Home / Prioritizing Employee Satisfaction: The Case for Better UX in Finance Tools

Prioritizing Employee Satisfaction: The Case for Better UX in Finance Tools

- Last updated:

- Blog

Co-founder & CCO, Yokoy

The world of finance is changing rapidly, with disruptive technologies and shifting consumer expectations reshaping the landscape. Yet, despite these changes, many finance tools remain stuck in the past, with a poor user experience and interface.

Although it may not seem like a pressing matter to address, the level of employee satisfaction in the finance department suggests otherwise.

Employee (dis)satisfaction in the finance department

According to a report by reclaim.ai in 2022, finance professionals are among the most dissatisfied with their roles.

Not only are they among the three most overworked departments, averaging 48.4 hour workweeks, but they’re also reporting the highest burnout rates, with 73.1% in 2022 compared to 81.7% in 2021.

Of course, it’s been a few months since the data was collected in October 2022, so these numbers may have changed slightly. But this doesn’t mean that the topic should be ignored.

So what’s causing the increased employee dissatisfaction in the finance department?

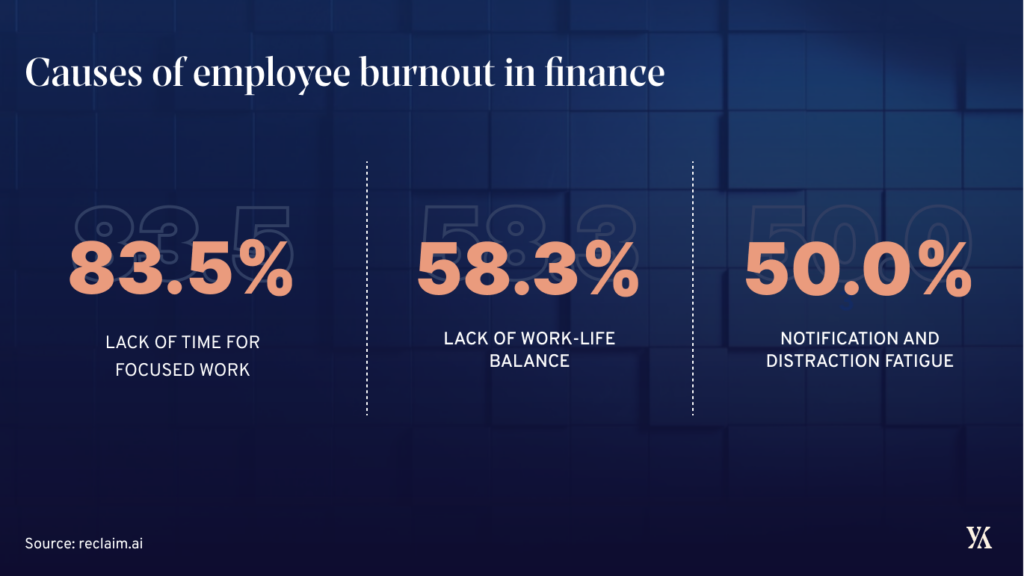

According to the survey, the top three stressors for finance professionals are:

- The lack of time for focused work (83.3%),

- The lack of work-life balance and not having enough time off (58.3%), and

- Notification and distraction fatigue (50%)

Surprisingly, it’s not the long working hours that are causing the most frustration. According to the respondents of this survey, the biggest stressor is the lack of time for focused work, which outdated tooling and inefficient processes contribute greatly to.

The constant switching between tools, the chasing of receipts and employees, the mix of manual and digital steps in finance processes – all of these small but annoying inefficiencies can interrupt the focus of finance employees, affecting their job satisfaction, well-being, and ultimately performance as well.

Most of these factors are relatively easy to fix.

By adopting modern tooling and reimagining traditional processes, finance leaders can enable their teams to work more efficiently and effectively. This can lead not just to higher productivity, but also to more engaged and satisfied employees and higher retention rates.

However, we understand that change can be daunting for many organizations, and finance leaders may be hesitant to take the leap into the unknown.

So in this article, we’ll take a closer look at how companies can tackle the employee experience and satisfaction problem in an effective manner. Let’s dive in!

Blog article

What Is Spend Management? Fundamentals and How It Works

In today’s competitive market, companies that can effectively manage their spending are better positioned to grow and remain profitable.

Lars Mangelsdorf,

CCO at Yokoy

From context switching to boredom: The root causes of finance employee dissatisfaction

One factor that contributes to dissatisfaction among finance employees is the constant context switching that they have to do.

This is particularly true in larger organizations, where finance professionals are required to juggle multiple tasks simultaneously, such as managing budgets, reviewing expenses, and processing invoices.

The high level of multitasking involved, as well as the disjointed processes caused by siloed systems and poorly executed integrations can lead to stress and burnout, ultimately resulting in reduced productivity, decreased job satisfaction, and high employee turnover.

Moreover, in global companies, finance professionals must navigate through numerous local rules and regulations, adding an extra layer of complexity to their workload. The need to focus on details when reviewing expenses or processing invoices can be both time-consuming and frustrating, especially when this process is done manually.

Finally, another factor that can contribute to dissatisfaction among finance employees is the repetitive and often mundane nature of the tasks they perform.

Despite advances in technology and digitalization, many finance processes still involve a mix of manual and digital tasks, which can add up to significant amounts of wasted time and effort. This can lead to boredom, frustration, and ultimately, decreased employee satisfaction.

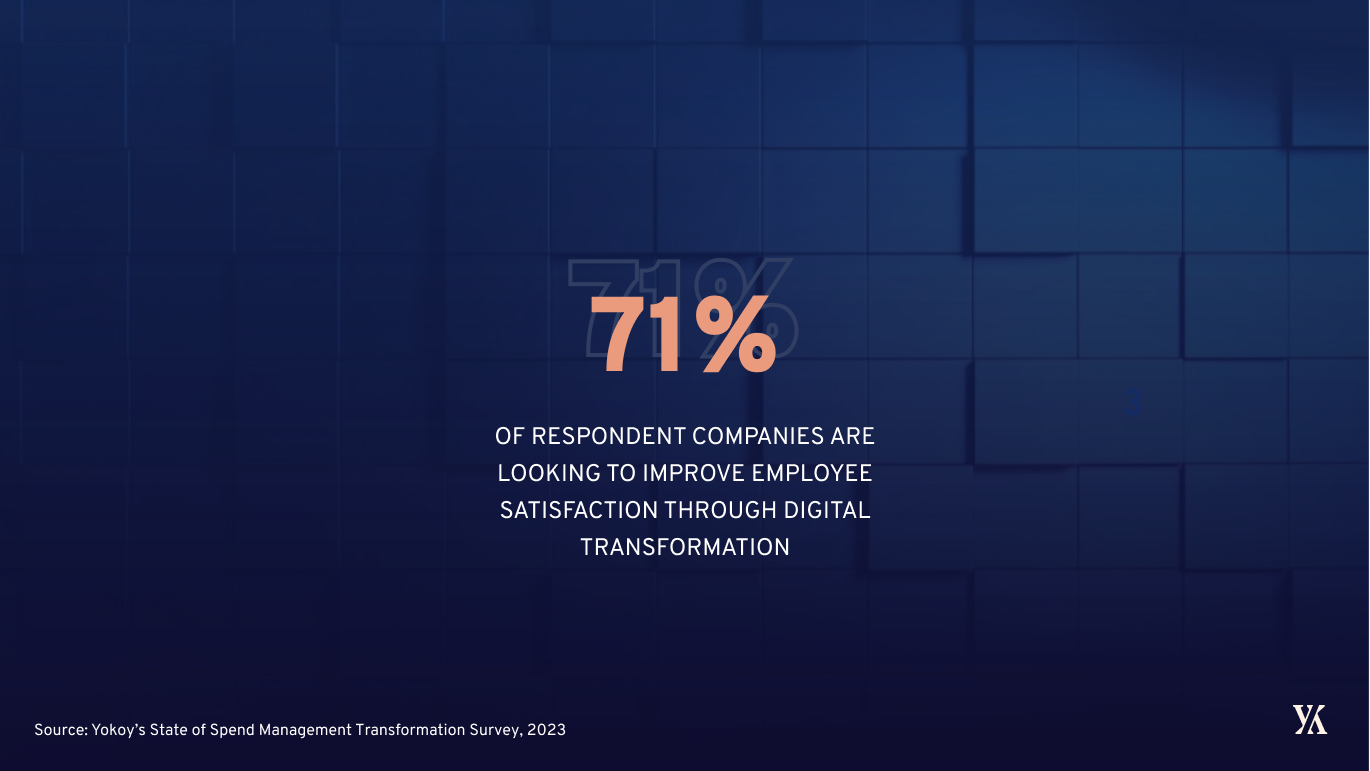

Why should all this matter, though?

Because an organization’s financial performance, the customer experience and customer satisfaction are all influenced by the corporate culture and by how engaged employees are. Finance leaders should care about their human capital just as much as they care about the company’s bottom line, because in the end, all the small dissatisfactions add up.

Now, what we often see is that companies try to balance the poor employee experience with incentives and a welcoming work environment. Unfortunately, such measures don’t fix the root cause of the problem, and don’t really contribute to higher profitability in the long run.

Thus, to address these challenges, organizations should start by fixing the basics: Replacing their outdated finance tools with modern, easy to use and intuitive software that removes system silos, streamlines processes, and eliminates repetitive, manual work.

Why are finance tools disregarding UX and employee satisfaction?

"Finance teams often have to work with multiple systems that don't integrate, leading to a fragmented and confusing experience. This can make it difficult to find the information you need and complete tasks quickly."

Lars Mangelsdorf, CCO at Yokoy

Legacy finance tools have historically prioritized functionality over UX, resulting in poor experiences for both submitters and approvers.

While employees may only interact with these tools when submitting expenses, finance professionals must deal with inefficient processes and system silos on a daily basis.

Until recently, the poor UX of finance tools was accepted as a given, and little effort was made to improve it. But as employees have become accustomed to the intuitive and user-friendly interfaces of B2C tools and software, their expectations for a better user experience in the workplace have risen.

Employees expect the same level of simplicity and ease of use in their work tools as they do in their personal lives.

Nobody wants to go from ordering an Uber and getting their groceries delivered at home in one click, to navigating convoluted systems and switching between manual and digital tasks to simply submit an invoice into an expense reporting tool.

This puts pressure on organizations to provide tools that are not only functional but also user-friendly and engaging. Employees who are frustrated with the tools they have to use will likely be less productive, less engaged, and less satisfied with their work.

The problem is compounded during end-of-month and end-of-quarter closing, when pressure is high, and small frustrations can quickly add up to the breaking point. Employees may rush administrative tasks, resulting in errors and additional workload for finance teams who have to chase them down.

To address these challenges, organizations must prioritize UX and employee satisfaction in their finance tools. This means investing in user-friendly interfaces, integrating disparate systems, and streamlining processes to reduce frustration and increase productivity.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

What finance leaders can do to improve employee satisfaction

Here are some steps finance leaders can take to improve employee satisfaction with finance tools.

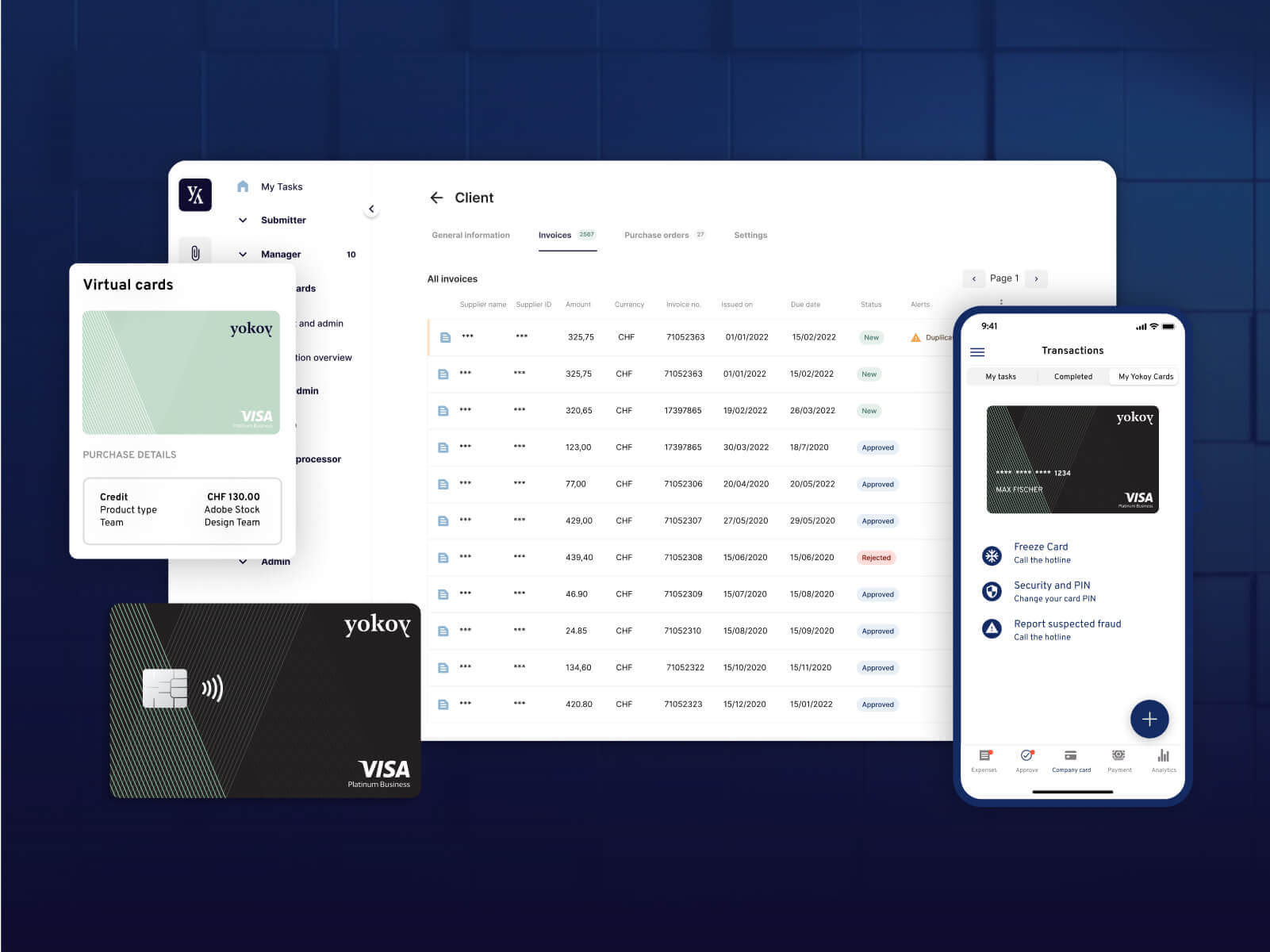

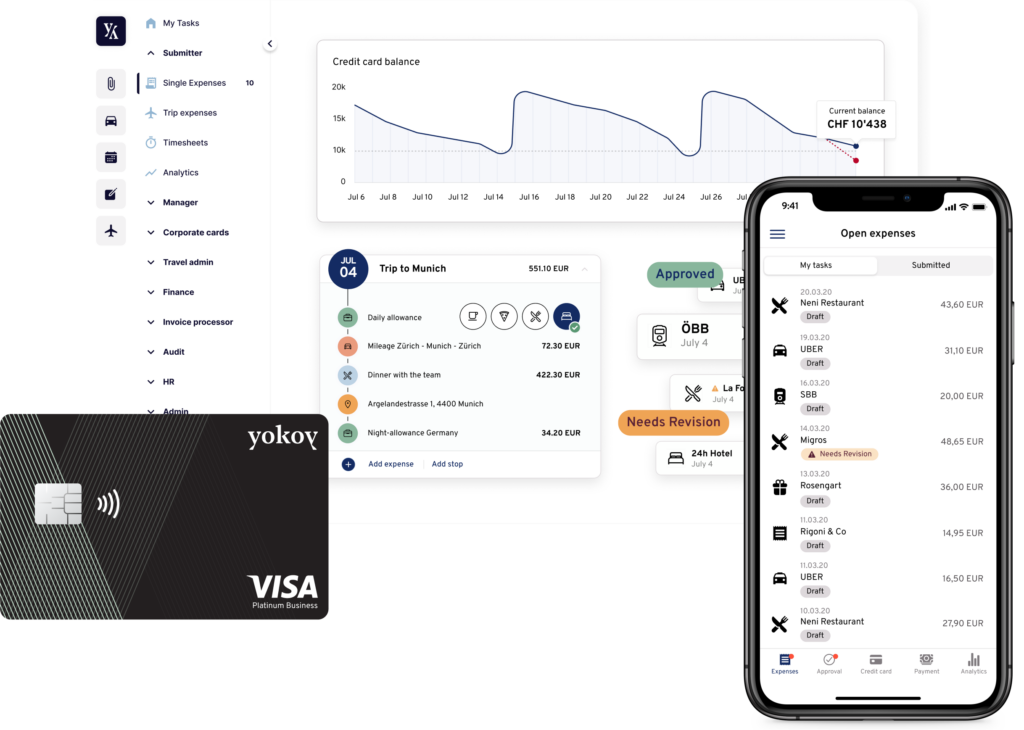

Submitter experience: AI & smart corporate cards

For submitters, move away from OCR-based tools and adopt modern AI-driven technology that eliminates the need for manual intervention.

One example is smart corporate cards that are connected to a central spend management tool that is mobile-friendly. This enables employees to easily submit expenses on-the-go, without the need for manual data entry or paper receipts.

Manual data entry can be a tedious and time-consuming process for employees, leading to frustration and errors. By adopting AI-driven tools that automate data capture, employees can save time and focus on more valuable tasks.

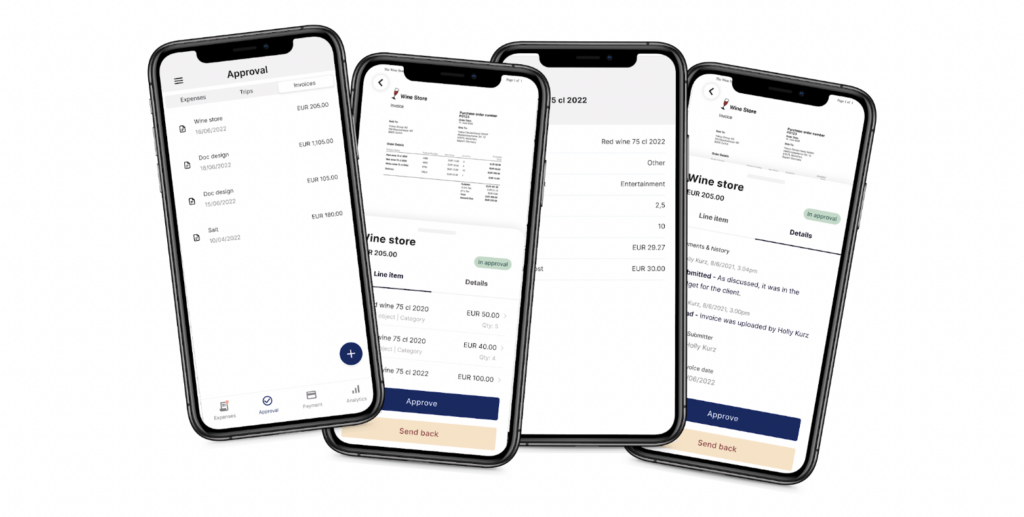

Approver experience: One central tool and real-time data

For approvers, streamline tooling to avoid context switching and choose tooling with a good approver/admin experience. This means selecting tools that integrate with other systems and provide a user-friendly interface for approvers to review and approve expenses.

A good approver experience is key to ensuring that expenses are approved in a timely manner. If the approval process is too complex or time-consuming, it can lead to delays and frustration for both employees and finance teams.

For both submitters and approvers, choose tooling that uses AI to automate both process logic and steps, to reduce the mental load on finance professionals and employees.

This can include automating processes such as expense categorization and reimbursement calculations, as well as providing intelligent notifications and reminders to ensure that tasks are completed on time.

And last, make sure you equip your finance team with software that can give them full control and visibility in real time.

By automating manual processes, you can reduce the risk of errors and free up finance professionals to focus on more strategic tasks. This can ultimately lead to better business outcomes and improved employee satisfaction.

Bringing it all together: The Yokoy experience

Now, picture a scenario where finance tools are crafted with the user’s comfort in mind. Every stage of the process is optimized and streamlined for the highest efficiency, and employees can submit expenses with ease and without any manual intervention.

At Yokoy, the user’s experience is a top priority, reflected in both design and engineering decisions. Here are a few examples of how we tackle the issues caused by outdated finance tools.

User experience

Yokoy’s user interface is intuitive and straightforward, making it easy for employees to submit expenses quickly and without any complications.

Mobile-friendliness

Yokoy is designed to work on any device, be it a desktop computer or a mobile phone, providing maximum flexibility for employees on the go.

Automation through AI

Yokoy automates up to 90% of the expense management process, reducing the need for manual intervention and freeing up valuable time for finance teams to focus on more strategic tasks.

Moreover, our artificial intelligence engine detects errors, duplicates, and outliers, removing the need for finance professionals to manually check receipts and invoices line by line or item by item.

Integrations

Yokoy integrates seamlessly with other popular finance tools, such as accounting software, travel management tools, and HR systems, making it a flexible and scalable solution.

Real-time analytics and reporting

Yokoy provides detailed analytics on all submitted expenses, giving finance teams greater visibility and control over their company’s expenses. This helps finance teams to quickly identify areas that require optimization and make informed decisions.

In conclusion, with Yokoy, experience is at the core of every decision made, and this is reflected in its design, functionality, and integration capabilities.

The result is a solution that provides maximum efficiency, flexibility, and scalability, allowing finance teams to work smarter and more effectively.

Next steps

Investing in user-friendly and efficient finance tools may require an upfront cost, but the benefits of increased productivity, employee engagement, and overall business success make it a worthwhile investment.

If you’d like to see what Yokoy can do for your finance team, you can book a demo below.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.