Home / Common Challenges in Manual Spend Management Processes

Common Challenges in Manual Spend Management Processes

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Sooner or later, every business that is sticking with outdated manual spend management methods will learn that the traditional approach can create challenges for a company’s AP department, influencing its bottom line. That is why we have compiled an overview of common business problems and identified ways to streamline processes with reliable software solutions.

Typical issues in traditional spend management workflows

Naturally, outdated/static spend management and expense management processes can have a severe impact on your company’s ability to grow. So it is best to watch out for these typical obstacles:

1. Lack of visibility in expenditures

Financial professionals need optimal visibility into a company’s day-to-day spending, that is a matter of fact. Employee expenses here, supplier costs there, with travel expenses and the need of office supplies on top — all that can sum up quickly and generate a lot of spend data that needs proper management. Otherwise, it can lead to maverick spending, duplicate payments, or other costly errors like internal or external expense fraud. If you prefer relying on error-prone paper methods or spreadsheets to record each step of your procurement-to-payment process, you need a detailed (and also time-consuming) way to examine this data.

2. Inefficient data access

Every business needs to acknowledge: A spend management solution based on traditional paperwork leads to inefficient data capture. Therefore, we recommend that an AP department should at least be able to review past procurement data easily to oversee current spending, and forecast future growth. This approach helps with making informed financial decisions.

However, manual processes make it difficult to access data, a threat that becomes more and more imminent with the growth of a business. When crucial analytics such as key performance indicators must be tracked and calculated manually, you have to sacrifice more resources than necessary concerning today’s technological options.

3. Optimisable manual processes

If your company heavily relies on paper handling, you will probably know this already: You have to enter data multiple times to add them to separate financial systems at different stages of the procurement and payment processes.

That is cumbersome work and also poses a high risk of human errors and bottlenecks as payments often must be individually verified and authorised by inefficient routing to the respective administrators.

4. Complex compliance processes

Audits do not have to be but easily become a huge pain point when AP professionals are faced with rows of filing cabinets filled with paperwork. Even the best-structured files make verifying procurements a painstaking process since the accounts payable team must meticulously match requisition requests to receipts of invoices and goods.

5. Insufficient supplier management

Your competition is probably already taking positive action to address their respective issues, as many businesses have found it necessary to rethink how they spend their money — especially since the AI boom. Not maintaining a robust supplier management software solution might affect your future business as others already might be a step ahead of you. A software that holds centralised vendor information allows you to gather all the latest contact information and contract data.

6. Struggling to stay within the budget

Businesses holding on to outdated spending management probably end up with inefficient budgetary processes. Why? Companies with traditional management tools are likely to decide budgets based on guessing. Even the previous year’s cycle can be less sufficient than real-time data. Fresh data insights from your automated expense management system could deliver more precise results and could, therefore, lead to better budgeting of business expenses.

Developing a spend management strategy: Where to begin

A spend management strategy involves

acquiring

organising

managing

classifying

and analysing spending information.

A robust strategy also addresses workflows and compliance concerns, ensuring financial control for the business. Spend management software is a vital element of this strategy, but other considerations are equally important. Therefore, we recommend that businesses should start by evaluating their current workflows, identifying steps in specific processes, and pinpointing factors causing slowdowns or inefficiencies.

Each phase of the procurement process can be individually reviewed and prioritised to identify improvements that positively impact the company. Baseline performance metrics, including time, cost, and manual user input, should be recorded for later comparison with implemented solutions.

Afterwards, companies need to select the best software solution and other strategic tools that address the most significant factors limiting workflow. Post-implementation, a thorough review of all spending processes should be conducted to fully visualise the benefits gained.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Benefits of spend management software

As EMR has revealed, the global business spend management software market size is projected to grow about 10 per cent between 2024 and 2032. This growth also comes with a decrease in the current supply chain risk and goes hand in hand with further optimisations, including better automation processes. With Yokoy’s intelligent spend management solution, you can prepare your business for the future and profit from its smart solutions right away.

Effortless expense management:

Yokoy’s AI-driven solution simplifies expense reporting, ensuring that managing expenses becomes a seamless and effortless task. Say goodbye to manual hassles and welcome a new era of automated efficiency.

Automation for improved efficiency:

Put your expense management on autopilot with Yokoy, automating tasks such as VAT reclaims and travel expense reporting. This not only saves time but also ensures accuracy in financial processes.

Eliminate manual tasks and streamline processes

Fast employee reimbursements

Modern and intuitive workflows

Paperless, centralised expense management

Full control over employee spend

Automated transaction reconciliation

Automated expense claim approval

Built-in compliance and automated audit trails

Automated booking to ERP

Faster month-end closing

Blog article

What Is Spend Management? Fundamentals and How It Works

In today’s competitive market, companies that can effectively manage their spending are better positioned to grow and remain profitable.

Lars Mangelsdorf,

CCO at Yokoy

Significant cost savings thanks to a new management system

Every business needs to keep a close eye on its finances. Simplifying spending through automated software from Yokoy is a practical approach to achieving this goal. Moreover, utilising software that consolidates procurement, vendor management, and supplier payments into a unified system improves record-keeping compared to traditional file cabinets. Documents can be linked for easy access, and historical transactions with a vendor can be readily consulted, providing insights for more favourable contract negotiations.

Improve your supplier management

Businesses often rely on suppliers for raw materials and other essential products, adding complexity to the supply chain. Implementing Accounts Payable (AP) software supporting spend management can expedite payments to suppliers, potentially attracting more vendors, lowering prices, and fostering stronger relationships.

Each step in the procurement process can then either be streamlined or handled more efficiently. Software that automatically matches incoming invoices to previous requests and received products or services creates a smooth workflow, optimising the Accounts Payable team’s efficiency.

You see: There is plenty of potential to optimise the way you handle your finances and Yokoy is here to help with every step of the way.

Next steps

If your organisation is ready to embrace the future of finance and revolutionise your spend management processes, reach out to our experts today to explore how our AI-powered solution can transform your financial operations for the better.

See Yokoy in action

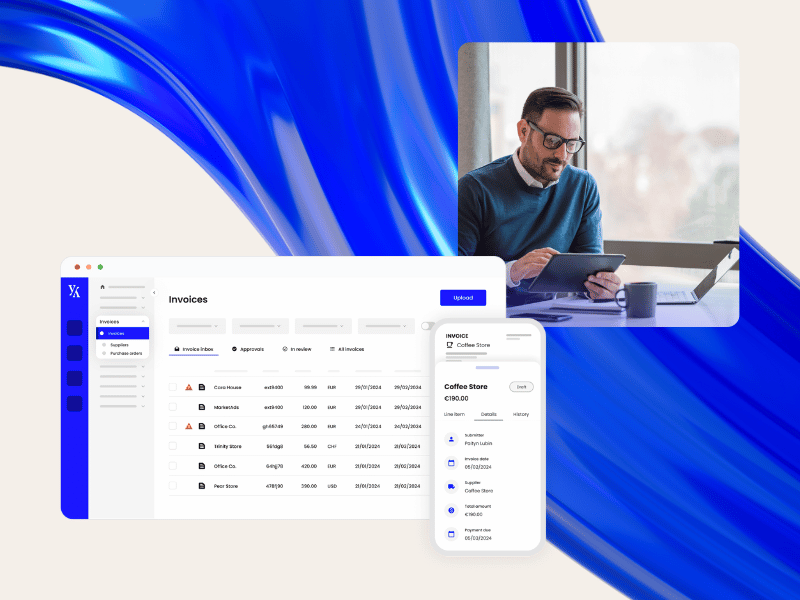

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.