Home / What the AI Era Means for the Finance Department

What the AI Era Means for the Finance Department

- Last updated:

- Blog

Co-founder & CEO, Yokoy

Three years into the decade of efficiency gains, the finance world is taken by storm. The emergence of new technologies like AI is causing a massive, irreversible change in the way businesses operate, and the finance department is no stranger to such change.

In the era of AI-driven digital transformation, traditional processes are becoming obsolete, and finance teams can no longer be simple number crunchers. Their role needs to evolve into true strategic partners driving business growth by embracing new technologies, championing innovation, and optimising their operations to maximise profitability.

As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve. Those leading the way have a clearly defined AI vision and strategy, and a roadmap prioritising AI initiatives linked to business value.

But before adopting tech solutions, finance teams must have a clear understanding of the business goals they want to achieve and the problems they’re trying to solve with the help of technology. And that’s because simply digitizing or automating a finance process through a digital transformation initiative doesn’t guarantee a successful outcome.

Our recent survey on the state of transformation in spend management shows that even in companies where digital transformation has started, finance teams continue to struggle with fragmented tech stacks, disjointed processes, and inefficiencies that cost them time, money, and employee satisfaction.

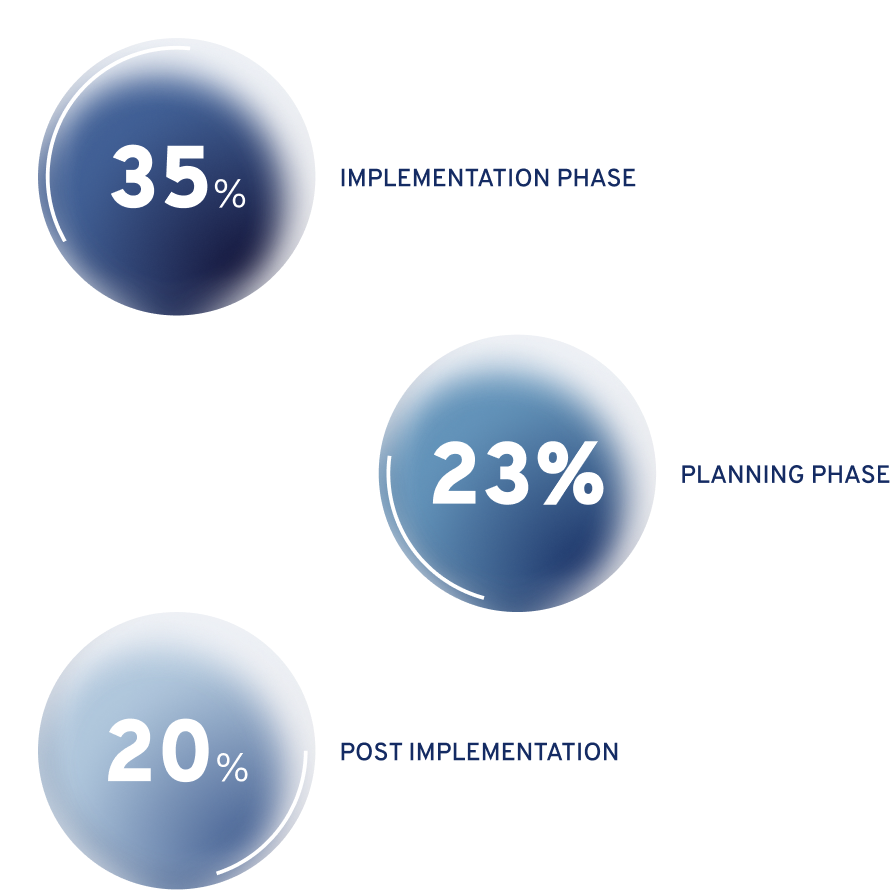

McKinsey reports that up to 70% of digital transformation initiatives fail to achieve their intended objectives. What’s more, while much of a transformation’s value loss (55%) occurs during and after implementation, a significant portion happens as early as day one.

Deloitte’s analysis reveals that a well-executed digital transformation strategy has the potential to unlock up to US$1.25 trillion. However, the wrong combination of digital transformation actions can have adverse effects, putting over US$1.5 trillion at risk for Fortune 500 companies.

While it’s true that artificial intelligence can help their teams get work done faster, it’s also true that finance departments have already found ways to work more effectively.

McKinsey’s 2020 analysis reveals that finance teams have managed to reduce operational costs by an impressive 29% in the last 10 years. Additionally, finance leaders now spend 19% more time on value-added activities compared to transaction-processing tasks.

These numbers demonstrate the strides made by finance teams in streamlining their operations and focusing on strategic activities.

So why should companies change?

White paper

Report: State of Spend Management Transformation [2023]

This report offer a glimpse into the current state of spend management transformation and the trends, challenges, and opportunities shaping its future.

Why AI-driven finance is the only way forward

Why should finance departments embrace AI technologies, if efficiency gains are already there?

Two main reasons:

Firstly, because of the superior performance of AI compared to traditional automation or digitisation methods.

Consider the following:

Using AI for risk management leads to a 43% reduction in false positives and 37% increase in accuracy [Deloitte]. Thus, AI doesn’t just automate processes; It also helps companies detect anomalies, fraud, and non-compliance more effectively than traditional technologies, safeguarding an organisations’ data, financial integrity, and – in the end – its reputation.

AI’s ability to leverage unstructured data sets, such as invoices, receipts, or contracts, provides finance teams with enhanced visibility and control over their financial operations. AI empowers finance professionals to easily grasp the bigger picture of their business spend management, by identifying trends and patterns with the push of a button.

AI-powered automation can bring the cost of processing an expense report down from $60 to $1, and can help companies pay their suppliers 2x faster, by putting the entire AP process on autopilot.

Moreover, AI offers a paradigm shift by providing intelligent decision-making capabilities, data-driven insights, and predictive analytics that surpass the capabilities of traditional systems. By leveraging AI, finance teams can provide valuable insights on cost optimization and revenue generation, enabling them to contribute directly to the company’s bottom line.

By using AI-powered automation, finance teams can delegate decision making in processes where the rules of the game are clear and unchangeable. Artificial intelligence can take over everything from repetitive workflows to pre-approval flows to supplier payments, without compromising on compliance or governance.

And secondly, the personal experiences of finance professionals with artificial intelligence in their everyday lives play a significant role in driving the demand for AI-powered solutions in the finance industry.

Individuals have become accustomed to AI-driven technologies that provide seamless user experiences, such as voice assistants, intelligent chatbots, and personalized shopping recommendations. These experiences raise the expectations of finance professionals who no longer wish to work with incumbent solutions that provide an unsatisfactory user experience.

On top of this, the ongoing war for talent in the finance industry further emphasises the need for AI adoption.

Finance professionals are increasingly attracted to organisations that use cutting-edge technologies, as it demonstrates the commitment to innovation and offers an environment conducive to professional growth.

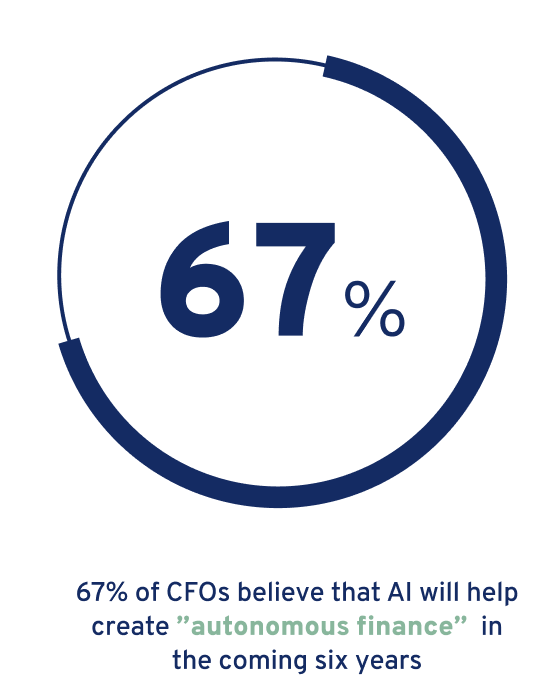

Two out of three CFOs believe that AI will help create “autonomous finance” in the coming six years. Thus, by embracing AI, companies can position themselves as attractive employers, fostering a culture of continuous learning and technological advancement.

It is therefore obvious that although digitisation and automation can help companies improve their ways of working and achieve greater efficiency, to truly drive innovation in finance, companies need to embrace the new reality and let AI work alongside people, each doing what they’re best at.

The future belongs to the early adopters

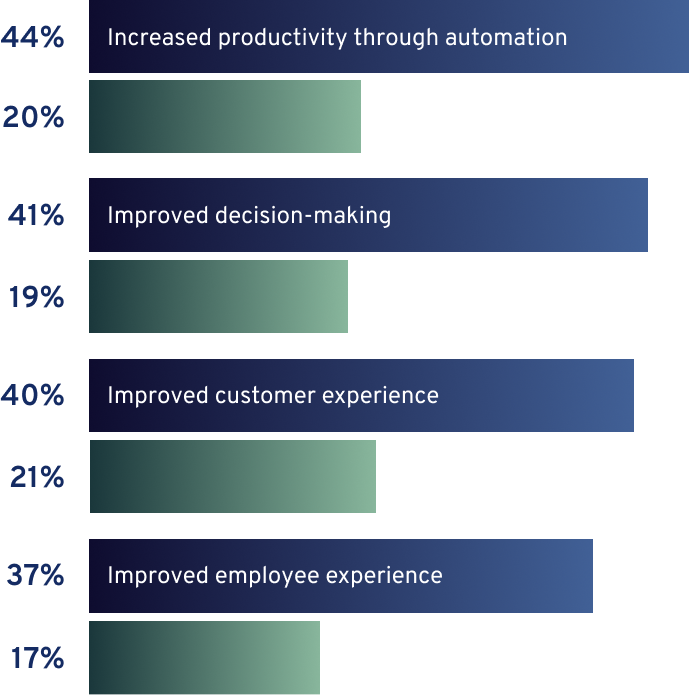

Deloitte’s CFO Signals 1Q 2023 shows that more and more CFOs are looking to enhance their companies’ decision-making in planning for 2023 and 2024 mainly through implementing digital technologies, AI, and automation, and building analytics capabilities.

At Yokoy, we believe AI technology is truly creating a paradigm shift in the finance function, making it imperative for finance teams to integrate artificial intelligence into their processes.

Merely approaching transformation without incorporating such technologies would lead to missed opportunities and incomplete progress. With this understanding, we propose a new framework specifically designed to transform the finance department in the AI era.

Our vision is centered around enabling companies to save money on every dollar spent by harnessing the power of AI and automation. By embracing AI and automation, and letting machines do what they’re best at, organizations can unlock unprecedented levels of cost optimization and operational excellence within their finance departments.

The time to embrace this transformative journey is now, as those who act swiftly and decisively will gain a significant competitive advantage in the AI-driven business landscape of the future.

Checklist

Finance Transformation Readiness Checklist

In this white paper, we delve into the essential steps for finance leaders to assess the readiness of their organization and construct a compelling case for digital transformation in finance.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.