Home / Business Payments

Intelligent, automated business card payments

Streamline your corporate cards and payments and get control over company spend with AI-powered business payment solutions that are as easy for your people as they are for your finance team.

One platform for all your payments

Control how people spend

Automate expense reporting and reconciliation

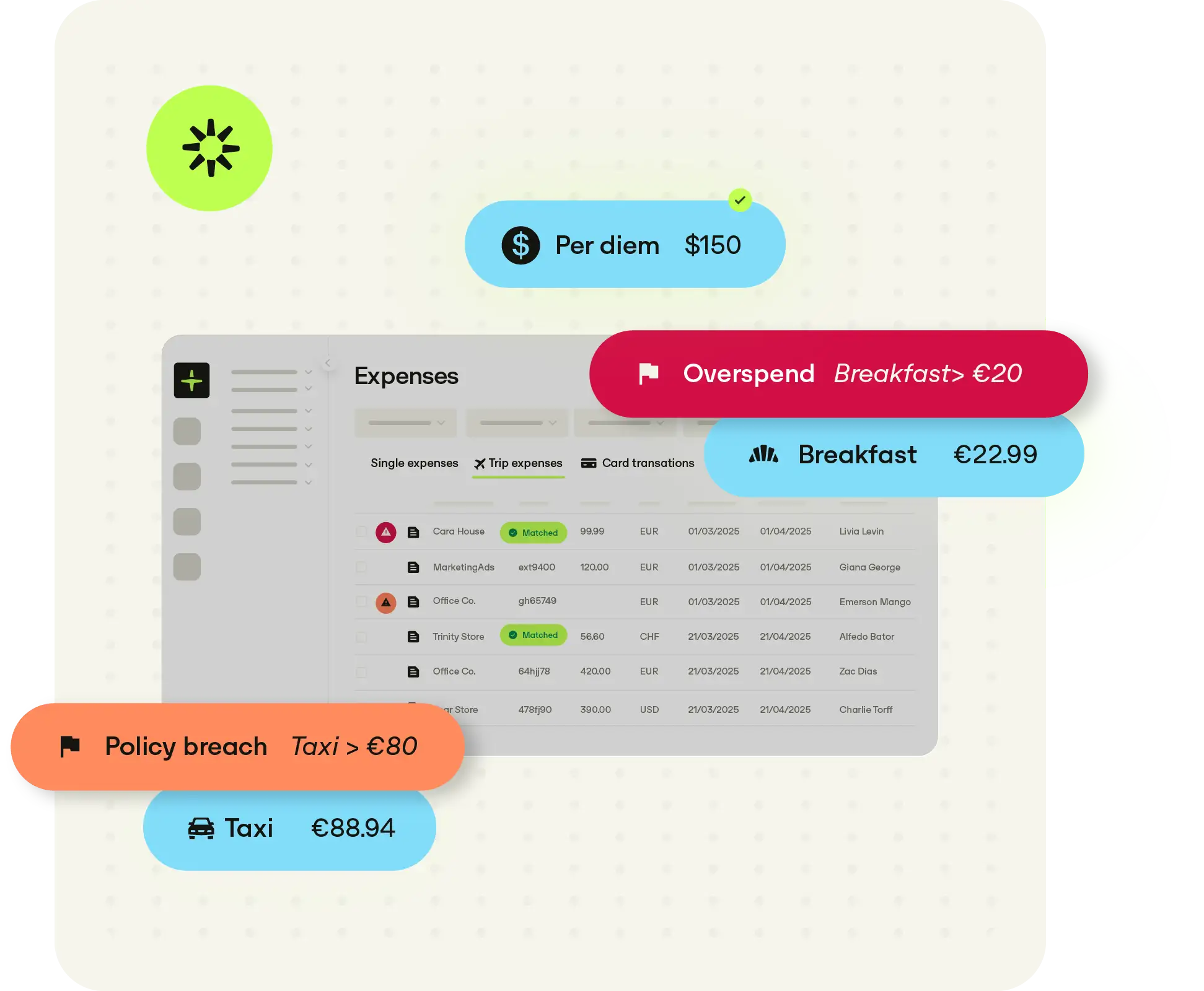

Say goodbye to hour after hour matching receipts and transactions – every time your people spend on their Yokoy card, it’s automatically matched to the right expense report and receipt, verified, and routed through the right approval workflow.

Explore our customer stories

Forward-thinking finance leaders around the world are already benefitting from Yokoy Pay.

How Yokoy corporate cards work

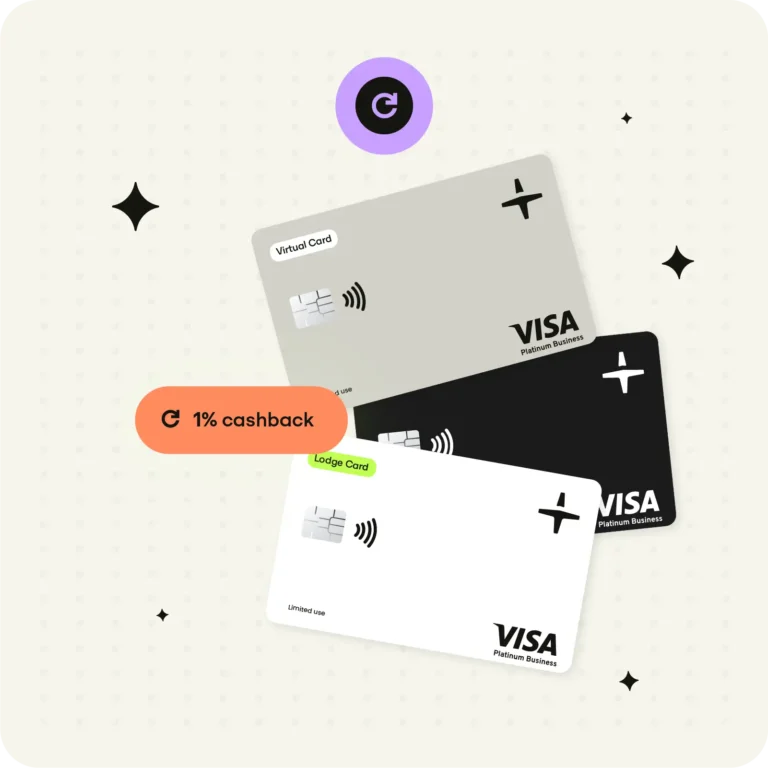

Company spend that pays off

Get up to 1% cashback on every company card transaction with the Yokoy Platinum Visa Debit Card.

Pay securely with your mobile

Tap to pay everywhere contactless payments are accepted. Just add your Yokoy Platinum Visa card to Google Wallet or Apple Pay to make fast, secure business payments no matter where you go.

Simplify your travel spend

Streamline travel payments with a single card for flights, rail, hotels and travel services. Your lodge card sits with your travel booking provider and automatically reconciles travel bookings and payments to simplify your travel management processes.

What you get with Yokoy Pay

Get to know our corporate card solution inside-out.

All payments in one platform

Centralise your corporate card payments, lodge card payments, and mobile payments in one platform, for full visibility.

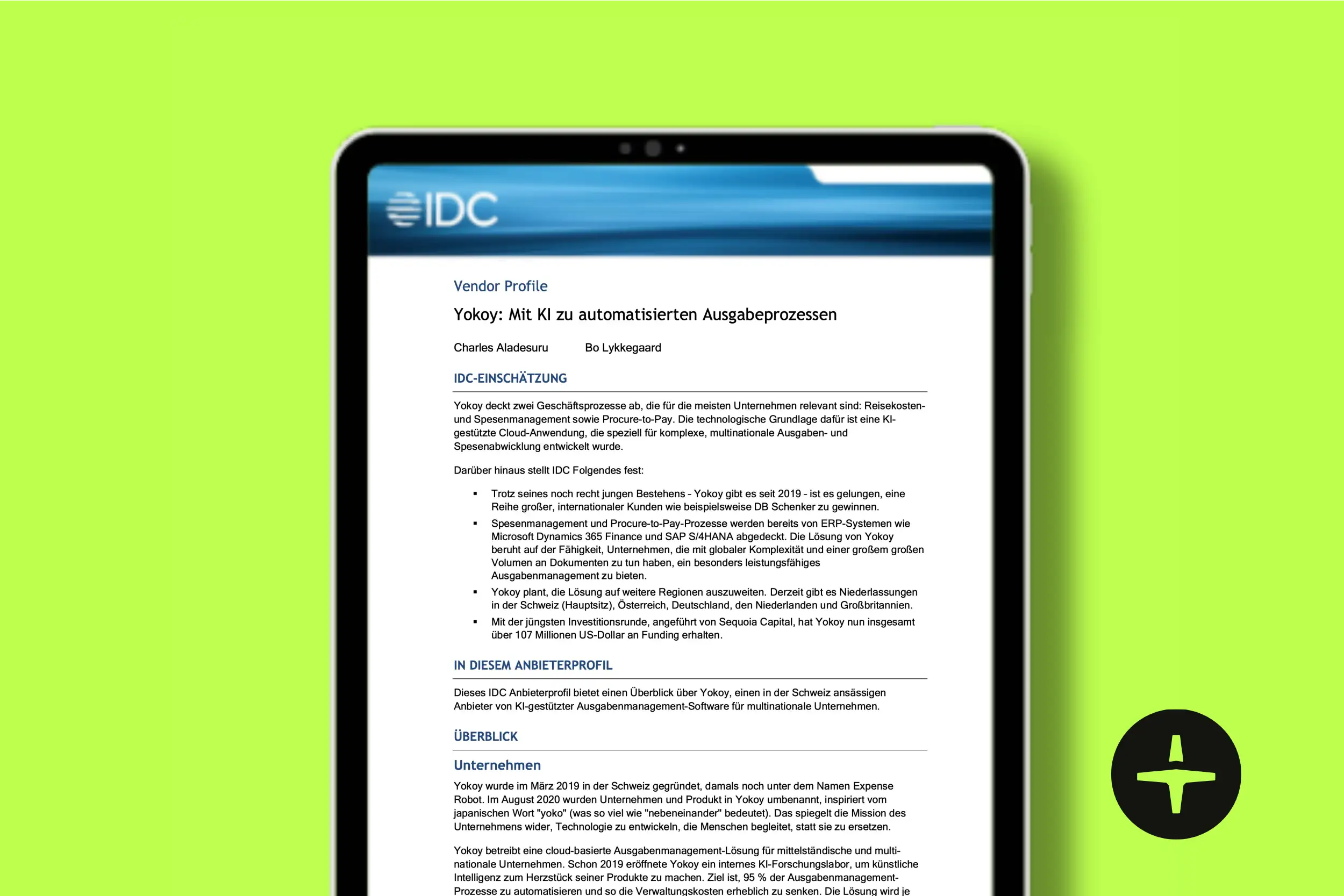

Simple administration

Issue physical or virtual cards, freeze lost or stolen cards, and update spend limits and other policies all in a single intuitive dashboard.

Granular spend controls

Allocate funds when and where they’re needed and define spending limits and controls for individual employees.

Fully automated reconciliation

All transactions are imported to Yokoy in real time and automatically matched with the corresponding receipts and invoices.

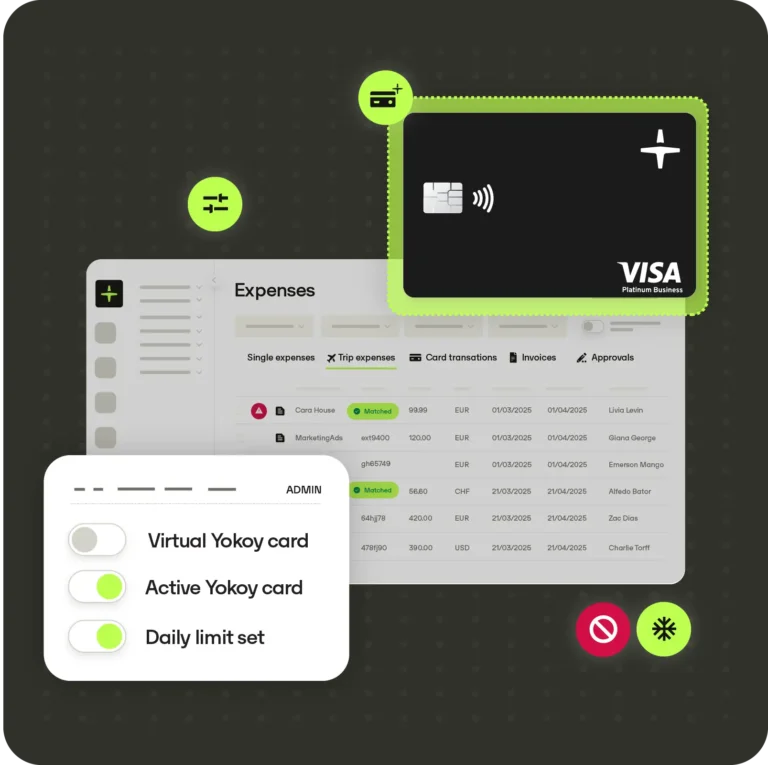

Automated compliance checks

Prevent fraud and overspending with AI-powered verification that flags issues like duplicate receipts, potential breaches of company policy, and more.

Custom work- and approval flows

Control how people spend and streamline your processes with easy-to-use admin controls that let you update policies and fine-tune the automation.

Real-time spend data

Export real-time transaction and expense data from across entities and identify areas to optimize and improve how your company spends.

Built-in security

Yokoy ensures your data is secure with features such as two factor authentication and virtual cards with limits.

* Yokoy customers receive up to 1% cashback (depending on the chosen plan) on every payment made with a Yokoy Platinum Visa Card up to a maximum cashback amount corresponding to the value of the recurring annual licence fees for Yokoy products. The cashback program is only valid for Yokoy Platinum Visa Cards. The following transactions are excluded from cashback payments: 1. Incoming transfers to your Yokoy account made by you or a third party. 2. Outgoing transfers from your Yokoy account. 3. Withdrawals from ATMs. 4. Chargebacks.

Yokoy explicitly reserves the right to change the cashback percentages paid on transactions with a Yokoy Platinum Visa Card at any time.

** No card fees, card account fees, foreign currency surcharges or transaction fees (in foreign currency/abroad) are charged. Cash withdrawals at ATMs cost 10 Euros per withdrawal. Negative interest: 0.0%.

For our complete cardholder terms, please refer to our Cardholder terms page.

See intelligent business cards in action

Gain full visibility and control over your business cards with AI-powered automation.

Book a demo