Home / Expense Submission Process: Manual vs. Automated Workflow

Expense Submission Process: Manual vs. Automated Workflow

- Last updated:

- Blog

Co-founder & CCO, Yokoy

For too long, manual expense reporting has been the unchallenged norm, but today, I invite you on a journey that questions the very foundation of this age-old practice.

Manual expense reporting, reliant on paper trails and spreadsheet juggling, has long been a bottleneck in the finance department processes. Manual expense tracking and submission is very inefficient, error-prone, and doesn’t scale.

Finance professionals find themselves at a crossroads, seeking a solution that can not only automate and streamline processes but also provide the granular control and compliance necessary for today’s global businesses.

Let’s explore the solution in this article.

Manual expense reporting process

Manual expense reporting involves the traditional paper-based or spreadsheet-driven approach. Finance teams are tasked with collecting, reviewing, and processing numerous receipts and expense claims.

Here’s a breakdown of the classical tasks involved in each step:

Step 1: Receipt collection

In the first step of manual expense reporting, finance teams are responsible for physically collecting receipts and invoices from employees. This involves employees submitting paper receipts or digital copies of receipts through email or other channels.

Receipt collection is often a time-consuming task as it relies on employees to gather and submit their expense documentation. It’s essential to ensure that all receipts are accounted for and accurately obtained. These can be business travel expenses, or receipts for goods or services.

Step 2: Receipt review

After the receipts are collected, finance professionals manually review each receipt. This review process involves checking for several key elements, including the expenditure accuracy, adherence to company expense policies, and proper documentation.

The finance team needs to ensure that all expenses were for business purposes, which can be tricky for example in the case of business trip expenses or office supply expenses. Receipt review can be subjective, as it relies on the judgment of finance personnel, and it often consumes a significant amount of time, especially in cases with a high volume of expenses.

Step 3: Data entry

Once the receipts have been reviewed, the next manual task is data entry. In this step, the finance team enters the information from the receipts into an expense report template, expense reporting software, or accounting software.

Data entry includes inputting details such as the type of expense, the expense amount, date, the expense category, and any additional notes or comments.

As you can imagine, manually tracking expenses is highly susceptible to human error, which can result in discrepancies and financial inaccuracies. Moreover, in case of out-of-pocket expenses, policy breaches can easily slip through and be approved during the expense reimbursement process.

Step 4: Expense claim submission

In the next step, employees submit their expense claims along with the associated receipts in this step. They typically fill out expense claim forms, either digitally or on paper, detailing each expense item, its purpose, and the total amount.

Transaction data from credit card statements also needs to be uploaded. If employees use traditional corporate cards, this process might be delayed, as they might need to wait for the end of month statements.

The submission process can vary but is often done through email, in-person handovers, or by uploading digital copies to a designated system. Delays in submission can hinder the overall efficiency of the expense reporting process.

Step 5: Approval workflow

Expense claims that have been submitted then go through an approval workflow. Finance professionals route these claims to the relevant approvers, who may include managers, department heads, or supervisors.

The approval process can involve manual steps, such as forwarding emails or physically passing documents for signatures. It is often characterized by a lack of real-time visibility into the status of claims, leading to potential bottlenecks.

Step 6: Employee reimbursement

Once expense claims are approved, finance teams proceed with the reimbursement process. This step involves calculating the total reimbursable amount for each employee and then disbursing the funds.

Reimbursements can be done through various methods, including physical checks, cash, or bank transfers. The manual nature of this process can result in delays in reimbursing employees and increased administrative overhead.

Common challenges in a traditional expense tracking and reporting process

One of the biggest challenges in managing expenses is ensuring that all data is accurately tracked and reported, and that errors are detected in time.

Traditional methods of expense reporting that rely on manual data entry are prone to errors and wasteful, especially when a lot of paperwork is involved. On top of this, they’re time-consuming and inefficient: A single expense report takes 20 minutes to process, and costs companies from $20 to $58 per report on average.

This includes the time spent by employees filling out the report, managers reviewing and approving it, and administrative staff processing the reimbursement. The cost can include expenses such as printing and mailing paper receipts, manual data entry, and potential errors that can result in overpayments or non-compliance penalties.

But the time-consuming nature of these steps isn’t the only challenge faced by finance teams who have to process expenses manually.

Inefficient, frustrating process

Traditional expense processing is inefficient and frustrating for both submitters and approvers: Employees have to hand in paper receipts and track their travel expenses in spreadsheets, while managers have to make sure the submitted reports have no errors and no fraudulent or incomplete data.

With the rise of remote work, traditional expense reporting methods that require in-person receipt submissions and approvals are becoming extremely impractical.

Context switching leads to employee dissatisfaction

Even when a mix of manual and automated steps are used, traditional expense reporting is still cumbersome, especially when the company’s digital landscape isn’t properly streamlined.

Approvers have to switch between multiple tools to check the right expense categories, the compliance with the company’s expense policy, what was paid with own money versus company cards, what tax deductions can be applied to the submitted employee expenses, and so on.

This constant context switching is one of the top causes of employee dissatisfaction in the finance department.

Enforcing expense policies is challenging

When companies rely on manual processes, enforcing expense policies can be challenging, leading to inconsistencies in spending and potential violations.

Without clear policies and automated enforcement mechanisms, employees may make unauthorized purchases or submit inaccurate expense reports, putting the company at risk of non-compliance.

Increased risk of fraudulent activities

Another compliance challenge with manual expense reporting is the potential for fraudulent activities.

Manual processes make it easier for employees to submit false or inflated expenses, such as claiming expenses that were never incurred, exaggerating the cost of expenses, or submitting personal expenses as business expenses.

Employee expense fraud can cost businesses significant amounts of money and lead to legal and reputational damage.

Limited visibility into business spend

On top of this, traditional expense reporting offers limited visibility into employee spending and overall company spend, and makes it difficult for finance teams to control costs in real time. In addition, manual processes can lead to delays in processing and reimbursements, increasing the risk of errors, and frustrating employees.

In addition, manual processes can lead to delays in processing and reimbursements, increasing the risk of errors, and frustrating employees.

Yet, manual expense submission and financial reports are still around: According to a survey from 2021, 47% of companies were still relying on traditional, manual processes for expense management, and 35% of companies were using a combination of manual and automated processes to manage their business expenses.

So why do some companies prefer to stick to their old ways of doing things, instead of automating their expense management process?

Blog article

Efficient Travel Expense Management: Pre-Trip, On-Trip, and Post-Trip Recommendations

Learn how to track your travel expenses efficiently and improve your control over the T&E process with AI-powered travel and expense management software.

Lars Mangelsdorf,

Co-founder and CCO

How Yokoy enables automated expense reports

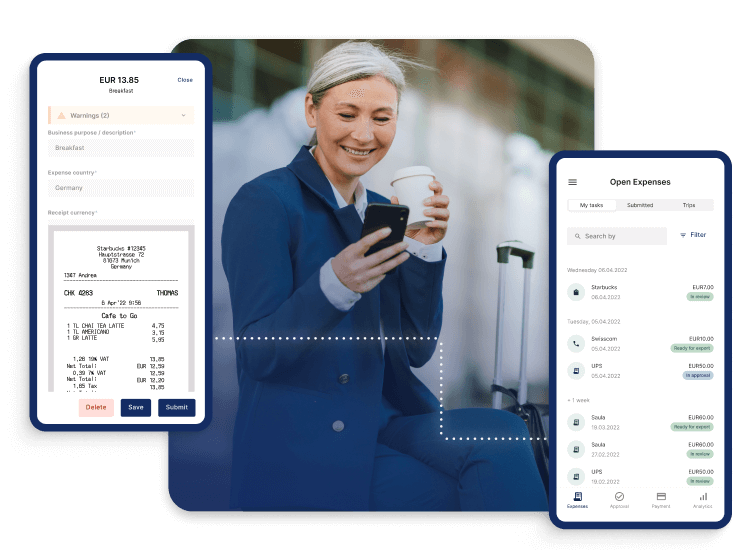

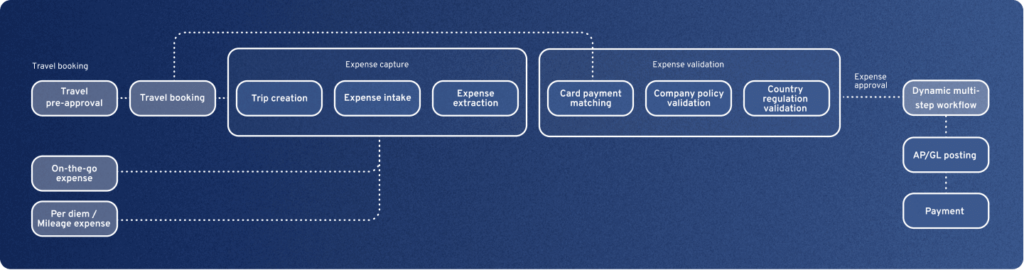

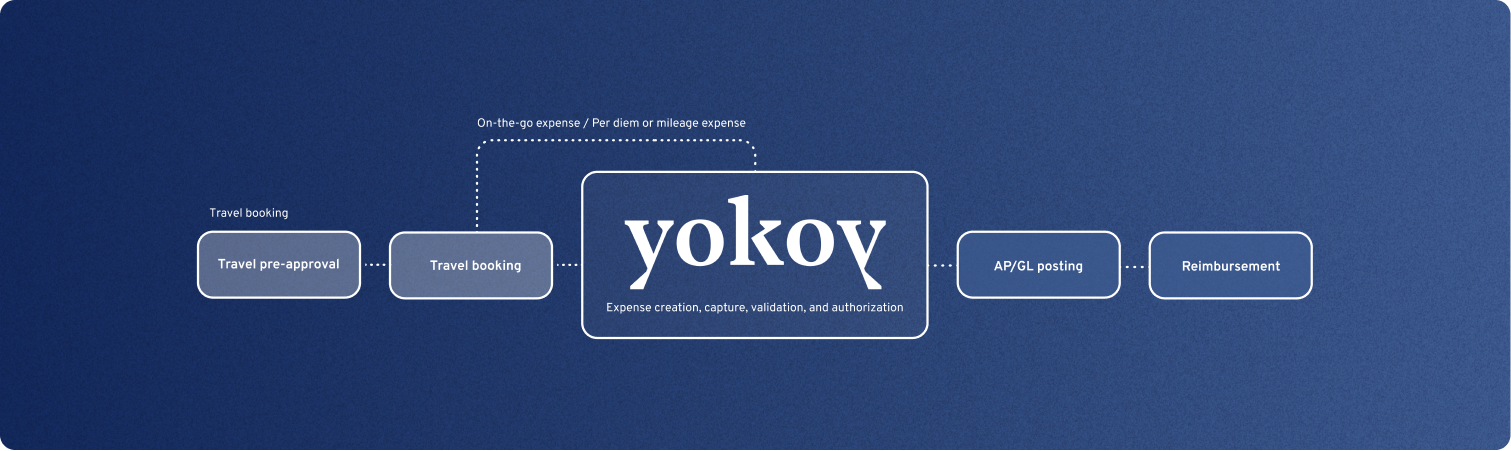

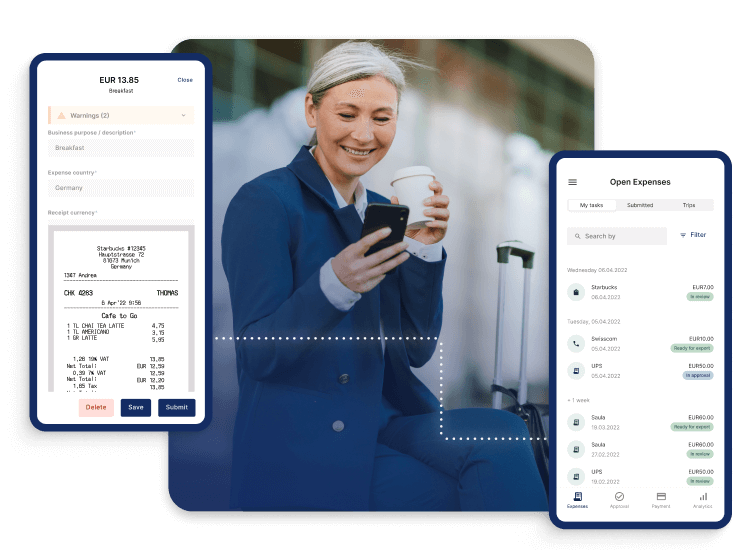

Yokoy’s AI-powered automation technology simplify this process, making it easier than ever for your finance team to manage expenses effectively. Here’s how it works:

1. Uploading receipts and documents

Start by uploading images of receipts or documents. It’s important to note that these documents can be in various formats, including PDFs.

With Yokoy, you have the flexibility to submit single expenses by capturing receipts or consolidate multiple expenses for business trips through seamless integrations with corporate travel companies.

2. Reading the data efficiently

Yokoy takes the hassle out of data extraction. Our advanced AI algorithm effortlessly extracts relevant information from your receipts and documents. This includes critical details like payment dates, purchase types, expenditure amounts, service providers, VAT, and more.

3. AI-powered data interpretation

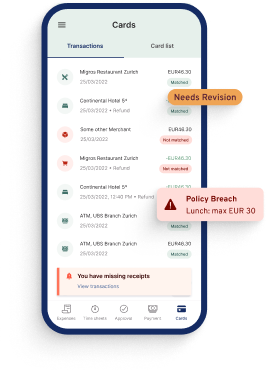

Our AI goes beyond data extraction. It comprehends the context and meaning behind the information it extracts. For example, it can distinguish between various items purchased and flag any expenses that don’t align with your company’s policies, such as alcoholic beverages.

4. Stringent data validation

In the validation phase, Yokoy’s AI rigorously checks expenses for compliance with your company’s configured regulations.

For instance, it can automatically apply per diem rates for meals and lodging as specified by your company policy. It also identifies expenses that exceed allowed limits, either flagging them for review or denying them outright.

5. Customizable rules for compliance

Yokoy understands that each company has unique needs and policies. Our system allows you to customize rules, even when regulations vary between subsidiaries.

For example, if your company requires pre-approval for specific expenses like business-class flights or lavish client dinners, Yokoy can automatically flag these for approval.

6. Detecting policy breaches and fraud

In this phase, Yokoy’s software detects potential duplicates and evaluates data for fraud. If everything is in order, an expense report is generated automatically.

However, if anomalies are detected, such as expenses exceeding limits or non-compliant travel expenses, the system marks them as outliers for the approver’s review.

7. VAT recognition and automated reclaims

For expenses incurred abroad, Yokoy automates currency conversion, eliminating the need for manual calculations. Additionally, our AI identifies expenses eligible for VAT reclaims based on category and location, streamlining the tax reclaim process in an ever-changing global VAT landscape.

Beekeeper reclaims VAT automatically with Yokoy

“The Finance team can focus on exceptions only and all other expenses are processed fully automated within seconds. The VAT recognition that Yokoy helps to ensure an automated VAT reclaim.”

Herbert Sablotny, Beekeeper’s CFO

8. Assigning expenses to cost centers

Yokoy’s app employs machine learning to not only extract data but also match expenses precisely to the appropriate cost center based on spend categories. Whether it’s single expenses, mileage reimbursements, or travel expenses, Yokoy automates categorization and assignment, even considering time zone differences.

9. Automated allowance detection

Yokoy detects allowances automatically based on the expense country, sparing your finance team from manually tracking ever-evolving regulations and allowances. This ensures hassle-free validation of submitted expense reports.

In summary, Yokoy’s automated expense reporting solution is your key to achieving compliance with regulations, tax laws, and internal policies while minimizing the risk of fines, penalties, and reputational damage.

Blog article

Automated Expense Reporting: Simplify Expense Tracking and Maximize Compliance

Automated expense reporting helps you simplify expense tracking, enforce compliance, and streamline your expense management workflows. See how it works.

Lars Mangelsdorf,

Co-founder and CCO

Prerequisites for moving to automated expense claims

Transitioning to automated expense reporting can significantly streamline your financial processes, enhance compliance, and improve overall efficiency. To make this transition seamless, here are the key prerequisites your finance team should consider:

- Clear objectives and goals: Before diving into automation, set clear objectives. Identify what you want to achieve through automated expense reporting, whether it’s reducing errors, improving compliance, or increasing efficiency.

- Data accessibility: Ensure that your financial data, including historical expense records, are readily accessible and well-organized. This data will serve as the foundation for configuring the automation system.

- Updated expense plicies: Review and update your expense policies to align with the automation system. Ensure that all employees are aware of these policies and understand how they relate to the automated process.

- Compatible software and systems: Ensure that your existing financial software and systems can seamlessly integrate with the chosen expense reporting automation solution. Compatibility is key to a smooth transition.

- Legal and regulatory compliance: Understand the legal and regulatory requirements related to expense reporting in your industry and region. Ensure that the automated system complies with these regulations.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

- Stakeholder buy-in: Gain support and buy-in from key stakeholders, including the CFO, finance team, and IT department. Demonstrating the benefits of automation can inspire confidence in the transition.

- Change management plan: Develop a change management plan that outlines how the transition to automated expense reporting will occur. Communicate this plan to all relevant parties and address concerns proactively.

- Implementation timeline: Create a timeline for the implementation of automated expense reporting. Set milestones and deadlines to ensure a structured and efficient transition.

By addressing these prerequisites, your finance team can pave the way for a successful transition to automated expense reporting, leading to improved efficiency, compliance, and financial control.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

Next steps

To sum it up, automated expense reporting can help organizations comply with local regulations, tax laws, and internal expense policies, reducing the risk of fines, penalties, and reputational damage.

By automating key aspects of the process, such as data entry, expense data validation, or expense categorization, finance teams can reduce the risk of errors and fraud, and can track employee expenses in real-time, which helps them identify potential issues early on and take corrective action.

If you’d like to see what Yokoy can do for your company’s expense reporting process, you can book a demo below.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.