Home / Compliance Center / Compliance in France

Compliance in France

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

Enhance spend management efficiency in France by understanding and seamlessly integrating compliance nuances into your financial operations.

Download for later

No time to read right now? Get the .pdf version of the guide below.

Proof of Receipt

Regulations in place

French government allows companies to store expense receipts in a digital format as long as the integrity, authenticity, correctness and completeness of the receipts can be ensured.

According to the French tax code, if the company intends to store receipts in an electronic format, the company must ensure, the documents are stored in a PDF format together with either:

- A server stamp based on a certification that complies with one-star general security reference framework (RGS) or a digital fingerprint, or

- An electronic signature based on a certification that complies with at least RGS one-star level or any equivalent secure service-based certificate issued by a certification authority on the French Trust Service status list.

Yokoy's solution

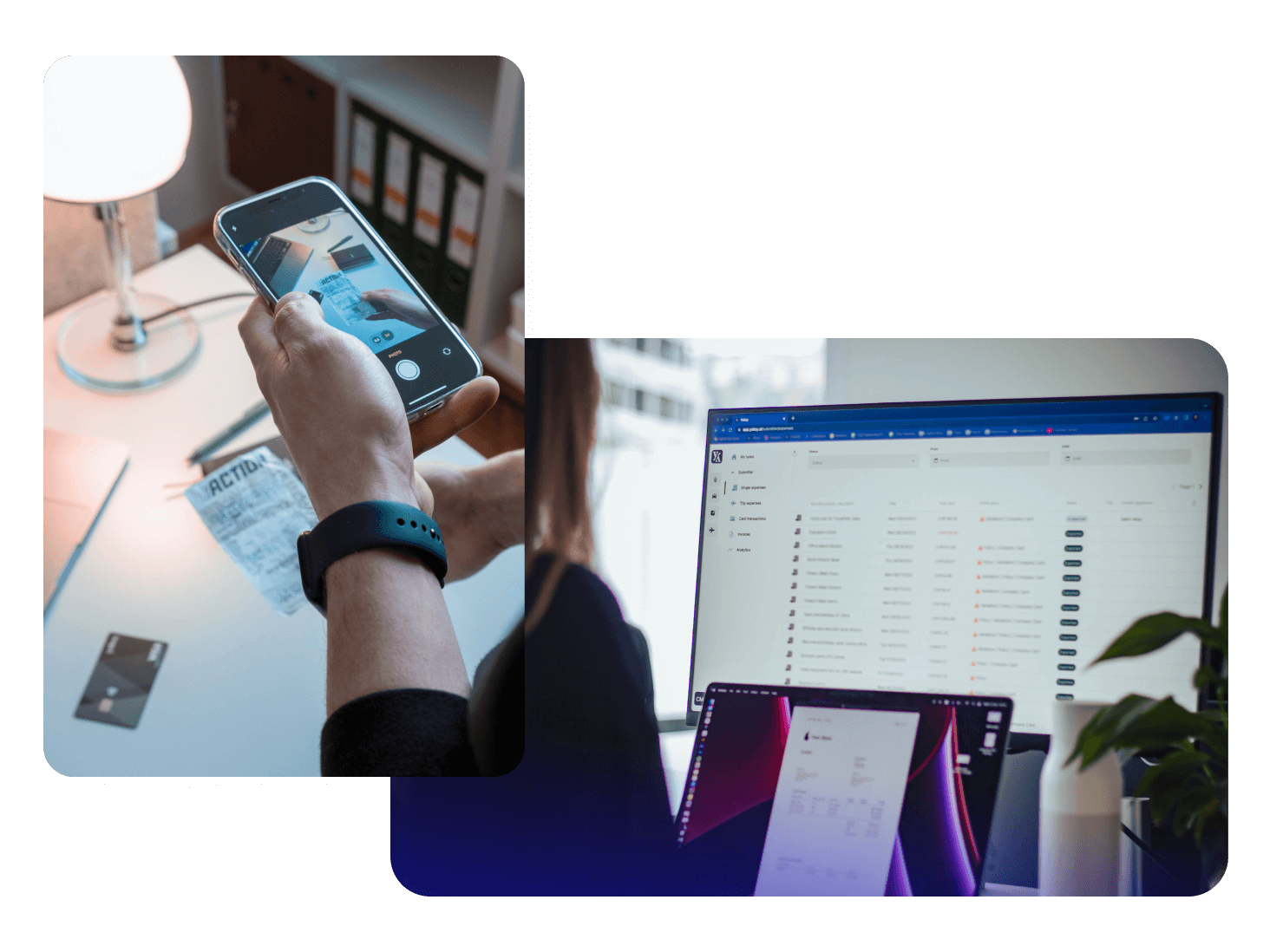

Yokoy enables employees to take a picture of the receipt or upload the digital expense receipt and submit them via Yokoy mobile or web application.

Once uploaded, Yokoy processes and extracts all required information from the receipt and automatically prepares the expense report in seconds. With any potential frauds or policy breaches, Yokoy immediately triggers a warning to highlight the specific event.

Depending on the specific workflow and company policy, expense report can be checked by multiple parties before being approved and booked into the ERP or Finance tool, ensuring correctness, quality and completeness of the receipt.

Yokoy adheres to GDPR regulations and stores receipts securely for the statutory retention period on its servers hosted in EU. However, to comply with local regulations Yokoy recommends companies to store physical receipts.

Per Diem

Regulations in place

In France, reimbursing expenses to employees differs based on the sector. The public sector companies or the French government reimburses their employees as Per Diem or daily allowances for the business trip. Whereas the private sector companies reimburse their employee’s business travel allowances for the actual cost occurred. This has the benefit of maximizing the VAT reclaims for the company.

Per Diems are fixed amount paid to employees for expenses incurred during a business trip such as meal, lodging and incidental expenses without needing to have an expense receipt as a proof of expense.

Employee can only receive Per Diem if they are not able to return to their place of residence each day due to working conditions. To receive Per Diem two conditions must be met:

- The one-way distance between the place of residence and their place of work is greater than or equal to 50 KM

- The one-way public transport could not be covered in less than 1h30m

In addition, if these two conditions are met and the employee has returned to their place of residence, the employee is eligible to claim Per Diem.

Business trip in mainland France

Employees are allowed to receive Per Diem for business trips within mainland France. Employees are entitled to receive a maximum Per Diem of:

- €20.20 for Meal expense for each meal (lunch & dinner)

- €72.50 for Accommodation and breakfast in Paris and the departments of Hauts-de-Seine, Seine-Saint-Denis, and Val-de-Marne

- €53.80 for Accommodation and breakfast in other French metropolitan departments

Reductions for business trips in mainland France

- According to the French regulation, employees are entitled to receive full Per Diem for the first 3 months of their business trips.

- For business trips more than 3 months and less than 24 months – from the 4th month Per Diem should be reduced by 15%.

- If the business trip continues beyond 24 months and less than 4 years – from the 25th month Per Diem should be reduced by 30%.

Business trips in French overseas departments

Employees are entitled to receive Per Diem for business trips in French overseas departments. According to French government, employees are entitled to receive maximum Per Diem for:

- Accommodation

- €120 (€ 70 if the business trip is before 22 September 2023) in Martinique, Guadeloupe, Guyana, Réunion, Mayotte, Saint-Pierre and Miquelon Departments

- €120 or 14320 F. CFP (€90 or 10740 if the business trip is before 22 September 2023) in New Caledonia, Wallis and Futuna, French Polynesia Departments

- Meal expense per meal

- €20 (€ 17,5 if the business trip is before 22 September 2023) in Martinique, Guadeloupe, Guyana, Réunion, Mayotte, Saint-Pierre and Miquelon Departments

- €24 or 2864 F. CFP (€21 or 2506 if the business trip is before 22 September 2023) in New Caledonia, Wallis and Futuna, French Polynesia Departments

Reductions for business trips in France overseas departments

- According to the French regulation, employees are entitled to receive full Per Diem for the first 3 months of their business trips.

- For business trips more than 3 months and less than 24 months – from the 4th month Per Diem should be reduced by 15%.

- If the business trip continues beyond 24 months and less than 4 years – from the 25th month Per Diem should be reduced by 30%.

Foreign business trips

French government announces Per Diem rates for different countries every year for the employee’s meal and accommodation expenses incurred during a foreign business trip. Per Diem for foreign business trip are highly dependent on the country that the employee is travelling.

Check the list of Per Diem rates for each country defined by the French government here.

Reductions in Foreign business trip

According to the French government, if the employer had already paid for certain expenses, Per Diem rates should reduced by

- 65% if the accommodation is already paid by the employer

- 17.5% if one of the meals had already been paid by the employer

- 35% if two meals had already been paid by the employer

In addition to these conditions, similar to the business trips in mainland France, the employees are entitled to receive full Per Diem for the first 3 months of their business trips.

- For business trips more than 3 months and less than 24 months – from the 4th month Per Diem should be reduced by 15%.

- If the business trip continues beyond 24 months and less than 4 years – from the 25th month Per Diem should be reduced by 30%.

Yokoy's solution

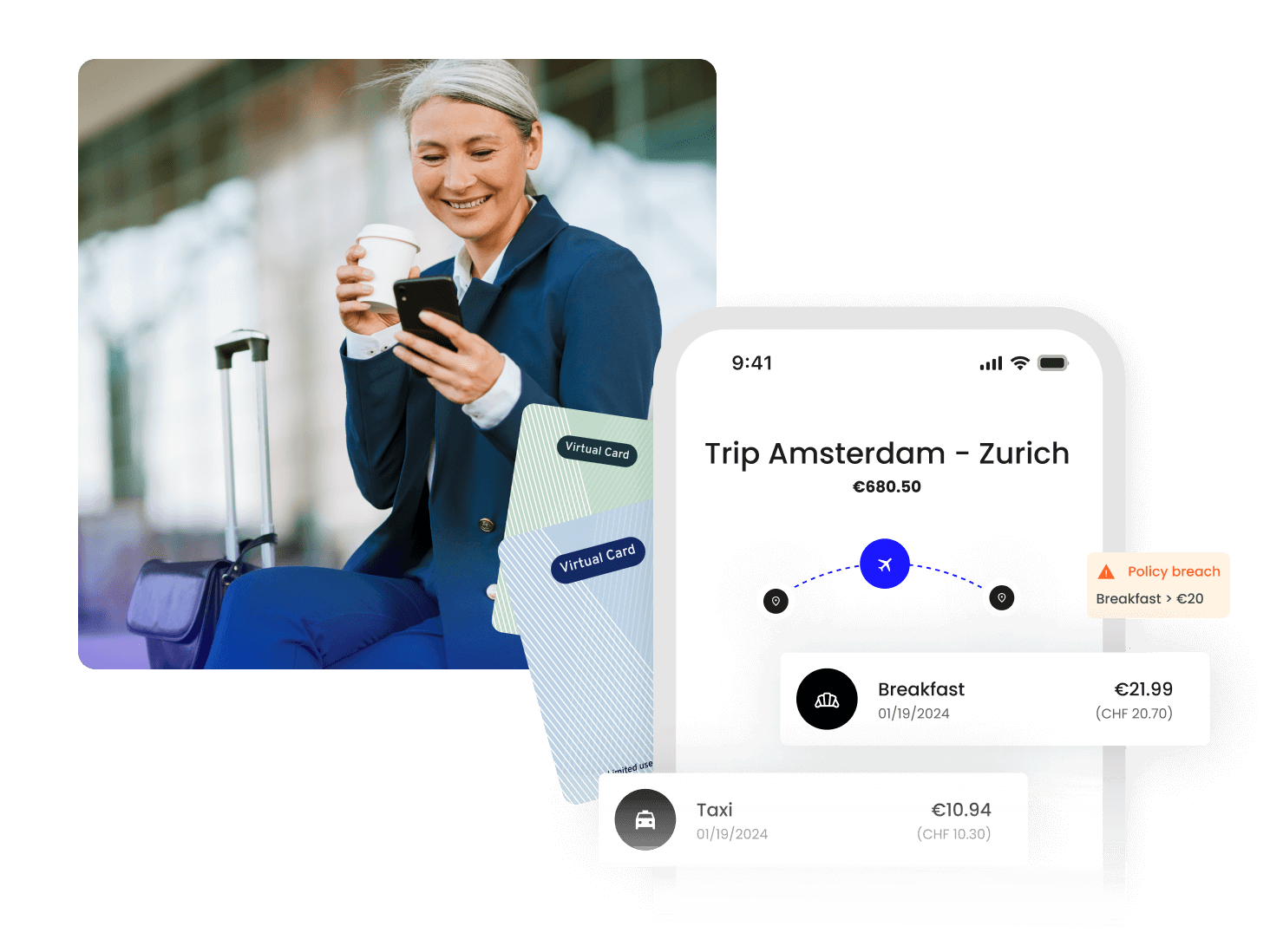

As you can imagine, these rules could be quite complex and you must always verify the user’s travel history to calculate Per Diem and check the amount that falls under income tax.

Yokoy can automatically calculate Per Diem rates based on the business trip and calculation rules without requiring any manual work from the employees. If the user receives allowance higher than the governmental rate, the difference can be booked and exported differently in the Finance tool.

For the private sector companies, with Yokoy employees can take a picture of the receipt or upload digital expense receipt and submit them via the Yokoy mobile or web application. Once uploaded, Yokoy processes and extracts all required information from the receipt and automatically prepares the expense report in seconds. This allows you to easily reimburse your employees’ actuals from their business travel.

In addition, Yokoy also extracts relevant VAT rates from the receipt and books them to the ERP/Finance tool, supporting you in reclaiming VAT by offering standard integration with VAT reclaim providers. This integration allows Yokoy to automatically export extracted VAT rates for specific countries as well as the relevant image of the expense receipt to the VAT reclaim tool.

Mileage Allowance

Mileage allowances are aimed to cover the employee’s commute cost for business trips when using a private vehicle. Mileage allowances are independent of daily allowances or Per Diem paid by the employer.

The French government recognises the below mentioned mileage allowances for specific vehicle types, if the employees receives more than what’s recommended by the government, the additional amount is subject to income tax.

As per French government, the Mileage allowance rates are:

- For car with engine size

- <3CV

- Up to 5,000 KM: €0.529/KM

- 5,001 KM to 20,000 KM: € 0.316/KM + 1065

- 20,001+ KM: €0.370/KM

- 4CV

- Up to 5,000 KM: € 0.606/KM

- 5,001 KM to 20,000 KM: € 0.340/KM + 1330

- 20,001+ KM: €0.407/KM

- 5CV

- Up to 5,000 KM: € 0.636/KM

- 5,001 KM to 20,000 KM: € 0.357/KM + 1395

- 20,001+ KM: €0.427/KM

- 6CV

- Up to 5,000 KM: € 0.665/KM

- 5,001 KM to 20,000 KM: € 0.374/KM + 1457

- 20,001+ KM: €0.447/KM

- 7CV and more:

- Up to 5,000 KM: € 0.697/KM

- 5,001 KM to 20,000 KM: € 0.394/KM + 1515

- 20,001+ KM: €0.470/KM

- <3CV

- For motorcycles with engine size

- 1 or 2 CV

- Up to 3,000 KM: €0.395/KM

- 3,001 KM to 6,000 KM: € 0.099/KM + 891

- 6,001+ KM: €0.248/KM

- 3.4 or 5 CV

- Up to 3,000 KM: € 0.468/KM

- 3,001 KM to 6,000 KM: € 0.082/KM + 1158

- 6,001+ KM: €0.275/KM

- More than 5CV

- Up to 3,000 KM: € 0.606/KM

- 3,001 KM to 6,000 KM: € 0.079/KM + 1583

- 6,001+ KM: €0.343/KM

- 1 or 2 CV

- For moped

- Up to 3,000 KM: €0.315/KM

- 3,001 KM to 6,000 KM: € 0.079/KM + 711

- 6,001+ KM: €0.198/KM

Yokoy's solution

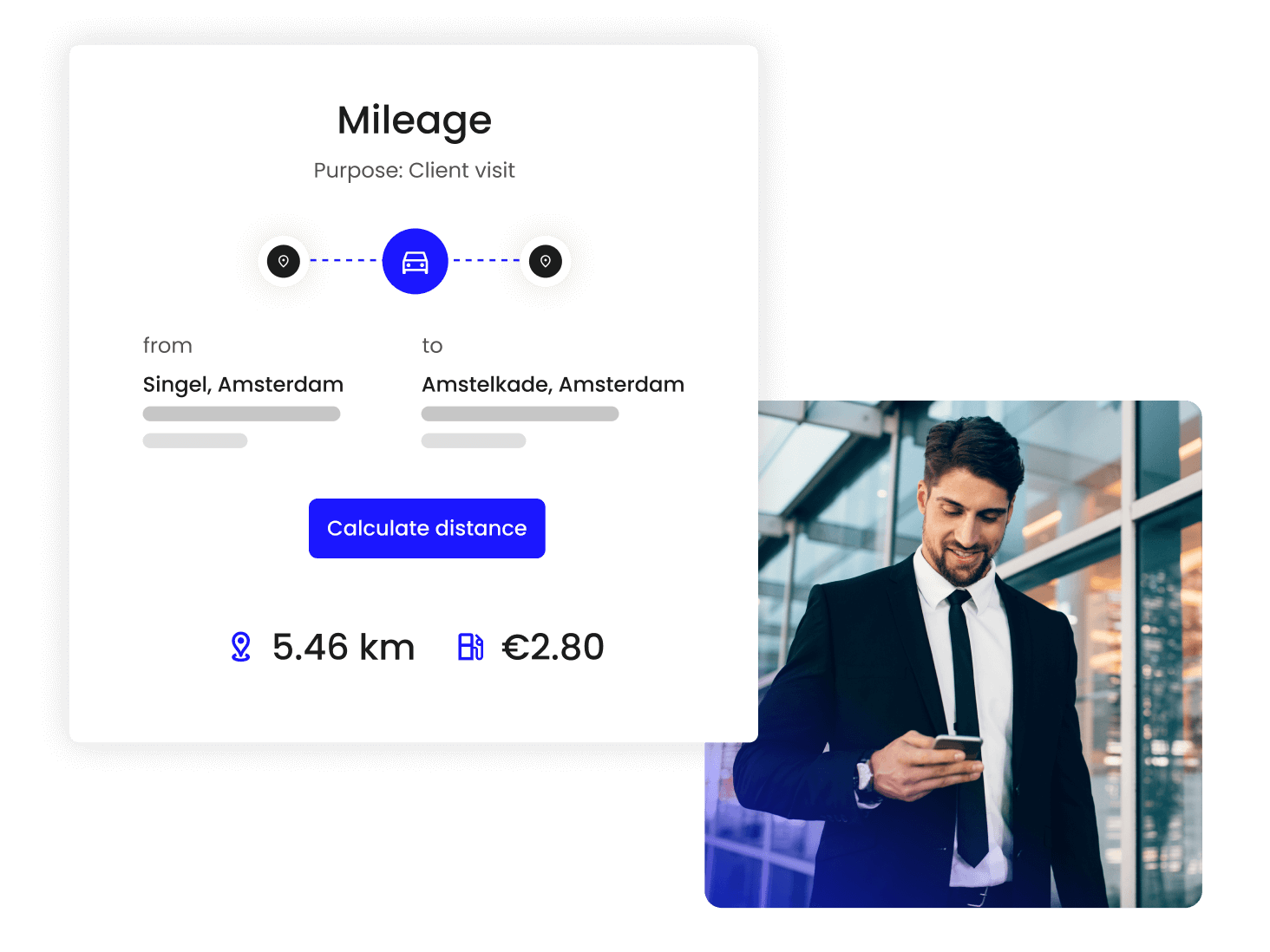

Yokoy recognises all official rates defined by the government and therefore can automatically calculate mileage expenses based on the distance travelled.

As you can imagine, manually calculating mileage allowance as per France regulations could be quite tiresome and time-consuming process.

With Yokoy customers can configure stepped mileage rates and automatically calculate mileage allowance based on the kilometer they have accumulated earlier and the distance they have travelled currently. If the employee exceeds a certain interval limit, Yokoy can automatically calculate mileage rate for the next interval.

VAT Rate

Regulations in place

The French government levies VAT rates for exchange of goods and service. There are five different VAT rates relevant for expense management:

- Standard VAT – 20% is applicable for majority of goods and services and for all products or services for which no other rate is not expressly provided.

- Reduced VAT – 10% is applicable for unprocessed agricultural products, firewood, housing improvement (those do not benefit from 5.5% reduced VAT rate), certain accommodation and camping services, catering, entertainment such as fairs and exhibitions, games and fairground rides, entrance fees to museums, zoos, monuments, passenger transport and processing waste.

- Reduced VAT – 5.5% is applicable for majority of food products, feminine hygiene protection product, equipment and services for disabled, books, gas, and electricity subscription, heat supply, meal in school canteens, tickets for live shows, import and export of certain art works, repairs to improve housing energy quality, social or emergency housing.

- Special VAT – 2.1% is applicable for medicines reimbursable by social security, sales of live animals for butchery and charcuterie to non-taxable person, television license fee, certain shows, press publications registered with the Joint commission of Publications and Press Agencies.

- Zero VAT – 0% is applicable for vaccines against Covid-19 and screening tests.

Yokoy's solution

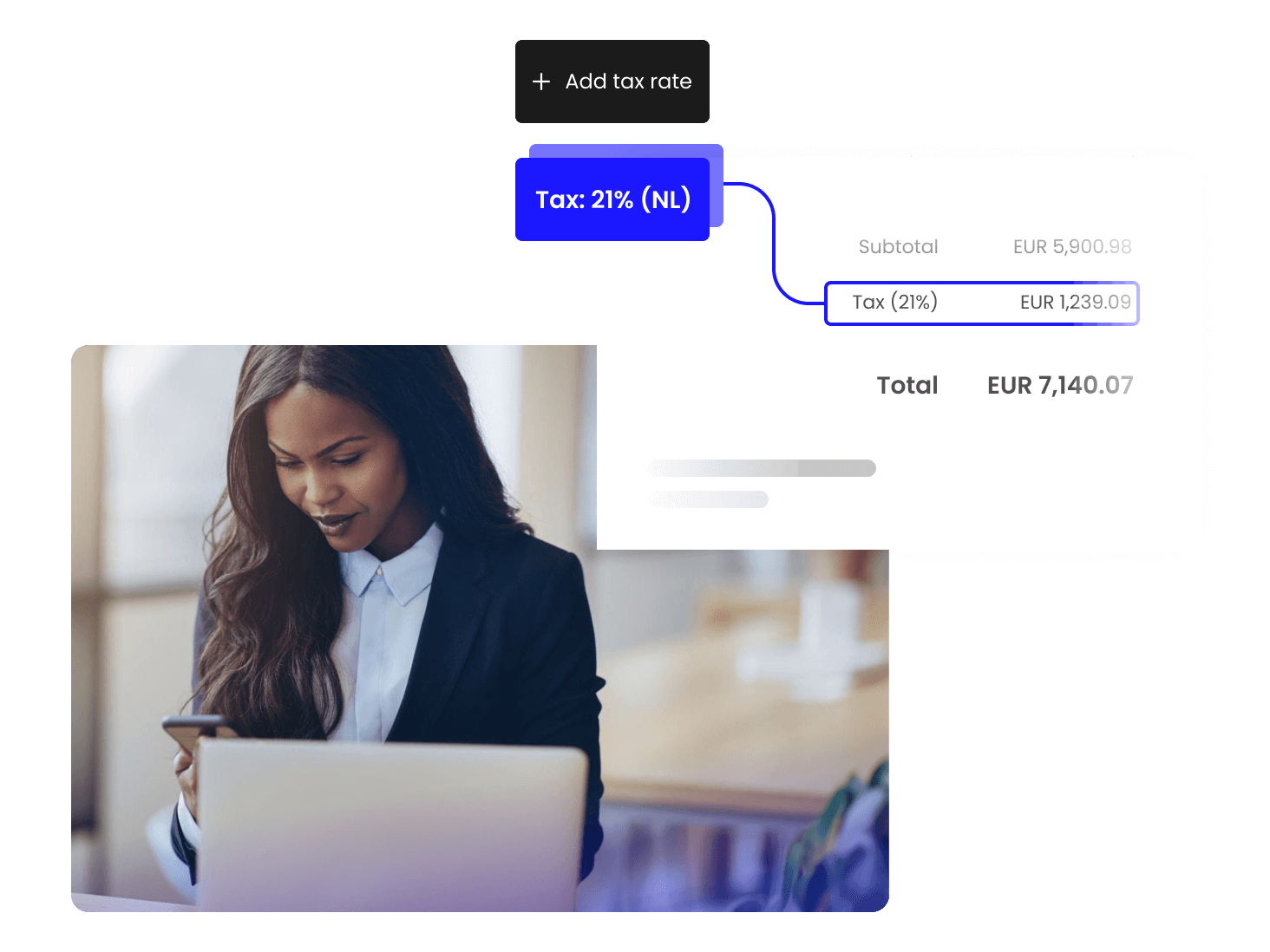

Yokoy automatically extracts all VAT rates relevant for expense management and companies can also add additional VAT rates for extraction. Yokoy extracts all relevant VAT rates from the expense receipt and books them into the ERP or financial system.

Additionally, Yokoy supports customers in reclaiming VAT, by offering standard integration with VAT reclaim providers. This integration allows Yokoy to automatically export extracted VAT rates for specific countries as well as the relevant image of the expense receipt to the VAT reclaim tool.

Salary Deductions

Regulations in place

As per French regulation, employees can opt for Flat rate deduction or deduct for the actual cost from their salary for the professional expenses occurred including travel expenses from home to work, clothing specific to the job, catering cost and a lot more.

For such professional expenses, if the employee chooses a lumpsum deduction of 10%, it is automatically calculated and deducted from the salary. The deduction amount should value at least a minimum of €472 and maximum of €13,522.

Employees also have another option to deduct the actual cost of the expense.

The deduction of actual expenses applies to all wage income. If the employee chooses 10% flat-rate deduction, they will not be able to receive a deduction of actual incurred cost of the professional expense.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo