Home / Cards Bringing Visibility into “Maverick” Spend Categories

Cards Bringing Visibility into “Maverick” Spend Categories

- Last updated:

- Blog

Managing “maverick” spend categories — unplanned or atypical expenses such as marketing campaigns, digital advertising, and cloud services — has become increasingly complex in today’s fast-paced business environment. These areas often require rapid, ad-hoc purchasing, leading to limited spend visibility and insufficient control for procurement teams, accounts payable managers, and finance leaders: Without strong oversight and a structured procurement process, maverick spend can exceed budgets, impact financial management strategies, and strain the bottom line.

By adopting solutions such as smart corporate cards, especially virtual and single-use options, your company can gain flexibility, improve cash flow and obtain real-time insights into these unpredictable expenses, ensuring you stay aligned with your financial goals and strategic sourcing initiatives.

Why cards are ideal for managing maverick spend

Managing maverick spending effectively requires tools that offer adaptability, control, and comprehensive spend analysis. Corporate cards offer a practical solution by balancing flexibility with enhanced oversight, making them ideal for handling these unpredictable expense areas, often classified as indirect spending.

Flexibility: Cards, especially virtual and single-use options, provide unmatched flexibility for managing atypical or unplanned expenses. Unlike traditional purchasing processes that require lengthy approval cycles, virtual corporate cards can be issued instantly, enabling quick response to urgent needs like marketing or last-minute service purchases. This agility supports teams in moving quickly and ensures ad-hoc spending is more manageable, reducing the risk of rogue spending that can disrupt budgets and impact procurement policies.

Control over budgets: With cards, finance teams can set customised spending limits, ensuring every transaction aligns with a pre-defined budget. Real-time tracking allows finance teams to monitor each purchase as it occurs, keeping maverick spend within set limits and thereby reducing the risk of budget overruns. This level of control offers a balanced approach, granting departments the spending flexibility they need while preserving financial oversight and help to comply with procurement policies.

Vendor-specific use: A primary benefit of virtual corporate cards is the ability to restrict usage to specific merchant categories. Cards can be assigned for use with a preferred category, such as a designated transportation method, preventing unauthorised purchases and non-compliance. By limiting spending to pre-approved categories, companies can ensure category management and better align expenditures with budgeted resources, improving control over tail spend and maverick buying.

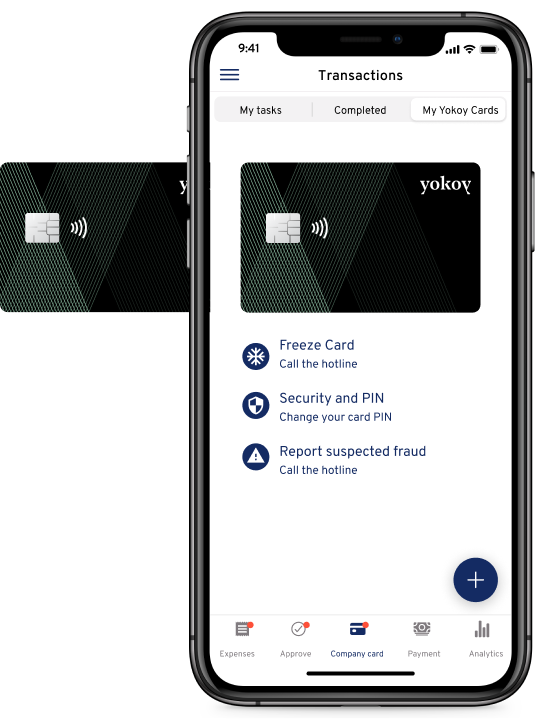

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Visibility into maverick spend with cards

Gaining visibility into maverick spend is crucial for finance teams aiming to control unexpected costs and keep budgets aligned with procurement and profitability goals. Especially virtual cards offer real-time insights and precise control over expenses, from budget alignment and transparent tracking to data-driven insights, equipping finance leaders with the tools needed to confidently manage unpredictable expenses.

Budget alignment for full control

Virtual corporate cards provide immediate alignment with established budgets, offering comprehensive spend visibility over unpredictable areas such as digital services or new vendors. By setting predefined limits for specific departments or projects, finance teams can ensure maverick expenses stay within budget without impeding flexibility. This proactive budgeting approach helps businesses forecast more accurately, bringing structure to requisition and spend management for unplanned expenditures.

Real-time tracking for full transparency

Real-time tracking is a standout feature of corporate cards in managing maverick spending. Instant transaction notifications and spending data provide procurement departments with visibility into each purchase as it happens. This transparency allows accounts payable managers and procurement professionals to monitor and assess expenses in real-time, improving collaboration, streamlining the procurement-to-pay process, and allowing quicker responses to irregular or unauthorised spending.

Data-driven insights for better decision-making

Beyond tracking amounts, corporate cards, particularly virtual ones, capture valuable insights into spending patterns and vendor usage. By analysing this data, procurement software can help finance teams identify trends, budget, and negotiate contracts or discounts with preferred suppliers. Data-driven insights support long-term planning, revealing cost-saving opportunities and optimisation areas, making corporate cards an essential tool for financial leaders focused on cost reduction and strategic sourcing.

Flexibility, control and accountability with cards

To manage maverick spend effectively, companies need tools that offer visibility, flexibility, and accountability. Corporate cards, particularly virtual and single-use cards, offer autonomy and oversight for unpredictable expenses. With features such as instant issuance, immediate cancellation, and customisable spending controls, cards empower finance teams to manage maverick spend categories proactively while supporting operational agility.

Instant issuance: Virtual and single-use cards can be issued instantly, making them ideal for urgent expenses or time-sensitive initiatives. Finance teams can quickly issue cards for new campaigns or unexpected project requirements, providing unmatched flexibility and avoiding delays common in traditional purchasing processes.

Immediate cancellation: The ability to cancel cards immediately adds a significant layer of control and risk management. If a project ends early or a security concern arises, finance teams can cancel a card instantly, halting further transactions. This feature prevents unauthorised purchases, safeguarding company funds and reinforcing budget adherence.

Pre-set spending limits: Finance teams are allowed to allocate funds precisely with pre-defined limits, ensuring each transaction aligns with departmental budgets. By capping expenses per card or transaction, companies can prevent overspending in maverick spend areas while encouraging mindful spending. This approach supports financial accountability and helps every transaction contribute to broader financial objectives.

Instant reporting and reconciliation: Instant reporting tools allow finance teams to track expenses in real time and streamline the reconciliation process. Automatically logged and categorised transactions provide up-to-date records that reduce manual work and support both compliance and financial accuracy, minimising uncontrolled spending and ensuring adherence to purchasing policies.

Vendor-specific restrictions: Vendor-specific restrictions let finance teams assign cards for exclusive use with approved vendors, such as preferred software providers or marketing platforms, aligning spend with procurement policy priorities. These restrictions improve budgetary control and ensure funds are directed towards strategic projects, preventing unauthorised purchases outside designated areas.

Blog article

Why Smart Corporate Cards Are a Must for Businesses

Payment methods have been undergoing a massive modernization phase, and the traditional corporate credit card is no exception. But the real question is, are these cards truly smart or just another gimmick?

Francesca Burkhardt,

Product Marketing

Managing maverick spend and more with Yokoy Pay

For companies seeking to streamline their procurement systems, Yokoy Pay offers a comprehensive solution that goes beyond basic expense management. With advanced features for real-time visibility, customisable controls, and seamless integrations, Yokoy Pay enables businesses to manage unpredictable spending areas more efficiently, supporting strategic sourcing, compliance, and improved supplier management.

Real-time visibility and control

Yokoy Pay provides instant access to transaction data, enabling finance and procurement teams to monitor departmental spending across supplier relationships as it happens. With real-time insights, finance managers can detect irregularities and make real-time adjustments, supporting ESG and other procurement initiatives to align with company goals.

Customisable limits and restrictions

Customisation is at Yokoy Pay’s core, with adjustable spending limits, vendor-specific restrictions, and robust spend management controls tailored to fit procurement policy and category management needs. Finance teams can set limits based on department requirements, individual employees, or specific requisition types, supporting the flexibility departments require while ensuring alignment with business priorities and cost-saving initiatives.

Integrated reporting

Yokoy Pay streamlines reporting workflows by automatically logging and categorising each transaction, facilitating seamless requisition tracking and adherence to procurement policies. Its integrated reporting offers finance leaders a consolidated, real-time tracking of expenses across departments, simplifying monthly reconciliations and enhancing data-driven decision-making. This comprehensive visibility empowers strategic planning for long-term profitability and optimises cost savings across all spend categories.

Built-in compliance

Yokoy Pay mitigates the risk of non-compliance by checking if spendings are unauthorised or non-compliant purchases. Automated compliance checks and controlled access settings ensure every transaction meets internal and regulatory standards, simplifying policy adherence and reducing potential ESG compliance issues for highly regulated sectors.

AI-driven automation

Yokoy Pay streamlines reporting by automatically logging and categorising each transaction, facilitating seamless requisition tracking and adherence to procurement policies. Its integrated reporting offers finance leaders a consolidated, real-time view of expenses across departments, simplifying monthly reconciliations and enhancing data-driven decision-making. This comprehensive visibility empowers strategic planning for long-term profitability and optimises cost savings across all spend categories.

Next steps

With Yokoy Pay, businesses can manage maverick spend with advanced tools that promote visibility, compliance, and efficiency, enabling financial teams to keep unpredictable expenses in check while driving smarter, data-informed decisions across the organisation.

Take control of your maverick spend with Yokoy Pay’s powerful, customisable solution designed to bring visibility, efficiency, and compliance to your business expenses. Discover how real-time insights and AI-driven automation can transform your approach to managing unpredictable spend categories.

See how Yokoy Pay can empower your team with the tools they need for smarter financial oversight, and book a demo today!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.