Home / Compliance Center / Compliance in the Netherlands

Compliance in the Netherlands

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

Optimize spend management while operating in the Netherlands by familiarizing yourself with the nuances of compliance and integrating them into your financial operations effectively.

Download for later

No time to read right now? Get the .pdf version of the guide below.

Proof of Receipt

Regulations in place

According to the Dutch government, companies can legally scan and store expense receipts digitally. The original physical receipts are no longer required if the integrity, authenticity, correctness, and completeness of the receipts can be ensured.

Digital expense receipts must be stored electronically in a digital format for 7 years (statutory retention period). However, for expenses related to electronic services, telecommunications services, and radio and broadcasting services, the receipts must be stored for 10 years (statutory retention period).

Yokoy's solution

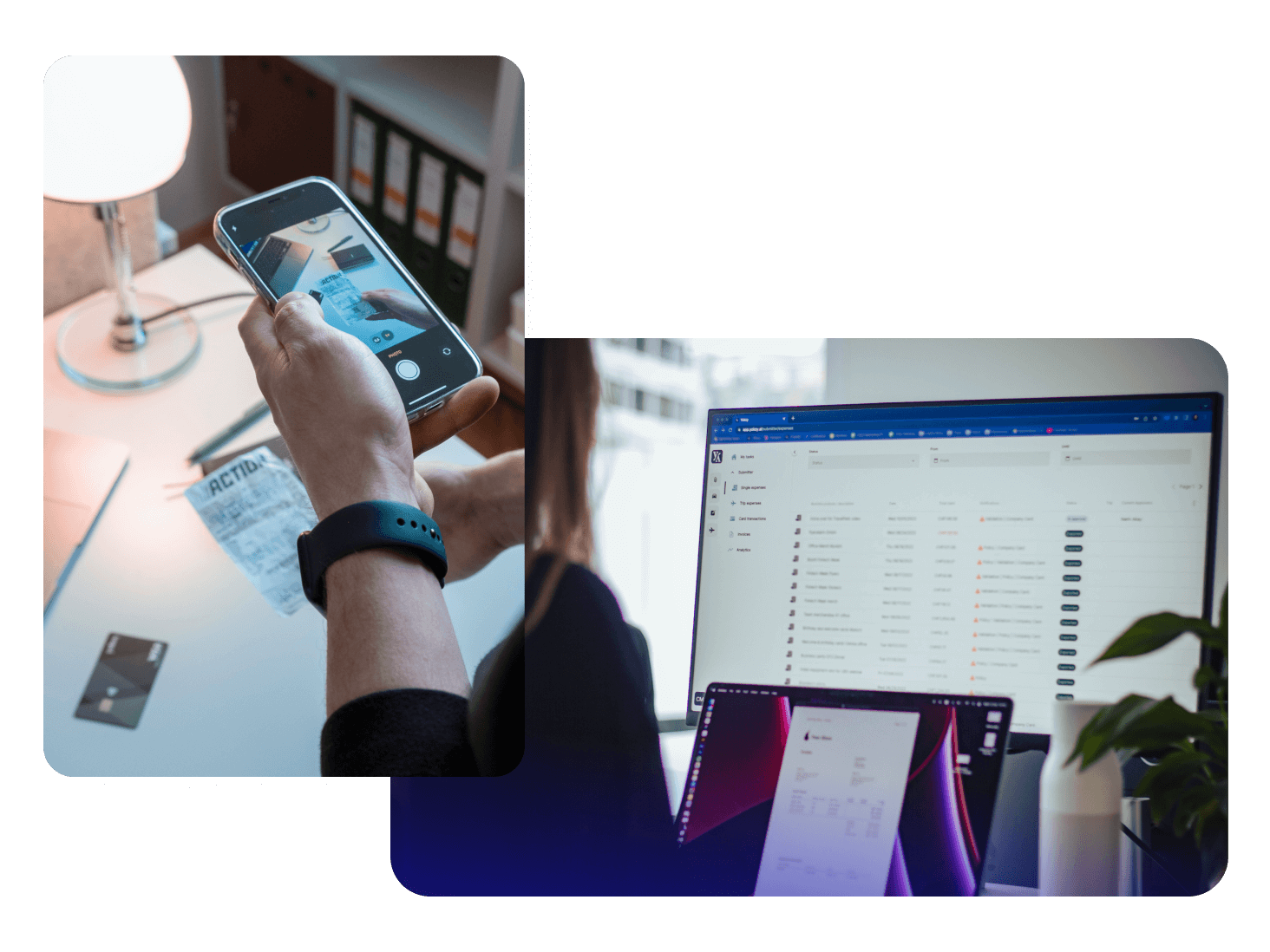

Yokoy enables employees to take a picture or upload digital expense receipts and submit them via the Yokoy mobile or web application.

Once uploaded, Yokoy processes and extracts all required information from the receipt and automatically prepares the expense report in seconds. With any potential fraud or policy breaches, Yokoy immediately triggers a warning to highlight the specific event.

Depending on the specific workflow and company policy, the expense report can be checked by multiple parties before being approved and booked into the ERP or finance tool, ensuring the correctness, quality, and completeness of the receipt.

Yokoy adheres to GDPR regulations and requirements outlined by the Dutch government. Yokoy archives and stores receipts securely for the statutory retention period on its servers hosted in the EU.

Per Diem

Regulations in place

In the Netherlands, reimbursing subsistence expenses to your employees differs based on the sector. The Dutch government pays its employees per diems or “daily allowances”. The private sector, on the other hand, reimburses employees actual vouched expenses known as “actuals”. This has the benefit of maximizing the VAT that the company can reclaim.

Daily allowances for domestic trips

The Dutch government pays its employees per diems or “daily allowances” when they travel for business or directly reimburse them for the actual expense.

Employees can receive this additional compensation when the following two conditions are met:

- The business trip lasts more than 4 hours and

- The destination is in another municipality or at least 1 kilometre from your work location.

While you can offer these allowances to your employees partially tax free and without need to submit cost statements, you are not required to do so.

Government employees can receive the following reimbursements for the costs of accommodation and meals:

- Small expenses during the day – € 6,64

- Small expenses in the evening – € 19,82

- Accommodation – € 142,10

- Breakfast – € 113,88

- Lunch – € 20,32

- Evening meal – € 30,74

Lower daily allowance

If the domestic business trip lasts more than 8 days, the employee only receives allowances for the first consecutive 8 evenings. From the 9th day evening, the employee should only receive half of the evening allowance.

Daily allowances for foreign trips

The Dutch government announces per diem rates for different countries and cities every year on the first of January and July. Unlike for domestic trips, per diems for foreign trips are highly influenced by the location (country and city) in which the employee is traveling.

If the employee can prove that the daily allowance is not sufficient, then the company is allowed to pay for the additional expense.

Download the list of per diem rates defined by the Dutch government here.

Domestic and foreign trips on the same day

If a part of the employee’s travel is within the Netherlands and:

- Meets the criteria of a domestic trip, then the employee is entitled to receive domestic allowance for that part of the journey.

- Does not meet the criteria of a domestic trip, then the trip is added to the previous part of the journey and reimbursed according to the rate for that part of the journey.

Reductions

Any meals provided to the employee should be reduced and accounted for by the employee. Therefore, the employee will not receive any amount for the reduced meal of the day. According to the Dutch regulations, allowances provided as:

- Small expenses should be reduced by 1.5%

- Breakfast should be reduced by 12%

- Lunch should be reduced by 20%

- Dinner should be reduced by 32%

If the foreign business trip lasts more than 60 days, the employee only receives the full amount for the first consecutive 60 days. From the 61st day onwards, the employee only receives half of the allowance for small expenses, breakfast, lunch, and dinner.

Note:

The Dutch government also defines the following conditions for daily allowances:

- The employee is not entitled to receive an allowance if the company provides accommodation and meals, unless the employee proves that they were not able to make use of it.

- Employee receives reimbursement:

- For lunch, if the time between 12:00 and 14:00 falls entirely within the duration of the business trip.

- For an evening meal, if the time between 18:00 and 21:00 falls entirely within the duration of the business trip.

- The employee must incur the cost of a meal in the dedicated establishment for this purpose or a generally accessible establishment that offers meals or drinks.

- The employee must submit a supporting document for the employee’s accommodation allowance; therefore, the employee is entitled to receive a reimbursement of the stated amount up to a maximum of the stated amount for the country and city in which the employee is traveling.

- If the employee fails to submit proof of these costs, then the employee is only entitled to receive €11.34 for each overnight stay for the maximum of four nights per business trip.

Yokoy's solution

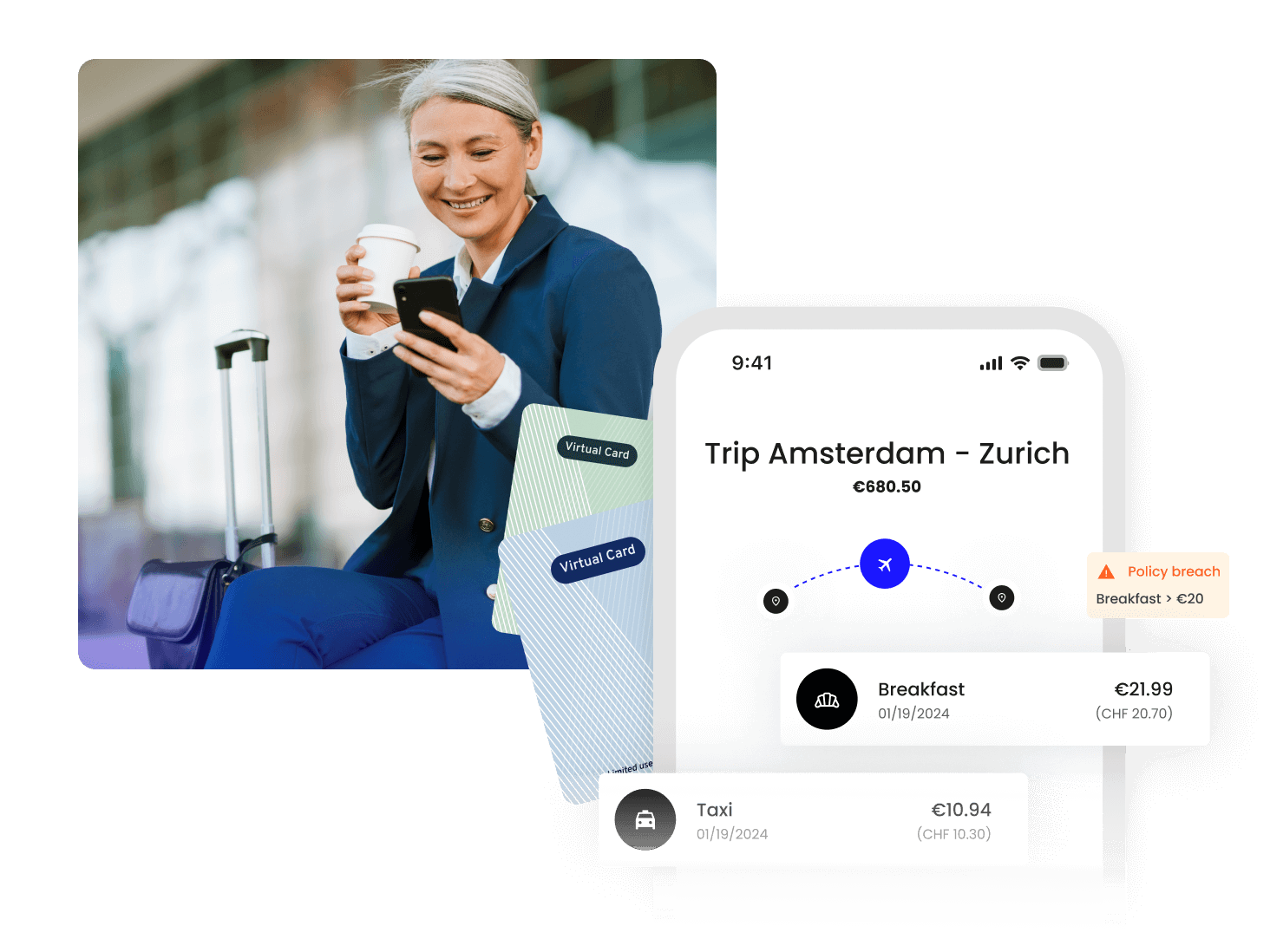

Yokoy enables employees to take a picture or upload digital expense receipts and submit them via the Yokoy mobile or web application.

Once uploaded, Yokoy processes and extracts all required information from the receipt and automatically prepares the expense report in seconds. This allows you to easily reimburse your employees’ actuals from their business travel.

Yokoy extracts all relevant VAT rates from the expense receipt and books them into the ERP or financial system.

Yokoy supports you in reclaiming VAT, by offering standard integration with VAT reclaim providers. This integration allows Yokoy to automatically export extracted VAT rates for specific countries as well as the relevant image of the expense receipt to the VAT reclaim tool.

Travel Allowance

Regulations in place

You can cover your employee’s travel expenses for traveling to work. This is not mandatory, unless stated in the collective labour agreements (CAO) for your industry or if it is stated in your own employment contracts or company policies.

When it comes to paying a travel allowance, an employee is reimbursed regardless of if they travel on foot, by bicycle, private car or public transport. In 2023, you may reimburse your employees €0.23 per kilometre tax-free. You can reimburse a higher amount per kilometre, but the amount above €0.23 is regarded by the Tax and Customs Administration as salary and is thus subject to tax.

Public transport allowance

If the employee uses public transport to travel during the trip, you can reimburse them €0.21 per kilometre traveled or the actual travel costs tax-free. Your employee must then hand in the train ticket or printout of the public transport chip card listing the costs.

Other transport

What if your employee travels a different way than by public or private transportation? In the case they travel by taxi, airplane, or by boat, you can reimburse the actual travel costs. Your employee must submit a receipt such as a plane ticket or a taxi ride receipt.

For more details about exceptions, read more here.

Yokoy's solution

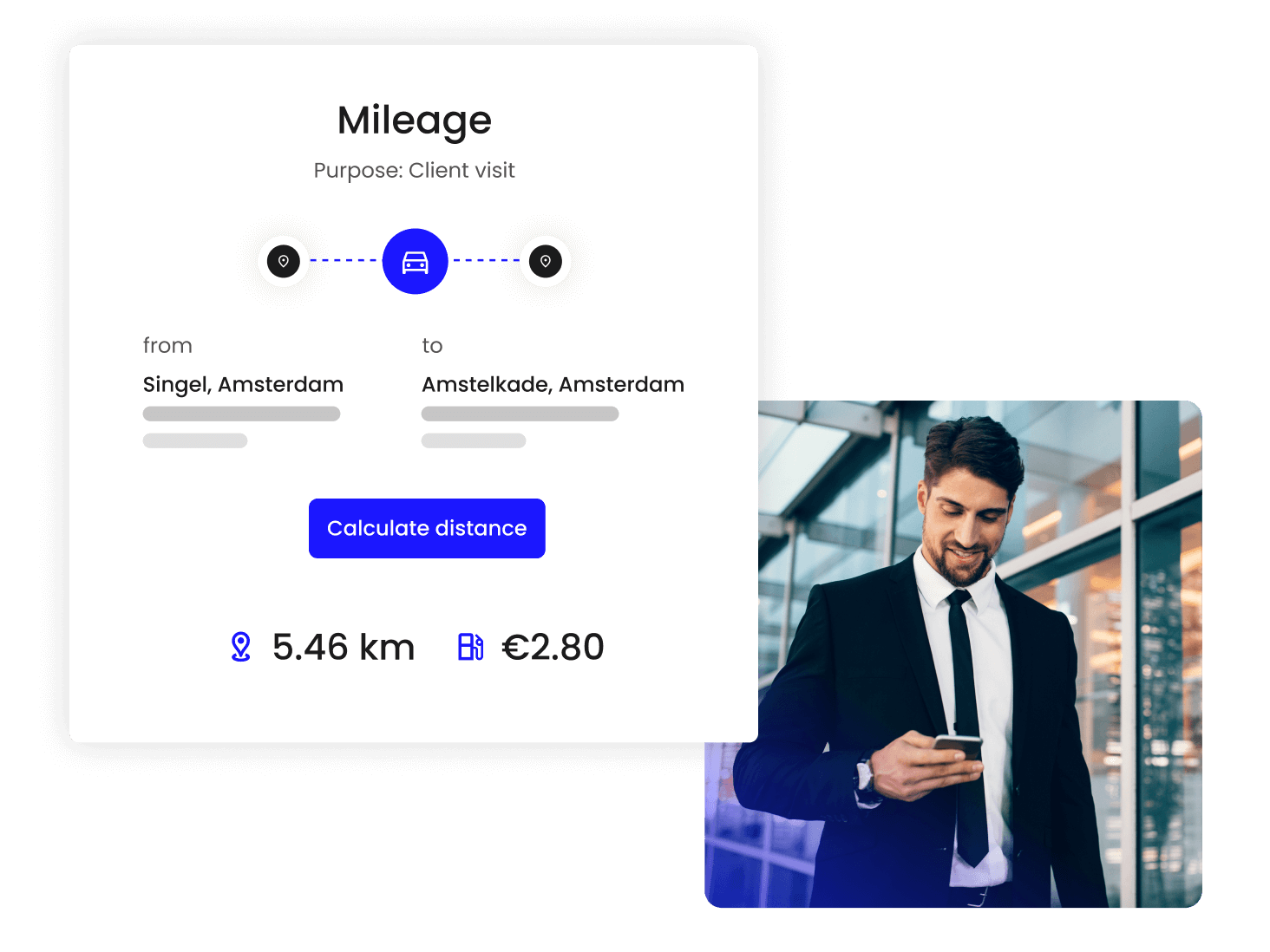

Yokoy recognizes all the official rates defined by the Dutch government and therefore can automatically calculate mileage rates based on distance traveled. If the company decides to pay employees more than the standard defined by the government, Yokoy can export the excess amount separately into the ERP or finance tool.

VAT Rate

Regulations in place

The Dutch government applies VAT rates for the exchange of goods and services. There are three different VAT rates relevant to expense management, namely:

- Standard VAT rate: 21% on all general goods and services, including energy supplied from 1 January 2023.

- Reduced VAT rate: 9% on goods and services related to food, water, agriculture goods, medicine and aids, art, collectibles, antiques, books and periodicals, and energy supplied from 1 July 2022 until 31 December 2022.

- Zero VAT rate: 0% on goods that are supplied abroad, supply of ships and aircrafts, fishing, excise goods, and solar panels.

Yokoy's solution

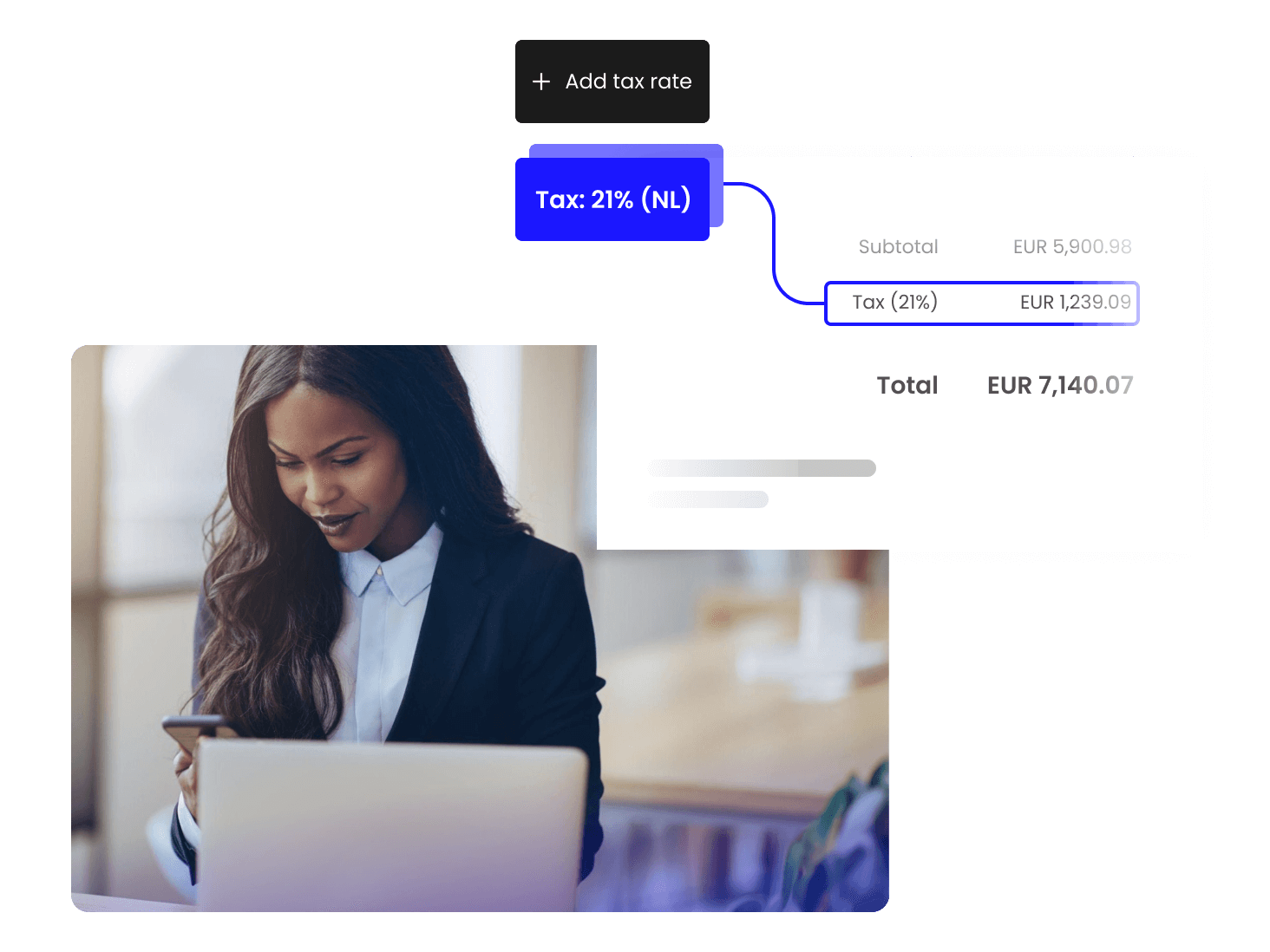

Yokoy automatically extracts all VAT rates relevant for expense management and companies can also add additional VAT rates for extraction. Yokoy extracts all relevant VAT rates from the expense receipt and books them into the ERP or financial system.

Additionally, Yokoy supports customers in reclaiming VAT, by offering standard integration with VAT reclaim providers. This integration allows Yokoy to automatically export extracted VAT rates for specific countries as well as the relevant image of the expense receipt to the VAT reclaim tool.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo