Home / Automated Expense Reporting: Simplify Expense Tracking and Maximize Compliance

Automated Expense Reporting: Simplify Expense Tracking and Maximize Compliance

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Automated expense reporting has been gaining traction as a solution to help finance teams streamline their workflows and gain real-time insights into company expenses.

But there’s one more area where automation and modern expense management solutions can help tremendously: Minimizing errors and fraud and adhering to local regulations. Or, in other words, ensuring compliance with internal and external policies.

In this article, we’ll look at the steps in the expense reporting process that can be fully automated, to help you move from Excel-based expense report templates and time-consuming manual processes to end-to-end automation.

Also, we’ll cover the most common types of policy breaches that may occur while reporting expenses, and the key considerations for maximizing compliance through expense reporting automation.

How Yokoy uses AI to automate expense reporting

By now, it should be clear that manual or Excel-based expense processing and reporting are things of the past, and there is no reason for companies not to look into automating such processes with the power of AI.

So, let’s look at some practical ways Yokoy uses artificial intelligence to enforce compliance in the spend management process, and implicitly, in expense management.

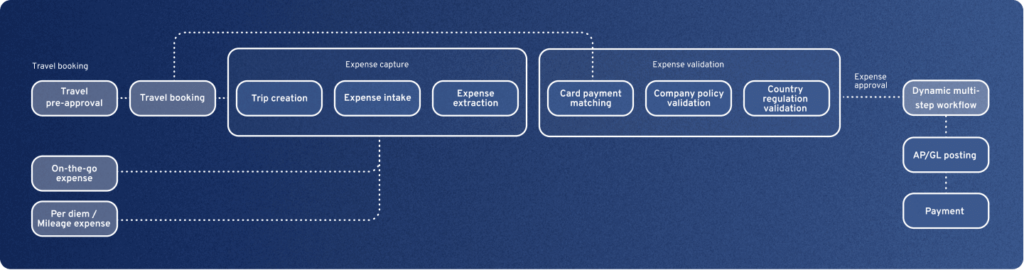

To make this more specific, we’ll look at the journey of a business expense through Yokoy, and where AI algorithms are involved.

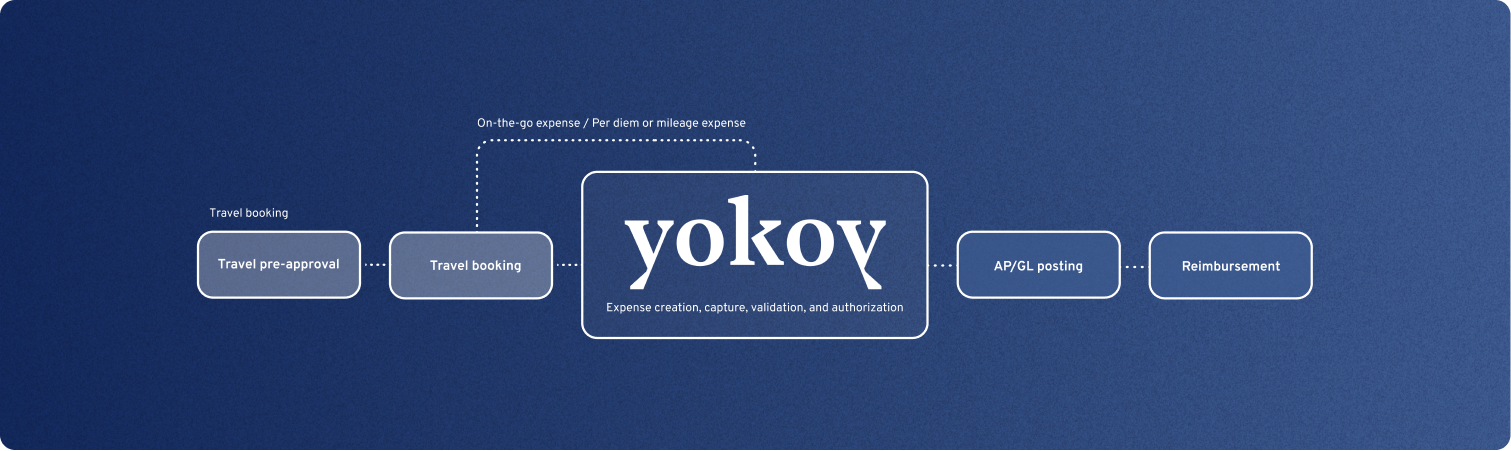

Initiating the expense report

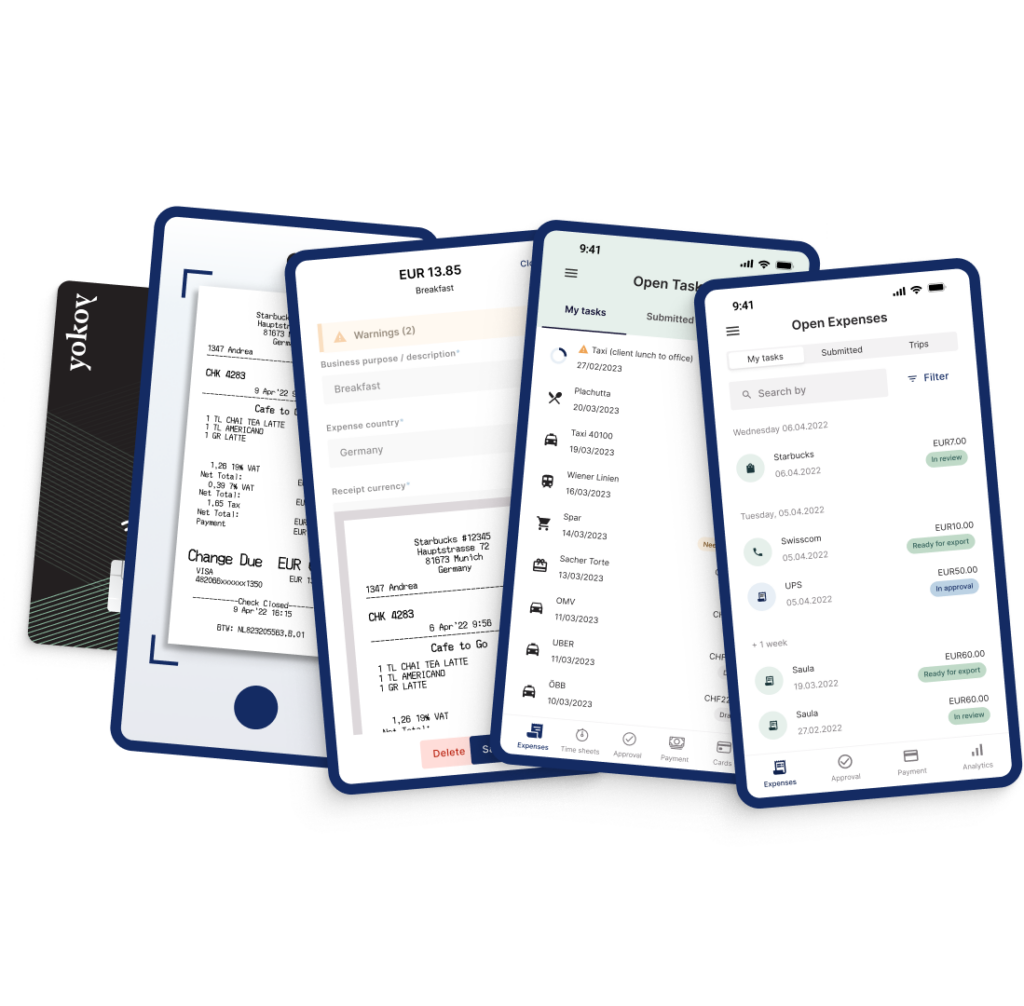

The first step in the expense reporting process is the upload of an image of a receipt. Please note that this doesn’t have to be a paper receipt – you can also upload .pdf documents.

In Yokoy, employees can submit single expenses just by capturing the receipt with the mobile app, or add multiple expenses to a business trip, through integrations with corporate travel companies.

Reading the data

Yokoy processes the image, extracting all the data that is relevant for the expense report: for example, the date of the payment, the type of purchase, the amount spent, the service provider, the VAT, and so on.

The AI algorithm reads all this data, recognizing its meaning and validating the information against relevant company policies.

For example, the artificial intelligence can distinguish between items purchased, and can flag expenditures that are not in line with company policy, such as alcoholic beverages.

In a single receipt, the Yokoy app can validate over 300 data points, which means that the risk of error is reduced to a minimum.

Once the data is read, Yokoy’s AI automatically assigns the transaction to the correct expense category. Everything is automated and in the background, so the only thing left for the employee to do is to add a brief description of the expense, and – if paid with own money – to select Paid privately as payment method.

Blog article

Automatic Receipt Extraction: Remove Manual Data Entry with OCR and AI Technology

Manual data entry for processing receipts is time-consuming and prone to errors. Here’s how to automate the receipt extraction process with OCR and AI.

Andreea Macoveiciuc,

Growth Marketing Manager

Validating the expense

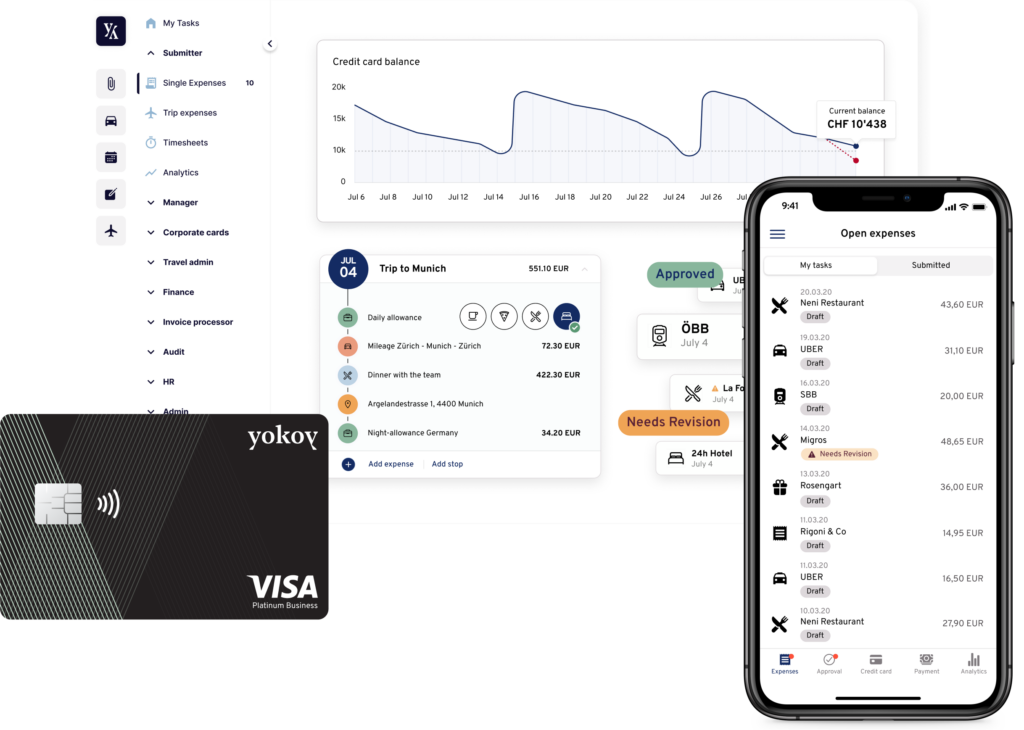

In the validation step, the Yokoy AI functionality verifies the expense for compliance with the regulations configured by the company. For example, AI algorithms can automatically apply per diem rates for meals and lodging expenses, as specified by company policy.

The system can also identify any expenses that exceed the allowed limits and either flag them for review or deny them outright. This can help to ensure that employees do not overspend on their expenses and that the company’s budget is being used appropriately.

The rules can be customized to meet specific company needs and policies, even when the regulations differ from one subsidiary to the other.

For example, if a company has a policy that requires pre-approval for certain types of expenses, such as business-class flights or expensive client dinners, the system can be programmed to automatically flag these expenses for approval before they are reimbursed.

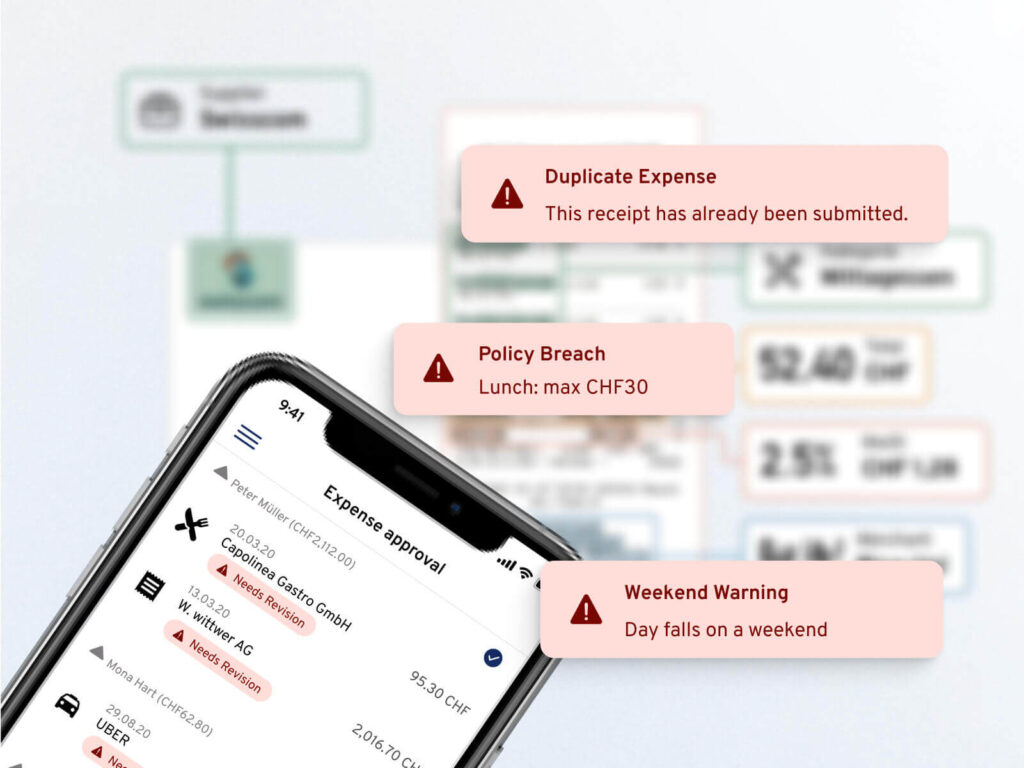

Flagging policy breaches and fraudulent payments

In this step, the software detects duplicates and evaluates potential fraudulent data. If everything looks good, the receipt is assigned to a specific category. In this case, the expense report is generated automatically, with no additional intervention needed.

If, however, the AI detects potentially fraudulent items and policy breaches – for example, means that exceed the allowed amounts, or travel expenses that are not in line with company policy, the items will be marked as outliers and the receipt will be sent to the approver, for review.

At the same time, duplicate receipts will be marked accordingly and the approver will be notified, preventing overpayments. This ensures an audit-proof expense management process and simplifies the financial reports, helping teams to keep company spend under control.

Recognizing VAT and automating reclaims

In case of expenses that occurred abroad, our software can convert the currency to your country’s currency, eliminating the need for manual conversions.

Also, the AI can identify the expenses that qualify for VAT reclaims based on their category and the country they occurred in, automating the full tax reclaim process.

Given how much the landscape of global VAT is changing, it can be quite overwhelming for companies to keep up with regulations, so using AI to automate this step reduces risks and makes the reclaim process much smoother.

Beekeeper reclaims VAT automatically with Yokoy

“The Finance team can focus on exceptions only and all other expenses are processed fully automated within seconds. The VAT recognition that Yokoy helps to ensure an automated VAT reclaim.”

Herbert Sablotny, Beekeeper’s CFO

Assigning expenses to cost centers

The Yokoy app automates this step, using machine learning not only to extract the data but also to match the cost center exactly based on the spend category. For example, the tool can recognize and process single expenses, but also mileage expenses that need to be reimbursed with specific rates.

Travel expenses that occur during business trips are also automatically categorized by Yokoy, and assigned to the correct trip through integrations with travel providers.

In case of traveling in different time zones, these differences are taken into account by the Yokoy app, when the lump sums are calculated and the reimbursement amounts are validated.

Yokoy detects allowances automatically based on the expense country, so finance teams don’t have to spend time manually checking the latest regulations and allowances, in order to validate the submitted expense reports.

The cost of not automating the expense reporting process

According to a survey by the Global Business Travel Association, 65% of companies reported that enforcing their expense policies was a challenge. The same survey found that only 57% of companies had a formal expense policy in place, and only 51% had an automated expense management system.

We agree that the transition can be challenging, and companies may worry that it will be time-consuming and costly.

But the cost of not implementing change is actually more significant.

We’ve mentioned above that a single expense report costs companies up to $58 per report on average. But these are just process costs.

The Association of Certified Fraud Examiners reports that expense reimbursement fraud accounts for 14.5% of all occupational fraud and abuse. In a survey by SAP Concur, 40% of employees admitted to violating their company’s travel and expense policies.

Failure to comply with expense reporting regulations can result in legal and financial penalties, with some jurisdictions imposing fines of up to $25,000 per violation.

And if we look at the steps in a traditional expense reporting process, there is nothing that can’t or shouldn’t be automated.

The steps below are part of a traditional expense management process:

Incurred expense: An employee makes a business-related expense using their personal funds.

Collection of receipts: The employee collects receipts and other supporting documentation for the incurred expense. The receipts, along with other proof of payment, should be attached to the expense report to substantiate the expense.

Filling out the expense report: The employee manually fills out an expense report form, detailing the incurred expense, along with the supporting documents. Expense details such as the date of the expense, the amount spent, and the purpose of the expense have to be manually filled in.

Approval process: The employee submits the expense report to their manager for approval. The manager then reviews the report, verifies the authenticity of the receipts, and approves or rejects the expense.

Reimbursement: Once the expense report is approved, the employee should receive reimbursement for their expenses.

With automated expense reporting software, companies can track expenses more efficiently, automate workflows, and ensure compliance with company policies and local regulations.

Does using expense management software to automate reporting pose compliance risks?

One of the main concerns related to the use of new technologies like automation or artificial intelligence in financial processes is that it may lead to policy breaches, non-compliance, and fraudulent activities.

This fear is not entirely unfounded, as automation can potentially expose companies to new risks and vulnerabilities.

For example, in a traditional, manual process, compliance breaches can occur in various ways, such as:

- Fraudulent expenses: Employees may submit fake or inflated expenses to receive more reimbursement than they are entitled to.

- Unapproved expenses: Employees may submit expenses that have not been pre-approved by their managers or are not in line with company policy.

- Inaccurate expense details: Employees may make mistakes when entering expense details, such as dates or amounts, which can result in incorrect reimbursements.

- Missing receipts: Employees may fail to attach supporting documentation, such as receipts, which can make it difficult to verify the legitimacy of an expense.

- Delayed submission: Employees may submit expense reports after the company’s deadline, which can result in delayed reimbursements or even denial of reimbursement.

Fenaco standardized their expense management with Yokoy

“With Yokoy, we have opted for a uniform and group-wide expense management solution that unifies our different expense processes on one platform and automates them across organizations, for increased efficiency.”

Marianne Schluep, Head of Finance and Accounting

However, with the right policies and procedures in place, automated expense management can significantly reduce these risks and improve overall compliance. To give just some examples:

- By using automation and AI, companies can flag non-compliant expenses or suspicious activities, reducing the risk of fraudulent expenses and other compliance violations.

- Artificial intelligence and automated pre-approval workflows can enforce spending limits, prevent unauthorized expenses, and provide real-time monitoring of expenses, for a better control of business spend.

- Furthermore, expense reporting automation reduces the need for manual data entry, which can significantly reduce the risk of human error and make it easier to track and manage expenses.

When the entire spend management process is automated, it can provide a clear audit trail and ensure that all expenses are accounted for, making it easier for businesses to remain compliant with internal policies and external regulations.

Overall, automating the expense reporting process reduces the risk of compliance violations and improving overall compliance with internal policies and external regulations.

Yet, for many companies, moving from manual work to automation seems to be a daunting task.

Next steps

To sum it up, automated expense reporting can help organizations comply with local regulations, tax laws, and internal expense policies, reducing the risk of fines, penalties, and reputational damage.

By automating key aspects of the process, such as data entry, expense data validation, or expense categorization, finance teams can reduce the risk of errors and fraud, and can track employee expenses in real-time, which helps them identify potential issues early on and take corrective action.

If you’d like to see what Yokoy can do for your company’s expense reporting process, you can book a demo below.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.