Home / e-Receipts: Streamline Data Entries and Reduce Manual Errors

e-Receipts: Streamline Data Entries and Reduce Manual Errors

- Last updated:

- Blog

In a world where expense management is as smooth as a well-oiled machine, you can lay back and let those machines take over tedious tasks so you can focus on more important things. And guess what: Right now, advanced AI technology is revolutionising spend management by automating e-receipt processing to ensure precision and efficiency. In addition, seamless integration into your accounting systems can deliver real-time insight into your company’s financial health and kick the risk of errors in manual tasks to the curb. It turns reconciliation from a tedious chore into a breeze and provides instant, spot-on insights that turn decision-making a snap. Say goodbye to time-wasting and cost overruns and hello to financial excellence with a touch of tech magic!

E-receipts: Definition, functionality and importance of electronic receipts

In an era where digital transformation is redefining business processes, e-receipts emerge as a crucial innovation in financial management. For Accounts Payable (AP) managers and financial leaders, the adoption of e-receipts can be a game-changer, streamlining data entry processes, significantly reducing errors, and contributing to cost savings. This article explores how e-receipts can enhance financial operations, align with corporate social responsibility goals, and drive environmental sustainability, making them an essential tool for modern financial management.

How do e-receipts work?

E-receipts are digital versions of traditional invoice processing. They are generated and sent electronically at the point of transaction. They integrate seamlessly with accounting software, automatically capturing details like invoice data, amount, and vendor information. By making manual entries to extract data obsolete, this automation reduces errors and speeds up financial processes. For AP managers, e-receipts offer more accurate financial records, faster reconciliation, and simplified audits, all while reducing administrative burdens and making financial management way more efficient.

Are e-receipts important for your business?

E-receipts are increasingly important for businesses looking to enhance efficiency, reduce time-consuming work, and support sustainability goals. By automating data entry and minimising manual errors, e-receipts streamline financial processes, leading to more accurate records and faster transaction reconciliations. This saves time and resources and aligns with business needs and social responsibility objectives by reducing paper waste.

For example, a retail company that switched from paper invoices to e-receipts saw a significant reduction in processing time and a noticeable improvement in data accuracy, highlighting the tangible benefits of adopting this digital solution.

Benefits of e-receipts

As you can see, there are numerous benefits that come with using e-receipts and using them throughout your business:

More efficient data entry: E-receipts automate the data entry process by being able to integrate directly with accounting systems. This reduces the time and effort for manual processing transaction details, leading to a more streamlined and efficient workflow.

Fewer errors: E-receipts’ automated invoice processing significantly reduces the risk of human errors, such as typos or misinterpretation of handwritten information. Also less errors mean less bottlenecks from correcting errors.

Higher accuracy: The automatic capture and categorisation of transaction details provided by e-receipts enhance the overall accuracy of financial records, leading to more precise reporting and better-informed decision-making.

Saving costs: E-receipts cut down on costs associated with printing, storing, and managing physical receipts. They also reduce labour costs by minimising the need for manual data entry and error correction, contributing to overall cost savings.

Data access in real-time: Transaction data and overviews of financial transactions are available instantly, allowing you to access and analyse your business’ financial health in real-time. This enhances transparency in financial operations and supports quicker decision-making.

Faster reimbursements: E-receipts facilitate quicker processing of expense reports and reimbursements, as the necessary documentation is readily available and can be easily verified, leading to faster reimbursements for employees.

More environmentally friendly: By replacing paper invoices with digital alternatives, e-receipts help businesses reduce paper consumption, contributing to environmental sustainability and aligning with corporate social responsibility goals.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Best practices for managing e-receipts

Managing e-receipts means everything needs to be organised and easy to find. You can start with a top-notch storage system that keeps your digital receipts tidy, organised and always accessible. To make sure your data is never lost, regular backups and encrypted, secure access are crucial parts of managing digital financial records, such as e-receipts. Keep it safe and secure but always accessible by using a cloud system. Finally, a seamless integration with your existing accounting system and proper training of your finance team will turn your e-receipt process into cruise control.

How to store receipts

Storing e-receipts should be easy, digital and organised — for example in a cloud system. Using a structured, cloud-based system that lets you sort and find your receipts fast, helps efficiency and reduces searching for paper invoices in dusty archives. Cloud storage is convenient, secure and lets you access financial documents from anywhere, anytime.

Strategies for backups

Think of backup strategies as your insurance policy against data-loss disasters. Automatic backup plans are included in common and smart accounting software. If using non-cloud-base software, you should consider storing multiple copies of all your financial records at different locations.

Keep security in mind

Security is paramount when managing e-receipts due to the sensitive financial data they hold. To safeguard this information, your company should utilise encrypted storage solutions that protect against potential breaches. Access should be restricted to authorised personnel only, with robust measures like strong passwords and multi-factor authentication in place. Conducting regular audits of security protocols is essential to keep ahead of emerging threats and ensure that your e-receipt management system remains secure and reliable.

Training your employees

Training is the secret ingredient to a successful e-receipt management recipe. Make sure your team knows how to handle e-receipts with care, following all the right steps for storing, backing up, and securing them. Teach them how to use your e-receipt software like pros so they can blend these processes into their daily work without missing a beat. Well-trained staff means your e-receipt game will be strong and secure!

Integration with accounting systems

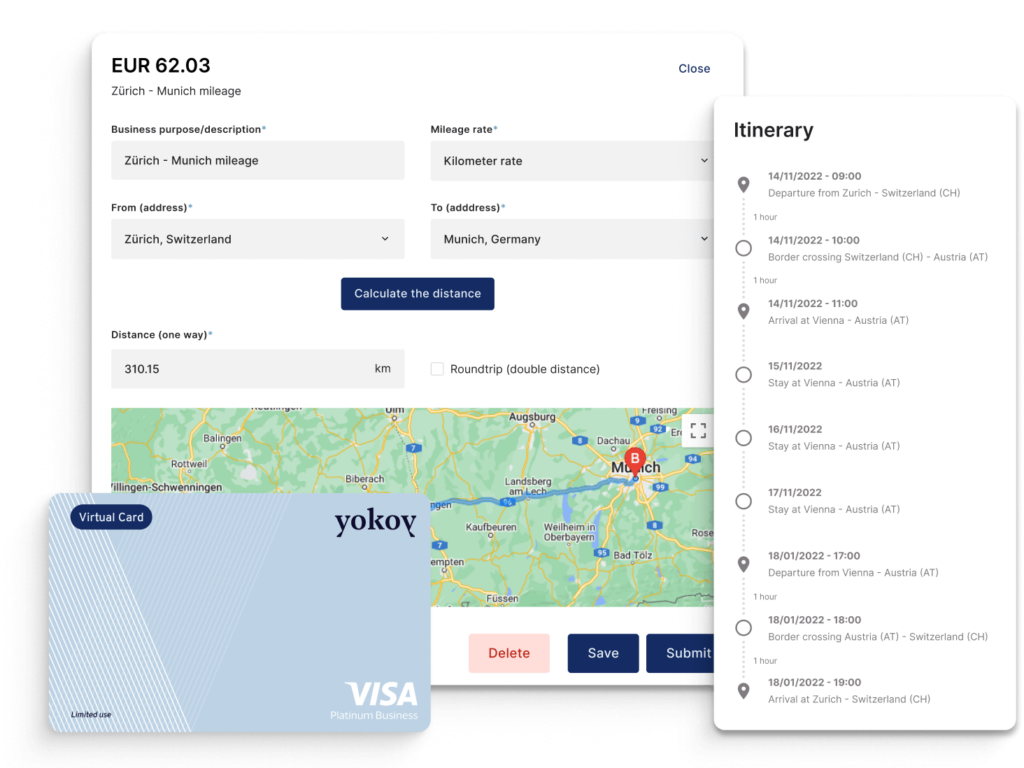

Integrating e-receipts with accounting systems is essential for automating data entry and enhancing financial accuracy. For example, Yokoy’s integration capabilities offer advanced receipt extraction and processing capabilities, automatically capturing and categorising transactions from extracted data of e-receipts.

Yokoy can significantly reduce error-prone manual labour with its integrated automation tools. Large or small businesses can profit from seamless integration into existing accounting software to streamline the entire accounting process, getting rid of inefficiencies and reducing risk of errors.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Using e-receipts and accounting software like Yokoy for efficient expense management

Yokoy is a cutting-edge expense management system that harnesses the power of AI to revolutionise the handling of e-receipts and accounting. By automating the extraction and tracking of e-receipts, Yokoy captures essential transaction details—such as date, amount, and vendor details—without manual input. This advanced automation significantly reduces the risk of human error and ensures that expense data is accurate and up-to-date.

Yokoy’s seamless integration with accounting systems allows for real-time syncing of financial data, streamlining reconciliation processes and providing financial teams with instant access to precise expense information. This operational efficiency simplifies workflows and supports more informed and timely decision-making, ultimately saving time, cutting costs, and boosting overall financial effectiveness.

Step 1: Automatic receipt extraction: Yokoy uses advanced AI and optical character recognition (OCR) technology for data capture to automatically extract key data from e-receipts, including details such as date, amount, and vendor information. This eliminates the need for manual data entry and ensures that all relevant information is accurately captured.

Step 2: Seamless integration with accounting systems: Yokoy integrates smoothly with various accounting software, automatically synchronising extracted receipt data with financial records. This integration ensures that all expense information is recorded in real time and accurately reflected in the company’s accounting system.

Step 3: Real-time data processing: The automation software processes e-receipts in real time, providing immediate access to updated financial data. This ensures that expense records are always current and facilitates timely financial reporting and decision-making.

Step 4: Error reduction through automation: By automating data extraction, entry processes and validation, Yokoy reduces the risk of human errors associated with handling large amounts of data manually. This leads to more reliable financial data and minimises the likelihood of discrepancies or inaccuracies.

Step 5: Enhanced compliance and audit trails: Yokoy maintains detailed digital records of all processed e-receipts, providing a clear and comprehensive audit trail. This enhances compliance with financial regulations and simplifies the audit process by ensuring that all expense documentation is easily accessible and well-organised.

Step 6: Expense categorisation and approval workflow: The software can automatically categorise expenses based on predefined rules and workflows. This streamlines the approval process by routing expenses to the appropriate approvers, reducing administrative overhead and speeding up expense approvals.

Step 7: Advanced analytics and reporting: Yokoy offers robust analytics and reporting features, allowing businesses to generate detailed insights into their spending patterns. This helps in identifying trends, managing budgets more effectively, and making informed financial decisions based on accurate, up-to-date data.

By implementing these steps, Yokoy transforms e-receipt management and accounting into a more efficient, error-free, and strategic process, ultimately enhancing overall financial operations and decision-making.

Next steps

See for yourself and experience how Yokoy can streamline and boost your business’ efficiency with e-receipt-handling and AI-powered automation. Book your demo now!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.