Home / Reclaim VAT Automatically: How Yokoy Uses AI to Simplify VAT Recovery

Reclaim VAT Automatically: How Yokoy Uses AI to Simplify VAT Recovery

- Last updated:

- Blog

Product Marketing Manager, Yokoy

In the world of finance, the process of Value Added Tax (VAT) recovery has traditionally been a labyrinthine maze of paperwork, data entry, and manual verification.

As a result, year after year, companies miss out on significant amounts of money by forgoing VAT refunds.

Finance professionals have long grappled with the complexities of VAT rules and regulations, dedicating countless hours to ensure compliance and reclaiming every eligible penny.

However, in the age of technological advancement, a paradigm shift is underway. The old way of VAT recovery, marked by laborious, error-prone processes, is giving way to a new era powered by Artificial Intelligence (AI). This transformative approach not only simplifies VAT recovery but also enhances accuracy and efficiency to unprecedented levels.

In this article, we’ll look at the traditional VAT recovery methods and compare them with cutting-edge solutions offered by AI-driven platforms like Yokoy.

Whether you’re a finance professional seeking inspiration for a more streamlined process or looking for a comprehensive education on the AI-powered VAT recovery revolution, our exploration will shed light on how AI is reshaping the landscape, making VAT recovery faster, smarter, and more accessible than ever before.

Traditional VAT recovery: Time-consuming manual processes

Traditional VAT recovery relied heavily on manual data entry and verification.

Finance teams were required to meticulously review invoices, receipts, and other financial documents, extracting relevant VAT-related information by hand. This process was not only labor-intensive but also susceptible to human errors.

The sheer volume of invoices and receipts that businesses handle made the traditional approach to VAT recovery a time-consuming endeavor. Finance professionals spent countless hours sifting through paperwork, leading to delays in the VAT recovery process. Additionally, the need for skilled personnel to ensure accuracy added to the resource burden.

On average, manual VAT reclaim processing can take anywhere from several weeks to several months. This includes the time required for collecting and organizing invoices, filling out reclaim forms, and submitting them to tax authorities.

VAT regulations are known for their intricacies, with varying rates and rules for different goods and services.

For example, in Austria, the government levies VAT rates for exchange of goods and service. There are four different VAT rates relevant for expense management:

- Standard VAT – 20% for most of the goods and services

- Reduced VAT – 13% for art works, sporting event, delivery of living animals, plants

- Reduced VAT – 10% for accommodation, Transportation

- No VAT – 0% for VAT excluded goods and services

In Spain, companies should report VAT to tax authorities digitally via SII. here are four different VAT rates relevant for expense management:

- 21% standard VAT rate for all goods and service

- 10% intermediary VAT rate

- 4% reduced VAT rate

- 0% VAT rate

This complexity often led to errors in VAT recovery. Mistakes in calculations, missed opportunities for VAT reclaims, and compliance issues were common pitfalls in the traditional VAT recovery landscape.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

The power of AI-driven VAT reclaim software

Artificial Intelligence (AI) is heralding a significant transformation in the field of finance, revolutionizing how tasks are performed and efficiency is achieved. AI’s growing role in finance extends beyond mere automation; it represents a paradigm shift in how financial operations are conducted.

AI encompasses a range of technologies, including machine learning, natural language processing, and data analytics, that enable computers to perform tasks that typically require human intelligence.

In finance, AI is being leveraged for tasks such as risk assessment, fraud detection, and, notably, automation of complex and repetitive processes.

Blog article

AI in Finance: 10 Use Cases That Will Become More Common in 2023

What can finance AI do for you? Learn how artificial intelligence is changing the finance industry in general, and the spend management process in particular.

Lars Mangelsdorf,

CCO at Yokoy

AI’s true power lies in its ability to automate intricate and time-consuming tasks. Finance professionals can now rely on AI algorithms to swiftly and accurately process large volumes of data, eliminating the need for manual data entry and verification. This automation significantly accelerates processes while reducing the risk of errors.

In the context of VAT recovery, AI plays a pivotal role in simplifying and expediting the process.

Here’s a detailed look at how AI streamlines VAT reclaim:

1. Automated data extraction

AI-powered VAT reclaim solutions employ advanced optical character recognition (OCR) technology to extract data from invoices, receipts, and other financial documents automatically. This includes key VAT-related information like invoice numbers, dates, supplier details, and VAT amounts.

2. Data verification and validation

Once the data is extracted, artificial intelligence algorithms perform validation checks to ensure accuracy and compliance with VAT regulations. This includes cross-referencing extracted information with relevant VAT rules and thresholds to flag any discrepancies or potential errors.

3. Categorization and classification

AI can intelligently categorize expenses and classify them based on predefined VAT codes. This automated categorization ensures that each expense is appropriately tagged with the correct VAT rate, reducing the risk of misclassification errors.

Blog article

Invoice Capture Solutions: From Manual Processing to OCR and AI Technology

Unlock the power of invoice capture methods in finance, transitioning from manual processing to advanced Invoice OCR and AI technology.

Andreea Macoveiciuc,

Growth Marketing Manager

4. Multilingual and multiregional capabilities

AI-powered systems are equipped to handle documents in multiple languages and comply with VAT regulations from various regions. This flexibility is particularly valuable for businesses engaged in international operations.

5. Continuous learning and adaptation

AI systems continuously learn and adapt to changing VAT rules and regulations. They can update their algorithms based on new tax laws, ensuring that VAT reclaim remains accurate and up-to-date even as regulations evolve.

6. Integration with accounting software

AI-driven VAT reclaim solutions seamlessly integrate with accounting and financial software. This means that once the VAT-related data is extracted and validated, it can be automatically entered into financial records, eliminating the need for manual data entry.

Beekeeper reclaims VAT automatically with Yokoy

“The Finance team can focus on exceptions only and all other expenses are processed fully automated within seconds. The VAT recognition that Yokoy helps to ensure an automated VAT reclaim.”

Herbert Sablotny, Beekeeper’s CFO

7. Real-time reporting and analytics

AI provides real-time insights into VAT-related data, offering finance professionals a comprehensive view of their VAT reclaims. This includes tracking the progress of claims, identifying potential issues, and generating reports for compliance and financial analysis.

8. Fraud detection

AI is equipped to detect irregularities or anomalies in VAT data that may indicate fraudulent activities. This adds an additional layer of security and compliance assurance to the VAT reclaim process.

By utilizing AI-driven software like Yokoy, businesses can automate VAT data extraction from invoices and receipts. This automation not only saves time but also ensures precision, making it an invaluable tool for finance professionals seeking to streamline VAT recovery operations.

Moreover, AI’s ability to adapt and learn from data ensures that it stays up-to-date with evolving VAT regulations, further enhancing its relevance in this domain.

Let’s see how Yokoy’s AI accelerates VAT recovery, making it more accessible, efficient, and error-free for finance professionals.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

Yokoy's solution: Automated VAT reclaim at scale

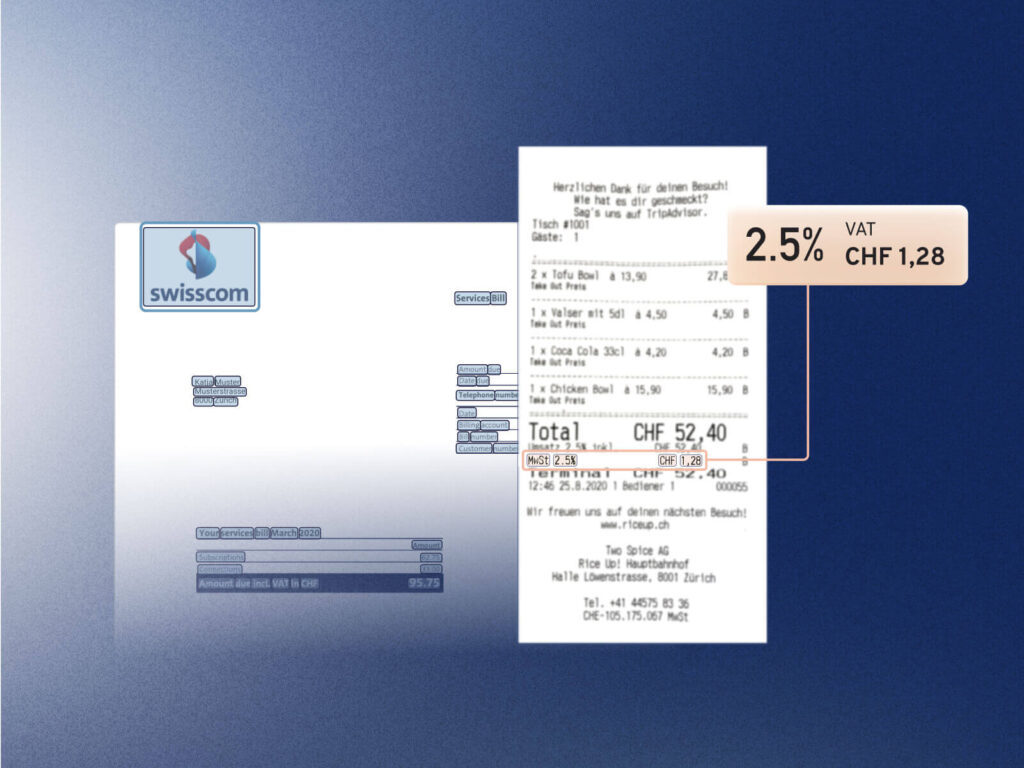

Yokoy automatically extracts all VAT rates relevant for expense management on the receipt pictures. Companies can also add additional VAT rates for extraction, if relevant. Yokoy can also extract VAT rates from other countries and book/export them separately in the Finance tool.

Yokoy’s AI-powered spend management suite processes all VAT rates, regardless of the country in which the receipt or invoice was issued. The software can rely on the methods of artificial intelligence to do this. In a second step, the digitized receipts are then compared with the regulations in force.

Finally, the accounting journal is included. In the process, all relevant data, including receipt pictures and the extracted VAT rates for specific countries, is forwarded to the ERP system or it is automatically transmitted to a third-party provider.

Yokoy offers standard integrations with external VAT reclaim providers, such as VAT IT, Cashback, Way2VAT or Taxback International.

This way, a company no longer misses an opportunity to reclaim VAT. All steps can be automated, no man-hour is wasted unnecessarily. Use your resources more efficiently and don’t miss a single VAT reclaim with Yokoy.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.