Home / Mastering Nonessential Expenses: A Guide to Discretionary Spending

Mastering Nonessential Expenses: A Guide to Discretionary Spending

- Last updated:

- Blog

Co-founder & CCO, Yokoy

One common misconception about discretionary expenses is the belief that they are always expendable. This implies that you can cut discretionary spending without considering the consequences.

The reality is more nuanced.

Discretionary expenses encompass costs that are optional and can be trimmed when necessary. However, they are far from being dispensable in all scenarios.

Let’s delve into this topic to gain insight into when it’s prudent to reduce these expenses and explore alternative solutions for effective business expense management.

What are discretionary expenses?

Discretionary expenses, also known as non-essential expenses, refer to the costs that a company incurs voluntarily.

These are the expenses that are not directly tied to the core operations of the business. They encompass various areas such as marketing, investments, company subscriptions, travel, team perks, and office improvements.

For example, branding campaigns or advertising campaigns aren’t “essential” per se. A company can perfectly survive without paying for advertising. However, such investments do benefit the organization in the long and short term, so “non-essential” or discretionary expenses doesn’t mean non-important.

Now that this is clear, let’s see what qualifies as essential spend.

Difference between discretionary spending and essential expenses

To comprehend the significance of discretionary expenses, it’s essential to differentiate them from essential expenses.

Essential expenditure, as it’s name implies, represents costs that are essential for a company’s survival and proper functioning or well being. These include costs such as rent, utilities, and employee salaries.

In contrast, discretionary or nonessential spending is optional and can be trimmed down or eliminated when necessary.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Examples of discretionary expenses

To provide a clear picture of discretionary items, let’s explore some common categories:

Marketing expenses

Marketing is a fundamental aspect of any business. However, the budget allocated to marketing campaigns, advertising, and promotions is considered discretionary budget. Finance professionals need to assess the ROI of marketing expenses carefully.

Some examples of discretionary marketing expenses include:

Advertising

Collateral materials like business cards, posters, and flyers

Event participation – whether it’s attending or hosting events

Video production

Agency and freelancer fees

Public relations, including press release distribution

Now, please note that certain marketing expenses are instrumental for business growth. Cutting them indiscriminately can hamper revenue generation and market presence. The key is to optimize these expenses rather than eliminating them entirely.

Investments

Investing in various ventures, stocks, or bonds is a discretionary expense. It’s essential to have a well-defined investment strategy to ensure these expenses align with your financial goals.

However, it’s crucial to have a well-defined investment strategy to ensure that these expenses align with your financial objectives. Some examples include:

Stocks

Bonds

Real estate

Cryptocurrencies

Commodities

Company subscriptions

Subscriptions to services and software can be a significant discretionary expense. Evaluating the necessity and cost-effectiveness of each subscription is vital. Here are some examples of subscriptions a company might be using:

Software services

Cloud storage and web hosting services

Industry-specific software

Market research tools

Travel expenses

Business travel is a common discretionary cost. Managing travel expenses efficiently can significantly impact your company’s bottom line. Here are examples of non-essential travel costs:

Airfare

Accommodations

Meals and dining out

Transportation

Conferences and trade shows

Client and staff entertainment

Travel insurance

Daedalean manages travel expenses with Yokoy & Travelperk

“Yokoy and Travelperk helped us with end-to-end travel expense management automation. Now employees easily book trips in Travelperk, and all data is sent to Yokoy in real time, with all compliance checks and VAT validation already in place.”

Yvonne Gross, VP of Finance & Operations, Daedalean

Team perks

Team perks and office improvements fall within discretionary expenses. For example, offering employee perks such as gym memberships or wellness programs falls into the discretionary category.

While they may not be immediately necessary, they contribute to employee satisfaction and productivity. Neglecting these expenses can lead to reduced morale and lower retention rates.

Here are other examples of team perks that are non-essential expenses:

Gym memberships and wellness programs

Health insurance benefits

Education assistance and certifications

Transportation subsidies

Employee recognition programs

Again, it’s essential to strike a balance between employee satisfaction and the amount of money that goes into such perks, before deciding to invest more or to cut costs from this category of expenses.

Office improvements

Upgrading the office environment and infrastructure is discretionary. However, these improvements can enhance productivity and employee satisfaction, making them worth the investment.

Examples of essential expenses

As said, certain expenses such as rent, employee salaries, and specific insurance premiums are considered essential. Legal obligations require the consistent payment of these expenses each month, so these qualify as mandatory spending.

Failing to meet these financial obligations could result in severe consequences, including legal actions, fines, or even the need to cease business operations altogether.

These business costs include:

Taxes

Employee salaries

Debt repayments, including loans and mortgages

Rent and inventory

Utility bills

Software that is essential for the company’s functioning

Necessary hardware

These examples demonstrate the diversity of discretionary expenses that finance professionals may encounter in their roles, highlighting the importance of strategic management in each category.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

How to manage discretionary spending effectively

Effectively managing discretionary spending is essential for maintaining financial control and optimizing resource allocation. Here are some guidelines to help you manage discretionary expenses efficiently:

1. Establish clear budgets

Create well-defined budgets that distinguish between essential and discretionary expenses. Allocate specific amounts for each discretionary category, setting clear spending limits. This proactive approach ensures cost control and accountability.

2. Perform regular expense reviews

Regularly review discretionary expenses, ideally on a monthly or quarterly basis. This allows you to identify areas where cost savings can be achieved. Look for redundant or underutilized expenses and consider eliminating or reducing them.

3. Prioritize spending based on impact

Prioritize discretionary expenses based on their impact on your business’s goals and objectives. Focus on investments or strategies that contribute significantly to revenue growth or cost savings. Not all discretionary expenses carry equal weight.

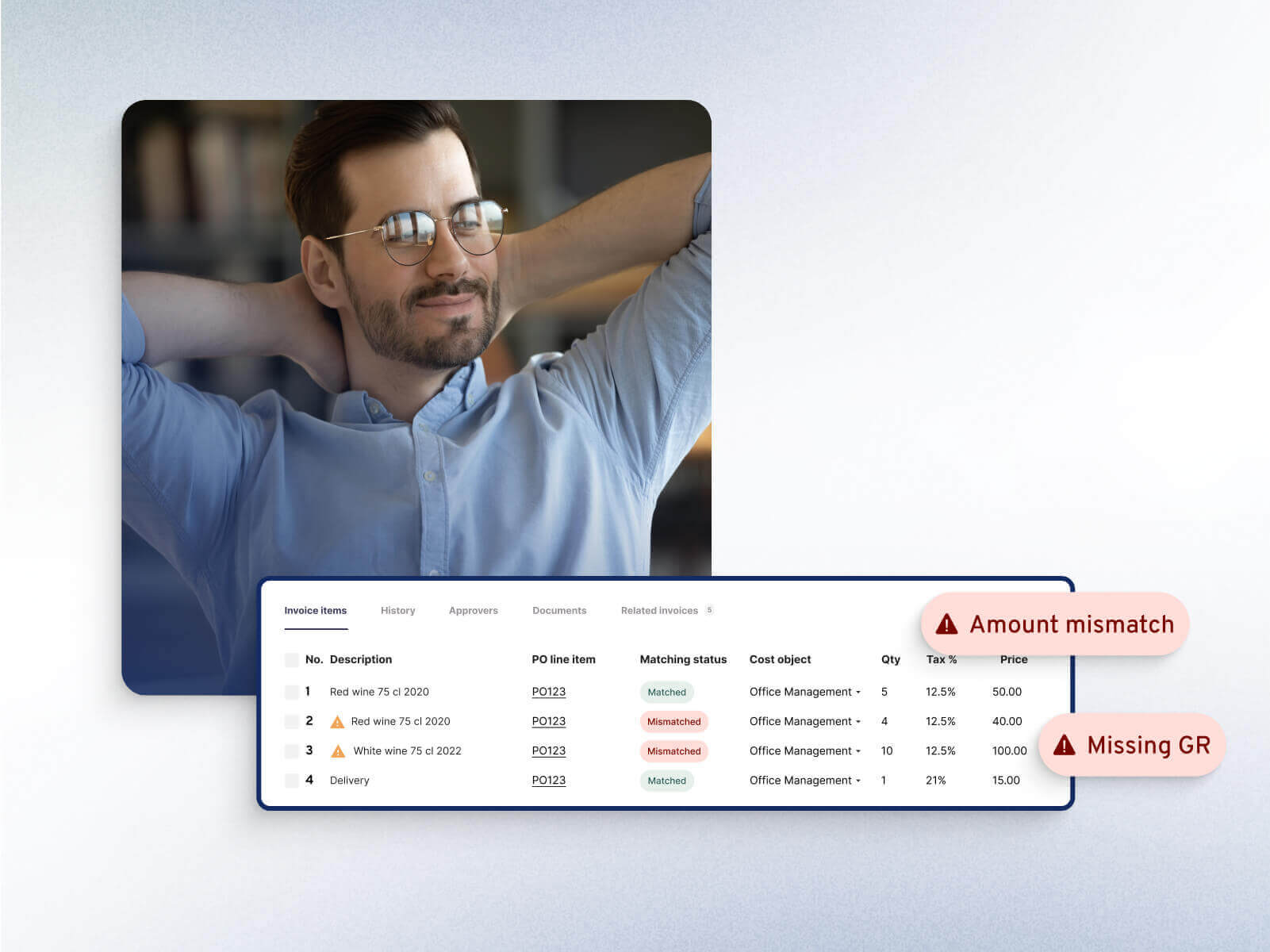

4. Use spend management software

Leverage automation and AI-driven solutions to streamline your spend or expense management. These technologies can help in tracking, reporting, and controlling discretionary spending more effectively, reducing manual errors and improving efficiency.

Before selecting a tool for managing your business expenses:

Define your needs: Identify your specific requirements for expense management software. Consider factors like scalability, integration with existing systems, mobile accessibility, and user-friendliness.

Research solutions: Explore different expense management software options available in the market. Look for user reviews, request demos, and assess their features against your needs.

Consider integrations: Ensure that the software can seamlessly integrate with accounting and financial systems, making the expense management process more efficient.

Create clear spend policies: Develop clear and comprehensive expense policies. These policies should detail what expenses are allowed, approval workflows, and documentation requirements.

If you’re ready to take this step, we’ve detailed the topic of selecting the right expense management software in the article below.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

5. Employee involvement

Educate your team about the importance of managing discretionary expenses and involve them in cost-saving initiatives.

Raise awareness of the company’s financial goals and encourage employees to identify areas where discretionary expenses can be reduced or optimized. Incentivize cost-conscious behavior through recognition or rewards.

This can lead to more conscientious spending decisions at all levels of the organization.

6. Vendor negotiations

Negotiate with vendors and service providers for better terms. Explore opportunities for volume discounts, extended contracts, or alternative pricing structures. Reducing the cost of subscriptions and services can significantly impact your discretionary spending.

7. ROI analysis

Conduct a return on investment (ROI) analysis for each discretionary expense. Assess how these investments contribute to the company’s bottom line. If an expense doesn’t deliver a clear return, consider reallocating those resources to more productive areas.

You can try out our ROI calculator below for a quick assessment of your potential savings.

ROI calculator

Calculate your savings

How much can you save annually if you choose Yokoy as your spend management suite? Our ROI calculator helps you quantify the return on investment, so you can build a solid case for finance transformation.

8. Benchmarking

Benchmark your discretionary spending against industry standards or competitors. This provides context and helps identify areas where you might be overspending or underinvesting in critical areas.

By following these strategies, you can effectively manage discretionary spending, reduce waste, and ensure that resources are allocated to areas that align with the company’s strategic objectives.

Next steps

The misconception that discretionary expenses are always expendable can be detrimental to businesses. While they provide flexibility, they are not devoid of importance.

Effective expense management involves striking a balance between controlling costs and supporting growth, employee satisfaction, and long-term financial health.

If you’re curious to learn more, we recommend to read the article below.

Blog article

From $456K Lost/Year, to Full Spend Control: Three Process Changes You Can Implement Today

In the current economic context, with inflation peaking and recession looming, finance departments are under pressure to control costs and cut unnecessary spending. The fastest way to do this is to identify hidden costs – a task proves to be more challenging than it should.

Thomas Inhelder,

CFO at Yokoy

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.