Home / The Hidden Cost and Risk Factor of Expenses

The Hidden Cost and Risk Factor of Expenses

- Last updated:

- Blog

Co-founder & CEO, Yokoy

The demand for business travel has reached $1.3 billion globally in 2017 and is forecasted to reach $1.7 billion in 2023, which is a predicted annual growth rate of more than 4%.

The driving force behind this trend are employees, who are required to travel for customer acquisitions, personal relationships and knowledge transfer; all areas that become increasingly global but cannot just easily be replaced by a machine.

In line with economic theory, a bigger demand has resulted in more supply, which in turn has been driving easier, cheaper and more business travel services.

The hidden saving potential in the business travel industry

"Knowing where and how money is being spent can support companies in getting better deals for high spending categories and control actual vs. budget spending."

Philippe Sahli, CEO of Yokoy

Business travel is a humongous industry with many sub-industries like air travel services (e.g. airlines), ground travel (e.g. taxi, bus), travel agents, travel insurances, travel software and many more.

For most businesses, it’s a challenge to ensure that they are efficiently equipped in all aspects of business travel. Thus, most companies have optimized the obvious parts like travel agents, airline partners, and hotel contracts but have neglected other parts like the expense management process.

A study conducted by the Global Business Travel Association estimates the true processing cost of an expense report to be around $58. The $58 include time used to file, submit, review and process an expense, tool- and postal- spending, as well as incorrect amounts paid out and error corrections.

The author of this paper argues that missed reclaims of VAT (sales & use tax) should be added to the processing cost too: Most expense submitters don’t have the knowledge of how to correctly put in VAT and/or don’t have time to do so.

Imagine you have 500 employees, each of them expensing one item a month and you use excel or a manual tool for expense management. You’d pay a shockingly 350,000 USD per year only for the processing of those expenses.

Compliance, fraud prevention and insights

However, the cost is only one part of the expense management challenge. Security around compliance and fraud prevention is another strong argument for getting rid of manual and semi-manual processes.

Also, you are missing out on data insights. Knowing where and how money is being spent can support companies in getting better deals for high spending categories and control actual vs. budget spending.

Use artificial intelligence to turn expense management into one of your strengths

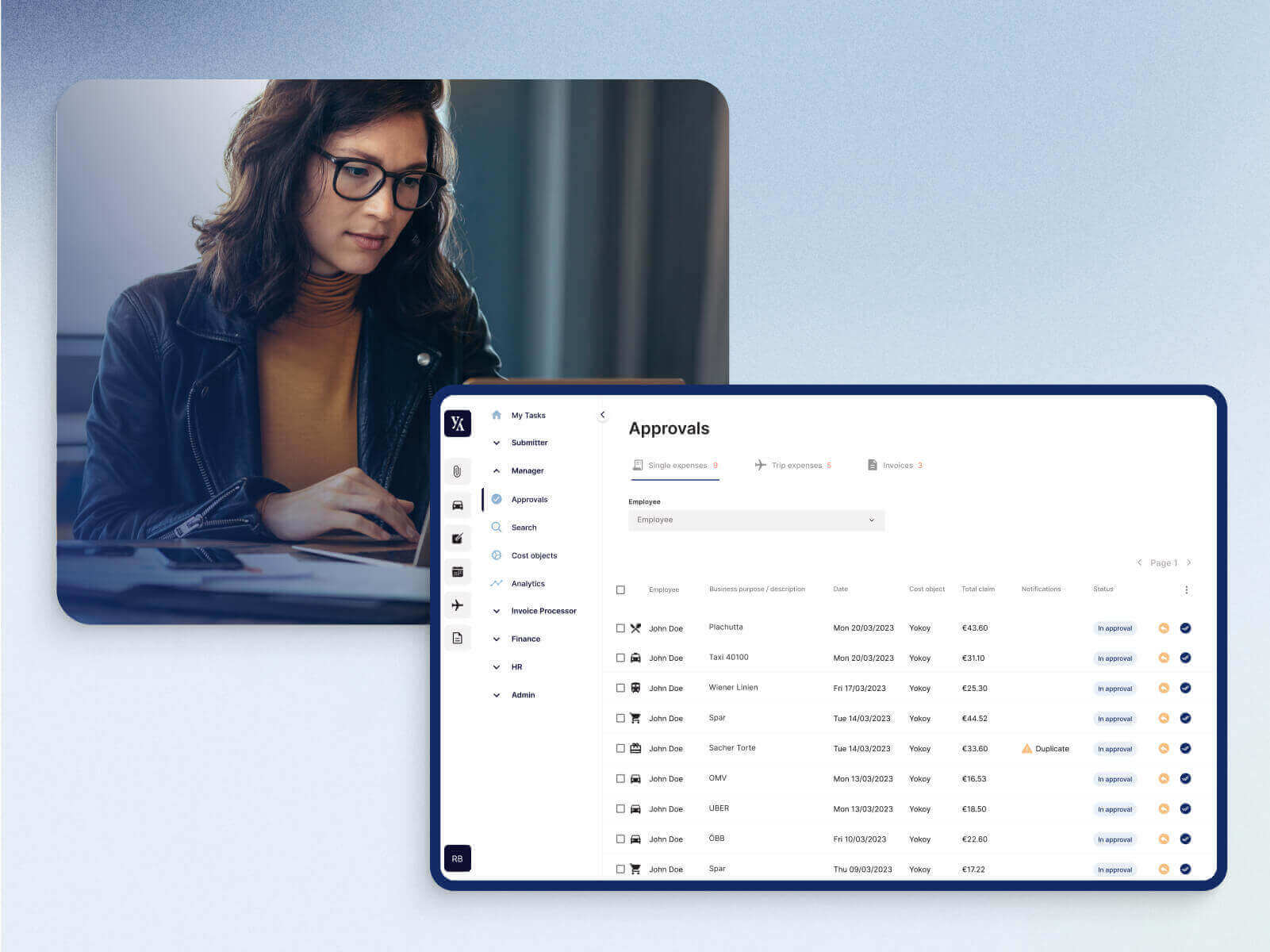

Having lived through manual and semi-automated expense management processes in various companies, the founders of Yokoy have decided to radically change the way expenses are submitted, reviewed, approved and processed.

Saving time and money is achieved through the use of Artificial Intelligence technology. All repetitive tasks such as the read-out of information from receipts, categorization, checking, approving, and Finance-processing are done automated with few manual controls in between.

Even better, the AI technology is able to self-learn, which means that every manual interaction (e.g. manual change of category) is used to develop the tool further.

Additionally, where relevant, the model reads-out VAT, checks, if it’s subject to input tax reclaim, and if so, books them correctly in the ERP system.

"Yokoy was designed to save time and money, increase employee happiness, ensure compliance and enable data-driven insights."

Philippe Sahli, CEO of Yokoy

The app and web-version of Yokoy are designed for simplicity, in order for the submitter, approver and Finance user to spend as little time as possible on their tasks to speed up the entire process. This means that the employees get reimbursed faster and have less work to do – a true employee happiness booster!

AI technology opens completely new opportunities in expense management. Using all data available, Artificial Intelligence can proactively prevent fraud, ensure that suspicious expenses are manually checked and approved and point the approvers and Finance users to the right parts in order to process lots of expenses in a short period of time.

Additionally, Yokoy turns data into valuable insights such as suppliers on which you have a saving potential.

White paper

The Future of Travel and Expense Management

After massive slumps caused by the pandemic, business travel is finally recovering. However, macroeconomic challenges are slowing the catch-up effect, forcing finance and travel leaders to cut costs by limiting business trips.

How can companies adapt?

Keep your existing processes and connect your ERP for full Integration

Like no other tool, Yokoy seamlessly integrates into your existing processes and systems. Simply upload your policies and workflows and connect Yokoy to your ERP system for full integration.

The major highlight of Yokoy is its flexibility. Yokoy is capable of precisely depicting your current cost hierarchy including legal entities, divisions, teams, projects, etc., even if part of the company is managed globally while another part is run locally.

Data protection is key

Security is one of Yokoy’s highest priorities. As a Swiss company, Yokoy feels obliged to defend the Swiss security values and has implemented bank-level security standards for data protection and data encryption (with audit logs).

All of the aforementioned values help bringing the cost of processing one expense from $58 to less than $1!

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.