Home / Blog

Blog

Join 12’000+ finance professionals and get the latest insights on the transformation of finance directly in your inbox.

Subscribe to our newsletter

All articles

Remember that paying for something meant digging through your wallet for the right card? Or maybe even worse: searching for dozens of coins?

If your travel and expense policy was last updated during the days of paper receipts and spreadsheet claims, this is your wake-up call.

Today's digital environment is becoming increasingly insufficient for traditional authentication methods, such as complex passwords and static PINs.

Remember when the buzz around finance transformation meant a new spreadsheet template and a coffee-fuelled meeting marathon? Those days are long gone.

If you’ve ever tried to book a straightforward business trip only to end up tangled in a mess of fare classes, missing receipts, and questionable expense claims.

If you’ve ever tried to book a straightforward business trip only to end up tangled in a mess of fare classes, missing receipts, and questionable expense claims.

Let’s face it: The days of chasing crumpled receipts, waiting weeks for reimbursements, and approving expenses on gut feel are over.

Let’s face it: The days of chasing crumpled receipts, waiting weeks for reimbursements, and approving expenses on gut feel are over.

Let’s face it: The days of chasing crumpled receipts, waiting weeks for reimbursements, and approving expenses on gut feel are over.

Not too long ago, the Chief Financial Officer (CFO) was primarily a master of spreadsheets, a gatekeeper of financial reporting, or just the one who ensured the numbers always added up.

A decade ago, the idea of finance teams using artificial intelligence (AI) sounded rather adventurous and more like science fiction than reality.

Imagine trying to steer a ship without a clear view of where it is — that’s similar to what traditional budgeting often feels like.

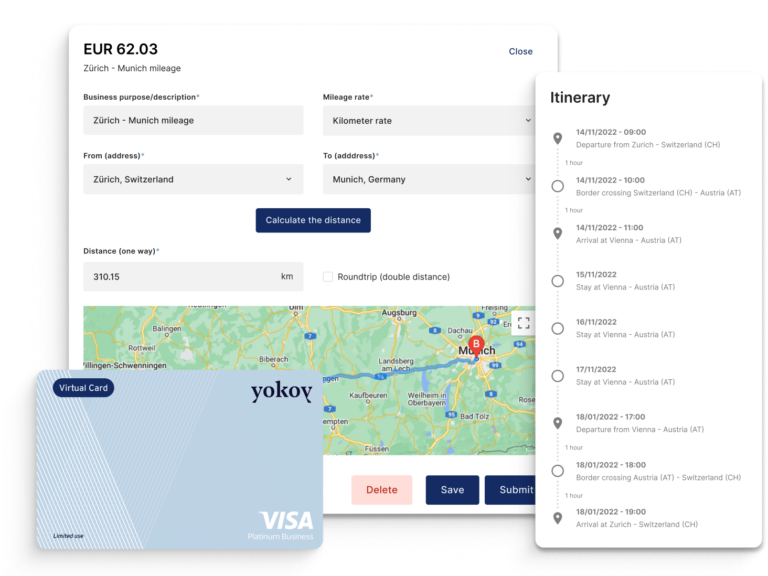

This guide explains how to calculate and track mileage allowance effectively, so you can reimburse your employees in time and avoid penalties.

Whether it’s sealing deals, meeting clients, or attending industry events, business travel remains a necessary part of growth for many companies.

Let’s face it — finance teams are challenged daily by changing market conditions and constantly evolve with new technology standards.