Home / Compliance Center / Compliance in the UK

Compliance in the UK

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

Optimize spend management while operating in the UK by familiarizing yourself with the nuances of compliance and integrating them into your financial operations effectively.

Download for later

No time to read right now? Get the .pdf version of the guide below.

Proof of Receipt

Regulations in place

To ensure compliance with HMRC rules, it’s essential to keep a clear record of all expenses and benefits given to your employees. This record should include:

- The date and details of each expense or benefit.

- Information needed to calculate year-end amounts.

- Any contributions your employees make toward these expenses or benefits.

You are required to keep these records for three years after the tax year ends. You can save them on paper, digitally, or in software like Yokoy. Make sure your records are accurate, complete, and easy to read to avoid HMRC penalties.

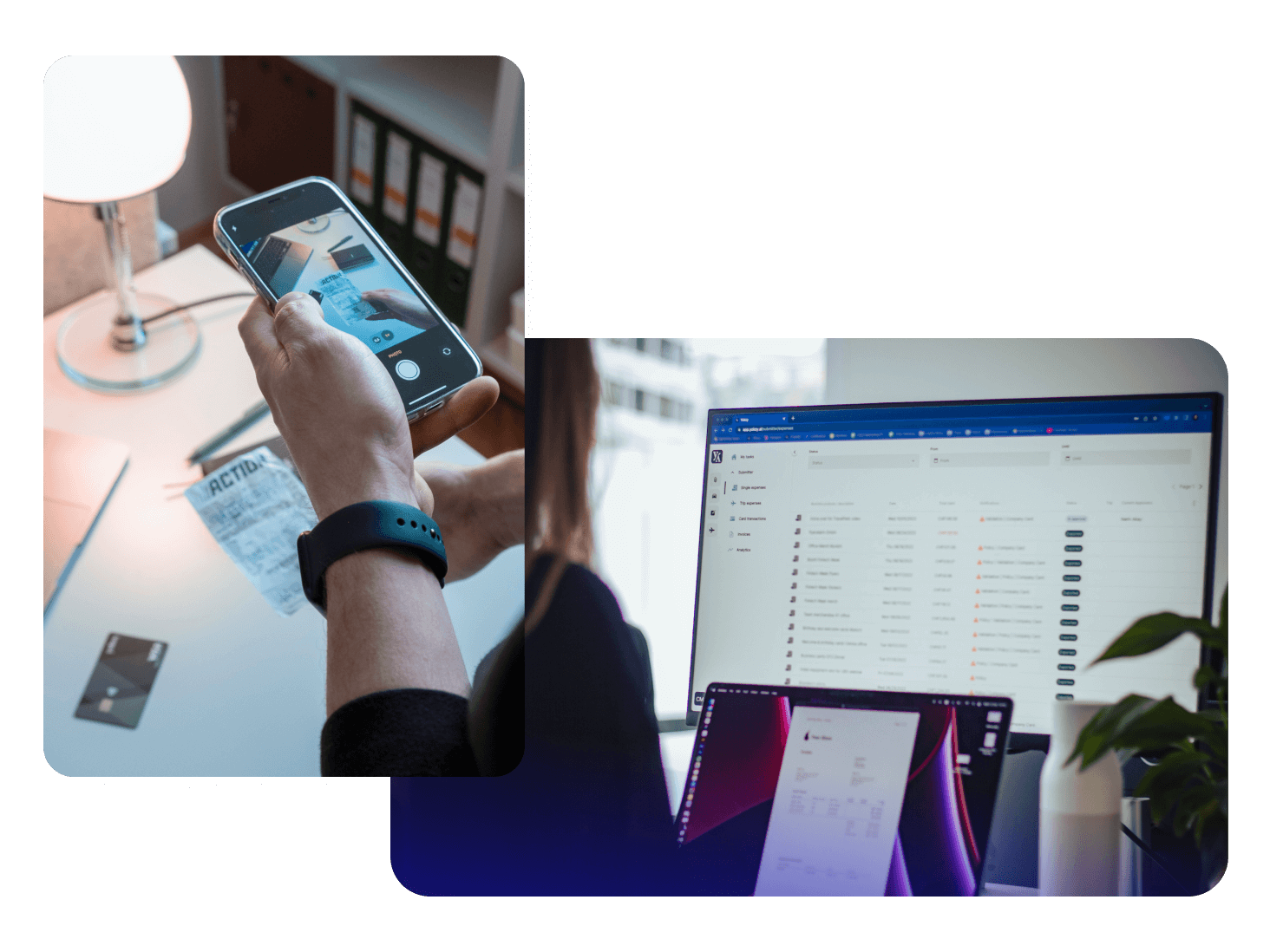

Yokoy's solution

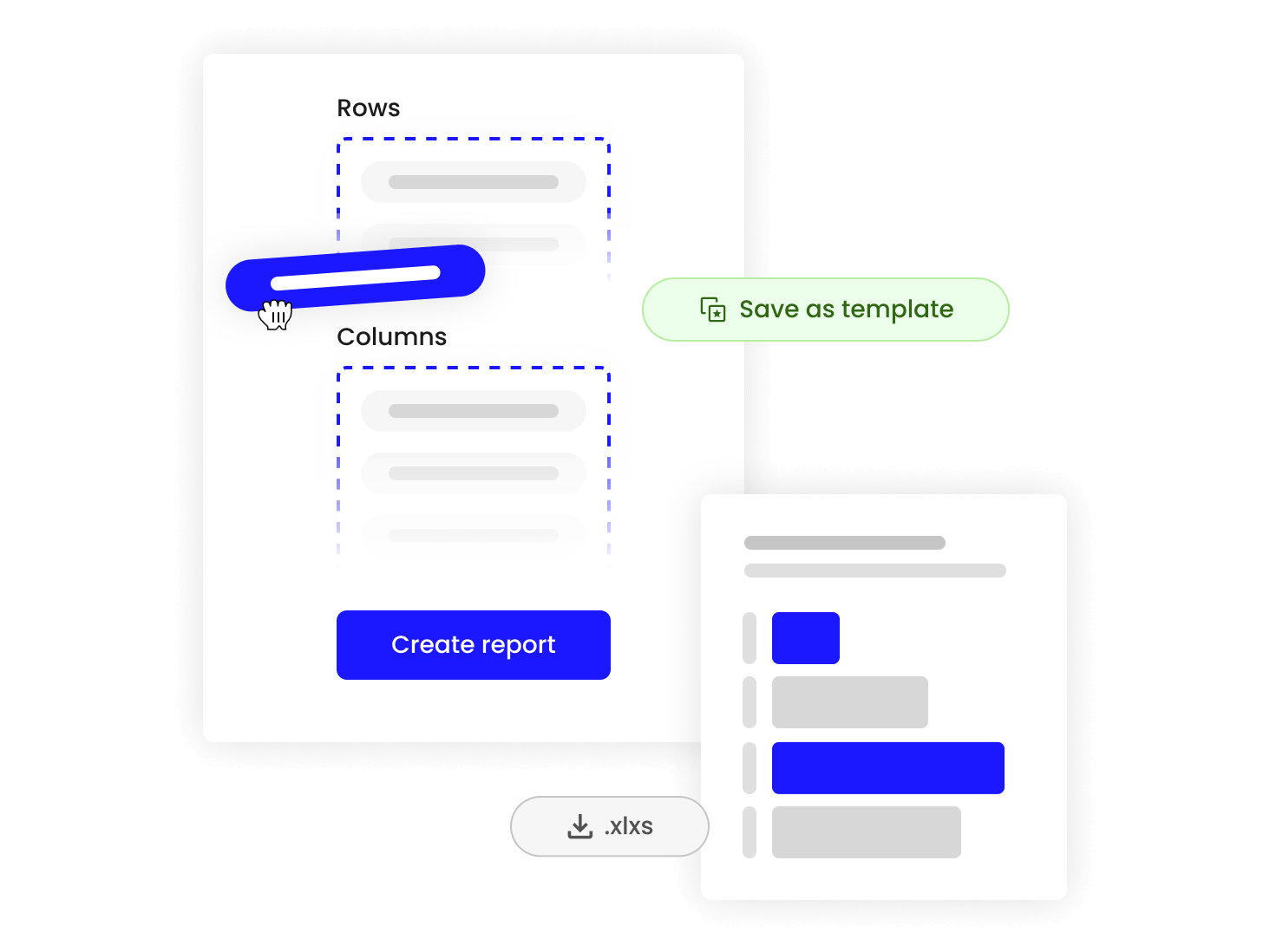

Yokoy enables employees to take a picture or upload digital expense receipts and submit them via the Yokoy mobile or web application.

Once uploaded, Yokoy processes and extracts all required information from the receipt and automatically prepares the expense report in seconds. With any potential fraud or policy breaches, Yokoy immediately triggers a warning to highlight the specific event.

Depending on the specific workflow and company policy, the expense report can be checked by multiple parties before being approved and booked into the ERP or finance tool, ensuring the correctness, quality, and completeness of the receipt.

Per Diem

Regulations in place

In the UK, there are three generally accepted approaches to reimbursing subsistence expenses to your employees.

- You can reimburse your employees actual vouched expenses known as “actuals”.

- You can pay your employees a per diem, often referred to as a scale rate payment, based on the standard rates set by the HMRC.

- You can pay your employees a custom per diem rate.

Most companies choose to pay actuals as it maximizes VAT returns. However, per diems or “scale rate payments” are considered a simple approach to reimburse your employees on an individual basis.

Per diems

If you choose to pay per diems, you have two choices when offering employees scale rate payments free of tax.

The HMRC publishes a standard amount for domestic and international travel for companies not covered under the Working Rule Agreements.

In case your company does a large amount of travel, you have the option to negotiate directly with the HMRC for a custom scale rate. If successful, you can offer higher rates free of tax to your employees. If you are not successful or choose to pay per diems above the rate set by the HMRC, the difference will be subject to tax and National Insurance Contributions (NICs).

When do per diem rates apply?

In order to offer per diems, the following conditions must apply:

- the travel must be in the performance of an employee’s duties or to a temporary place of work

- the employee should be absent from their normal place of work or home for a continuous period in excess of 5 hours or 10 hours

- the employee should have incurred a cost on a meal (food and drink) after starting the journey

HMRC’s domestic rates

The current benchmark rates for domestic travel in the UK are:

- Minimum journey time: 5 hours – Maximum rate: £5

- Minimum journey time: 10 hours – Maximum rate: £10

- Minimum journey time: 15 hours (and ongoing at 8pm) – Maximum rate: £25

Notes on Domestic Per Diems:

- An additional meal allowance of up to £10 per day may be paid if an allowance under a) or b) is paid and travel is ongoing at 8 pm.

- No benchmark rate has been set for overnight accommodation.

- The over 15-hour rate will almost always apply when an employee is required to stay overnight and provided that the cost of any meal is not included as part of the accommodation.

HMRC’s overseas rates

HMRC issues a list of rates for an extensive number of countries. If you are traveling for more than 24 hours, a 24 hour rate plus the room rate can be paid out. The 24 hour rates includes the cost of lunch, dinner, a drink and public transportation to the office. While the room rate includes the total cost of a hotel room.

The HMRC publishes a 5 hour, 10 hour or 24 hour rate as well as a room rate in the country’s local currency for one or more cities within a country.

In some countries, there are different rates published for cities, like in the case of Munich and Berlin, Germany. In case you are traveling to a city not listed, the guidance is to use the rate that applies to the nearest city within the same country on the list. For example, if you travel to Hamburg, you would select the Berlin rate as it is geographically closest.

For the full list from the HMRC, refer to the government website.

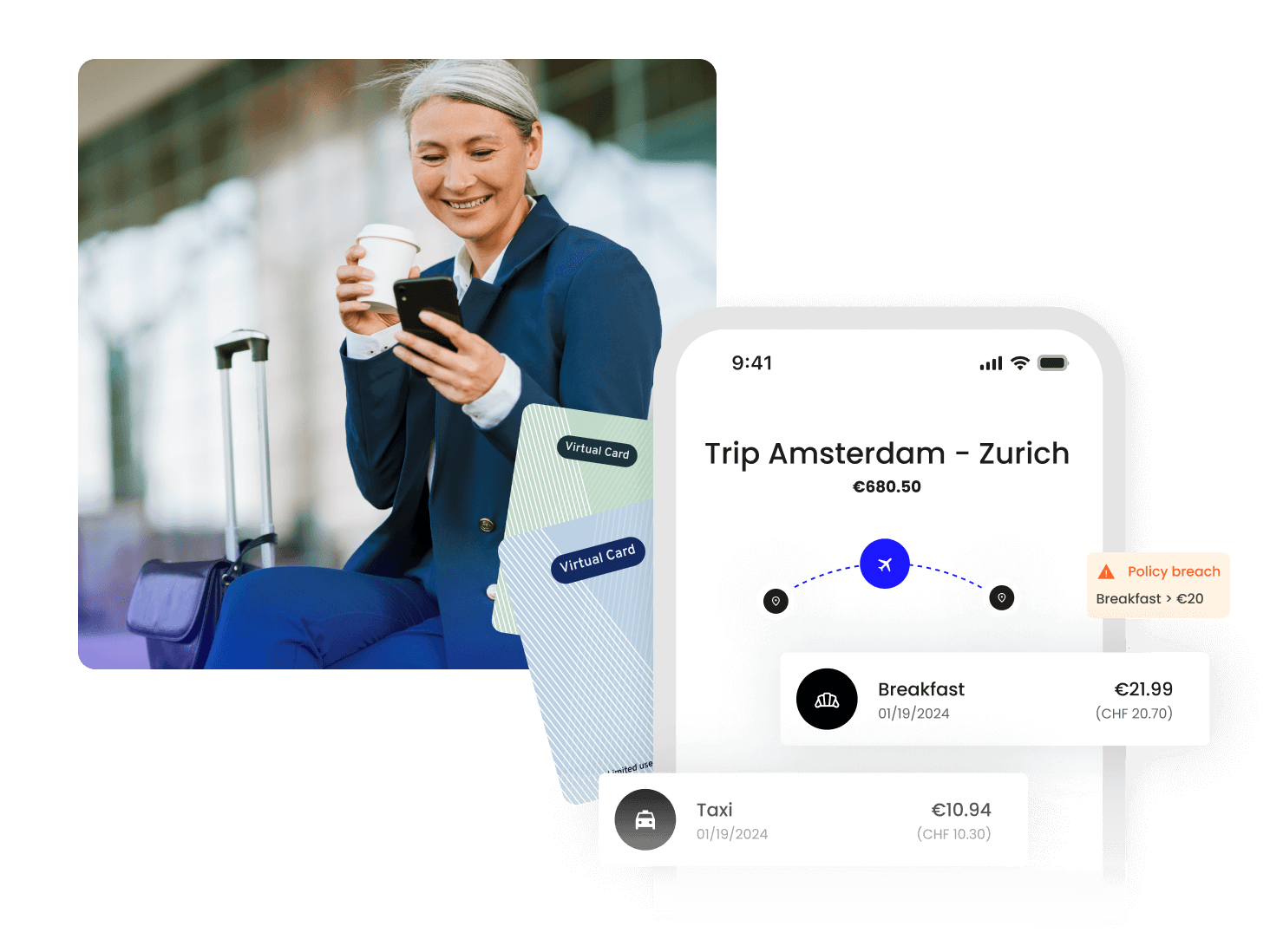

Yokoy's solution

With Yokoy, you can easily pay your employees actuals or per diems. As a company, you can configure different per diem rates and respective calculation rules. Per diems are then automatically calculated in Yokoy with no manual work required by your employees.

If a user receives an allowance exceeding the government rate, the difference can be booked and exported differently in our finance tool.

Mileage Allowance

Regulations in place

You can pay your employee Mileage allowance payments (MAPs) when they use their private vehicle for business trips. You can make these payments without needing to report them to the HMRCS nor pay tax on them.

The approved MAPs, or AMAPs, can be calculated by multiplying the approved rate by the business miles driven. The approved rate differs based on the mode of transportation and the total amount of business miles driven per tax year.

- First 10,000 miles within a tax year:

- Cars and vans – 45p

- Motorcycles – 24p

- Bikes – 20p

- Above 10,000 miles within a tax-year:

- Cars and vans – 25p

- Motorcycles – 24p

- Bikes – 20p

If you pay more than the approved amount, the excess must be added to any other earnings the employee receives in the earnings period.

Anything below the approved amount will not have to be reported to HMRC nor paid tax on, but, your employee will be able to get tax relief (called Mileage Allowance Relief, or ) on the unused balance of the approved amount MAR.

This only applies to employees using their own vehicle. If you are reimbursing your employees for fuel mileage on a company car, please refer to the HMRC’s advisory fuel rate calculation.

“Ordinary commuting”, or any travel from your home to a permanent workplace, is not approved for MAPs.

Reclaim VAT on mileage

The UK is the only country that allows companies to reclaim VAT on the fuel portion of the mileage allowance. HMRC publishes Advisory Fuel Rates (AFR) on the amount of fuel you can attribute to a mileage claim of a business trip. These rates differ based on the type of engine (petrol, diesel, LPG or electric) and the engine size of the vehicle. Your employees must keep a record of fuel receipts for you to claim the VAT on the mileage expenses.

The HMRC reviews the AFRs quarterly.

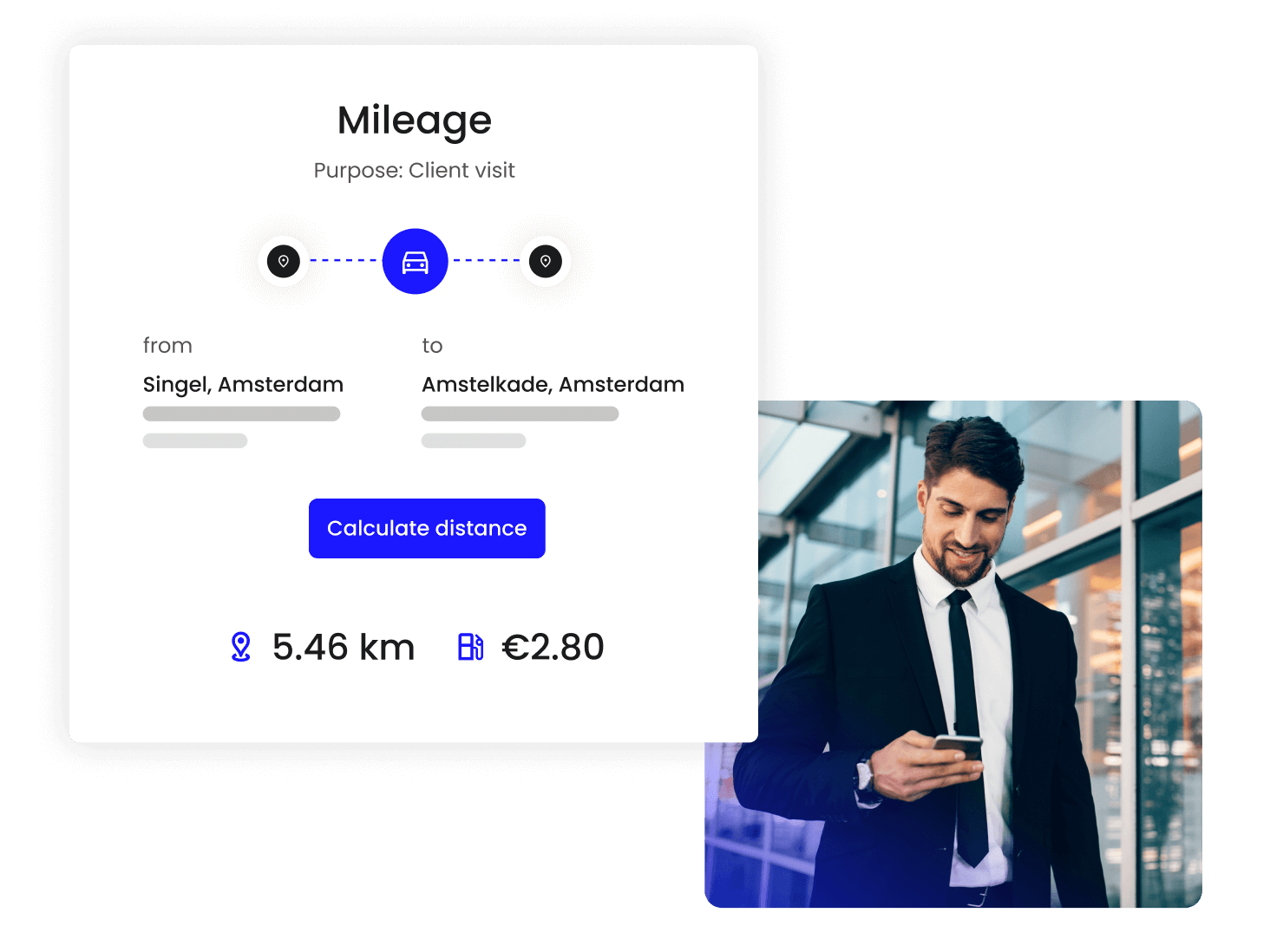

Yokoy's solution

Yokoy recognises all the official rates defined by the government and therefore can automatically calculate mileage expenses based on the distance travelled. If a company decides to pay more than the rates defined by the government, Yokoy can export/book the excess amount separately in the Finance tool.

VAT Rate

Regulations in place

There are three VAT rates in the UK. VAT can be reclaimed on goods and services purchased for your business. When a purchase can also be used for private use – for example, in case of mileage allowance, you may only reclaim the business proportion of the VAT.

- Standard rate – Most goods and services – 20% VAT

- Reduced rate – Some goods and services, eg. children’s car seats and home energy – 5% VAT

- Zero rate – Zero-rated goods and services, eg. most food and children’s clothes – 0% VAT

For more guidance on VAT reclaim in the UK, read the HMRC guidelines here.

The HMRC publishes monthly exchanges rates which should be used if convert any foreign currency to sterling for VAT purposes.

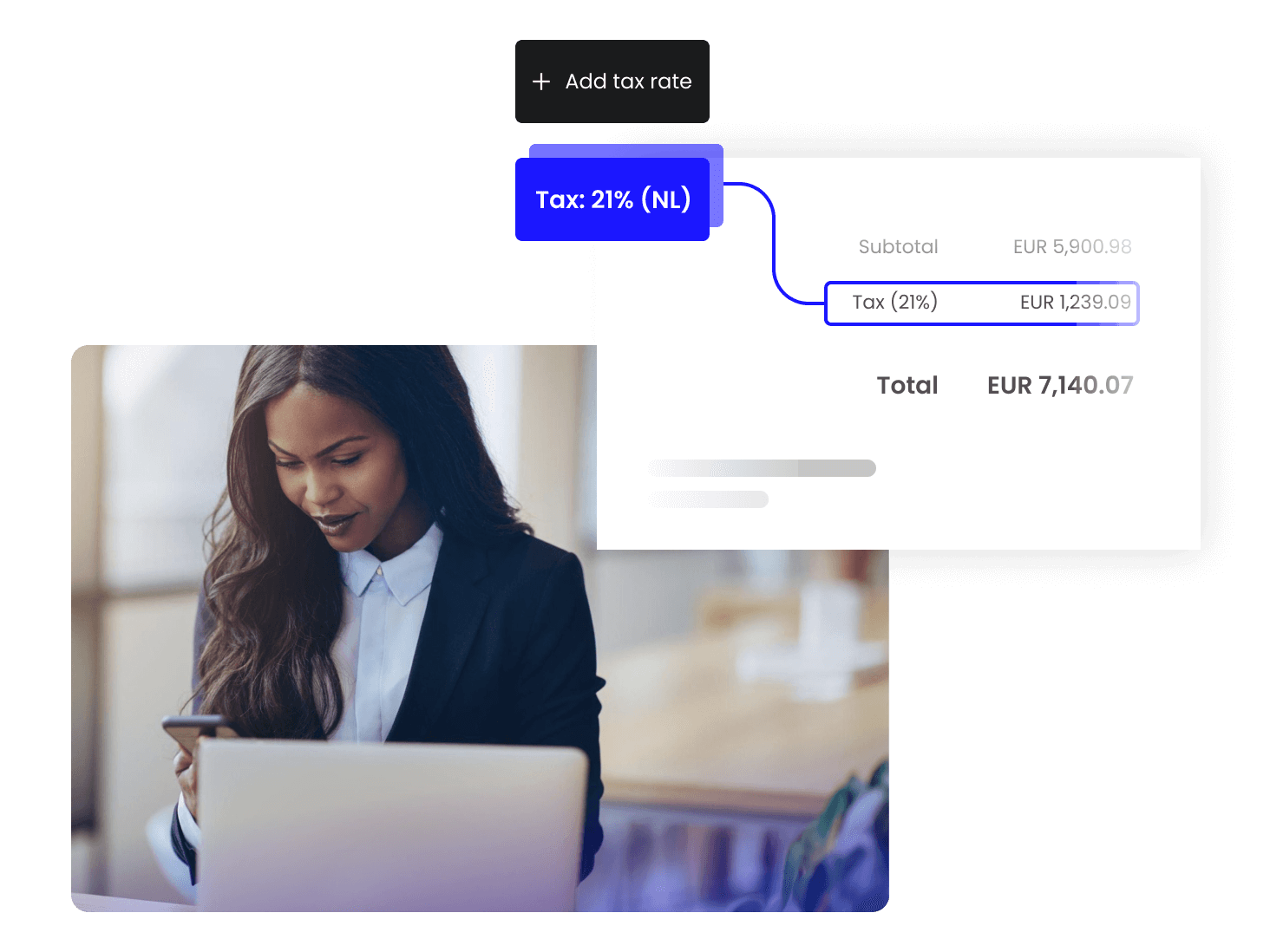

Yokoy's solution

Yokoy automatically extracts all VAT rates relevant for expense management and companies can also add additional VAT rates for extraction. Yokoy extracts all relevant VAT rates from the expense receipt and books them into the ERP or financial system.

Additionally, Yokoy supports customers in reclaiming VAT, by offering standard integration with VAT reclaim providers. This integration allows Yokoy to automatically export extracted VAT rates for specific countries as well as the relevant image of the expense receipt to the VAT reclaim tool.

P11D Reporting Requirement

Regulations in place

In the UK, employees are required to fill out a year-end form that includes all expenses that could be considered as a benefit in kind. This form is called a P11D expense form and is used for this purpose.

Normally, it’s the finance teams, not the employees themselves, who keep track of this process. Employees simply create their expenses as usual, and then the finance teams review the reports and label the expenses as P11D expenses.

The report details of all their P11D transactions, including information such as:

- Expense Type/Category

- Amount

- Date

Yokoy's solution

With Yokoy, your finance team can easily export the necessary information from Yokoy Analytics and provide this data to your payroll team. If you have more than 500 employees, you should fill in and submit the P11D forms through your payroll software.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo