Home / Business Expense Categories: Best Practices for Compliant Spending

Business Expense Categories: Best Practices for Compliant Spending

- Last updated:

- Blog

Co-founder & CCO, Yokoy

One of the key frustrations finance professionals face on a daily basis lies in the accurate categorization of business expense, which demands an in-depth understanding of the company’s specific categories and accounting codes.

Simultaneously, ensuring strict policy compliance adds another layer of complexity, requiring vigilance to ensure that expenses align with local tax regulations.

In this article, we address these challenges and offer solutions to streamline the management of expense categories for a more efficient and controlled financial landscape.

Why knowing business expense categories matters

Identifying and categorizing business expenses can significantly impact your company’s financial health. It allows you to:

Budget effectively: By knowing what types of expenses to expect, you can create accurate budgets that help your company plan for the future.

Control spending: Understanding expense categories enables you to implement spending policies and controls, preventing unnecessary expenditures.

Maximize efficiency: You can streamline your approval and expense reimbursement processes, saving time and reducing manual work.

Enhance visibility: Proper categorization provides insights into where your company’s money is going, increasing financial visibility.

Categories vs. types of business expenses

While the terms “types” and “categories” are often used interchangeably in the realm of business expenses, they hold distinct meanings that are essential for finance professionals to grasp. The difference lies in their scope and purpose.

Business expense types

When we refer to “types,” we’re looking at expenses from the perspective of their behavior or characteristics. In this context, we categorize expenses into three primary types: fixed, variable, and periodic.

This classification is based on how expenses react to changes in production, sales, or time intervals. Understanding these types is crucial for budgeting, financial forecasting, and cost management, as each type requires a different approach.

Fixed costs: Fixed costs are consistent and unchanging, irrespective of production or sales levels. Notable examples of fixed costs encompass rent or lease payments, employee salaries, insurance premiums, and property taxes.

Variable costs: Variable costs ebb and flow in direct response to production or sales variations. Common instances of variable costs encompass expenses for raw materials, utility bills, and sales commissions.

Periodic expenditures: Periodic expenditures emerge less frequently, typically on a quarterly or annual basis. Instances of periodic expenditures include taxes, licensing and permit fees, as well as expenses related to equipment maintenance.

Categories of expenses

On the other hand, “categories” deal with the purpose or nature of expenses. Expense categories are the way we group and label expenses according to their specific function within a business.

These categories may include common classifications like office supplies, travel expenses, marketing costs, and employee salaries. Properly categorizing expenses helps in financial reporting, tax compliance, and tracking expenditures related to distinct aspects of business operations.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Common business expense categories

Allowable expenses are essential business costs that are not taxable. Allowable expenses aren’t considered part of a company’s taxable profits. You therefore don’t pay tax on these expenses.

Business travel expenses

Flights: Airfare expenses incurred during business trips. Managing and categorizing flight expenses is crucial for efficient travel cost control.

Accommodation: Costs for lodging during travel, including hotel expenses.

Meals: Expenses related to foods and drinks, or dining during business travel.

Transportation: Includes costs of transportation during business trips, such as rental cars, taxis, or public transportation.

Miscellaneous: Other travel-related costs like visa fees, baggage charges, and so on. Careful categorization of miscellaneous expenses enhances financial visibility and control.

Blog article

Efficient Travel Expense Management: Pre-Trip, On-Trip, and Post-Trip Recommendations

Learn how to track your travel expenses efficiently and improve your control over the T&E process with AI-powered travel and expense management software.

Lars Mangelsdorf,

Co-founder and CCO

Entertainment expenses

Client meetings: Costs associated with entertaining clients or potential business partners. This includes client gifts and the expenses incurred during client meetings.

Team building events: Includes registration fees and associated costs for attending industry events, conferences, and seminars.

Conferences and seminars: Registration fees and associated costs for attending industry events.

Office supplies and equipment

Stationery: Expenses for pens, paper, printer ink, and other office supplies.

Office furniture: Costs for desks, chairs, and other office furniture.

Computer and software: Expenses for hardware and computer software purchases.

Maintenance and repairs: Costs for maintaining office equipment.

Please note that some employers have policies in place to reimburse their employees for home office expenses, especially in the case of remote work. This reimbursement may cover a portion of expenses like internet costs, office supplies, and equipment.

Business utilities

Electricity: Expenses for powering your business premises.

Water and gas: Costs for utilities other than electricity.

Internet and phone: Expenses for communication services, including internet and mobile phone bills.

Waste management: Costs related to office waste disposal.

Employee expenses

Salaries and wages: Regular payroll expenses for employees, or staff costs.

Benefits: Expenses related to employee benefits, such as health insurance or retirement plans.

Training and development: Business costs for employee training and skill development. These don’t include expenses incurred by staff on their own, the training courses must be for business use.

Employee recognition: Expenses for awards or recognition programs, bonuses, paid vacations, and so on.

Marketing and advertising

- Online advertising: Costs for digital marketing campaigns.

- Print advertising: Expenses related to print materials, like brochures or flyers.

- Events and promotions: Costs for marketing events and promotional activities.

Professional services

Legal fees: Expenses for legal services and consulting.

Accounting fees: Costs for professional accounting and auditing services.

Consulting fees: Expenses for external consultants, such as their business rates.

Research and development (R&D)

- Expenses incurred in research and development activities aimed at innovation and product improvement.

What is not considered a business expense?

As a finance professional, it’s crucial to ensure that only legitimate business expenses are recorded and claimed. Here are some key points to consider:

- Personal expenses: Expenses that are purely for personal use and unrelated to business activities are not considered business expenses. These can include personal meals, entertainment, personal purchases, as well as utility bills and phone bills in case of employees working from home, if the company doesn’t have a clear policy for home office expenses.

- Capital expenditures: Capital expenditures, such as large equipment purchases or real estate investments, are not typically considered day-to-day business expenses. These are usually treated as long-term investments and are subject to different accounting and tax rules.

- Non-business travel and commuting: Expenses related to daily commuting to and from work are generally not considered business expenses. Business travel expenses, on the other hand, are typically deductible.

- Non-business entertainment: Entertainment expenses that are not related to business activities or client meetings are not considered valid business expenses. It’s crucial to clearly document the business purpose of any entertainment expenses.

- Personal mileage: If employees use their personal vehicles for business purposes, it’s important to differentiate between personal and business mileage. Only business-related mileage is tax-deductible.

- Non-business subscriptions: Subscriptions or memberships that are not directly related to the business, such as personal gym memberships, are not considered valid business expenses.

Blog article

Avoiding Fraud in Mileage Reimbursements: The Yokoy Solution

Learn how AI automation reduces errors, duplicates, and fraud, helping you manage trip expenses and mileage reimbursements automatically, at scale.

Lars Mangelsdorf,

Co-founder and CCO

When are expenses tax-deductible?

Tax-deductible expenses are a crucial consideration for finance professionals. Here’s when expenses are typically tax-deductible:

- Ordinary and necessary: For an expense to be tax-deductible, it must be considered both ordinary and necessary for the business. This means the expense should be common and accepted in your industry, and it should be essential for your business operations.

- Business-related: Tax-deductible expenses must have a direct business purpose. This includes expenses related to running and maintaining your business, as well as those incurred while conducting business activities.

- Substantiated and documented: To claim tax deductions, you must keep thorough records and documentation of your expenses. This includes receipts, invoices, and a clear explanation of the business purpose of the expense.

- Consistent with local tax laws: Tax laws can vary by location and change over time. It’s essential to stay informed about the tax regulations in your area and ensure your expenses comply with these rules.

Business expenses list: tax-deductible and non-deductible

Below is a general list of tax-deductible and non-deductible business expenses that a global corporation might encounter. However, it’s crucial to consult with tax experts and consider local regulations for accurate guidance:

Tax-deductible expenses:

Operational costs

Travel expenses

Research and development (R&D)

Advertising and marketing

Employee benefits

Interest payments

Professional fees

Charitable contributions

Depreciation

Legal expenses

Non-deductible expenses:

Non-business personal expenses

Non-compliant expenses

Dividends: Payments to shareholders in the form of dividends, as these are generally not considered business expenses for tax purposes.

Illegal activities

Non-business gifts and entertainment: Gifts and entertainment expenses that are not directly related to business activities or that exceed allowable limits.

Luxury expenses: Excessive or extravagant expenses that do not align with the business’s core operations.

Please note that the tax-deductibility of expenses can vary significantly between countries, and it is vital for a global company to work with tax professionals who have expertise in the specific tax regulations of each jurisdiction where they operate.

Tax laws and regulations can change over time, so staying informed and compliant is essential for a global corporation’s financial health.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

Best practices for setting up business expense categories

Ensuring consistent business expense categorization is essential for maintaining accurate financial records and streamlined processes. Here are some principles to follow when setting up your categories.

1. Identify categories and tailor them to your business

Customize your expense categories to match your specific business needs. Use detailed categories to provide a clear breakdown of expenses. Instead of a generic “Miscellaneous” category, create specific ones like “Office Supplies,” “Travel,” or “Marketing.”

This ensures that expenses are easily understood and managed by your finance team.

Simplify expense classification by keeping categories broad and limiting the number of GL accounts. Use custom fields to capture essential transaction details (who, what, where, why) for flexible reporting and reclassification.

For instance, while you might need to know that an employee made a meal purchase for internal tracking, tax deductions require details like the number of diners and discussion topics.

This level of granularity can impact deductible percentages, making custom transaction details invaluable for streamlined reporting and tax benefits.

2. Use a consistent naming convention

Implementing a uniform naming convention is the linchpin of clarity and cohesion. Opt for names that are lucid, succinct, and easily comprehensible, ensuring that everyone shares a common understanding and recall of expense categories.

Here are some examples of implementing a consistent naming convention for expense categories:

Travel expenses:

- Clear and consistent: “Airfare,” “Accommodation,” “Meals,” “Transportation,” “Miscellaneous”

- Inconsistent: “Flight Costs,” “Lodging Expenses,” “Food,” “Travel Transport,” “Other Expenses”

Office supplies:

- Clear and consistent: “Stationery,” “Office Furniture,” “Computers & Software,” “Maintenance & Repairs”

- Inconsistent: “Office Materials,” “Furniture for Office,” “Tech and Software,” “Repairs and Maintenance”

Marketing expenses:

- Clear and consistent: “Online Advertising,” “Print Advertising,” “Events & Promotions,” “PR & Media”

- Inconsistent: “Digital Marketing,” “Printed Ads,” “Promotional Activities,” “Public Relations”

Employee benefits:

- Clear and consistent: “Health Insurance,” “Retirement Plans,” “Employee Training,” “Recognition Programs”

- Inconsistent: “Medical Coverage,” “Pension Schemes,” “Staff Development,” “Rewards & Recognition”

Utilities:

- Clear and consistent: “Electricity,” “Water & Gas,” “Internet & Phone,” “Waste Management”

- Inconsistent: “Power Costs,” “Water Bills,” “Communication Services,” “Waste Disposal”

3. Aggregate similar expenses

The consolidation of similar expenses serves as a powerful lens through which you can discern spending patterns and trends.

For instance, you can consolidate all your office supply expenses under a single category to easier see what expenses your employees incur. Alternatively, marketing expenditures can be bundled into a distinct category.

This system helps build simplified expenses categories and decreases the risk of errors and mistakes during expense reporting.

4. Use subcategories when needed

In addition to establishing broad categories, the incorporation of subcategories is a refined stratagem for in-depth expense classification.

Consider, for instance, a “meals and entertainment” category, within which you can craft subcategories such as “client meals,” “employee meals,” and “entertainment expenses.” This tiered approach furnishes a more granular understanding of your expenditure landscape.

5. Establish clear expense policies

Develop detailed expense policies that clearly define different expense categories and provide examples for each category. Communicate these policies to all employees, ensuring they understand the rules and expectations.

6. Align with tax codes

Ensure that your expense categories align with local tax codes and regulations to simplify tax reporting and VAT reclaim, and stay compliant.

7. Educate your team

Provide training to employees on expense categorization and policy compliance. This minimizes errors and ensures accurate financial reporting. Keep employees updated on any changes in policies or the chart of accounts.

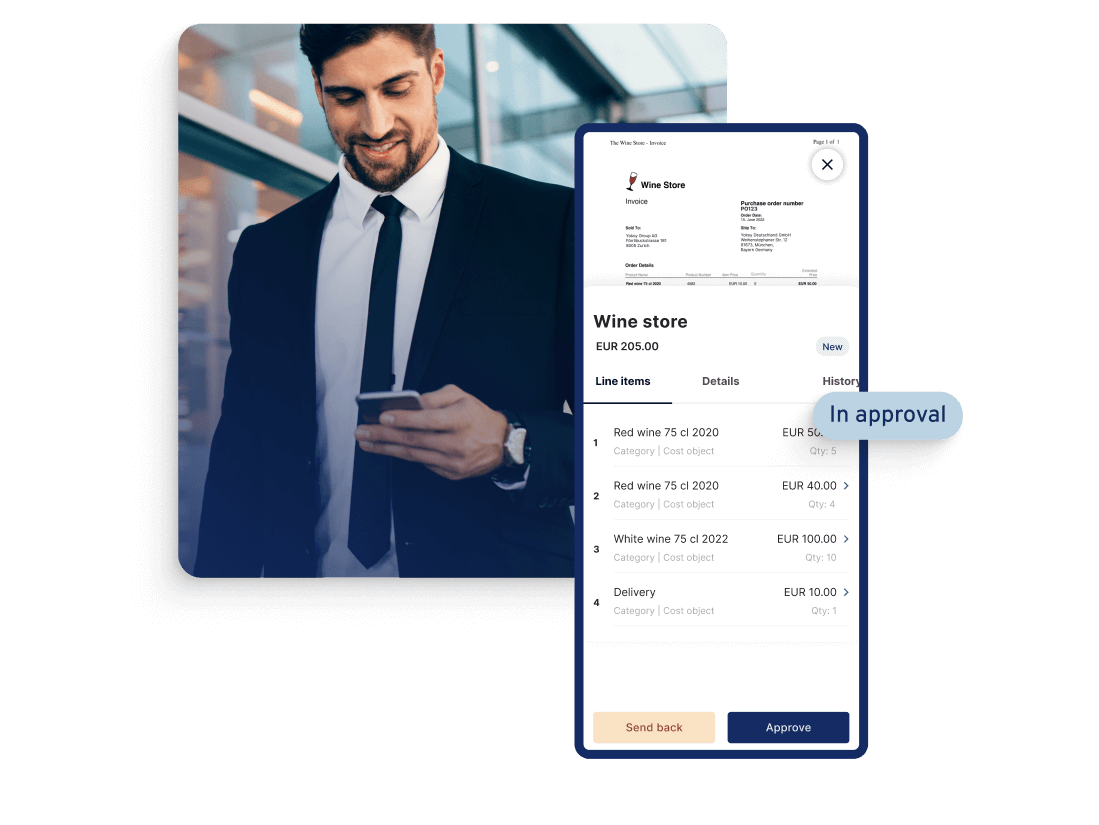

8. Leverage technology to enforce compliance

Consider using expense management software like Yokoy, which uses AI-powered automation to streamline expense processes from end to end, reducing manual work and decreasing the risk of errors and fraud.

Automate categorization

- Utilize expense management software with AI capabilities to automate categorization based on predefined rules.

- Ensure the software is set up to categorize expenses accurately.

Set up expense approval workflows

- Identify stakeholders: Determine who needs to be involved in the approval process. Typically, this includes employees who incur expenses, their managers, and finance or accounting personnel.

- Establish spending policies: Create clear spending policies that outline what expenses are allowable and under what circumstances. These policies should be communicated to all employees.

- Define approval levels: Determine the hierarchy of approvals. For example, low-value expenses may require approval from a direct manager, while high-value expenses may need approval from a department head or finance manager.

- Configure the workflow: In your expense management system, configure the workflow to match your organization’s approval structure. Assign specific approvers to different expense categories or amounts.

- Submission of expenses: Employees should submit their expenses through the expense management system. They should attach receipts and provide details about each expense.

- Review and approval: Approvers receive notifications when expenses are submitted for their approval. They review the expenses, ensuring they comply with spending policies.

- Automated routing: The system automatically routes expenses to the appropriate approver based on the predefined approval levels.

- Exceptions handling: Define a process for handling exceptions or expenses that require further review or clarification.

- Tracking and reporting: Use the system to track the status of expenses in the approval workflow. Generate reports for auditing and analysis.

- Final approval and reimbursement: Once all necessary approvals are obtained, the expenses are marked as final and ready for payment. The finance team can process reimbursements or payments.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Regularly audit expenses

- Conduct periodic audits of expenses to identify any inconsistencies or errors. Address any issues promptly to maintain accuracy.

Track changes and revisions

- Keep a record of any changes or revisions made to the expense categorization system.

- Document the reasons for these changes for future reference.

By adhering to these rules and principles, you can establish a solid foundation for consistent and accurate business expense categorization, ultimately leading to improved financial control and reporting.

Next steps

Understanding these common business expense categories empowers finance professionals like you to make informed decisions.

You can use this knowledge to implement effective spend management strategies, control expenses, and increase efficiency.

It’s also crucial to consider automating expense management processes and leveraging AI solutions to reduce manual work and improve accuracy.

Yokoy can support you in setting up an effective expense management system and process. If you’d like to see our software in practice, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.