Home / Enhancing Financial Reporting with AI-Driven Expense Tracking

Enhancing Financial Reporting with AI-Driven Expense Tracking

- Last updated:

- Blog

Looking to the future, AI trends extend far beyond simple chatbots with quirky names. In financial reporting, the new technology is set to revolutionise the field with advanced predictive analytics and natural language processing (NLP). These emerging technologies will offer deeper insights, optimise data interactions, and significantly improve decision-making within expense management software. Let us dive in!

Why you need AI to transform your financial reporting

Traditional financial reporting relies on manual data entry, complex spreadsheets, and time-consuming reconciliations. This approach can lead to errors, delays, and limited visibility into financial performance.

In contrast, AI-driven expense tracking revolutionises financial reporting by automating data collection and processing, significantly improving accuracy and speed. AI systems provide real-time insights, enabling businesses to access up-to-date information whenever needed. Additionally, AI’s predictive analytics offer deeper insights, allowing companies to forecast and make data-driven decisions. By transitioning to AI-powered financial reporting, companies can streamline their processes and gain a competitive edge through enhanced precision and timely decision-making.

Challenges of traditional financial reporting

Traditional financial reporting is mostly viewed as outdated due to several critical limitations: Customary processes are often slow and rely on repetitive tasks to compile and reconcile data from datasets. This can not only entail potential risks and delays but also undermine financial reports’ accuracy.

Data analytics of financial health are crucial not only for chief finance officers (CFO) but for stakeholders and risk management as well. Traditional methods struggle with maintaining data integrity and compliance issues, especially when integrating with existing systems. Additionally, ensuring data security in usual financial reporting is challenging, as manual processes increase the risk of breaches and data loss. Therefore, modernising your company’s financial reporting process can be an efficient update for your finance team.

The impact of AI on financial decision-making

Artificial intelligence is transforming financial decision-making by providing businesses with the tools to make more informed and strategic choices. It gives companies access to real-time financial insights, allowing them to respond swiftly to market trends and internal financial dynamics. AI reduces your employees’ workload by automating routine tasks, helps with fraud detection, and ensures high regulatory compliance. The integration of AI can proactively suggest strategic decision-making based on comprehensive data analysis, offering recommendations grounded in the latest trends and predictive models. In an increasingly competitive financial landscape, this can also position companies to stay ahead.

Benefits of AI-driven expense tracking

AI-driven expense tracking provides real-time, accurate financial data, enabling better decision-making. By automating data collection and processing, AI reduces the risk of errors, ensuring finance teams can focus on high-value tasks and ultimately driving profitability.

Better financial decision-making: AI-driven expense tracking equips financial leaders with the tools to make better decisions. By providing real-time data and comprehensive insights, AI enables businesses to quickly assess fraudulent activities or discrepancies in financial statements and respond to changing market conditions with agility. This capability enhances the quality of decisions, allowing companies to allocate resources more effectively and optimise budgets.

Improved data accuracy in real time: One key advantage of leveraging AI is its ability to process and analyse data in real time. Traditional methods often involve delays and the risk of inaccuracies due to manual data entry and consolidation. In contrast, AI-driven systems automatically capture and validate financial data as submitted, ensuring that data entries are correct. This real-time accuracy enhances financial reporting and provides a solid foundation for financial analysis and strategic planning.

Less human errors: Manual expense tracking is prone to errors, whether from data entry mistakes, miscalculations, or oversights. These errors can lead to inaccurate financial reports and poor decision-making. AI-powered process automation significantly minimises the likelihood of mistakes by automating routine tasks, ultimately improving the accuracy of financial reporting and decision-making.

Predictive analytics: AI not only simplifies tracking expenses but also offers predictive analytics that can forecast future financial trends based on historical data and market trends. This forward-looking capability allows businesses to anticipate potential risks and opportunities, enabling proactive decision-making. Companies can optimise their financial strategies, mitigate risks, and capitalise on emerging opportunities, giving them a competitive edge in the market.

Cost optimisation: AI-driven expense tracking helps businesses bring cost-saving opportunities to light that might be overlooked with traditional financial reporting. With detailed insights into spending patterns and inefficiencies, smart software enables companies to identify areas where costs can be reduced without compromising quality or performance.

Yokoy Expense

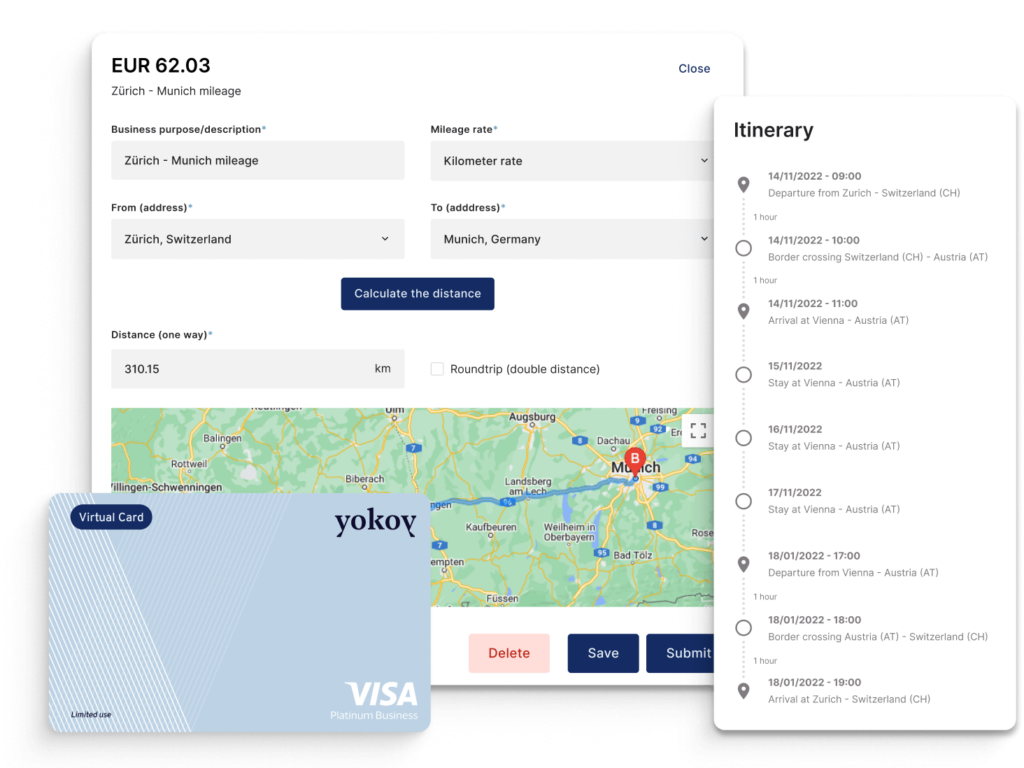

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Key features for spend tracking automation - already integrated in Yokoy

The smart solution of Yokoy’s spend management and automation software delivers features that can help you transform your business spend tracking processes:

Real-time data aggregation

Yokoy’s spend tracking software excels in real-time data aggregation, seamlessly consolidating financial data from various sources, including invoices, receipts, and credit card transactions. This feature ensures that all financial information is updated instantly, providing a comprehensive view of expenses at any given moment. By integrating with existing financial systems, Yokoy eliminates the delays associated with manual data entry and ensures that decision-makers always have access to the most current financial data.

Automated categorisation

Yokoy automates the categorisation of expenses by intelligently recognising and sorting transactions based on predefined categories and user behaviour. This feature reduces the time and effort required for manual classification, ensuring consistency and accuracy in financial records. By leveraging machine learning, Yokoy continuously improves its categorisation process, adapting to specific business needs and preferences, which results in more precise financial reporting and easier expense management.

Anomaly detection

Yokoy’s anomaly detection feature uses advanced AI algorithms to identify irregularities and potential errors in spending patterns. The software flags unusual financial transactions, such as duplicate expenses or outliers, which might indicate fraud or misallocation of funds. This proactive approach allows businesses to address issues before they escalate, ensuring financial resources are used appropriately and efficiently.

Future spending predictions and trends

Yokoy incorporates predictive analytics to forecast future spending trends based on historical data. This feature allows businesses to anticipate upcoming expenses and adjust their budgets accordingly. By analysing patterns in past transactions, Yokoy can provide insights into potential cost fluctuations and help companies make informed financial decisions, ensuring better resource allocation and financial planning.

Real-time monitoring

Real-time monitoring in Yokoy enables businesses to track their spending continuously, providing instant visibility into their financial status. This feature ensures that any changes in spending patterns are immediately visible, allowing for prompt adjustments if necessary. Financial leaders can stay on top of their budgets with real-time alerts and dashboards, ensuring that spending aligns with organisational goals and economic constraints.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

How Yokoy helps to transform your financial reporting with AI-driven expense tracking

Yokoy’s spend tracking is a cornerstone of its holistic spend management solution, designed to provide your business with comprehensive control over financial operations. Key features include real-time data aggregation, automated categorisation, anomaly detection, predictive analytics for spending, and real-time monitoring. These features offer accurate, up-to-date insights into your company’s expenses, reduce manual workload, and identify cost-saving opportunities. Yokoy’s spend tracking integrates with other financial tools, ensuring that all aspects of expense management are facilitated, from data entry to reporting and decision-making.

Integrated AI (and how it works)

Yokoy’s Integrated AI is the engine that powers its automation and analytics capabilities. The AI processes large volumes of financial data in real time, learning from user behaviour and historical data to improve accuracy and efficiency. It automates routine tasks, such as expense categorisation and anomaly detection, and provides predictive analytics for future spending. This AI-driven approach ensures that the software continuously evolves, adapting to your business’s specific needs and delivering actionable insights that drive smarter financial decisions.

Built-in expense policies

Yokoy includes built-in expense policies that ensure compliance with company guidelines and regulatory requirements. These policies are embedded into the system, automatically enforcing rules and limits during the expense filing and approval processes. This reduces the risk of policy violations and ensures that all expenses align with corporate standards, streamlining the approval process and reducing administrative burden.

Customisable workflows

Yokoy offers customisable workflows that allow businesses to tailor the approval and reporting processes to their individual needs. Companies can design workflows that reflect their internal structures, ensuring that expenses are reviewed and approved by the right people at the right time. This flexibility helps optimise operational efficiency, reduce bottlenecks, and ensure that financial processes align with organisational goals and hierarchies.

Integrations and apps

Many financial systems, tools, and apps can be integrated into Yokoy to enable seamless data exchange and collaboration across platforms. This includes integration with Enterprise Resource Planning (ERP), accounting software, and corporate banking systems. Yokoy’s integrations simplify managing multiple systems and ensure that all aspects of spend management are connected.

Corporate cards

Employee spending can be efficiently tracked with Yokoy’s support for issuing and managing corporate cards. The corporate card functionality is integrated with Yokoy’s expense management system, allowing real-time tracking and automatic categorisation of card transactions. This ensures that all expenses are captured accurately, reduces the need for manual entry, and provides businesses with better oversight and control of corporate spending.

Modern financial management for Canton Basel-Stadt and Breitling

Several organisations and companies already trust Yokoy’s tools with their financial management:

For example, we transformed the financial management of Canton Basel-Stadt by automating their entire expense process. This process automation streamlined data capture, categorisation, and reconciliation, significantly reducing manual effort and increasing operational efficiency. The real-time visibility provided by Yokoy’s solutions enabled strategic financial decision-making, while automated compliance checks ensured accuracy and adherence to regulatory requirements.

For Breitling, Yokoy’s expense management solution replaced manual transaction processes with smooth end-to-end automation for travel and expenses. This shift accelerated expense management and improved accuracy, from data entry to approval workflows. Breitling gained instant visibility into spending patterns through real-time data aggregation and advanced analytics, which significantly improved their financial oversight and strategic planning capabilities.

Next steps

The future of AI in the financial sectors will see increasingly sophisticated predictive analytics and make use of NLP, enabling deeper insights, more intuitive data interaction, and enhanced decision-making capabilities. Start with Yokoy into the future!

In this article

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.