Home / Business Payments / Smart Corporate Cards / Visa Corporate Cards

Yokoy Platinum Visa Card

Spend safely and limit out-of-pocket expenses while enjoying maximum flexibility and control with the Yokoy Platinum Visa Card. No FX fees.

ISO 27001, ISO 9001, and ISO 14001 certified. GDPR compliant.

Fully integrated for instant expense reports

The smart payment solution for medium and large enterprises.

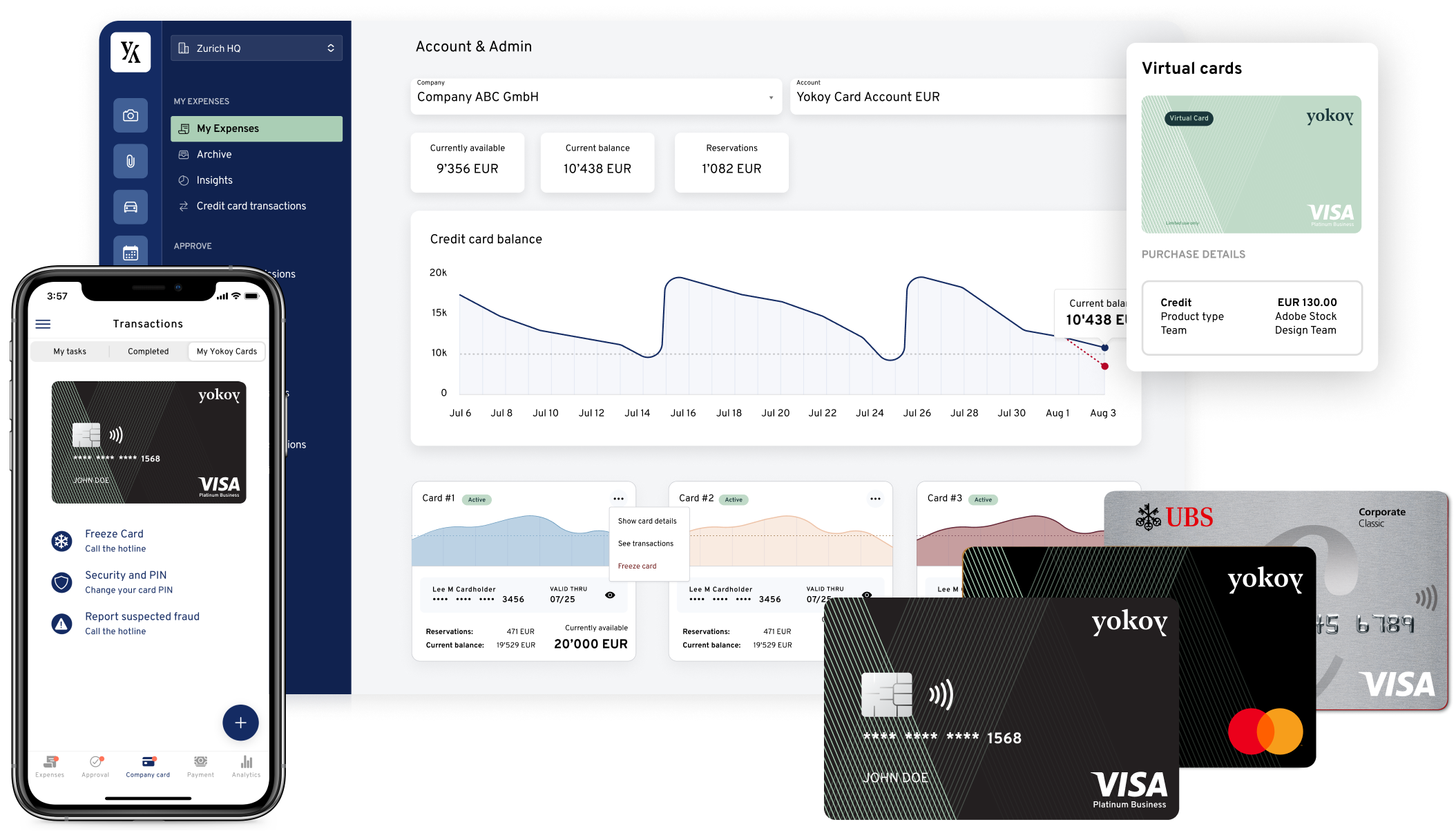

End-to-end visibility

The Yokoy Platinum Visa card is fully integrated into the spend management suite, ensuring full visibility and control over your card payments and corporate spending.

Automated reconciliation

Yokoy automatically links your card transactions to their respective receipts and ensures that they are correctly booked in your accounting system.

Simple administration

See card details and transactions in real time, order new cards and start using them right away, and freeze your cards on the go – all at the touch of a button.

"We chose the Yokoy card as our corporate card because thanks to the zero-fee model, we not only enjoy the ideal solution on the cost side, but at the same time it allows us to avoid a lot of manual administrative work as well as making our spend management much clearer and more efficient."

Peter Grausgruber, former CFO Bitpanda

Physical cards

Order the physical Yokoy Platinum Visa Cards directly in the app and use them right away. Enable your employees to spend without having to pay out of pocket, with the added layer of spend controls.

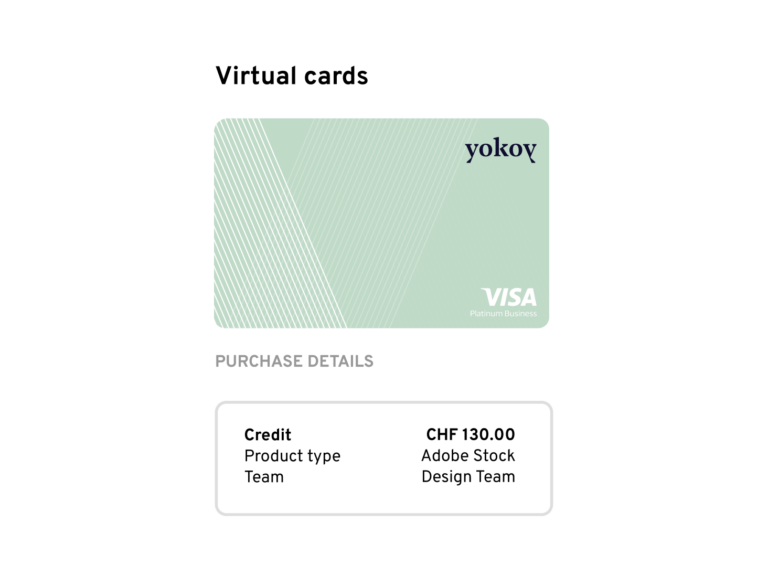

Virtual cards

Get more flexibility without compromising on security or compliance with the virtual Yokoy Platinum Visa Card. Start using it right away and customize the card for one-time payments or merchant-specific transactions, directly in the app.

Yokoy Mobile Payments

Pay securely with

your mobile

Tap to pay everywhere contactless payments are accepted. Just add your Yokoy Platinum Visa Card to Google Wallet to make fast, secure business payments no matter where you go.

Main features

Get to know our Smart Corporate Cards

Secure spending

Freeze and terminate cards in a few clicks. Push notifications for authorisations and detect potential fraud in real time, to prevent unapproved card spending.

Granular spend controls

Allocate funds when and where they’re needed and define spending limits and controls for individual employee cards.

Automated reconciliation

Yokoy automatically imports card transactions and matches them with expenses, speeding up expense reporting, approval, and reimbursement.

Built-in compliance

Decide what types of business purchases your employees can spend money on and Yokoy flags policy breaches automatically to ensure compliance with corporate and regulatory guidelines.

Real-time data

Gain real-time visibility into business expenses and analyze all your card transactions in one central platform with Yokoy’s analytics solution.

Easy card administration

No more lengthy processes – Yokoy makes card ordering and administration a breeze. Issue as many cards as you need and manage them effortlessly through the web or mobile app.

Global card acceptance

Manage your company spending safely across geographies and entities. Our cards are accepted globally thanks to the card network of VISA and Mastercard.

Cashback on every transaction

No card fees, no transaction fees, no foreign exchange fees. Plus, you receive cashback on every transaction.*

Multi entity support

Streamline complex AP and T&E processes across entities and subsidiaries, and standardize your workflows for increased efficiency and control with a central spend management platform.

World-class service and support

Get answers to your questions right away, troubleshoot issues with help from our experts, and improve your knowledge with in-depth live and self-guided Academy trainings.

What our customers say

Yokoy & Visa: Driving financial transformation together

The payment solution for medium and large enterprises.

Press Release: Yokoy Visa Cards for Business Customers

Thanks to its versatility and attractive fee structure, the Yokoy Platinum Visa Card is an ideal debit card solution for companies whose employees operate across Europe.

Webinar: Why You Need Smart Company Cards

What advantages do smart company cards offer? And how can you benefit from them in practice?

Podcast: Business Travel Trends Driving the Future of Spend Management

Learn about the current landscape of business travel, trends in the market, and the biggest challenges we help our clients solve.

Frequently asked questions

Companies from numerous countries can open a Euro account after they pass the relevant KYB checks. The Euro account is located in the EU. Our partner is licensed and regulated by the Central Bank of Ireland as an e-money institution. The general terms and conditions apply.

Virtual cards are like normal corporate cards, but you don’t receive a physical card. Instead, the relevant card details are available inside the Yokoy platform, which also serves as the main tool for ordering a new virtual card. You will receive the virtual card within a few seconds, and you can either use it for a specific purpose for certain payments or authorize certain people to use it. In both cases, the company can decide on restrictions, such as the validity period, the spending limit or when and where the card can be used. This makes the virtual card incredibly secure, flexible and very quick to use.

No, Yokoy Pay is only available in combination with Yokoy Expense. Nevertheless, the greatest benefit is of course the complete package of expense, card, and invoice management, as the interfaces to the ERP system can be used for the entire spend management and everything can also be operated in the same Yokoy application.

Yes, Yokoy integrates with more than 50 solutions, automating your entire spend management process from end to end. At the same time, our API makes it easy to build custom integrations, if you can’t find what you’re looking for. Check our Integrations page for more details.

Yes, although we serve both midsize and large customers, Yokoy’s added value is best experience by global enterprise customers. Our suite is built for complex, global multi-entity configurations, and integrates with most enterprise ERP & HRM tools such as SAP R3/S4 and Successfactors, among others.

This depends on the number of legal entities, the required configurations and integrations, as well as the readiness and responsiveness of the customer project team. For example, a global implementation with 4 legal entities, an ERP system integration, credit card integrations, and SSO setup could take from 2 to 6 months, depending on the level of standardization, the IT landscape and on how quickly required information can be provided. The project scope and duration will be individually assessed with you, by our certified Implementation Partner or our Yokoy Services Team.

Data protection is a top priority at Yokoy. Your data is encrypted both in transit i.e. from your device to Yokoy and at rest in the cloud with a 256Bit AES encryption. Our cloud data is stored exclusively in the EU (Frankfurt, and St. Ghislaine, Belgium). Information about the security of the Google Cloud Data Center can be found here and about the compliance standards we follow can be found here. Last but not least what we as Yokoy do for data security and data protection can be found here.

Given that no two setups are the same, we’ll discuss your specific needs during the sales process, and provide you with a tailored offer that ensures you’ll get the most out of our spend management suite. Request a quote here.

* Yokoy customers receive up to 1% cashback (depending on the chosen plan) on every payment made with a Yokoy Platinum Visa Card up to a maximum cashback amount corresponding to the value of the recurring annual licence fees for Yokoy products. The cashback program is only valid for Yokoy Platinum Visa Cards. The following transactions are excluded from cashback payments: 1. Incoming transfers to your Yokoy account made by you or a third party. 2. Outgoing transfers from your Yokoy account. 3. Withdrawals from ATMs. 4. Chargebacks.

Yokoy explicitly reserves the right to change the cashback percentages paid on transactions with a Yokoy Platinum Visa Card at any time.

** No card fees, card account fees, foreign currency surcharges or transaction fees (in foreign currency/abroad) are charged. Cash withdrawals at ATMs cost 10 Euros per withdrawal. Negative interest: 0.0%.

For our complete cardholder terms, please refer to our Cardholder terms page.

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo