Home / How Corporate Cards Ensure a Clear Audit Trail

How Corporate Cards Ensure a Clear Audit Trail

- Last updated:

- Blog

Maintaining transparency and efficiency in financial management is crucial. One of the most effective ways to achieve this is by implementing corporate cards for business expenses. Whether you go with physical or virtual cards, they simplify expenditure tracking and ensure a robust audit trail while implementing essential security measures, enhancing the organisation’s overall financial governance.

With this article, we highlight the specific benefits of corporate cards, their role in compliance and how they streamline expense management. Additionally, we explore how solutions like Yokoy Pay’s smart corporate cards can support finance teams in maintaining accurate financial data and optimising workflows.

The challenges of traditional expense tracking

Traditional expense tracking methods, which often rely on manual processes, can pose numerous challenges for businesses. Here are the main challenges that can slow your business down.

A lot of work for employees: Manual expense reporting is time-consuming and prone to errors. Team members often must collect physical receipts, fill out forms, and wait for approvals. This process can lead to delays in reimbursements, causing frustration among staff.

Risk of fraud: Traditional methods are susceptible to fraudulent activities such as falsifying receipts or inflating business expenses. Without a clear audit trail, finance teams face difficulties in verifying expenses and identifying discrepancies in expenditure records.

Inefficient auditing: The absence of an automated system complicates the internal audit process. Ensuring that all expenses comply with company policies and regulatory requirements becomes challenging. As a result, audits are often more time-consuming and less accurate.

Lack of transparency: When expenses are recorded manually, there’s a higher risk of human error and inconsistencies. This lack of transparency makes it hard for finance teams to have a real-time view of financial data and impedes decision-making.

Delayed data analysis: With paper-based records and manual data entry, consolidating financial records in a timely manner becomes difficult. This delay hinders financial reporting and prevents companies from having a real-time understanding of their financial position.

How corporate cards streamline expense management

Corporate cards offer a great solution to the challenges posed by traditional expense tracking methods. Here’s how they can transform spend management:

Real-time tracking

With corporate credit cards, all transactions are recorded in real-time. This allows finance teams to view expenditures as they occur, providing greater visibility into company spending. Real-time tracking reduces the need for manual data entry and ensures up-to-date financial records.

Categorisation and automation

Corporate cards often come with features that automatically categorise expenses, making it easier to generate detailed expense reports. Additionally, integrating corporate cards with expense management software allows for automated workflows, reducing the burden of manual verification and record-keeping.

Better control and visibility

Corporate cards provide finance teams with enhanced control over company expenditures. Spending limits, notifications for suspicious activity, and automated approval workflows ensure that all transactions align with company policies.

Integrated reporting

By integrating corporate cards with the company’s financial management systems, finance teams can generate comprehensive reports that include all financial transactions. This integration facilitates easier compliance with regulatory requirements and simplifies financial reporting.

Integration of company policy

Corporate cards can be tailored to reflect company policies and procedures. For instance, restrictions can be set on card usage, such as limiting purchases to certain categories or setting spending caps for different levels of employees.

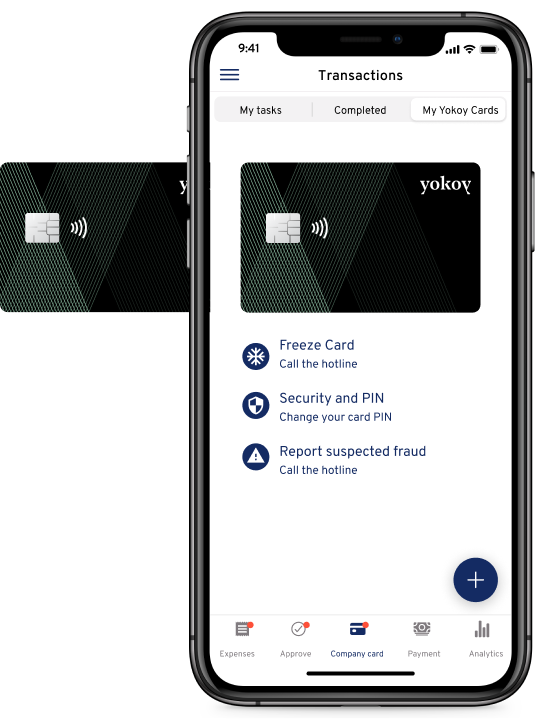

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

The role of corporate cards in compliance and governance

Corporate cards are not just tools for simplifying expense management—they play a crucial role in ensuring organisational compliance and governance. Here’s how:

Compliance with company and governance regulations

Corporate cards help companies comply with internal policies and external regulations by providing a structured way to manage expenditures. Automated systems ensure that all credit card transactions are within the boundaries of predefined company policies, thus supporting regulatory compliance.

Fraud prevention

With built-in fraud detection mechanisms such as real-time notifications, role-based permissions, and automated verifications, corporate cards minimise the risk of fraudulent activities. This proactive approach helps ensure only authorised transactions occur. This feature significantly reduces the potential for financial loss.

Audit-ready records

Every transaction made with a company credit card is automatically recorded and categorised, creating an audit-ready log that eliminates the need for manual verification during internal audits. This feature supports internal controls and allows companies to conduct more efficient checks.

Role-based permissions

Corporate cards allow organisations to implement role-based permissions, guaranteeing employees only have access to what they need. This reduces the risk of misuse and ensures all cardholder transactions are legitimate and within scope.

Employee satisfaction

Corporate cards contribute to higher employee satisfaction by simplifying the expense reporting process and speeding up reimbursement times. Automated processes also ensure fewer disputes over business expenses and fewer delays in approvals.

Blog article

Why Smart Corporate Cards Are a Must for Businesses

Payment methods have been undergoing a massive modernization phase, and the traditional corporate credit card is no exception. But the real question is, are these cards truly smart or just another gimmick?

Francesca Burkhardt,

Product Marketing

Why a clear audit trail is crucial for financial leadership

A clear audit trail allows finance leaders to gain real-time insights into financial operations. This level of transparency supports more accurate financial reporting and ensures that financial records reflect the actual state of the business.

With access to real-time financial data, finance teams can make informed decisions based on the company’s current financial position. This aids in strategic planning, helps manage cash flow, and forecasts future financial needs.

When every transaction is logged and categorised accurately, the auditing process is simplified. Finance teams can quickly verify records, identify discrepancies, and ensure that all financial statements are accurate and compliant with regulations.

A clear audit trail strengthens internal controls by providing a structured process for verifying expenditures. This reduces the risk of human error and fraud, making it easier to maintain the integrity of financial records.

Introducing Yokoy Pay and our smart corporate cards

Yokoy Pay offers a range of smart corporate cards that are designed to enhance expense management and support a clear audit trail. Here’s how Yokoy’s solutions stand out:

Smart corporate cards and lodge cards

Yokoy Pay provides both corporate credit cards and lodge cards, allowing companies to streamline various types of business expenses, from travel and procurement to everyday office purchases.

Integration with existing systems

Yokoy’s corporate cards can be seamlessly integrated with existing accounting software and expense management systems. This integration supports real-time data analysis and ensures that all financial transactions are recorded and categorised accurately.

AI-powered expense management

Yokoy Pay utilises AI to automate expense management workflows. From verifying receipts to categorising expenses, AI helps reduce manual efforts, minimise errors, and provide detailed expense reports.

Custom controls and workflows

Yokoy’s corporate cards offer custom controls, such as setting specific spending limits, creating automated approval workflows, and enabling role-based permissions. This flexibility ensures that all transactions comply with company policies.

Global reach on enterprise level

Yokoy’s solutions are designed for companies with a global presence. Whether you operate in one country or several, Yokoy Pay’s corporate cards support global transactions and offer consolidated reporting for simplified financial management.

Next steps

We are convinced that corporate cards are a powerful tool for ensuring a clear audit trail, enhancing financial governance, and simplifying expense management. Features like real-time tracking, automation, and compliance support enable companies to optimise financial operations and maintain transparency.

Do you wish to learn more about how Yokoy’s smart corporate cards can support your organisation’s expense management and audit trail?

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.