Home / How to Prevent Expense Fraud with AI-Driven Compliance and Custom Workflows

How to Prevent Expense Fraud with AI-Driven Compliance and Custom Workflows

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Expense fraud is a pervasive problem that continues to plague companies of all sizes and industries.

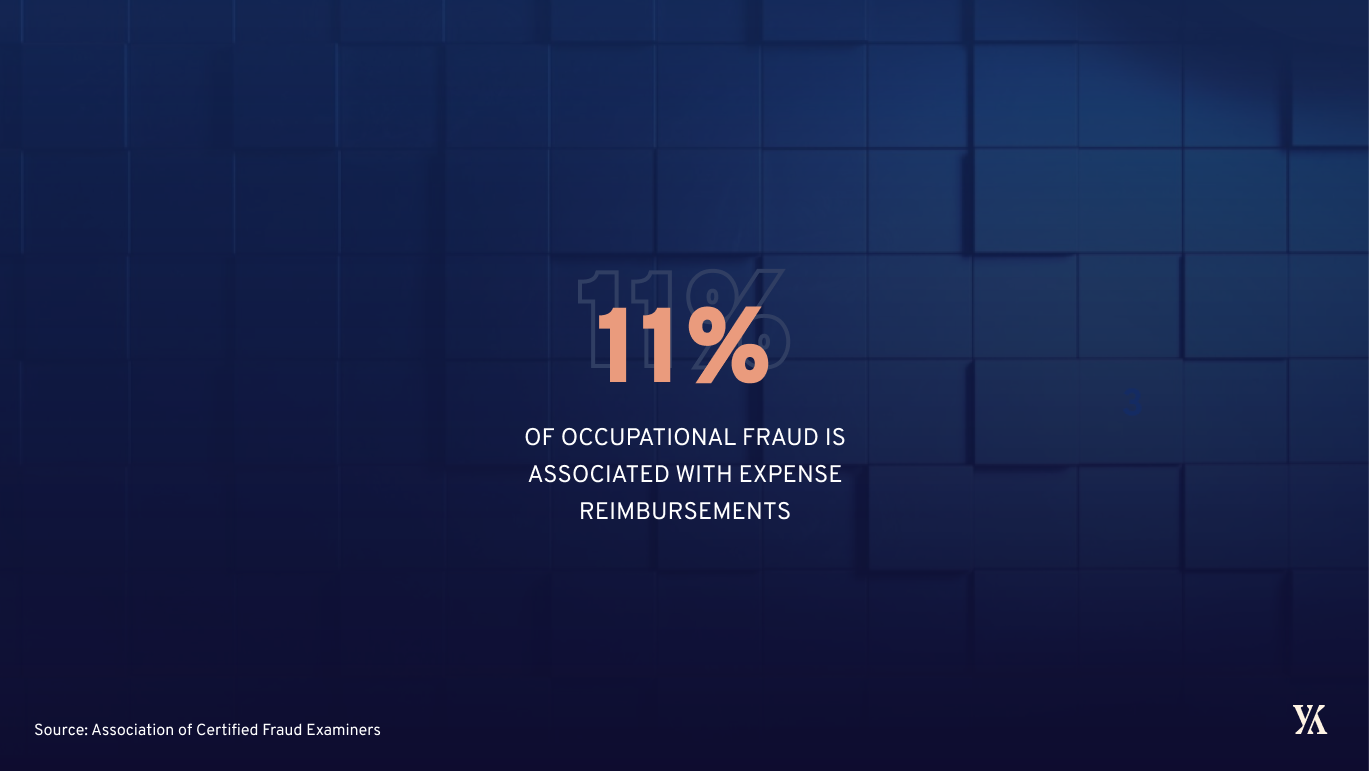

In fact, a recent survey by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being one of the most common types of fraud.

For enterprise companies with multiple global entities, the risk of expense fraud can be even higher, given the complexity of managing expenses across different regions and business units.

The good news is that there are innovative solutions that can help to prevent expense fraud and streamline the expense reporting process. And the even better news is that these solutions are powered by AI-driven compliance and custom workflows, providing a level of automation and accuracy that was once thought impossible.

But here’s the catch: The idea that machines can be trusted to accurately detect and prevent expense fraud might seem like a contradiction to some. How can we trust machines to make ethical judgments when it comes to expense reporting?

And yet, the truth is that AI-driven compliance solutions can provide an unparalleled level of accuracy and transparency that can help to prevent fraud and ensure compliance with company policies and regulations.

In this article, we will explore how AI-driven compliance and custom workflows can help to prevent expense fraud in midsize and large companies.

Most common types of expense fraud in a traditional expense reporting process

To understand where and how employee expense fraud occurs, let’s take a closer look at the different stages of the traditional expense reporting process and zoom in on the steps where fraud commonly occurs.

According to data from the Association of Certified Fraud Examiners, the most common types of expense fraud affecting companies are:

- employees creating fraudulent physical documents – 39%

- submitting altered physical documents – 32%

- employees creating fraudulent digital documents – 28%

- submitting altered electronic documents – 25%

- destroying or withhelding physical documents – 23%

The same report shows that most of the occupational fraud cases come from four departments:

- operations – 15%

- accounting – 12%

- executive or upper management – 11%

- sales – 11%

Now let’s zoom into these the types of fraud related to expense reimbursements specifically and let’s cover these one by one, to understand the associated risks, as well as the changes you should implement to prevent fraud in your organization.

Personal expenses

This type of fraud involves an employee submitting expenses that are personal in nature, such as personal meals, office supplies for personal use, gifts for family members, or personal travel expenses.

As these expenses are not business-related, they should not be reimbursed by the company. But because they were paid with private credit cards, instead of using corporate credit cards, they’re harder to track and prevent.

Falsified receipts

One of the most common types of expense fraud is the submission of falsified receipts.

This can include submitting receipts for personal expenses, claiming fictitious expenses that never occurred, such as claiming meals with clients, or inflating the amount of a legitimate expense – for example, the cost of a taxi ride.

Fake receipts can be difficult to detect, especially in companies they rely on paper receipts, and particularly when receipts are convincing.

Overstated expenses

Employees may overstate the cost of a legitimate expense, such as claiming a higher mileage rate or claiming more meals than were actually purchased for business purposes. This can be a subtle form of fraud that can go unnoticed if the employee is only slightly overstating expenses when submitting their reimbursement requests.

Duplicate expenses

Employees may submit duplicate expense claims for the same business expense, such as claiming reimbursement for the same meal or taxi ride twice. This can occur by mistake or intentionally, and can be difficult to detect by hand, if the employee is careful to submit the duplicate expense on different reports.

However, with an automated expense management system in place, companies can easily identify such errors and fraudulent activity, preventing double reimbursements.

Double dipping

Double dipping occurs when an employee submits the same expense to multiple sources, such as submitting the same expense to both their company and a client. This can result in an employee being reimbursed twice for the same expense. Again, this type of employee fraud detection is rather difficult in this case.

Outdated policies

This area is often overlooked, but outdated expense policies can also contribute to fraud, and this happens mostly in finance departments dealing with overwhelming volumes of expense claims.

For example, if the policy allows for a certain amount of expenses to be reimbursed without receipts, employees may take advantage of this by inflating expenses or submitting false expenses.

Weak controls

Finally, weak controls over the expense reporting process can also contribute to fraud. For example, if there is no system for reviewing expenses or the review process is not rigorous enough, employees may feel more comfortable submitting false expenses.

Despite the risks involved by such practices, many finance teams don’t have the time to check every expense report to make sure all claims comply with company policy, so the smaller amounts are often approved with minimum checks.

This is why it’s important to have strong policies and controls in place to prevent fraud and ensure that expenses are properly documented and reviewed. With the rise of automation and digital solutions, companies can now implement more efficient and secure reporting processes that can help to reduce expense report fraud.

To sum it up: Both error and fraud can occur at any stage in the expense reporting process, but a traditional, paper-based or manual process is much more prone to fraud and policy breaches than a fully digitalized and automated one.

Each type of fraud mentioned here can have a significant impact on a company’s bottom line, so it’s important for companies to have strong internal controls in place and to use technology to prevent and detect these types of fraud.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

How much are companies losing due to expense reimbursement fraud?

Companies lose a significant amount of money each year due to fraudulent expense reporting. While it can be difficult to determine an exact figure, studies suggest that businesses lose an average of 5% of their revenue to fraud each year, and expense reimbursement fraud is one of the most common types of fraud.

A report by the Association of Certified Fraud Examiners found that the median loss due to expense reimbursement fraud was $40,000 per case. Additionally, a survey by Chrome River found that the average fraudulent expense claim is $2,481.

Fraud schemes can be extremely costly, with a median loss of $140,000 and more than one-fifth of cases resulting in losses of at least $1 million. These schemes can go undetected for a median of 18 months.

This is a global problem, with similar trends in fraud schemes and anti-fraud controls across different regions. Owner and executives tend to cause the most damage, with a median loss of $337,000, followed by managers with a median loss of $125,000, and employees with a median loss of $50,000.

But the impact of fraudulent expense reporting goes beyond just the financial losses. It can also damage a company’s reputation and erode trust among employees. When employees see others getting away with expense fraud, it can create a culture of dishonesty and undermine the company’s values.

Fortunately, there are steps that companies can take to prevent expense fraud and reduce its impact.

This can include implementing strong policies and controls, using digital solutions that can automatically flag potential fraudulent activity, and providing training and education to employees on how to properly report expenses.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

How to detect and prevent fraud in employee expense reporting

Yokoy’s spend management software helps companies detect and prevent fraud in employee expense reporting through a mix of AI technology and automation. Here’s what this means in practice.

Automated receipt capture

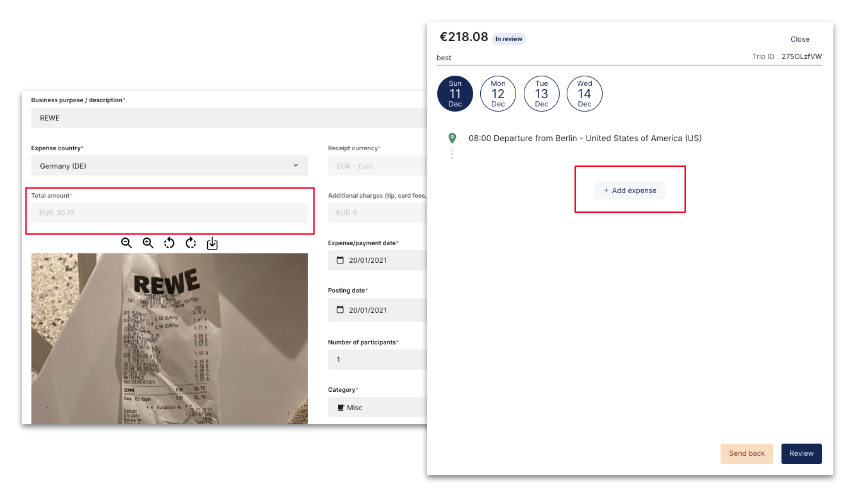

Automated receipt capture is a key feature of spend management software like Yokoy. This functionality helps to streamline the expense reporting process and reduce the risk of errors and fraud.

How does receipt capture work in Yokoy?

This feature allows employees to take a picture of their receipts using their smartphone and upload it directly into the system, eliminating the need for manual data entry and paper-based receipts.

With automated receipt capture, employees can easily capture and submit receipts for all types of expenses, including meals, transportation, lodging, and other business-related expenses.

The software automatically extracts key information from the receipt using OCR technology – for example, data like vendor name, date, and amount. The, Yokoy’s AI technology ‘reads’ the data, assigns it to the right categories, and associates it with the corresponding expense report.

This feature helps to ensure that all expenses are properly documented and can be easily audited by the finance team, and improves the visibility and transparency of expense reporting for both employees and managers.

Furthermore, automated receipt capture can help companies comply with tax and accounting regulations, as it provides a secure and auditable trail of all expenses. This can be especially important in industries with strict compliance requirements, such as healthcare, finance, or government.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Real-time expense tracking

Another functionality that helps prevent fraudulent activity and claims is the real-time expense tracking and reporting. This functionality provides companies with a way to monitor employee expenses in real-time, giving them greater visibility and control over employee spending.

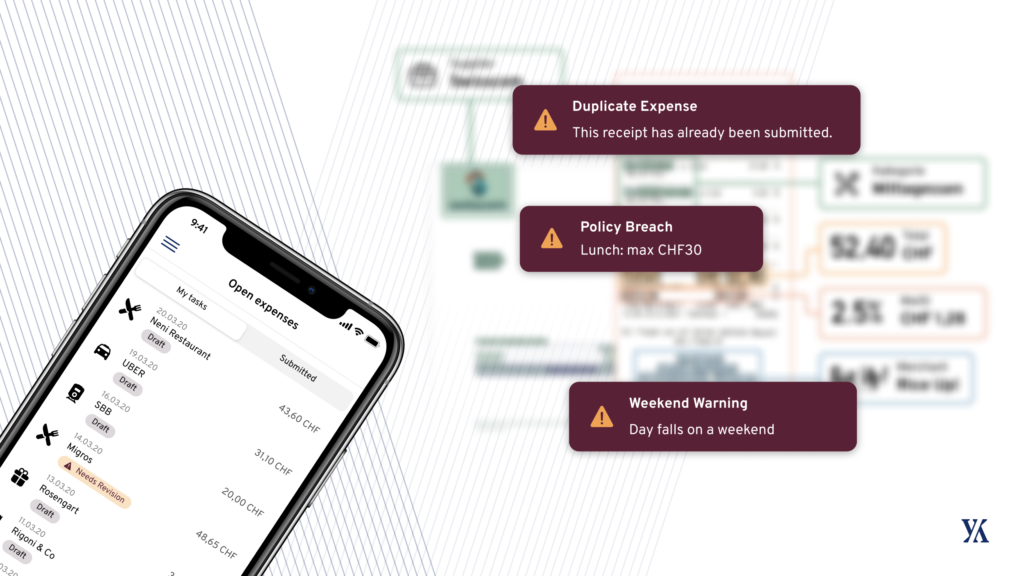

With real-time expense tracking, companies can set up automated alerts and notifications for certain spending criteria, such as expenses that exceed a certain amount, duplicate claims, or other policy breaches. These alerts can be sent to managers or the finance team, enabling them to review and take action on any questionable expenses.

The real-time tracking of expenses also provides a level of transparency and accountability for employees. It helps to ensure that employees are following the company’s expense policy guidelines, and it allows them to see the status of their expenses as they are being processed.

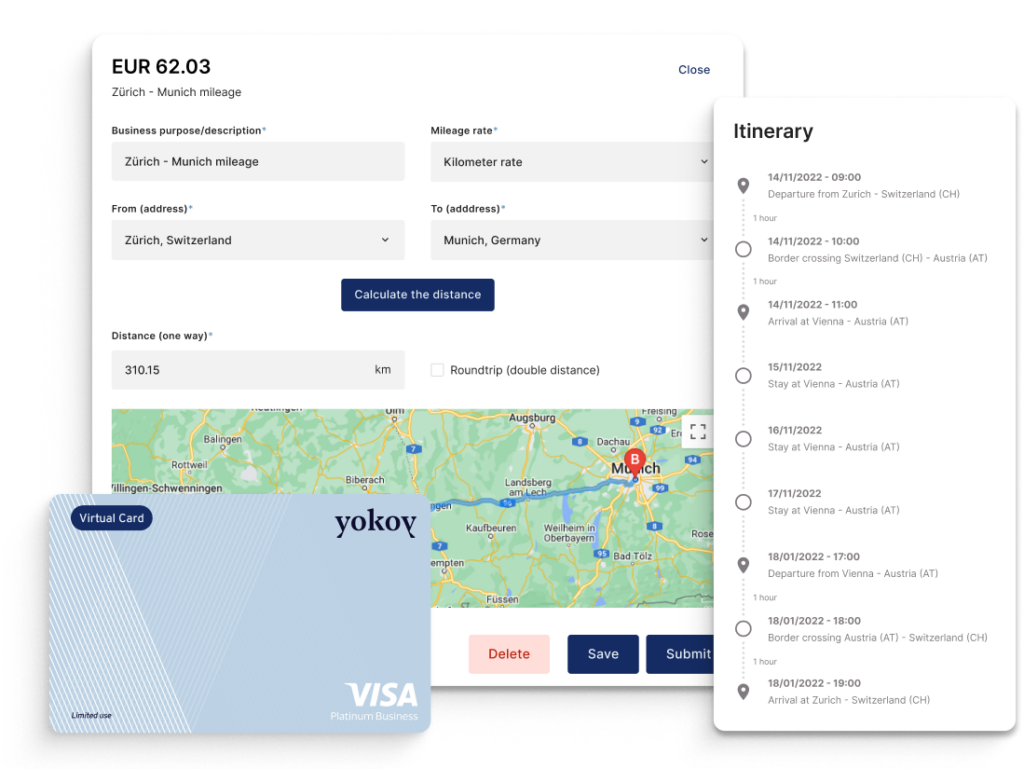

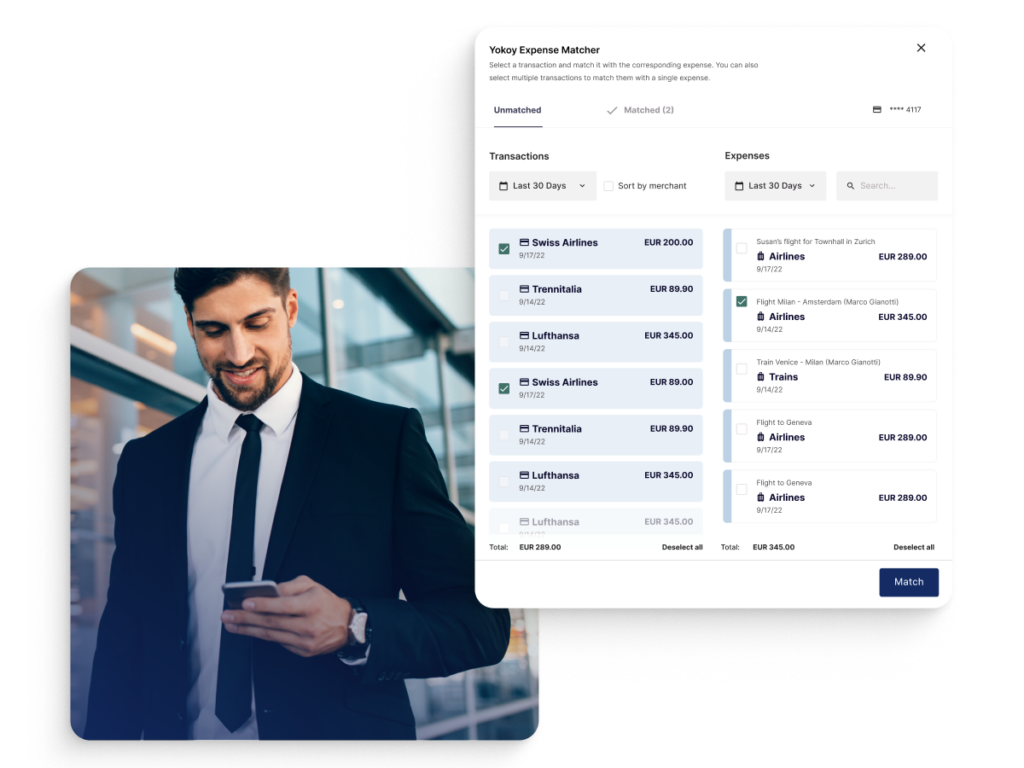

Besides, customers can also pay with their Yokoy smart corporate card and match transactions automatically when reporting an expense without having to look for other vendors. We’ve covered the topic in detail in the article below.

Opinion

Maximizing Compliance through Automated Expense Reporting

Automated expense reporting has been gaining traction as a solution to help finance teams streamline their workflows and gain real-time insights into company expenses. But there’s one more area where automation can help tremendously: Staying compliant.

Lars Mangelsdorf,

Co-founder and CCO, Yokoy

Customizable approval workflows

Third on our list are the pre-approval workflows: Yokoy provides customizable approval flows to help companies ensure compliance with their expense reporting policies.

This feature allows companies to define and implement their expense policies with different levels of approval and routing, tailored to their specific needs.

For example, companies can customise their approval processes depending on their policies and can set up multi-level approval process depending on the expense type, department and project. Besides, companies can also set auto-approvals if there are no policy breaches and if the expense amount falls under certain limit.

For instance, an expense report for a business trip may require approval from a direct manager, a finance team member, and a department head. Alternatively, an expense report for office supplies may only require approval from the finance team member. If the claim is compliant with policy and within a certain limit, the expense can be automatically approved.

This allows companies to streamline their approval process across departments and entities, and ensures that expenses are properly authorized before reimbursement.

Additionally, Yokoy’s approval workflows enable companies to track the status of each expense report and provide visibility into the approval process for both the finance team and employees.

Note: Thanks to our end-to-end integrations with travel booking platforms such as TravelPerk, the trip booking process can be fully automated, eliminating the need for approvals for transport and hotel bookings.

Your finance team can book all flight or train tickets in TravelPerk, and pay directly with the Yokoy Smart Lodge Card. This way, employees don’t have to book their own trip and don’t have to pay with private cards for travel bookings.

If all these expenses are handled directly by your finance team or by a travel manager, they can be removed from the approval flows for travel expenses, simplifying the process.

AI-powered automated policy enforcement

Our solution can also help to enforce expense policies automatically. For example, if an employee tries to submit an expense that exceeds a certain amount or violates a company policy, the software can automatically reject the expense or send it to a manager for further review.

This is done by setting custom rules based on specific company policies, and by using AI technology to flag policy breaches, duplicates, and fraudulent activities in real time.

Yokoy’s software can recognize and process receipts in various currencies and languages, so it can help streamline the expense tracking and reimbursement process across entities and geographies.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

Spend data analytics and reporting

Finally, Yokoy offers data analytics and reporting capabilities, which allow companies to analyze their expense data and identify any trends or anomalies that may indicate fraud in real time. At the same time, our solution makes it easy for auditors to know when and why there’s over-spend, and facilitates the archival and export of expense reports.

By using expense management solutions like Yokoy, companies can improve their visibility and spend control, significantly reducing over-spend and the risk of fraud during the expense reporting and reimbursement process.

Next steps

In conclusion, accurate expense reporting is crucial for businesses to avoid potential losses and maintain trust in their employees. To prevent and detect fraudulent reimbursement claims, companies need to take a proactive approach by implementing strong controls, educating employees, and utilizing technology solutions.

Yokoy supports midsize and large companies in preventing employee expense fraud through AI-powered automation and built-in compliance. If you’d like to see what our expense management solution can do for your company, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

In this article

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.