Spend Management for Financial Services

ISO 27001, ISO 9001, and ISO 14001 certified. GDPR compliant.

Full control and regulatory compliance

Bring your invoices, expenses, and corporate card payments into one central platform, powered by AI.

Real-time control

Keep spend under control, analyze spending patterns across departments, and forecast accurately with real-time data insights and reporting.

End-to-end automation

Remove manual tasks and speed up processing times for expenses, card transactions, and invoices with custom workflows and end-to-end automation.

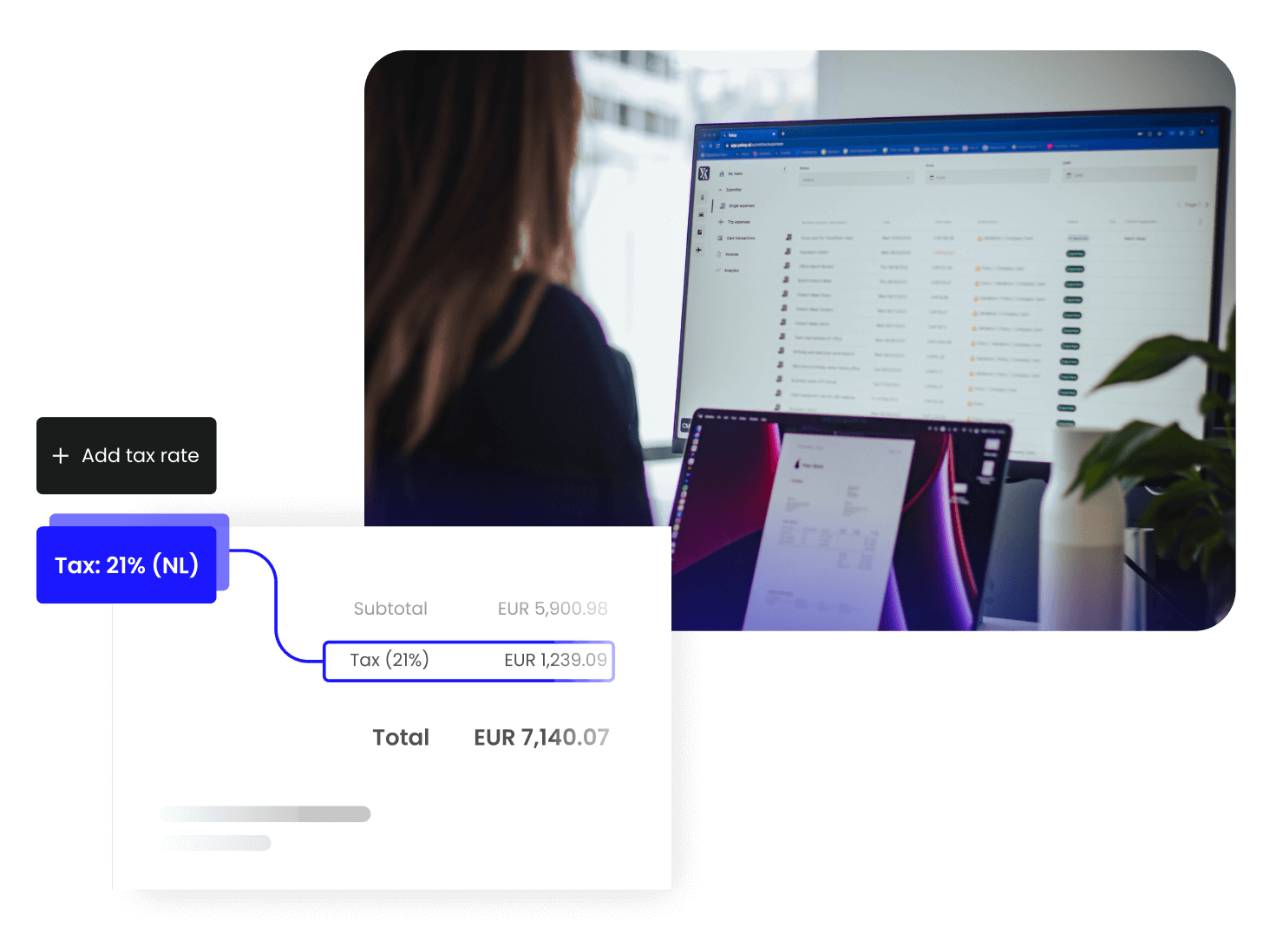

Built-in compliance

Automatically enforce compliance with company policies, tax regulations, and international laws through built-in controls and pre-approval flows.

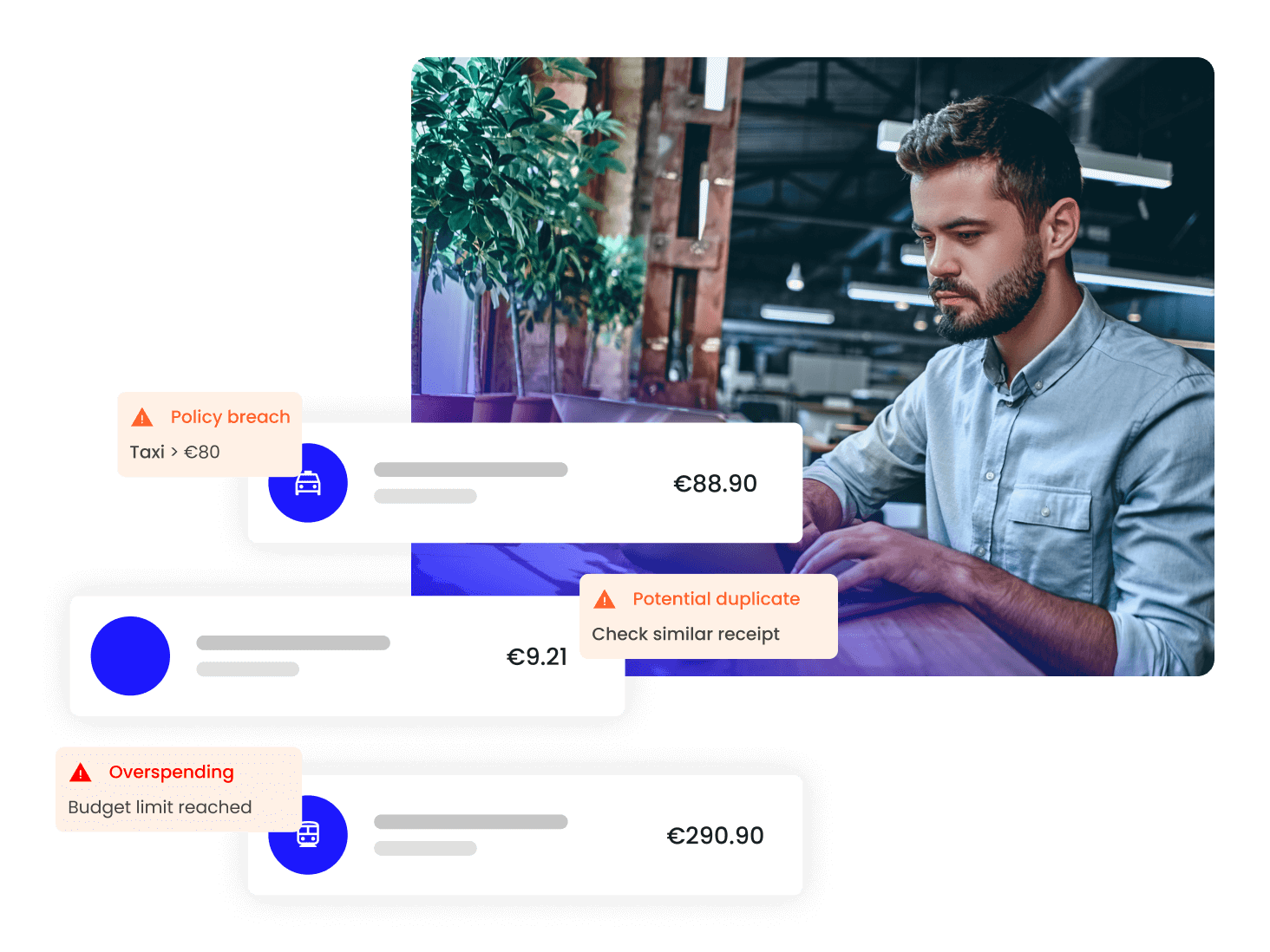

Reduce risks and combat fraud

Stay compliant with local and international regulations and manage risks in real time. Through AI-powered automation, Yokoy sets and enforces policies, flagging outliers, and helping you combat fraud.

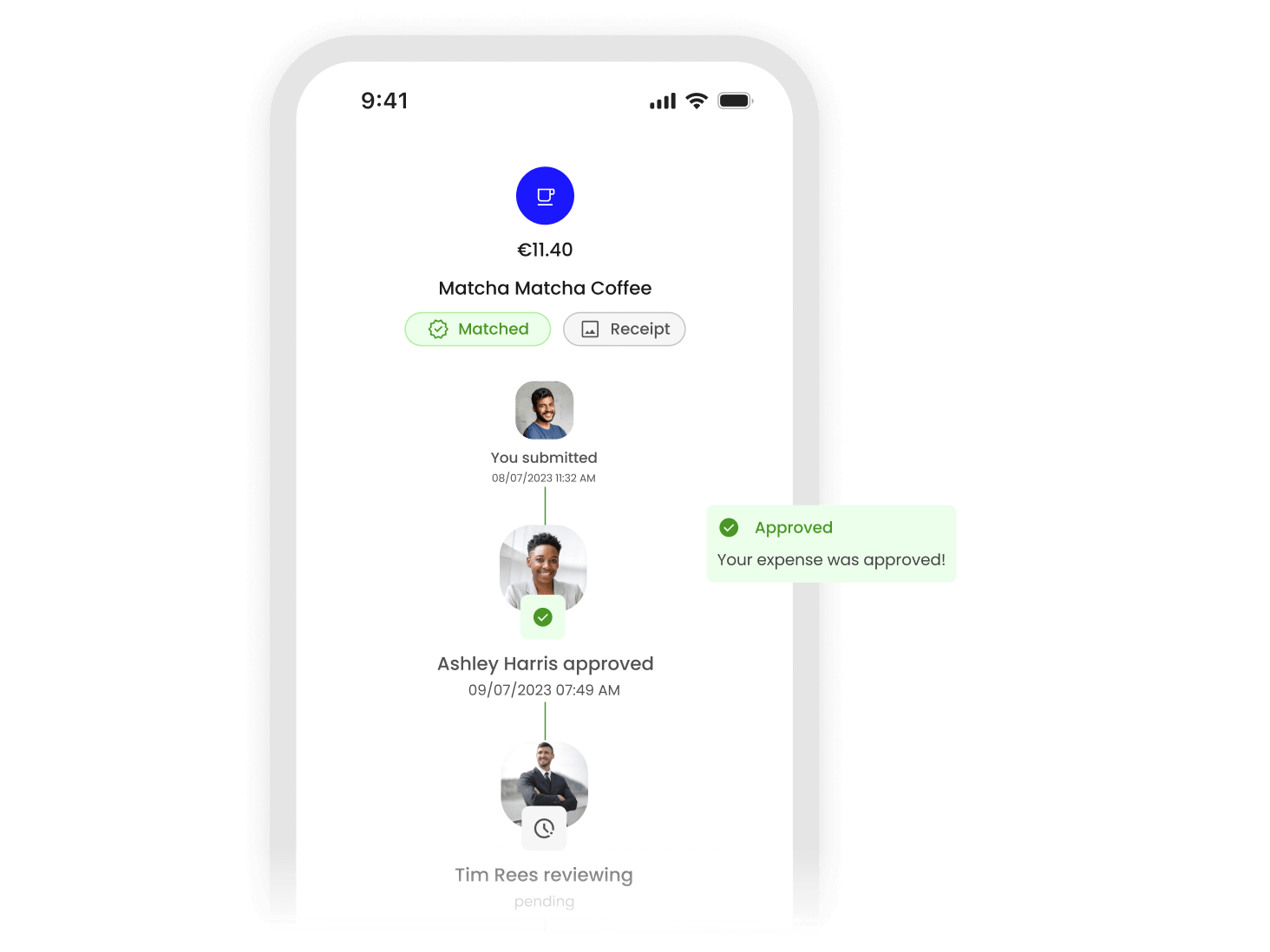

Streamline operations

Reduce complexity, streamline operations and ensure governance through seamless integrations, custom workflows, and automated pre-approval flows.

Optimize your spend

Get the full picture of your spending, analyze patterns and trends, and spot outliers in real time. Bring all your spend data into one platform to gain insights, find cost saving opportunities, and make better financial decisions.

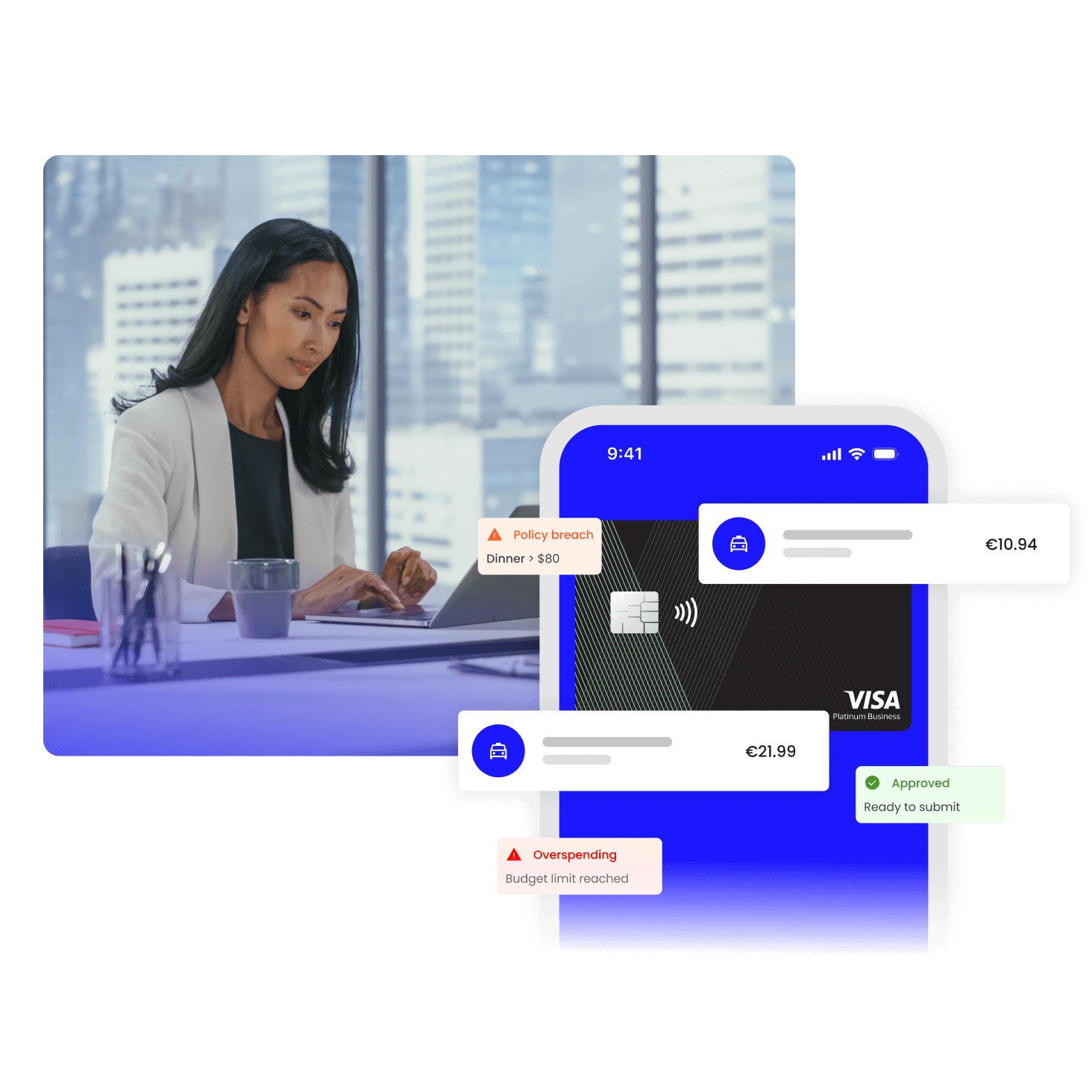

Simplify card administration

Order corporate cards on the go, adjust limits and freeze cards directly from the app, set employee-specific card limits to enforce compliance, and minimize out-of-pocket payments to control spend.