Home / What Drives the Transformation of Spend Management? Preliminary Survey Results

What Drives the Transformation of Spend Management? Preliminary Survey Results

- Last updated:

- Blog

Co-founder, Yokoy

The finance landscape is constantly evolving, and one area that has seen significant transformation is spend management.

As organizations strive for greater efficiency, transparency, and cost optimization, they are increasingly recognizing the need to adapt their approach to managing business spend.

To gain insights into the key drivers behind this transformation, we’ve reached out to finance professionals from diverse industries, geographies, and company sizes, and we are excited to share some initial insights.

These early findings offer a glimpse into the current state of spend management and help us better understand the trends, challenges, and opportunities shaping the future of spend management.

Let’s dive in.

Assessing the state of finance transformation – Preliminary insights

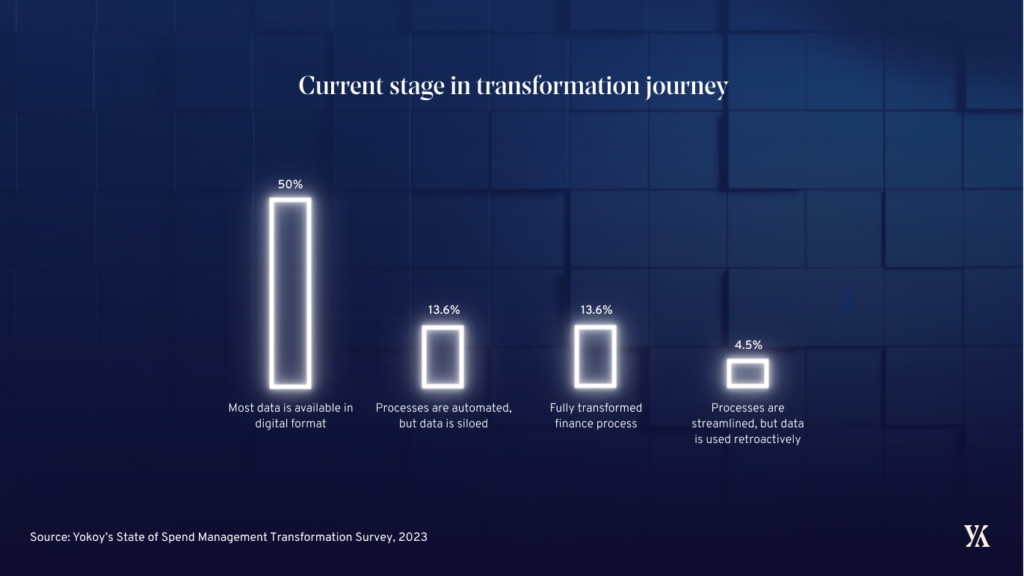

Unsurprisingly, the majority of respondents indicate that their companies are presently undergoing a phase of digitalization, where data is in digital format (50%) or processes are automated, but systems and data are siloed (13.6%). 4.5% of respondents said their companies have undergone digitalization projects and have streamlined their processes, but data is still used reactively.

Only 4% of respondents haven’t started their digital transformation journey yet – a finding that’s in line with previous industry reports. Only 13.6% of our respondents said they have fully transformed their finance function, with CFOs and CEOs leading the initiatives.

But who’s at the forefront of driving this change?

The trailblazers – those who have fully transformed their finance department – belong to Business services and Technology companies (14%), followed by Retail and Consumer Goods (4%). At the opposite end of the spectrum, Automotive, Construction, and Sports & Education are the least transformed industry sectors, based on our preliminary findings.

As for the champions of innovation, CFOs and CEOs are the driving force behind finance transformation projects across industries, along with Head of Finance and Accounting professionals. The same decision makers are involved in the software buying procedures, CFOs and Head of Finance being mentioned by most (57%) of our respondents.

Departments such as IT (33%), HR (24%), or Travel Management (5%), are looped in for their expertise in both medium-sized and large global enterprises, although in global companies with multiple subsidiaries, other roles such as Chief Operating Officer (9.5%) and Head of Digital Transformation (5%) are also involved in software buying decisions.

Finance processes, still heavily manual

Speaking of software, most respondents said they are currently using a mix of manual and digital processes (57%) or relying on Excel (48%), with 29% of respondents having a dedicated Expense management solution in place, and 14% using Invoice processing software as well.

While it’s not surprising to see these mixed approaches with partially digitalized processes, what does strike us is the fact that manual steps are still widely utilized across industries – even in companies where data is available digitally, hindering the full realization of finance transformation’s potential.

In companies still relying on manual procedures, the main challenges faced by finance professionals are the inefficient processes (31.5%), the lack of visibility and control over spending (21%), the time-consuming reporting and audits (18%), and staying compliant (13%).

In comparison, companies who have already undergone a financial transformation mention the poor integrations between tools (26%), the poorly executed implementation (21%), the lack of adoption (21%), the lack of skills within their team (21%), and the lack of guidance from the vendor (15%) as their main challenges post implementation.

This shows just how important it is to choose a vendor with expertise in leading both smaller scale and global projects, with complex implementation requirements, who also offers support and training post-implementation.

What’s driving the transformation of spend management processes?

So what are the drivers behind the transformation of spend management? Why are or aren’t companies adapting their processes to future-proof their operations?

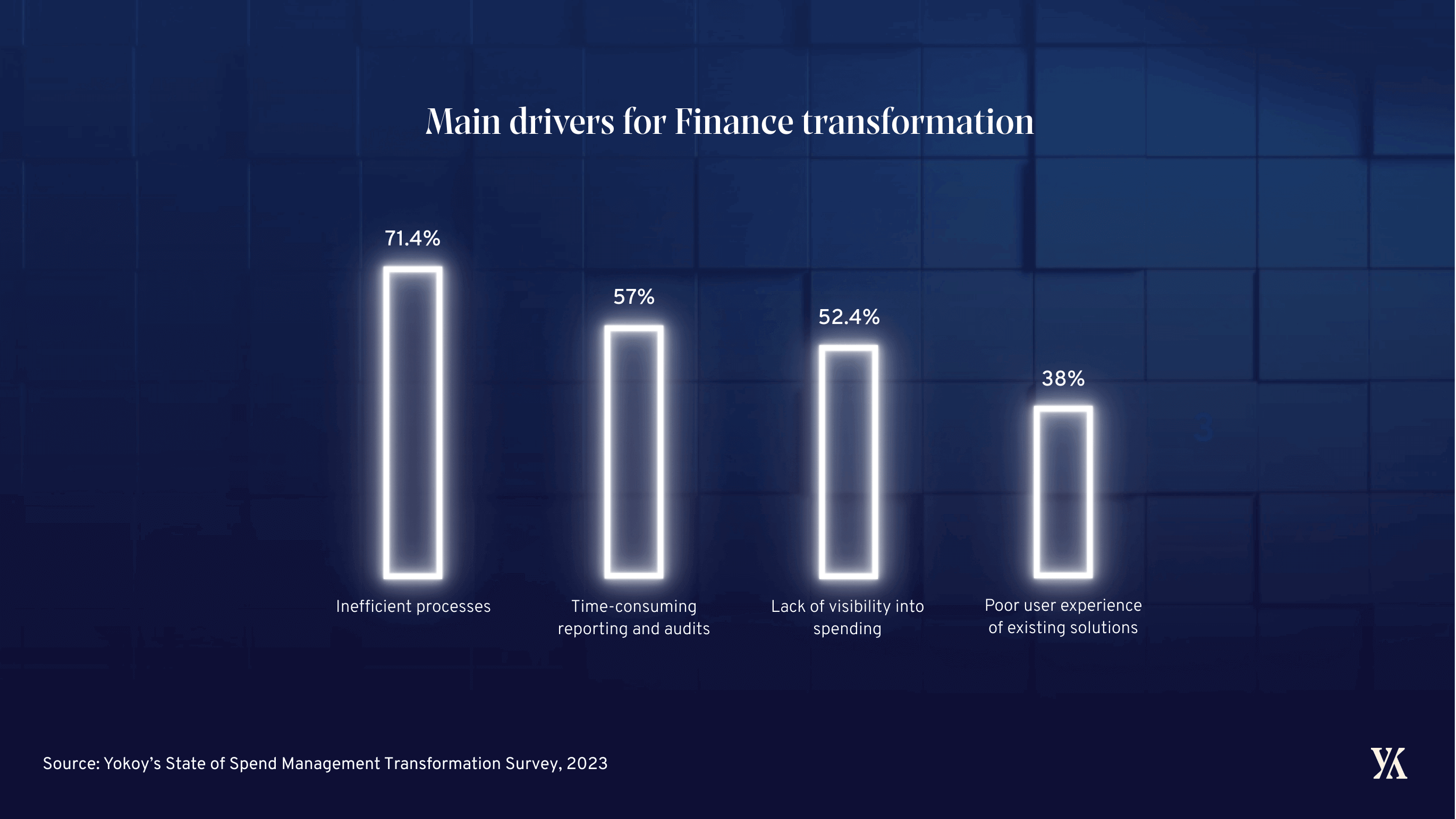

Our preliminary data shows that overall, across industries and company sizes, the biggest drivers for change are inefficient processes (71.4%), time-consuming reporting and audits (57%), lack of visibility into spending (52.4%), and the poor user experience of existing solutions (38%).

What’s interesting to see is that the reasons behind transformation projects are slightly different in enterprise companies versus mid-size ones.

In global enterprises, most projects are initiated because of inefficiency (37.5%), poor usability or scalability of existing solution (25%), lack of visibility (19%), and fragmented IT landscape and siloed data streams (12.5%).

On the other hand, in mid-size companies, the biggest drivers for the transformation of spend management are inefficient processes (59%), lack of visibility into spending patterns (18%), poor usability and scalability of the current solution (9%), and compliance (9%).

As for companies who haven’t yet started their transformation journey, the main reasons mentioned are the satisfactory performance of existing solutions (45.5%), the prioritization of ERP projects (27%), and the lack of budget (9%) and expertise (9%). These reasons are similar across company sizes and industries.

A shift towards user-centric finance tools

Finally, if we look at the value that organizations hope to get out of finance transformation projects, most of our respondents mentioned operational efficiency (90.5%), increased employee satisfaction (71%), enhanced spend control (62%), and easier reporting (52.4%).

This is in line with our general observations, showing once again that there is a shift in the industry towards more user-centric tools.

Legacy finance software is notoriously known for its complexity and lack of user-friendliness, which explains the growing demand for modern solutions that prioritize intuitive interfaces and seamless user experiences.

Conclusion

This is just the beginning of the conversation. To see the full results of our survey, download the report below.

White paper

Report: State of Spend Management Transformation [2023]

This report offer a glimpse into the current state of spend management transformation and the trends, challenges, and opportunities shaping its future.

*The preliminary data is derived from various key sectors, including Manufacturing, Construction, Automotive, Retail, Technology/Software, Business Services, Financial Services/Banking, Sports, Education, and Marketing and Advertising.

The survey respondents represent diverse departments such as Finance, Travel Management, Solutions, Delivery, Operations, and IT, and include C-suite executives. Among the respondents, 52% hold senior positions as Head, Director, VP, or C-level executives. The surveyed companies are located in the DACH region, The Netherlands, Spain, Portugal, and the UK. In terms of company size, these initial insights come from small companies (26%), mid-size businesses (43%), and large enterprises (31%).

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.