Home / Compliance Center / Compliance in Austria

Compliance in Austria

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

Austrian businesses engaging in spend management activities must navigate a complex landscape of rules and guidelines.

Ensuring adherence to these compliance measures is not only a legal requirement but also a reflection of the country’s strong emphasis on ethical and responsible financial practices.

In this context, understanding and effectively integrating compliance measures is essential for businesses seeking to streamline their spending processes while maintaining the highest standards of integrity and accountability.

Proof of Receipt

Regulations in place

Austrian government allows companies to reimburse business expenses to employees.

According to the § 132 and § 162 of the Federal Tax code, to recognise the expense as a business expense, companies must collect all receipts of these expenses. Companies must be able to show receipts to the tax authorities during an audit or upon request. The collected receipts must be archieved for seven years (statutory retention period).

According to §132 para 2 of the Federal Tax code, the receipts can be stored electronically if the following is guaranteed until the end of the statutory retention period:

- complete,

- orderly,

- identical content, and

- true to the original reproduction

Yokoy's solution

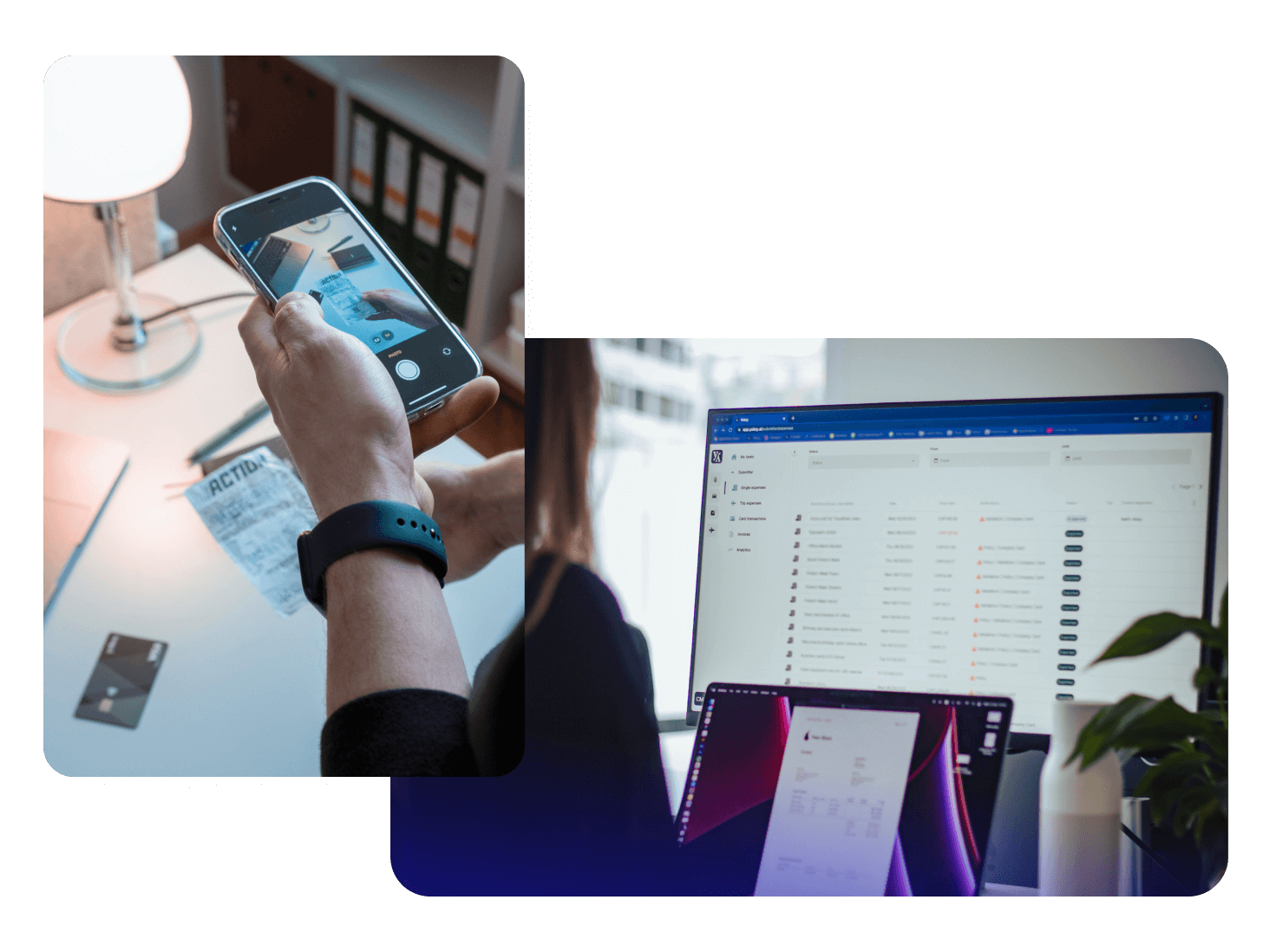

Yokoy allows employees to upload or take pictures of receipts and submit them in the Yokoy app (mobile phone or computer).

Yokoy extracts all necessary data from the picture, prepares the expense report automatically in a few seconds and even validates the expense report by generating warnings to highlight specific events (e.g. duplicate of picture).

Depending on the workflow of the company, the data and pictures can be checked by multiple parties (including the Finance team) before the expense is approved, booked in the Finance tool and reimbursed to the employee. Such checks can include the correctness of the data or quality and completeness of the picture.

Yokoy archives the pictures in line with the requirements for storing electronic photos for at least the statutory retention period.

Per Diem

Regulations in place

Per Diems are fix amount allowances paid to employees for expenses incurred when travelling (for lodging, meals, and incidental expenses) without the need to have a receipt.

There are Per Diem rates defined by the Austrian government, which outline permissible limits for meal and lodging reimbursements that come with no tax implications. However, any amounts surpassing these limits are regarded as taxable income for the user and necessitate meticulous tracking.

Note: The rates are published by the Austrian Government on a yearly basis.

In addition, the Austrian Federal Economic Chamber (Wirtschaftskammer Österreich or WKO) have signed numerous treaties (called collective agreements) with various unions across the country whereby Per Diem rates are defined that apply to these employees. Furthermore, company-specific agreements with employees might also influence these rules.

The applicable collective agreements in conjunction with the Government-defined (legal) rates will be the actual permissible rates to reimburse an user.

Calculating the correct amount for Per Diems can be complex since the rates can very depending on the duration of trip, the location and other factors.

Performing complex Per Diem calculations

Austrian regulation entails considerably a lot of collective agreements for each worker’s union. Due it’s complex nature, manually performing such complex calculations based on the trip is not just time-consuming but also highly prone to errors.

Here is a selection of specifications of Per Diems in Austria.

Definition of a “Day”

As per Austrian regulation, a day could be defined as follows:

- Calendar Day – Per Diem calculated in one “specific” day. Meaning, if the user starts the trip at 08:00am and ends the trip at 08:00am the next day; then it is considered that the user has travelled for two days.

- 24 hours – If the calculation is according to the 24-hour calculation, one day is calculated as 24 hours. Meaning, if the user starts the trip at 08:00am and ends the trip at 08:00am the next day, the user is entitled to receive Per Diem for one day.

- 3/3 Rule: Often, collective agreements also have certain conditions on how daily allowances should be calculated, one such is defined as 3/3 Rule or Three-thirds Rule. According to this condition, Per Diem is split across the following three intervals:

- If the employee travels more than 5 hours, the user is entitled to receive 1/3rd of the Per Diem

- If the employee travels more than 8 hours but less than 12 hours, the user is entitled to receive 2/3rd of the Per Diem

- If the employee travels more than 12 hours, the user is entitled to receive 3/3rd of the Per Diem or complete Per Diem for the day.

Domestic and Foreign Trip

Domestic Trip

Employees are entitled to receive a daily meal allowance according to the official rates published by the government. The Austrian regulation also states the user is entitled to receive Per Diem only if the business trip is more than 3 hours (which is 03H:01M).

Once this requirement is met, then the Per Diem for the day would be spread across 12 intervals; therefore, allowing users to claim 1/12 allowance per hour to a maximum of 12/12 per day.

The standard domestic trip is calculated according to the Calendar Day.

As per Austrian regulations, employees are entitled to receive a maximum of €30.00 as a daily allowance (24 hours) for domestic trips.

Foreign Trip

For a trip to be considered foreign:

- the user must have crossed the border

- the user must have at least spent 5 hours in a foreign country

Every year, Austrian government also publishes business travel allowances for each specific foreign location. If the user travels domestic & foreign trip on the same day, the rules for the foreign trip takes the priority for the day. However, the user receives domestic allowance for the time spent in home country.

If the user receives an allowance that is higher than the governmental rate (or collective agreement), the difference must be accounted to the income tax.

Please refer the Per Diem rates published by Austrian government for each countries.

Multiple trips on the same day

If the user takes multiple trips on the same day, each trip should be calculated individually based on the number of hours travelled for each trip. If multiple trips occur on the same day, the calculation will be based on the 12/12 limit.

Meal reductions

Any meals provided to the employee should be reduced and accounted for the employee, therefore the employee will not receive any amount for the reduced meal of the day.

According to Austrian regulation, meal provided as:

- Breakfast should be reduced by 0€

- Lunch should be reduced by 50%

- Dinner should be reduced by 50%

Yokoy's solution

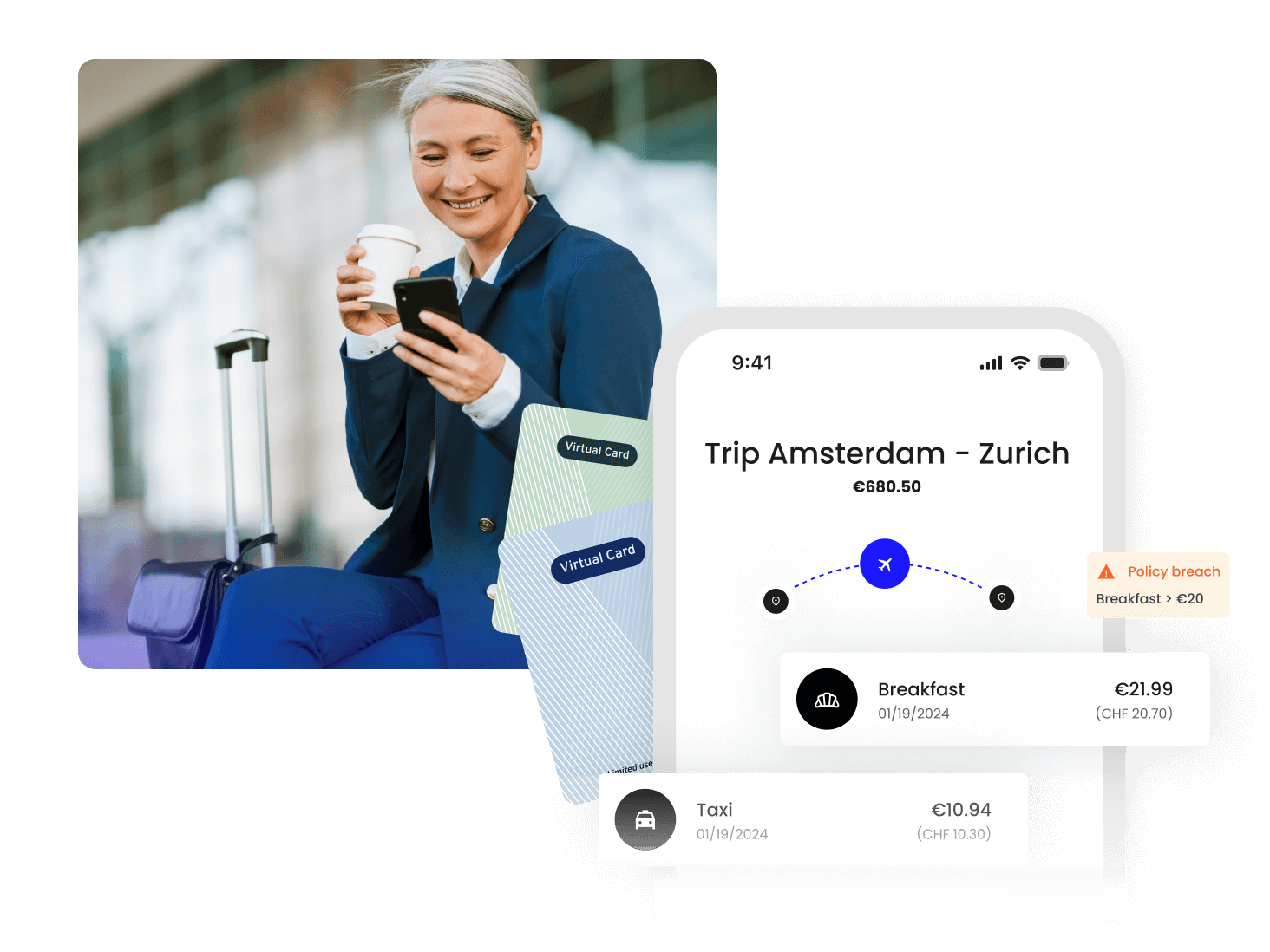

A company can enter different Per Diem rates and the respective calculation rules. Per Diems are thereby automatically calculated based on the rates and the calculation rules without any manual work needed from the employees.

If the user receives an allowance that is higher than the governmental rate (or collective agreement), the difference can be booked/exported differently to the Finance tool.

As one of only few solutions in the market, Yokoy can be used in Austrian companies and can calculate the correct Per Diem for the user based on a trip, configured collective agreement, legal rates and company policies.

Yokoy supports all calculation methods such as:

- 12/12 Rule

- Definition of a day – Calendar day / 24 Hour

- 3/3 Rule

- Border Crossing

- Border Regions

- Tax statement

- Collective Agreements

- Configure Income Tax & Tax-fee amount

Mileage Allowance

Regulations in place

Mileage expenses are aimed to cover the employee’s commute cost for business trips when using a private vehicle apart from the daily allowance/Per Diem.

Austrian government recognises the below mileage allowances as a flat-rate for all costs incurred for the usage of private vehicles for a business trip. This amount can currently be recognised for a maximum of 30,000 kilometre per calendar year.

- If the company decides to pay more than the published government rates, the difference in amount is considered as taxable income and needs to be accounted for as such (different accounting booking would be needed for the excess mileage rates).

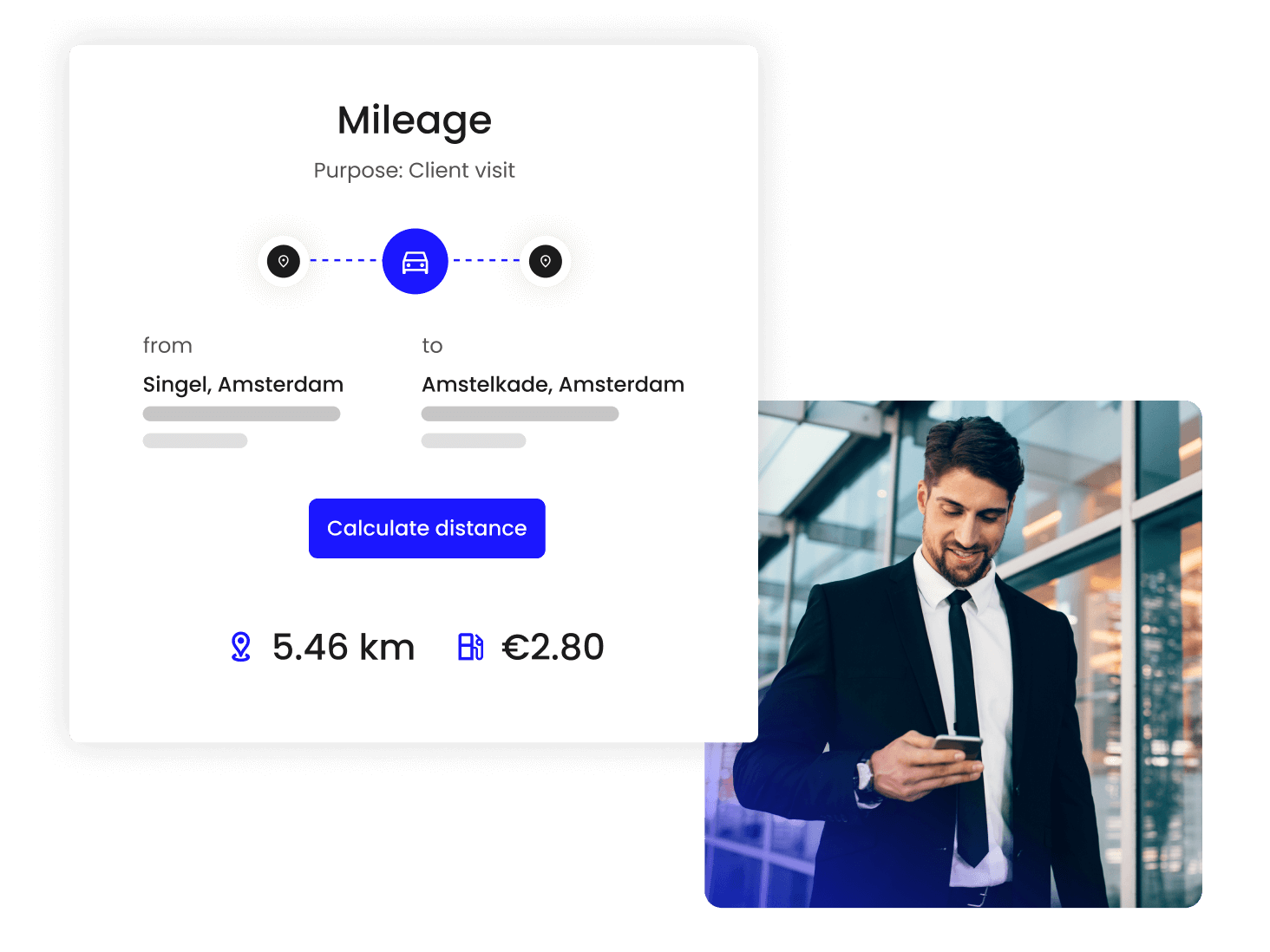

Yokoy's solution

Yokoy recognises the official rates defined by the Austrian government and therefore can automatically calculate mileage expenses based on the distance travelled.

VAT Rate

Regulations in place

The Austrian government levies VAT rates for exchange of goods and service. There are four different VAT rates relevant for expense management:

- Standard VAT – 20% for most of the goods and services

- Reduced VAT – 13% for art works, sporting event, delivery of living animals, plants

- Reduced VAT – 10% for accommodation, Transportation

- No VAT – 0% for VAT excluded goods and services

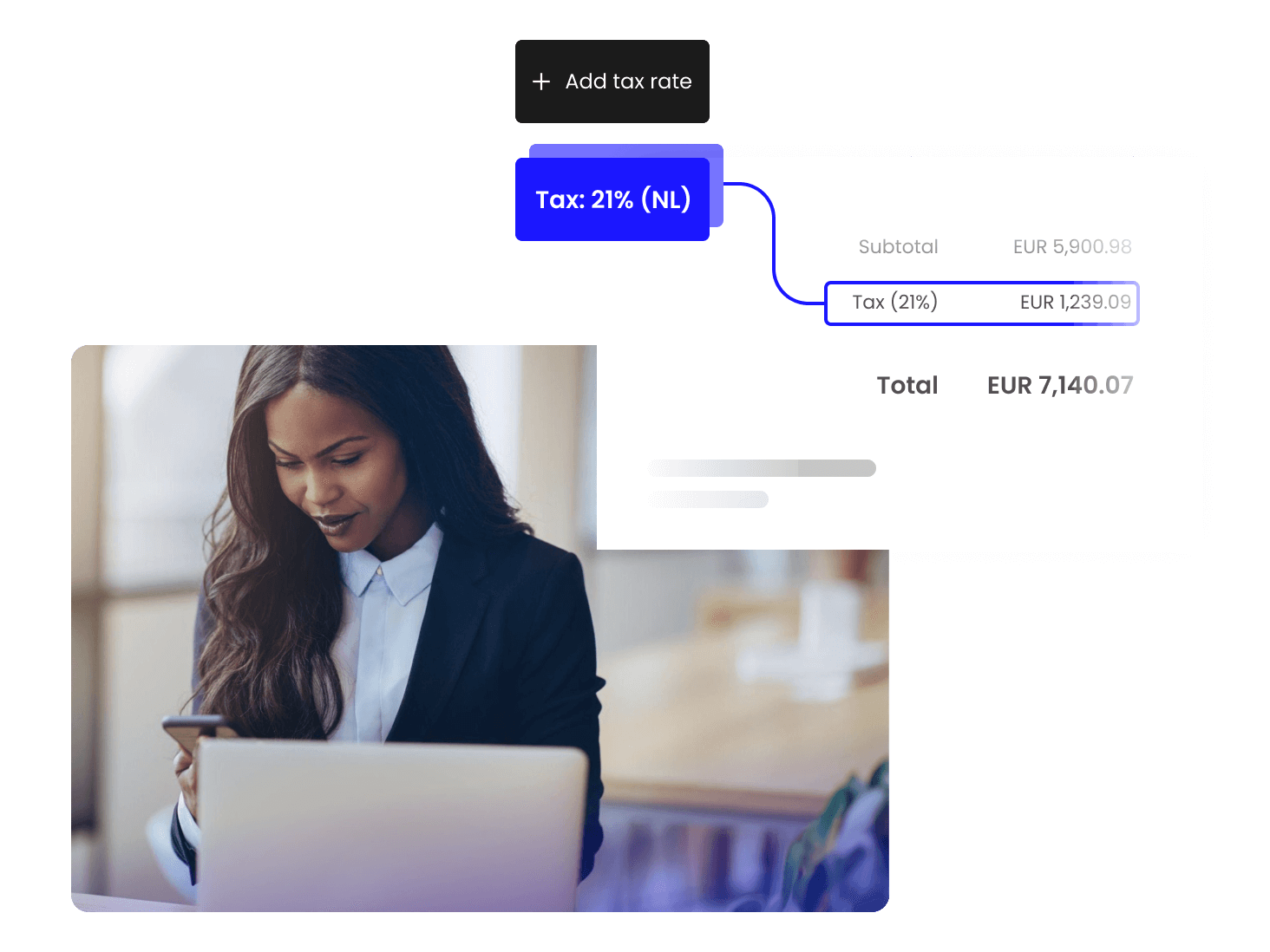

Yokoy's solution

Once the solution is correctly configured, Yokoy automatically extracts all VAT relevant for expense management from the submitted receipt pictures (see the details above). If relevant Companies can also add additional VAT rates for extraction. Yokoy can also extract VAT rates from other countries (e.g. Germany) and book/export them separately in the Finance tool.

Additionally, Yokoy offers standard integrations with external VAT reclaim providers, wherein the receipt pictures and the extracted VAT rates are for specific countries are automatically made available to the third-party.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo