Home / The Yokoy Guide to FP&A: What It Is, Why It Matters, and Where We Fit In

The Yokoy Guide to FP&A: What It Is, Why It Matters, and Where We Fit In

- Last updated:

- Blog

Co-founder & CFO, Yokoy

What is financial planning and analysis (FP&A)? It’s more than expense tracking. More than accounting. And more than corporate finance.

In this guide to FP&A, we take you through its main areas – showing why the best outcomes come from integration across the whole enterprise.

What is FP&A?

In a small business, financial planning tends to be seat-of-the-pants: the founder and his team make budgeting and investing decisions based on their feel for the business since they know their customers and costs in detail. This approach works -up to a point. Because once a business starts to scale it’s impossible to make good decisions by gut instinct.

After all, with 1,000+ people you’re not a garage operation anymore. You’ve got stakeholders. Shareholders. Employees. And of course customers. All of them depend on the finance team to take timely, effective, and supportable actions that let the business compete and succeed.

That’s where FP&A – financial planning and analysis – enters the picture. Methods for understanding your organisation in aggregate, without having to learn the details of every transaction by heart; seeing the business as the big picture it is, with all its financial flows and interaction points visible.

No FP&A team can function without two things: accurate data and the ability to make sense of it. By streamlining and automating a huge chunk of the process – capturing data at critical touchpoints, bringing it together in context, and transforming it into the right outcomes – we enable your finance people to produce results smoothly and with more confidence.

FP&A needs an accurate and dependable model of the company’s finances – and that means it’s deeply integrated into the financial environment. But how can this happen, when a typical large enterprise uses many different applications and data sources? Successful financial planning and analysis need data to be connected in context.

The role of financial planning and analysis

There isn’t a single definition of FP&A, but one of the best comes from industry analyst Gartner.

The research group describes it thus: the process of planning and budgeting for business needs, integrated financial planning that covers the whole organisation, management and performance reporting that feeds accurate information to executives, and forecasting and modeling that explores future outcomes of the situation today.

FP&A meaning according to Gartner:

- Planning and budgeting

- Integrated financial planning

- Management and performance reporting

- Financial forecasting and modelling

That means the FP&A process isn’t “accounting”. Important as that function is: accounting looks at what’s already happened, and strives to record it accurately. Nor is it purely a finance application, since it isn’t limited to what’s done on a spreadsheet.

FP&A is best thought of as an integration of different business and financial skills, connecting multiple silos and datasets across the organisation into the most useful picture of what’s really happening – including how things are changing over time.

So if we summed up FP&A in one word, it’d be breadth. It involves finance wherever it touches the business, spanning accounting statements, capital expenditure, expense management, and even financial controls.

Why FP&A? How it fits today’s enterprise

To take one example: when any business grows beyond around 150 people, FP&A becomes vital. That number of people – 150 – is a good rule-of-thumb.

A company of 150 people doesn’t function too differently from one of 50; it’s still small enough for everyone in the business to know each other, and for the right people to have an accurate picture of what’s happening in the business just by looking at reports, walking around, and talking to people.

But beyond 150 people, things change. Especially when you grow to 1,000 people and more. The “village” starts becoming a “city”. Not everyone knows everyone else’s name; employees settle into silos with narrower job functions; departments have separate P&Ls and performance metrics, and focus on their own team’s goals rather than those of the broader organisation.

All this is well and good – you want people focussing on their own work, after all. But as workflows and data sources splinter and separate, the FP&A process flow offers a way to keep them integrated. It allows data to be understood in its proper context: how it affects the business. Which means management decision-making is better informed.

Departmental managers can set tasks that benefit the entire business. Expense management follows clear structures. And the company strategy can be unified and coherent, making it more likely to succeed.

That’s how FP&A answers the needs of today’s enterprise: it offers control at scale. A way to steer the ship precisely and predictably, even as it changes from a small speedboat to a 10,000-tonne cruiser.

Control at scale needs automated processes – and Yokoy can put them in place for you. Imagine a straight-through process from a traveling employee’s hotel bill on paper to correct allocation in your expense accounting, with time-consuming manual tasks automated away.

Steps in the FP&A process

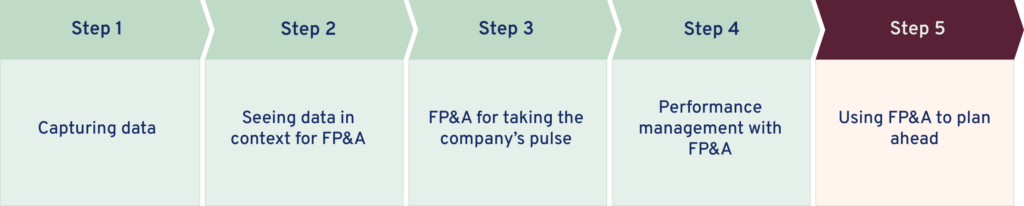

While the four areas of FP&A happen on different timescales – one business unit may be planning and budgeting while its neighbour is forecasting and modeling – note everyone involved follows a similar pattern of steps.

The initial steps in effective financial planning are threefold: data collection, consolidation, and verification.

Step 1: Capturing data

The first stop might be departmental paperwork: expense reports, invoices, receipts. So the first stop – collection – might be the accounting system. But across the organisation there may be different financial processes for capturing those costs; documents may be processed in different formats; some of them might not even be in electronic form.

So consolidation comes next: getting all those chunks of data into a standard structure that tells the whole truth. However, to get there another step is needed: verification, checking and authenticating each transaction before giving it the all-clear.

This is where Yokoy comes into play: by implementing spend management solutions like our Expense or Invoice module, collection, consolidation and verification are taken care of automatically – reducing time, costs and mismatches.

The first step in FP&A lays the foundation for the whole process – people need to be multiskilled and exercise critical judgment, as they bring together data sources from ERP (Enterprise Resource Planning) software, data warehouses in the cloud, and the occasional cardboard box under someone’s desk.

Step 2: Seeing data in context for FP&A

The next step is to make sense of that data: seeing it as a big picture of the business and understanding how changes to any part will affect individual business units and teams. But that’s easier said than done.

An expense report from one department means nothing without context: how much that team is spending versus other teams, how that relates to broader budgets and financial controls, and whether that spend is resulting in ROI.

Again, this often means looking “across” multiple data sources and applications, struggling to build a meaningful model of cost centers across the business.

Step 3: FP&A for taking the company’s pulse

Of course, the main reason for all this effort is to see how the company’s doing: the net-net of all its activities. And it’s not just about profit and loss.

Companies need to know that what they’re doing doesn’t breach agreed limits from their banks; they must be able to assure regulators they’re in compliance with the law; they need a reliable overview of the business to share with investors.

This is where the C-Suite often enters the FP&A function: it’s the CFO who sees consolidated reports and summaries, and depends on them is accurate and complete. Done well, FP&A and also intelligent Spend Management support these goals.

Step 4: Performance management with FP&A

Next up is using that information to good effect. Comparing and contrasting consolidated data is how managers support their decisions – or (more frequently) make those decisions at all. And it’s performed by managers at all levels.

The CEO of a multinational wants to compare business units with each other to separate the cash cows from the dead dogs. But individual department heads need this step of FP&A too. They can see which of their teams are within budget and which are breaching; where headcounts are too high or resource utilisation too low.

Step 5: Using FP&A to plan ahead

If Step 3 answered “Where are we now?” and Step 4 was “What should we do about it?” then Step 5 is “Where do we want to be?” It’s the longer-term actions of setting goals and charting a course towards them – although “long-term” in today’s economy can be just weeks rather than years.

External factors come into play here. Perhaps the company’s market is changing, and its mix of competencies needs to transform. Or a competitor’s innovation has made one product line obsolete, and only a boost in R&D can get the business back on track. It’s about mitigating risks and addressing challenges, yes. But it’s also about opportunities.

Every enterprise occupies a unique space in the marketplace and in people’s minds – imagining what the future might be like, and how these assets can be leveraged to reach it, is part of every large business’s FP&A activity.

FP&A roles across the organisation

As mentioned, FP&A roles go beyond the Finance department. The C-Suite needs consolidated summaries that present a picture of the entire organisation.

Business unit leaders need specific information on their own divisions, with their own KPIs and metrics. Functional departments need to set budgets and manage ongoing costs; even individual workers need to know if they’re complying with their per-diem allowances.

This means FP&A touches many parts of today’s enterprise – far more, perhaps than just a few years ago. The CFO and CEO make decisions. Their assistants present reports. Other managers propose their plans and ask for investment. While lower-level workers need to ensure their expenses are apportioned and approved in the right way.

Ultimately, a business is a machine for transforming inputs into outputs that produce a profit. While things like purpose, brand, and values matter, the bedrock of business is about the numbers. So ensuring those numbers are accurate, complete, and timely is the job of everyone.

These days, everyone’s an FP&A person.

FP&A tools and tactics

Financial planning and analysis tools are many and varied. But let’s draw one overwhelming thought from the ideas above: it’s all about the data.

Make it easier for people to get data into the right place, and the whole FP&A function becomes easier to run. So the game plan is to see where people spend time and aim to reduce it. If they visit the office with sheaves of receipts, try to do it electronically.

If your accounting team is endlessly chasing salespeople for costs, make the submission process simpler. If your finance people have to do monthly data draws from a distant database, connect that data source to your ERP properly. The right tools make it all happen.

One such tool, of course, is Yokoy’s Expense module. Instead of endless paper-pushing, form-filling, and box-ticking – some rather large organisations still do this manually, asking employees to staple receipts to spreadsheets – employees can capture an invoice on camera, then leave the job of recognising and categorising that expense to an automated process.

Consolidation of suppliers

Let’s say your workforce spends a lot of time on the road visiting customers. They’ll be staying in lots of hotels – and probably paying for them on their personal credit cards, submitting expense reports later on.

What if you discovered 350 people are staying at Hotel Chain X multiple times a month, adding up to thousands of nights per year?

You’d want to negotiate a preferred rate and make sure your people use it. This can save millions for a large organisation. Being able to see the aggregate picture of what you’re paying – and who you’re paying it to – is a key application of Yokoy.

Road warriors save time by scanning receipts and invoices into a simple mobile app, with AI automating the process from there is – sometimes all the way through to expense settlement, without taking hours away from humans in the FP&A organisational structure.

Tax optimisation of costs

The EU (to take one example) is a complex place when it comes to sales taxes – with different rates of VAT across member states. Much of it is reclaimable or reimbursable in your home state – if your FP&A processes are capable of separating it out.

But many companies don’t bother, because sorting through the maze of regulations is hard. The key point: with the right software, it’s also automatable, letting you outsource that tedious busywork to software.

Imagine every shop receipt from Germany, every restaurant bill in the Netherlands, and every stationery order in Spain with its tax component split out and aggregated into sums you could reclaim in your country offices. Again, this strategy can add millions back to your bottom line.

FP&A trends: where it’s all going

As you’ve seen, corporate financial planning and analysis isn’t a static set of rules; it’s changing all the time, as people find new ways to use it.

They’re using it for business flexibility. Large companies don’t need to lose the ability to shift course quickly. A nimble FP&A reporting system can flag roadblocks and opportunities early, enabling decisions to be put into action at speed.

Another is shareholder value. One way to create value is to separate or spin out business units that can stand on their own merits – and an industrial-strength FP&A process can make this happen faster, in a period measured in quarters rather than years.

While others are using it to empower workers. Rather than jump through hoops of approval for every purchase, people can get expenses “signed off” straightaway, as part of an automated process that starts with their mobile phone. It means happier, less frustrated workers – with a positive effect on the bottom line.

All this is leading to yet another trend: FP&A throughout the organisation. Bringing this guide full circle: financial analysis and planning isn’t a department, or team, or even a shared function. It’s becoming part of everyone’s life – making their work easier, simpler, and less stressful.

Conclusion: the bright future of FP&A

In summary, financial planning and analysis isn’t some dry departmental discipline. And it’s certainly not the sole province of accountants and finance types. It’s the circulatory system of your business, its breath and blood. This means the more efficient you can make it, the more effective your organisation will be.

FP&A is the ultimate level of digital transformation, bringing multiple financial flows together so they can be understood, analysed, and used for action. We’re Yokoy and we’d like to help you on that journey by delivering the world’s leading Spend Management solution.

Why not see how you could improve your finances with Yokoy?

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.