Home / From Spreadsheets to Finance Automation: The Benefits of Streamlining Your Finance Processes

From Spreadsheets to Finance Automation: The Benefits of Streamlining Your Finance Processes

- Last updated:

- Blog

Co-founder & CFO, Yokoy

By automating your financial business processes, you can realise huge efficiency gains, reduce costs, avoid errors, increase employee satisfaction, and combat fraud.

In this article, we will explain what financial automation comprises and how you can benefit from automating your financial business processes.

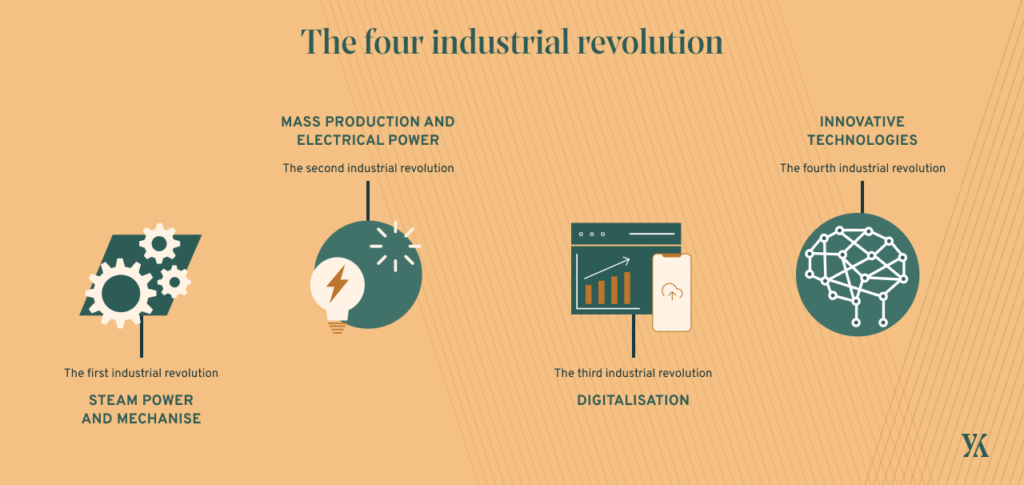

The Fourth Industrial Revolution: Automating your financial business processes

During each industrial revolution, there have been companies that succeeded in adopting the technological breakthroughs of the era timely. Entrepreneurs that failed to harness steam power and mechanise in the First Industrial Revolution couldn’t keep up.

Industries that didn’t switch to mass production and electrical power in the Second Industrial Revolution soon became obsolete. Companies that didn’t fully embrace digitalisation in the Third Industrial Revolution have gone the way of the dinosaur and are extinct by now.

The common theme in each of the Industrial Revolutions is the advent of a specific technology that then went on to transform traditional production and business methods fundamentally.

In the Fourth Industrial Revolution, we are now witnessing the introduction and acceleration of innovative technologies such as the Internet of Things (IoT), Augmented Reality (VR), Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), and Natural Language Processing (NLP).

To remain successful, companies need to move towards using the innovations unleashed by the Fourth Industrial Revolution in all their business processes.

Many companies have already succeeded in integrating these technological innovations in their manufacturing processes and service models. Unfortunately, most financial business processes still appear to be stuck in the digitalisation phase of the Third Industrial Revolution.

Companies often continue to rely on traditional systems to support financial operations. As a result, financial procedures are slow and error prone due to repetitive manual tasks and inefficient work processes.

Whereas companies can realise huge efficiency gains, reduce costs, avoid errors, increase employee satisfaction, and combat fraud by automating their financial business processes.

Finance Automation: Automate your company’s finance processes

Financial automation rates can now be significantly increased in financial business processes thanks to the rise of:

- Artificial intelligence: the development of computer systems that is able to perform tasks normally requires human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages.

- Machine learning: the use and development of computer systems that are able to learn and adapt without following explicit instructions, by using algorithms and statistical models to analyse and draw inferences from patterns in data.

- Deep learning: a type of machine learning based on artificial neural networks in which multiple layers of processing are used to extract progressively higher level features from data. Artificial neural networks are computational models that mimic the way nerve cells work in the human brain.

Artificial intelligence in finance automation

Finance automation technology integrates AI in Finance, as well as machine learning and deep learning for use in areas such as financial analysis, payroll administration, invoice automation, collections actions, and preparing financial statements.

The use of such automated software reduces the need for human intervention in these activities. With technological solutions such as Optical Character Recognition (OCR) combined with AI, core finance tasks – such as invoicing and expense management – can now be automated.

Your finance department will no longer be burdened with mind-numbing, error-prone, repetitive, manual tasks and can focus more on strategic issues, compliance, and dealing with exceptions.

Blog article

The Game-Changing Potential of AI in Finance Transformation

The AI-shaped finance function of the future will look profoundly different from the one of today: It will be defined by a highly collaborative process, with humans and machines working together to achieve common goals.

Melanie Gabriel,

CMO at Yokoy

Examples of financial automation technologies that can be applied to financial processes

Document automation

Document automation enables the generation and processing of electronic documents. Document generation systems involve logic-based systems that use pre-existing text and/or data segments to compile a new document.

Generating standardised invoices or financial statements is an example of this technology.

You can also use technologies like machine learning and OCR to auto-extract, validate and enrich documents. This enables the automated processing of most documents (e.g., invoices).

Robotic Process Automation (RPA)

Many everyday business tasks, like processing data or producing reports, are standardised and repetitive – what used to be called “paper-pushing”. Such tasks are boring for humans – and also take up human resources that are better used elsewhere.

RPA solves this by creating software “agents” that perform the same task again and again as needed, engaging with applications and data as a human would – but with the process automated and not needing human supervision.

While RPA is often used for tasks of fixed scope that never change, increasingly AI is used to make the software agents more capable and flexible.

Process mining

A functioning business is the sum of its processes – all the tasks people perform every day and how they interact.

Business improvement typically involves analysing these processes and making them perform better. But even a small business may have hundreds, with many variants from the ideal – making this “process mapping” difficult.

That’s where process mining comes in. With PM, software “looks at” a company’s data flows and how they produce a result (such as how a purchase order leads to a payment approval), identifying the data interactions and transformations that represent each process.

This gives a “process map” that can be used as a tool for business improvement.

Chatbots and conversational agents

A chatbot is a computer programme that allows people to obtain information from machines using text and voice.

In finance, conversational agents can be used as virtual assistants for finance teams, or they can help automate communication between finance teams and suppliers and customers.

Machine learning

Rule-based automation helps businesses define and execute requirements for various operations in compliance with the rules. Machine learning, on the other hand, learns from past transactions and customer decisions, identifies decision-making patterns, and uses these patterns to make future choices.

Finance teams can benefit from this technology, for example, to run accurate simulations and take precautions for possible adverse scenarios.

White paper

How Artificial Intelligence Promotes Process Automation

Automation projects can break down as a result of unclear targets or through failure to consider the human factor.

Hyperautomation takes past experiences into account whilst also making use of the future potential of artificial intelligence.

In this white paper, we look back at the beginnings of automation and highlight the advances and opportunities for businesses in the age of hyperautomation.

Finance processes that could benefit considerably from automation

Order-to-Cash (O2C)

O2C is the step-by-step process of receiving customers’ orders to receiving the outstanding balance.

Source-to-Pay (S2P)

S2P or purchase-to-pay or procure-to-pay (P2P) is a process that starts with finding, negotiating with, and contracting the suppliers of goods, and culminates in final payment for those goods (including accounts payable / invoice automation).

Payroll Administration

Payroll administration comprises the activities required to arrange the compensation of employees for hours worked. These can include the control of overall hours served by staff, the rate of pay and the allocation of compensation to staff.

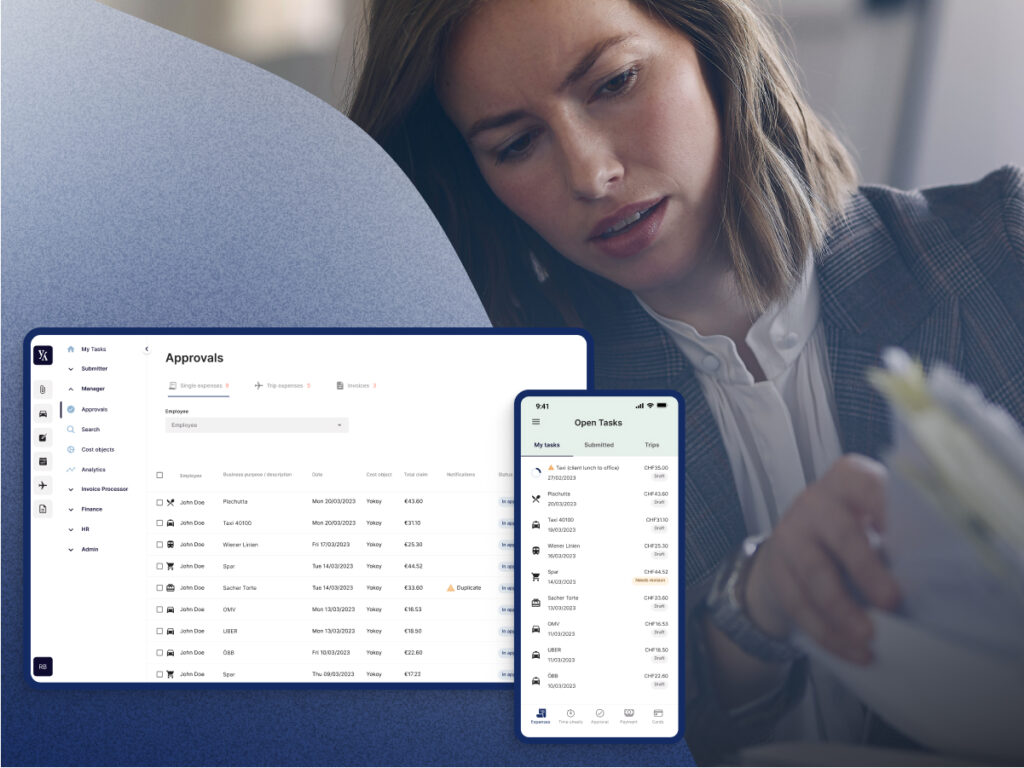

Expense reimbursement

Expense management automation will not only raise consistency and accuracy of financial records, but also help with flexible decision-making and meeting compliance. Furthermore, eliminating manual and tedious work will free up time for finance teams to concentrate on tasks that are more crucial for business growth.

Financial close

Financial close is the monthly practice of going through a company’s transactions in the preceding month, closing out temporary accounts, and posting the retained earnings into the company’s records. Accuracy is crucial in this process.

Financial planning and analysis

Financial planning and analysis include the onerous task of the preparation and compilation of financial statements by a variety of departments, which can be at least partially automated.

Accounts reconciliation

Accounts reconciliation is another low-skill task for finance teams. However, any mistakes might cause significant disruption to businesses.

Tax administration

Tax administration automation includes eliminating manual work on processes like submitting tax returns and claiming domestic and foreign VAT refunds on expenses.

White paper

Report: State of Spend Management Transformation [2023]

This report offer a glimpse into the current state of spend management transformation and the trends, challenges, and opportunities shaping its future.

The benefits of finance automation

Finance teams that rely on manual processes and tools like email and spreadsheets to manage financial data and operations are prone to confusion, data loss and errors.

By standardising, automating and integrating these processes, teams can minimise mistakes, improve collaboration and increase overall productivity. The benefits of finance automation are numerous.

Reduced costs

One of the main advantages of finance automation is that it can significantly reduce data entry and processing costs. With manual data entry and processing, there is always the risk of errors, which can be time-consuming and costly to correct.

Automating these processes can eliminate errors and ensure accuracy, which can reduce the need for costly resources to correct mistakes. Moreover, by automating finance processes, companies can eliminate the need for manual labor, which can be costly and time-consuming.

By freeing up staff from repetitive and time-consuming tasks, businesses can shift their focus to more strategic activities that add value to the company. This can lead to increased productivity, improved operational efficiency, and reduced labor costs, ultimately resulting in a more profitable business.

Blog article

From $456K Lost/Year, to Full Spend Control: Three Process Changes You Can Implement Today

In the current economic context, with inflation peaking and recession looming, finance departments are under pressure to control costs and cut unnecessary spending. The fastest way to do this is to identify hidden costs – a task proves to be more challenging than it should.

Thomas Inhelder,

CFO at Yokoy

Time saving

With faster and more efficient processes, businesses can handle more tasks in the same amount of time. Accounts Payable automation can reduce the cycle time to four days, while the manual process takes up to 17 days for most companies, which in turn can help companies obtain discounts by making early payments.

Improved financial data security

Financial automation ensures that financial workflows can proceed error-free and that any errors are quickly detected and corrected. With financial process automation, you remain in-control of the whole process from A to Z.

Fewer manual reports

Financial process automation reduces the errors occurred when performing manual tasks. People make mistakes, which is an inevitable part of being human, so automation can really make a difference here.

Improved data visibility and integrity

Real-time is crucial in this day and age, it is beneficial to be able to respond quickly to each new development and take the right action immediately. Financial automation makes it easier to track the financial workflows and build an audit trail.

More time for strategic work

When processes are organised and manual work is automated, teams can spend more time on interpreting data, providing advice, and making sound business decisions.

Higher employee satisfaction

Employees will no longer have to perform boring repetitive manual tasks and will be able to focus on more interesting and rewarding work with a higher added value.

What are the main challenges for finance automation?

Although the benefits of automating finance processes are numerous, businesses can still face many challenges along the way:

- Finance operations are the backbone of the business; therefore, companies are often reluctant to make changes in their finance business processes.

- Implementing any changes in this area could meet with powerful resistance and distrust from employees with a strong preference for the status quo.

- Regulatory challenges have to be overcome.

- Risk issues have to be taken into consideration.

Fortunately, specialised finance automation companies such as Yokoy offer innovative finance automation tools that can easily be integrated with your existing financial software and IT systems. You won’t have to make any significant changes to your processes and workflows.

Therefore, you can increase your level of automation without taking the risk of altering the trusted systems that you currently have in place. In addition, you will not be confronted with huge capital outlays and a burdensome and long drawn-out implementation process.

Consequently, you can reap the benefits of automating your finance processes practically immediately.

Next steps

With AI-based automation of financial back-end processes, you can save more than 90% of the time spent on recording and processing supplier invoices, expense claims, corporate credit cards, and claiming VAT refunds, while actively incorporating fraud prevention.

If you still aren’t convinced, then it might be time to take a closer look at Yokoy’s AI-powered spend management solution. Book a demo below to see our software in practice.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.