Home / Navigating the German “Three Month Rule” (Dreimonatsfrist) in Expense Management

Navigating the German “Three Month Rule” (Dreimonatsfrist) in Expense Management

- Last updated:

- Blog

Co-founder & CCO, Yokoy

In the world of finance and spend management, adherence to regional regulations is a cornerstone of operational excellence.

One such regulation in Germany, often referred to as the “3-month rule” or “Dreimonatsfrist,” wields a significant impact on expense management for business travellers.

In this comprehensive article, we will delve into the intricacies of this rule, explore exceptions, and offer guidance on managing expense report compliance within the German market.

The German 3-month rule (Dreimonatsfrist) and Per Diems

In Germany, employees embarking on business trips are entitled to per diems. These per diems serve as compensation for the additional costs incurred during travel, particularly for food and accommodation.

For example, let’s say an employee needs to go on a business trip and spend more time away from home than planned. The trip falls into the category of business travel, therefore the employer has to cover the employee’s daily meals.

This can be done with per diems, or with receipt-based reimbursements. If you’re confused by the terminology, we’ve explained the difference between per diems and regular reimbursements in the article below.

Blog article

What Is Per Diem? Exploring the Basics of This Reimbursement System

Learn about per diem rates, how they’re different from actual expense reimbursement, as well as the legal and tax implications across countries.

Andreea Macoveiciuc,

Growth Marketing Manager

A notable distinction is that per diems are not considered part of an employee’s income, rendering them tax-free.

However, there’s a caveat to this tax-free benefit. Per diems are only tax-free up to a certain legal limit, and here is where the three-month rule enters the scene.

So let’s see what makes this rule so complicated and how expense management software like Yokoy can help you stay compliant and avoid issues with expense reports and employee reimbursements by automating the compliance rules in the system.

Compliance in Germany

Stay up-to-date with rules and regulations around per diem rates – including the midnight rule and 3-month rule, mileage allowances, proof of receipt, and VAT rates in Germany, while Yokoy keeps you audit-ready.

Navigating the complexity of the German three-month rule

Determining the applicability of the three-month rule is a nuanced task that goes beyond a simple three-month timeframe.

In Germany, allowances for business stays that are longer than three months – essentially, anything that’s classified as long stay – are, by law, taxable.

A stay of three days or more in a single location within a week qualifies as an extended stay. Each successive stay in the same location accumulates until it reaches a duration of three months, unless interrupted by an absence of 28 days or more from that specific location.

If an event happens that interrupts the three-month period for at least four weeks in a row, then the clock on the 3-month rule restarts, regardless of the nature of this interruption.

Still, note some exceptions:

Business stays of one or two days, even if the location is the same, do not trigger the Dreimonatsfrist rules. This period is too short and in German law it’s considered that any employee can work from external locations for 1-2 days a week, while getting their regular daily allowance.

Another exception refers to permanent assignments that involve mobile “locations”, for example aircraft, ships, and other such arrangements. These are exceptions to this rule and do not fall under its jurisdiction.

But all in all, the benefits of per diem allowances are capped at three months. Once an employee’s stay surpasses this threshold, the per diem benefit transforms into taxable income.

For this reason, it’s mandatory for businesses and employees to accurately track and report the business trip expenses, to ensure compliance with per diem regulations.

Ensuring compliance with the "Dreimonatsfrist": The Yokoy solution

Yokoy’s spend management suite simplifies the expense tracking and reporting process by automatically calculating the duration of a business trip as well as the regulations that apply.

For example, the software determines whether a trip qualifies for the three month rule or not. Also, Yokoy automatically updates the per diem rates, mileage allowance, and VAT rates, ensuring compliant expense management across countries.

Here’s what this looks like in practice.

Example: Three-month rule in Yokoy

Let’s say that the employee travels to a single location over the course of three months. Yokoy will detect and validate the 3 month rule under these conditions:

The company is located in or has an entity in Germany and the user reports all Per Diem to this Tätigkeitsstätte location.

The employee stays at a single location, for more than two days per week. The days don’t need to be in sequence, so Monday, Wednesday, and Friday stays qualify as well.

The employee spends more than 8 hours per day at that specific location.

The employee travels to this location regularly, and there is no break of four or more consecutive weeks (28 days). If this does happen, as mentioned above, the rule no longer applies, as the interval resets.

All the per diems during the 3 months are linked to the same location (Tätigkeitsstätte).

The amount triggered for the 3 month rule is considered taxable.

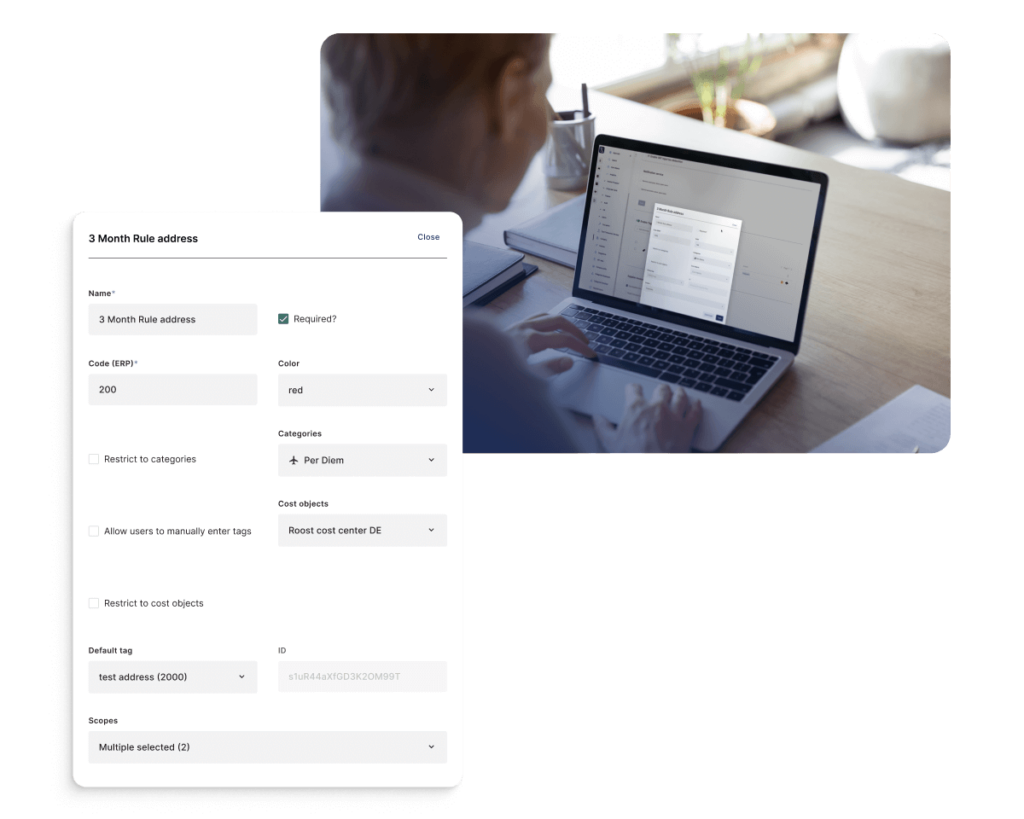

In the Yokoy platform, all these calculations are done automatically. Once the trip functionality is enabled at company level, the different location destinations can be added to the system.

These locations can be grouped under a “3-month rule addresses” category for easier administration and expense reporting. Then, the employee can simply select the addresses for their trip from the list of pre-setup addresses.

Based on these settings, the business trips will be automatically checked by the tool, and if they qualify for the three month rule, the tax calculations will be done automatically as well.

This way of working ensures an error-free and compliant process, and removes the risk of human error that can easily occur when manually adding these details and doing per diem calculations.

Yokoy enables real-time expense tracking and ensures full visibility into the monthly expenses per branch, entity, and at company level. The reports make it easy to see whether a trip falls under the three-month rule or not, and if per diems apply.

Next steps

In a rapidly evolving financial landscape, knowledge of regulations like the three-month rule is a powerful tool to ensure efficient and compliant expense management.

Solutions like Yokoy offer invaluable assistance in navigating the intricacies of this rule, providing clarity and compliance in an otherwise complex landscape.

If you’d like to see the Yokoy Expense module in practice, you can book a demo below.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.