Home / Streamline Cross-Border Payments with Corporate Cards

Streamline Cross-Border Payments with Corporate Cards

- Last updated:

- Blog

Managing cross-border payments can feel like navigating a maze: Every turn presents new hurdles like high transaction fees, fluctuating exchange rates or compliance challenges. Trying to manage a global workforce with travelling employees manually submitting expense reports in different currencies from personal credit cards is a complex process. But there are solutions like corporate cards that can cut right through this maze by automating currency conversions and expense tracking in real-time.

Now let’s show you how to cut that clear path and find out how embracing modern tools can ease your businesses’ global payments, reduce costs and ensure compliance.

Challenges of managing cross-border payments

Global business can be tricky, with currency conversion, additional fees, and various service providers for payment services. Each transaction typically involves foreign exchange (FX) fees, and fluctuating rates can make costs unpredictable, impacting budgets and, hence, cash flow. Over time, these hidden fees add up, eating into profits. Additionally, keeping track of multiple currencies manually increases the chance of errors and delays, further complicating a business’ financial management.

On top of that, companies must navigate complex compliance regulations in each country they operate in: Every jurisdiction has its own rules regarding taxes, anti-money laundering and data protection and staying compliant can be resource-intensive. Just overlooking the rules of financial institutions in Europe can already be hard.

Manual payment processing only adds to the workload, making it harder to get an accurate, real-time view of global finances. However, having this insight can be significant when making decisions that interfere with a company’s liquidity.

How corporate cards simplify cross-border payments

Business expense cards can dramatically simplify cross-border payments by automating many of the manual and error-prone tasks that slow down international transactions. When linked to holistic spend management software, smart corporate cards handle currency conversions seamlessly and eliminate the need for manual calculations, therefore reducing FX fees. Integrating corporate cards with the API of a spent management solution ensures that travel expenses are automatically tracked and recorded in real-time, giving finance teams clear visibility into global spending.

This also helps to ensure compliance by consolidating reporting across multiple jurisdictions. This cross-border payment solution can help businesses meet local regulations without complex, manual oversight.

With modern travel and expense management solutions and corporate cards, reporting and categorisation of expenses can be streamlined, providing financial leaders with an accurate, on-demand overview of their global business, enabling smarter decision-making and fluent cost control.

Unified platform

When corporate cards are integrated with a unified spend management platform, all payments, regardless of the country or currency, are centralised. This not only makes it easier for finance teams to manage global spending from a single dashboard, but it also reduces the need for multiple systems and provides a clear, consolidated view of all payments.

Automatic currency conversion

One of the biggest challenges in cross-border payments is handling multiple local currencies. With modern corporate cards, international payments are automatically converted at competitive exchange rates, eliminating manual conversions and the risks of costly errors. This cost-effective solution saves time, helps avoid excessive FX fees, and ensures transparency in exchange rates.

Seamless reconciliation

In contrast to visa- or debit cards, with smart corporate cards, reconciliation becomes a breeze: Transactions are automatically matched with the correct receipts and expense categories are applied—without any manual intervention. This streamlines the reconciliation process, reducing errors.

Real-time monitoring

Corporate cards provide real-time visibility into a business’s international trade: Finance managers can track transactions as they happen, giving them immediate insights into spending patterns across different countries. This helps businesses stay agile, adjust budgets as needed and therefore make better decisions based on accurate, up-to-date financial data.

Faster reimbursements

Employees like to have their private wallets less pressured when travelling for their company. Company cards significantly speed up the reimbursement process to help them feel satisfied and acknowledged. With expense management that tracks real-time transactions, employees don’t have to wait for manual approvals or lengthy processing times. This reduces another administrative bottleneck in a corporation’s payment ecosystem.

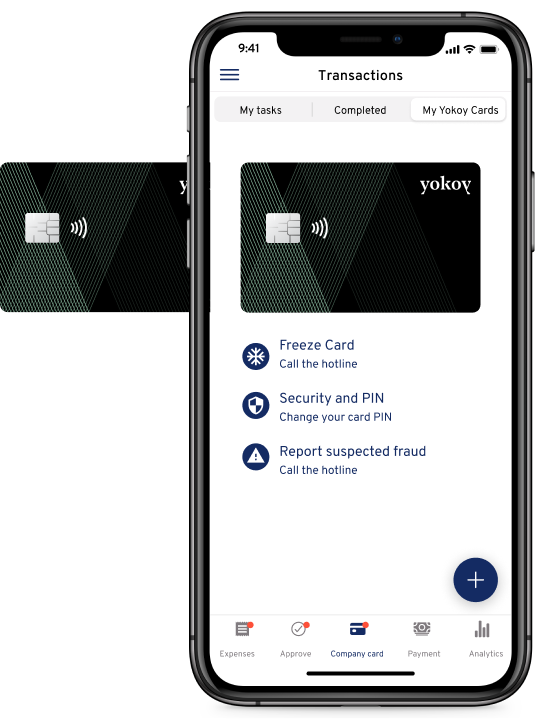

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Improving global compliance and financial control with corporate cards

If you want to include corporate cards in a global spend management strategy, you can help your businesses maintain compliance with international laws, enhance security, and gain greater control over financial operations. Here are some key features:

Compliance with international tax laws: Especially when businesses operate across multiple countries, navigating a complex web of international tax laws and regulations can be challenging. With corporate cards integrated with spend management software, you can automate the tracking of expenses and generate detailed reports that align with local tax requirements. This reduces the risk of non-compliance, ensures accurate reporting for tax audits, and simplifies VAT reclaim processes. The system keeps track of country-specific tax regulations, making it easier for businesses to adhere to ever-changing compliance standards without manual intervention.

Reduced fraud risk: Corporate cards also help reduce fraud risk by providing controlled spending limits, transaction tracking and enhanced security features. With real-time monitoring and automated alerts, finance teams can quickly detect suspicious activities or unauthorised transactions, ensuring swift action to mitigate potential fraud. These cards offer customised user permissions and spending limits, ensuring funds are used only for approved purposes. This reduces exposure to fraudulent spending or misuse by your employees.

Centralised spending visibility: One of the most significant functionalities of corporate cards is the centralised visibility they offer in terms of global spending. All transactions are tracked and recorded in a unified platform, giving finance managers a comprehensive view of where money is spent across regions, departments and currencies. With such real-time transparency, better decision-making, improved budgeting, and tighter financial control is easier than ever. You can easily spot trends, identify inefficiencies, take corrective action to improve cash flow and stay aligned with your company’s global financial strategy. Centralising this data also simplifies audit trails and ensures that financial records are consistent and easily accessible.

Blog article

Why Smart Corporate Cards Are a Must for Businesses

Payment methods have been undergoing a massive modernization phase, and the traditional corporate credit card is no exception. But the real question is, are these cards truly smart or just another gimmick?

Francesca Burkhardt,

Product Marketing

Why streamlining cross-border payments is critical for growing businesses

For startups or new e-commerce businesses, streamlining cross-border payments is critical to driving cost-effective global expansion and staying competitive in the modern market sphere. Instead of getting headaches from a maze of laws and challenges, you can simplify your team’s payment experience by introducing corporate cards to your new employees during onboarding.

Let smart corporate cards and integration with a holistic spent management solution take care of currency conversions, fluctuating exchange rates and compliance with varying regulations. Automating these processes with corporate cards removes many of these obstacles, allowing your business to move through the maze with ease.

Your startup can efficiently drive global expansion with smooth, error-free transactions that corporate cards can do for you. This leads to reduced operational costs, as your business can avoid hidden fees and improve transaction accuracy with every use of your corporate card.

Additionally, real-time monitoring of global spending provides your financial leaders with clear financial visibility, which can empower you to make enhanced decisions. An immediate overview can help you quickly adjust budgets and allocate resources, allowing you to focus on growth rather than being bogged down by payment complexities.

Introducing Yokoy Pay and the ease of cross-border payments with corporate cards

Now, let’s cut a straight path through the maze and show how the virtual corporate card or Yokoy Platinum Visa Card equip your businesses with the tools you need to navigate the complex maze of cross-border payments effectively. With features like global currency support, AI-driven automation, automated compliance checks, granular spend controls, and seamless enterprise resource planning (ERP) integration, corporate cards from Yokoy will simplify your international transactions, help to stay compliant and provide your business with greater control over every cent spent — worldwide.

Global currency support

Yokoy’s corporate cards provide robust global currency support, allowing businesses to make payments in multiple currencies without the hassle of manual conversions. With competitive exchange rates automatically applied at the time of the transaction, companies can conduct cross-border payments seamlessly and reduce the associated foreign exchange fees. This ensures that businesses can easily manage their international expenditures while maintaining budget accuracy.

AI-driven automation

Yokoy’s zero-touch platform leverages AI-driven automation to streamline various aspects of the payment process. From automatic data entry to expense categorisation, Yokoy’s corporate cards minimise the manual effort involved in cross-border transactions. This not only accelerates the payment process but also reduces the risk of human error, ensuring that all financial data is accurate and up to date. These automation capabilities will enable your finance team to focus on strategic decision-making and save valuable time for other administrative tasks.

Automated compliance checks

Compliance with international regulations is a significant concern for businesses operating globally. Yokoy’s smart lodge card addresses this by implementing automated compliance checks, helping you to ensure that all transactions adhere to local laws and tax regulations. This feature mitigates the risk of non-compliance and potential penalties, allowing your financial leaders to operate with peace of mind while confidently managing their cross-border payments.

Granular spend controls

With Yokoy, your company gains access to granular spend controls that allow you to set specific spending limits and permissions for employees. This reduces the risk of fraud or misuse by ensuring that corporate cards are used only for authorised expenses. Your finance team can oversee every employee’s spending in detail. This can help your company to maintain tighter control over your budgets and enforce company policies effectively.

Integration with ERP systems

Yokoy seamlessly integrates with existing ERP systems. This enables your business to consolidate financial data and streamline internal payment processes. With such integration, you can facilitate effortless reconciliation of cross-border transactions and ensure that all financial records are synchronised and accessible on demand. By linking payment data directly to the ERP system, your company can achieve greater financial visibility and improve financial reporting.

Next steps

Join businesses like DO & CO, who have successfully streamlined their international payments using Yokoy’s smart corporate cards for 75 % of every expense. They improved cost control, enhanced financial visibility and cut costs for expense processing with Yokoy’s AI-powered automation tools by 57 %.

Experience first-hand how integrating corporate cards can simplify your cross-border transactions and elevate your financial management. Book your demo today to see how our solutions can transform your payment processes!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.