Home / How to Improve Your Invoice Process Time with Automation

How to Improve Your Invoice Process Time with Automation

- Last updated:

- Blog

Every finance professional knows: efficiency is vital to staying competitive and profitable. But there is one critical area where many companies seek improvement and that has to do with their invoicing processes. Manual invoicing can be time-consuming, cause avoidable mistakes, and create a bottleneck that prevents small businesses and even mid-sized and large enterprises from smoothly managing their cash flow.

Fortunately, technological advancements have paved the way for robust solutions that can dramatically enhance invoice processing efficiency. Automation is a transformative tool in this arena, offering the potential to significantly shorten invoice processing times, reduce errors, and free up valuable resources for other strategic tasks. In this article, we will explore various strategies and technologies that your company can employ to improve its invoice process time through automation, ensuring quicker turnaround times, enhanced accuracy, and improved financial health. Let’s go!

Why you need to look into automating your invoice process now

Manual data entry is one of the most time-consuming tasks in the invoice processing workflow. As research has shown: Automation significantly cuts down on this labour-intensive process by over 80 per cent, allowing your finance team to focus on more strategic activities. Automated systems can capture invoice details such as descriptions, unit costs, and quantities accurately, minimising human error and boosting productivity.

Moreover, it is good to know that processing a single paper invoice can cost up to almost £12, including labour, materials, and postage. Automation reduces these costs dramatically to £2.36 or less per invoice by eliminating the need for physical handling and double-checking the entire process. For companies processing hundreds or thousands of supplier invoices monthly, this cost reduction translates to substantial annual savings.

Studies have shown that manual invoice processing typically allows a finance team to handle about five invoices per hour. With AP automation, this rate can increase to 30 invoices per hour, saving over 70 per cent of the time usually spent on Accounts Payable tasks. This efficiency gain means faster processing times, fewer delays, and a significantly smoother workflow.

It is also worth noting that automating repetitive tasks like vendor invoice validation and approval correspondence can save mid-to-large enterprises between £196,000 to £236,000 annually. This savings comes from redeploying full-time employees (FTEs) to more valuable activities that drive business growth. Employees can focus on higher-value tasks, enhancing job satisfaction and reducing burnout from monotonous manual work.

The benefits of streamlining your invoice process

Improving your AP process offers several tangible benefits that can positively affect the efficiency and effectiveness of your business operations. Here’s a more detailed look at these advantages:

1. Time savings through reduction of manual tasks

Automating the invoicing process reduces the need for manual entry, which is often time-consuming and prone to human error. Employees can redirect their focus from tedious administrative work to more critical areas such as strategic planning and decision-making by minimising these manual tasks. This shift enhances productivity and allows finance teams and the AP department to contribute more significantly to business growth and innovation.

2. Enhanced strategic financial decision-making

With automation handling the repetitive aspects of invoice processing, financial leaders and their teams have more availability to analyse data and insights generated from automated systems. This accessibility to real-time data and more precise analytics supports better forecasting, budgeting, and overall financial decision-making. It enables a proactive approach to finance management, where opportunities and risks can be identified and addressed more swiftly than ever.

3. Cost reduction

Even though automation usually is an investment, streamlining the invoicing process significantly reduces costs associated with manual processing, including labour costs, printing, postage, and storage. Automated systems streamline workflows and can operate continuously without the overhead associated with human labour. Additionally, these systems require less physical space than traditional paper-based processes, saving on office space costs and supplies.

4. Less errors

Manual invoice processing is susceptible to errors such as duplicate entries, incorrect amounts being keyed in, or invoices being lost in the shuffle. Automation software incorporates checks and balances that ensure accuracy by automatically verifying data against predefined rules and patterns. This reduces the occurrence of errors as well as the time and resources spent on rectifying them.

Additional tip: Advanced automation solutions equipped with artificial intelligence (AI) can further enhance error detection by learning from historical data and identifying inconsistencies or anomalies that may indicate errors or fraudulent activity.

5. Ensuring compliance with company guidelines

Automated invoice processing systems are programmed to comply with company policies and regulatory requirements. They can be set to enforce compliance checks automatically, such as ensuring that payment terms, spending limits, and approval hierarchies are adhered to. This built-in compliance helps prevent violations and the potential financial penalties associated with them, ensuring that all financial operations are transparent and within legal and company guidelines.

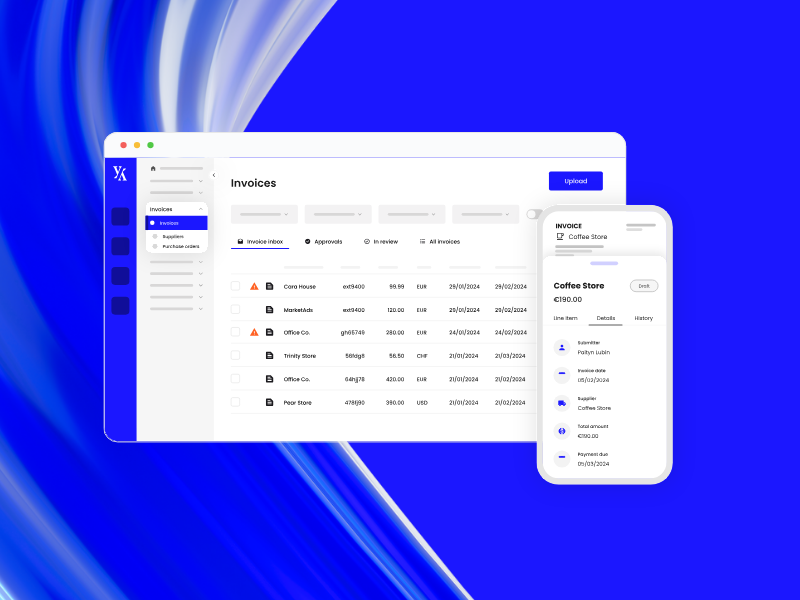

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Traditional invoice processing vs automated invoice processing

Comparing traditional and automated invoice processing reveals significant efficiency, accuracy, and scalability differences. Here is a detailed look at how the steps in the invoicing process differ between these two methods, drawing insights into the typical pitfalls of manual processing and the enhancements offered by automation.

1. Invoice receipt

Traditional Processing: Invoices arrive in various formats, including paper, email, or PDFs. They need to be sorted, opened, and organised manually. This process is time-consuming and prone to misplacement or loss of invoices.

Automated processing: All invoices are centralised in a digital format, regardless of their original form. Automation software can capture and convert data from paper invoices using Optical Character Recognition (OCR) technology and import digital invoices directly, eliminating the risk of losing important documents.

2. Data entry

Traditional processing: Manual data entry requires staff to enter invoice information into the company’s accounting system. This step is particularly prone to human error such as typos or misread data, which can lead to discrepancies and require additional time for corrections.

Automated processing: Automation tools extract data automatically from invoices. AI and machine learning improve over time, learning from each invoice processed to increase accuracy and significantly reduce errors.

3. Invoice validation and verification

Traditional processing: Employees must manually verify that the goods or services billed match purchase orders and delivery receipts. This involves cross-referencing multiple documents and can be quite error-prone and time-intensive.

Automated processing: Automated systems can instantly match invoice data to purchase orders and delivery receipts stored in the system. They flag discrepancies automatically for human intervention, streamlining the verification process and minimising mistakes.

4. Approval workflow

Traditional Processing: The approval process often involves physically routing invoices to approvers, which can delay processing especially if approvers are unavailable. Tracking and follow-ups are manual, adding to the administrative burden.

Automated processing: Workflow automation directs invoices to the appropriate approvers based on predefined rules. Approvers receive notifications and can approve invoices from anywhere, speeding up the process significantly to meet due dates. The system also provides automatic reminders to prevent late payments.

5. Exception handling

Traditional processing: Handling exceptions in a manual process can be cumbersome as it often requires back-and-forth communication and manual tracking of the issue resolution progress.

Automated processing: Automated systems highlight exceptions and can route them to specialised staff. Some advanced systems provide analytical tools to identify patterns in exceptions, helping to address systemic issues proactively.

6. Payment execution

Traditional processing: Preparing payments in a traditional setup can be complex, involving manual preparation of payment batches, checks, or electronic payment files. Manual scheduling can also lead to delayed payments.

Automated processing: Payment processes are integrated with smart invoice approval workflows, allowing for automatic payment scheduling and execution once approvals are obtained. This ensures timely payments and leverages early payment discounts.

7. Archiving and reporting

Traditional processing: Physical storage of invoices is common, requiring significant space and making retrieval difficult. Reporting is often manual, which can be both time-consuming and limited in scope.

Automated processing: Digital archiving in combination with powerful invoice processing software makes retrieval instant and simple. Automation offers advanced reporting capabilities, providing real-time insights into spending patterns and vendor performance and can aid in forecasting and budgeting.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Automate your invoicing with Yokoy’s smart features

We can say with confidence: Automating your invoicing process with Yokoy will help you streamline operations, enhance accuracy, and boost efficiency in ways that will make you think: Hey, why didn’t we do this sooner?

Here’s a breakdown of Yokoy’s main features and how they contribute to optimising key performance figures:

Yokoy’s automated data capture feature utilises advanced OCR technology to extract data from invoices automatically. This eliminates the need for manual data entry, reducing errors and saving valuable time.

You can create customisable approval workflows tailored to your organisation’s specific requirements. By automating the approval process, Yokoy reduces processing time and ensures invoices are routed to the appropriate personnel efficiently.

Yokoy’s invoice management features provide real-time visibility into invoicing and expenses, allowing you to track the status of invoices throughout the approval and payment process. This transparency enables better financial control and decision-making.

The compliance checks feature ensures that all invoices adhere to internal policies and external regulations. By automating compliance checks, Yokoy helps minimise the risk of errors and ensures that invoices meet regulatory requirements, reducing the likelihood of costly penalties.

Yokoy easily integrates with ERP systems, allowing for seamless data flow and eliminating the need for manual data entry. This integration improves data accuracy, reduces processing time, and enhances overall efficiency.

Yokoy’s mobile app enables users to manage invoices and expenses on the go, providing flexibility and convenience. With mobile accessibility, employees can submit invoices and expenses anytime, anywhere, further accelerating invoicing.

Benefit from detailed audit trails for every invoice, as Yokoy provides a complete record of all actions taken throughout the invoicing process. This audit trail enhances transparency and accountability, facilitating internal audits and ensuring compliance with regulatory requirements.

Next Steps

Numerous business owners and financial teams have embraced Yokoy with enthusiasm, marking a significant transition in their operations. Below, we are happy to share three exemplary cases with you.

On, a global leader in innovative sporting goods, aimed to align its expense management practices with its values of freedom and trust. In partnership with Yokoy, On implemented a mobile-first, intuitive solution that automated compliance checks and approval workflows, preserving employee autonomy.

On’s results with Yokoy:

Achieved a 90 per cent automation rate, virtually eliminating manual reviews.

Processed expenses within a day, resulting in a 472 per cent increase in efficiency.

Realised a 78.8 per cent reduction in costs relative to total spending.

Attained an annual ROI of 27 times the Yokoy license fee, driven by direct savings and VAT reclaims.

Stadler, a leading Swiss railway rolling stock manufacturer, faced inefficiencies with its paper-based expense management system, prompting dissatisfaction among employees and finance teams. Yokoy’s solution, including the pay module and Lodge Card, streamlined flight-related payments and revolutionised travel and accounting processes.

Stadler’s results with Yokoy:

Enhanced finance team efficiency by 3.5 times.

Reduced expense report processing costs by 83 per cent, from CHF 120 to CHF 20.

Minimised employee support requirements, with most issues swiftly resolved by administrators.

Canton Basel-Stadt, renowned for its cultural heritage and economic dynamism, sought to modernise its financial management processes. Yokoy’s AI-powered expense management platform, featuring automated compliance checks and customisable workflows, offered an intuitive, app-based solution to this pressing need.

Canton Basel-Stadt’s results with Yokoy:

Achieved 100 per cent compliance with internal and external regulations.

Slashed processing time by a remarkable 91 per cent through automated compliance checks.

Reduced administrative workload by 89 per cent, easing the burden on Finance and HR departments.

Achieved a paperless process, eliminating paper consumption entirely.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.