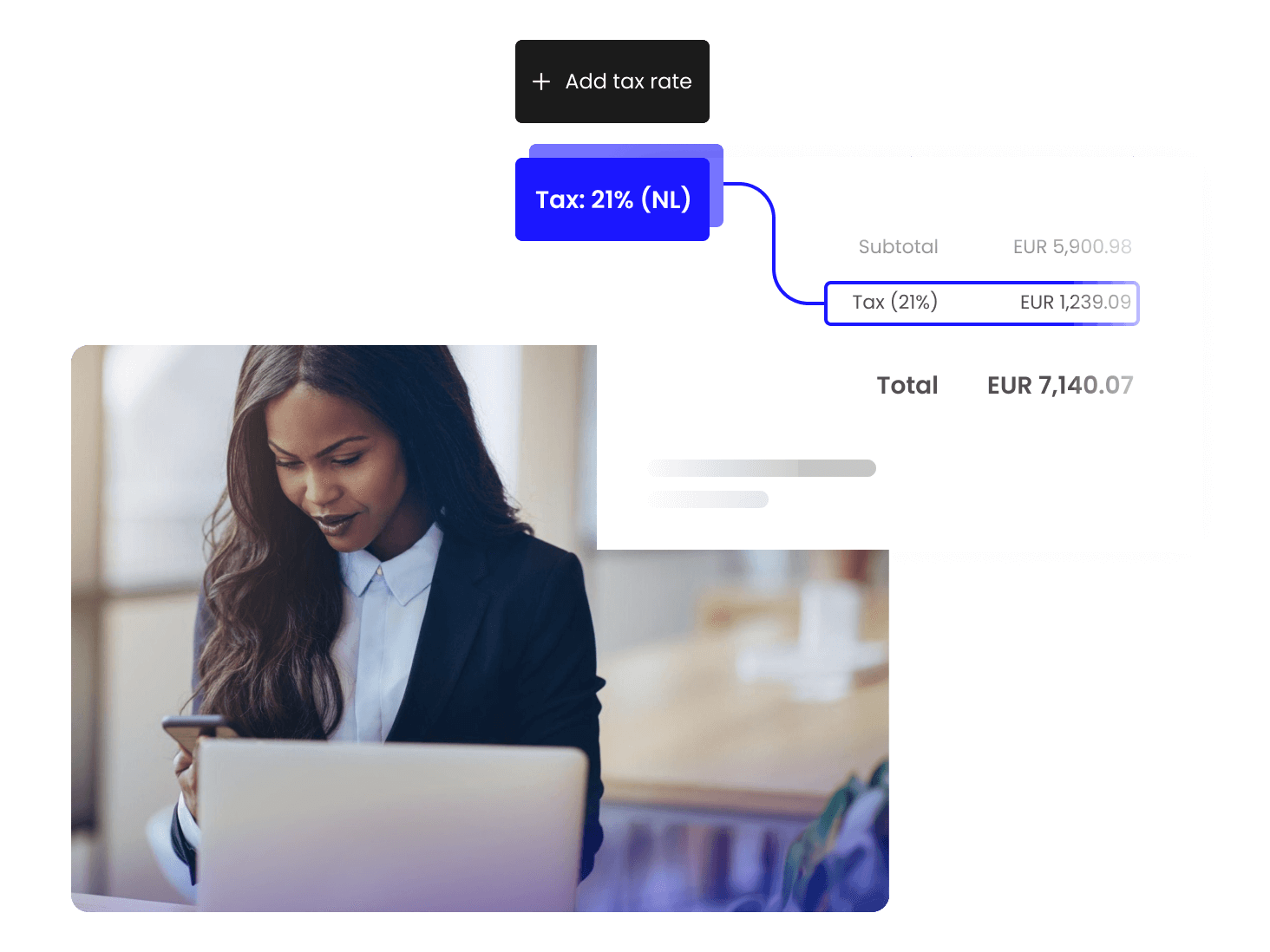

Yokoy automatically extracts all VAT rates relevant for expense management and companies can also add additional VAT rates for extraction. Yokoy extracts all relevant VAT rates from the expense receipt and books them into the ERP or financial system.

Additionally, Yokoy supports customers in reclaiming VAT, by offering standard integration with VAT reclaim providers. This integration allows Yokoy to automatically export extracted VAT rates for specific countries as well as the relevant image of the expense receipt to the VAT reclaim tool.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo