Home / Financial Audit Checklist: How to Prepare and How Automation Can Help

Financial Audit Checklist: How to Prepare and How Automation Can Help

- Last updated:

- Blog

Co-founder & CCO, Yokoy

When preparing a financial audit, time is of the essence, and your goal is to execute this process efficiently, remove potential errors, and stay in compliance.

So, whether you’re seeking recommendations, education on best practices, or immediate execution guidance, you’ll find it all here.

What does a financial audit include?

Before delving into the nitty-gritty of preparing for a financial audit, let’s first demystify the components that constitute this crucial financial evaluation.

Here’s a breakdown of what it typically includes:

1. Financial statements analysis

At the heart of the audit process are the financial statements. These documents, including the balance sheet, income statement, and cash flow statement, provide a snapshot of your company’s financial performance over a specific period.

Auditors meticulously assess these statements for accuracy, consistency, and adherence to accounting standards.

2. Transaction testing

Auditors dig deep into your financial transactions. They select a sample of transactions, both revenue and expense-related, to verify their authenticity and adherence to accounting principles. This step helps identify discrepancies or irregularities that require further investigation.

3. Internal controls evaluation

One key focus of a financial audit is evaluating your organization’s internal controls. Auditors assess the effectiveness of your financial processes, ensuring they are designed to prevent errors and fraud. Strong internal controls are essential for maintaining financial integrity.

4. Compliance assessment

Financial audits also entail a close look at your compliance with relevant laws and regulations. This ensures that your financial operations align with legal requirements, industry standards, and internal policies.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

5. Risk identification

Auditors identify potential financial risks that your organization may face. This includes assessing the likelihood of financial misstatements, fraud, or operational inefficiencies. Identifying risks allows you to take proactive measures to mitigate them.

6. Documentation and evidence gathering

Throughout the audit, auditors maintain meticulous documentation and gather evidence to support their findings. This documentation is crucial for ensuring transparency and providing a basis for their conclusions.

7. Communication of findings

Once the audit is complete, auditors communicate their findings to key stakeholders, including management and the board of directors. This includes highlighting any issues or areas that require attention and providing recommendations for improvement.

Preparing for a financial audit involves a holistic approach to address these components comprehensively.

Types of finance audits

As finance professionals, it’s imperative to understand that not all audits are created equal. The world of finance is complex, and various types of audits cater to different aspects of your organization’s financial operations.

Here, we’ll explore two primary categories: internal audits and external audits, shedding light on their unique purposes and intricacies.

Internal audits

Internal audits are your organization’s proactive approach to self-assessment. They are conducted by your internal audit team or an external audit firm engaged specifically for this purpose.

These finance audits are a crucial tool for maintaining transparency, improving internal controls, and enhancing operational efficiency.

Key aspects of internal audits

Objective: The primary objective of internal audits is to evaluate and improve the effectiveness of your organization’s internal controls and risk management processes. They aim to identify weaknesses in your accounting practices and recommend enhancements.

Frequency: Internal audits are typically conducted on a regular basis, often annually or quarterly, depending on your organization’s needs and industry regulations.

Scope: The scope of an internal audit can be broad, covering various aspects of your financial operations, including expense management, invoice processing, accounts payable, and procurement processes.

Ownership: Internal audits are conducted by your organization’s internal audit team or external auditors hired for this purpose. The team performing the audit should be independent and impartial.

Outcome: The result of an internal audit is a detailed report that highlights findings, recommendations, and action plans for improvement. These audits help you address issues in your financial records proactively, before they escalate.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

External audits

On the flip side, external audits are conducted by independent audit firms that have no affiliation with your organization, and follow specific auditing standards. They serve as an impartial third-party assessment of your financial statements and operations.

External audits are often mandated by regulatory bodies or required by stakeholders such as investors, lenders, or government agencies.

Key aspects of external audits

- Objective: External audits primarily focus on providing assurance to external stakeholders that your financial statements are free from material misstatements and comply with relevant accounting standards.

- Frequency: External audits are typically conducted annually, as mandated by regulatory requirements or contractual agreements with stakeholders.

- Scope: The primary focus of an external audit is on your financial statements, including the balance sheet, income statement, and cash flow statement. Auditors also assess the overall financial health and compliance of your organization.

- Ownership: External audits are performed by certified public accounting (CPA) firms or audit firms with no direct affiliation with your organization. They offer an unbiased perspective.

- Outcome: The outcome of an external audit is the issuance of an audit report, which contains an opinion on the fairness of your financial statements. This report is shared with external stakeholders to instill confidence in your financial reporting.

Understanding the distinction between internal and external audits is essential for finance professionals.

Internal audits empower you to proactively improve your financial processes, while external audits provide assurance to external stakeholders, including investors and regulatory authorities. Both types of audits play a vital role in maintaining financial transparency and integrity within your organization.

In the next sections, we will delve deeper into the specifics of how to prepare for both finance audits, providing you with actionable insights and best practices to navigate these critical processes effectively.

How do you prepare a financial audit? Checklist

Whether you’re gearing up for an internal audit to strengthen your organization’s internal controls or facing an external audit to provide assurance to stakeholders, the following steps will guide you through the preparation process:

1. Define your objectives and scope

Start by defining the objectives of the audit. What specific aspects of your financial operations do you want to assess or improve? Determine the scope of the audit, including the departments, processes, and financial statements to be examined.

2. Assemble your audit team

Building a skilled and experienced audit team is critical. Depending on the scope of the audit, this team may include internal auditors, external auditors, financial analysts, and subject matter experts. Ensure everyone is aligned with the audit’s goals and timelines.

3. Review and update internal controls

Internal controls are the backbone of financial integrity. Evaluate your organization’s internal control procedures and make necessary updates to strengthen them. Ensure that controls are well-documented, understood by employees, and consistently applied.

4. Gather documentation

Auditors will require access to a plethora of financial documentation. Organize and collect your company’s financial statements, transaction records, invoices, receipts, contracts, and any other relevant documents.

Ensure that financial information is readily accessible for the audit team, either via an accounting system, ERP, or spend management system.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

5. Perform a risk assessment

Identify potential risks in your accounting processes and broader financial operations. Consider the likelihood and impact of errors, fraud, or compliance breaches. Develop strategies to mitigate these risks and be prepared to discuss them with auditors.

6. Conduct a mock audit

Prior to the official audit, consider conducting a mock audit internally. This exercise helps your team familiarize themselves with the audit process and identifies potential weaknesses or gaps that need addressing.

7. Stay compliant with regulations

Ensure that your financial operations adhere to relevant laws, regulations, and industry standards. Auditors will assess compliance, so proactively addressing any non-compliance issues is essential.

8. Prepare for interview and testing

Be ready for auditors to conduct interviews with key personnel and perform testing on selected transactions. Ensure that employees are well-prepared to answer questions and provide the necessary documentation.

9. Document findings and remediation plans

Throughout the audit, maintain meticulous documentation of findings, recommendations, and any issues that arise. Develop action plans to address identified weaknesses and track progress in implementing improvements.

10. Review prior audit reports

If this isn’t your first audit, review previous audit reports and recommendations. Use them as a source of inspiration for improvement and to demonstrate progress to auditors.

11. Final review and quality assurance

Before the audit begins, conduct a final review of all documentation and preparations. Ensure that everything is in order and that your team is well-prepared for the audit process.

By following these steps and maintaining a proactive approach, you’ll be well-equipped to navigate the audit process with confidence and success.

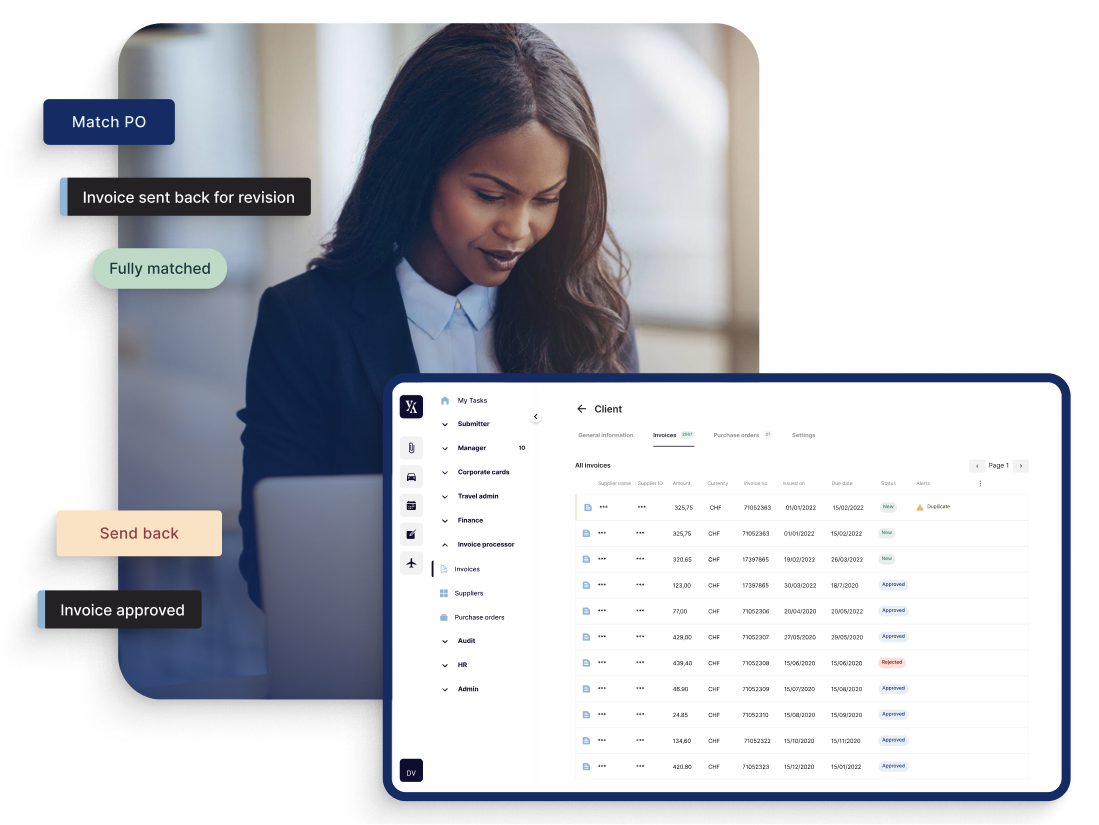

How Yokoy automates the financial auditing process

A very common challenge when it comes to preparing for a financial audit is the ever-changing regulations.

Finance professionals need to stay on top of all the different financial regulations and laws across countries to properly prepare an audit of financial statements. Even when these rules are set up in accounting tools or ERP systems, adjusting them is a time-consuming and error-prone process.

To minimize the risk of errors and ensure compliance with domestic and international regulations, Yokoy uses AI-powered automation and updates all regulations automatically. These changes are propagated into the software, ensuring that your Per diems, VAT rates, mileage allowance rates and so on are always up to date.

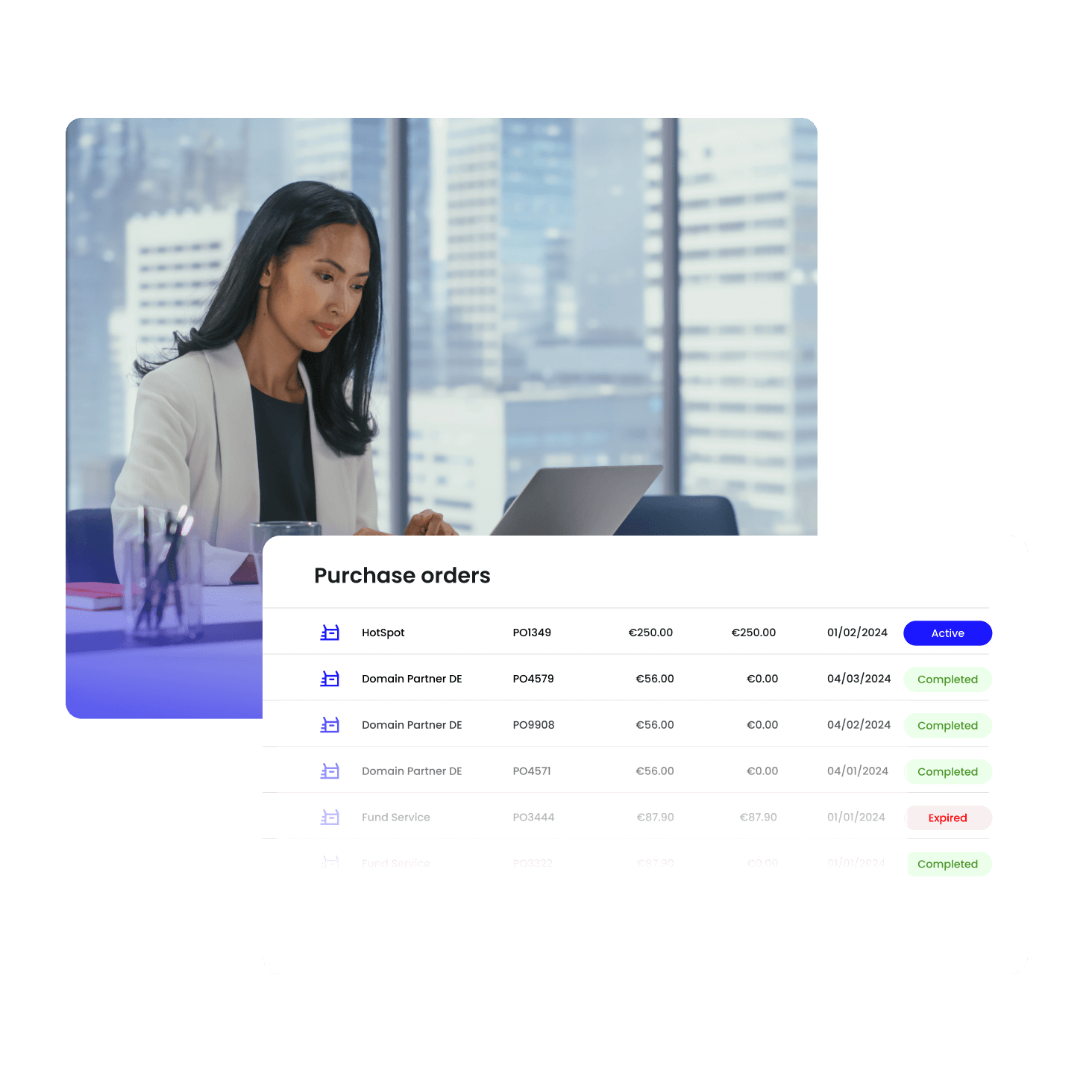

Moreover, all receipts and invoices are archived in digital format, for easy retrieval. All card transactions, invoice payments, and the entire approval history is readily available, with timestamps, ensuring end-to-end process traceability.

The information can be automatically synced with your ERP system, removing the need for manual intervention and ensuring an error-free audit preparation.

To learn more about Yokoy’s automated audit trails and see our spend management solution in action, book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.