Home / Business Payments / Smart Corporate Cards

Pay the smart way

Simplify your card administration, track global transactions in real time, and keep all expenses under control with Yokoy’s Smart Corporate Cards.

ISO 27001, ISO 9001, and ISO 14001 certified. GDPR compliant.

Business payments, fully automated

The smart company cards for medium and large enterprises.

Pay securely, online and offline

Create virtual cards for secure online payments or category-restricted cards for specific spend categories.

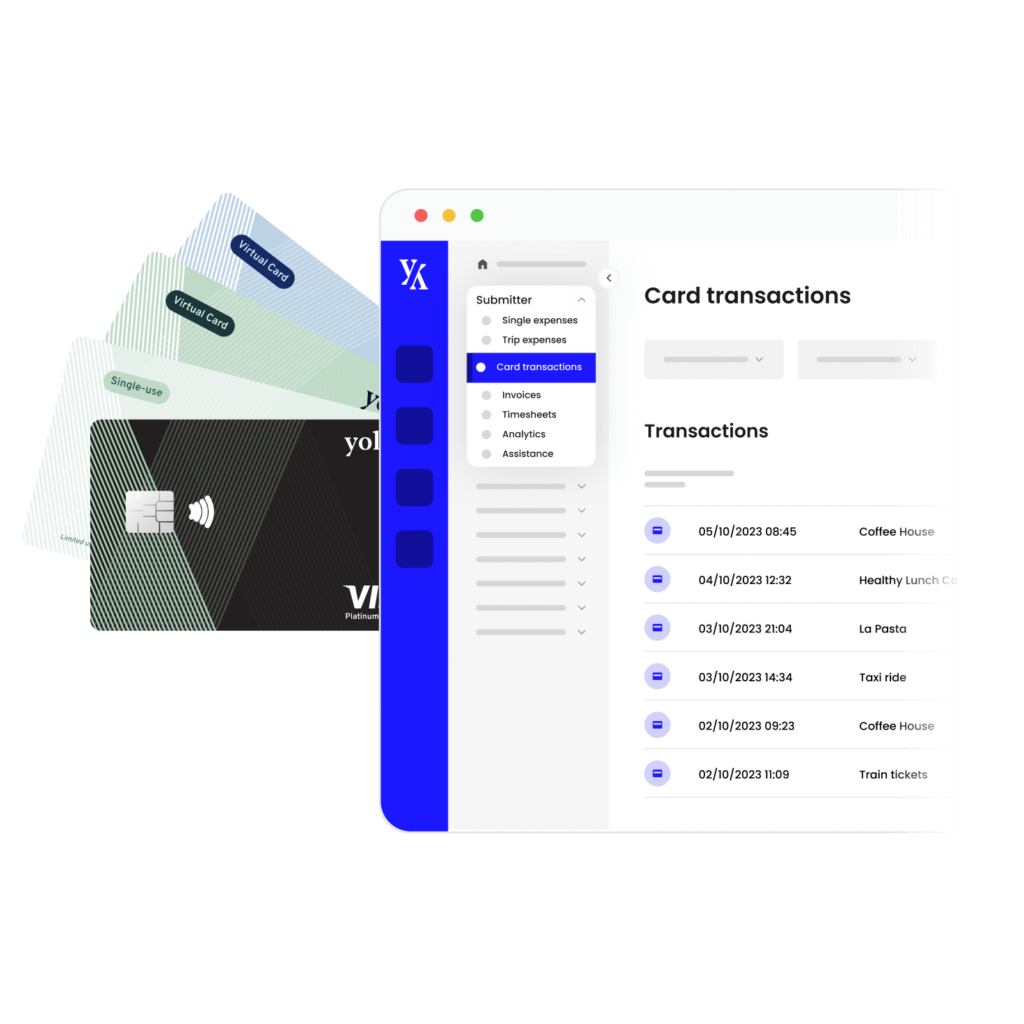

Track your spend in real time

View all payments in one platform and gain real-time transparency. No need to wait until the end of the month.

Spot outliers automatically

Identify spend anomalies quickly and flag them for later, ensuring internal and external policies are followed and risks are mitigated.

Available within EU, Switzerland, & UK

Yokoy Platinum Visa Card

Spend safely and limit out-of-pocket expenses while enjoying maximum flexibility and control with the Yokoy Platinum Visa Card. No FX fees.

- End-to-end spend visibility

- Individual spend limits

- Automated transaction reconciliation

- Simple administration

- Natively integrated into the Yokoy suite

Available within Switzerland

UBS Corporate Cards

Automate your spend management process and gain full control with the integrated card solution by Yokoy and UBS.

- Physical cards

- Automated reconciliation

- Full visibility into spend

- Manage your cards in the Yokoy suite

Available within EU, Switzerland, & UK

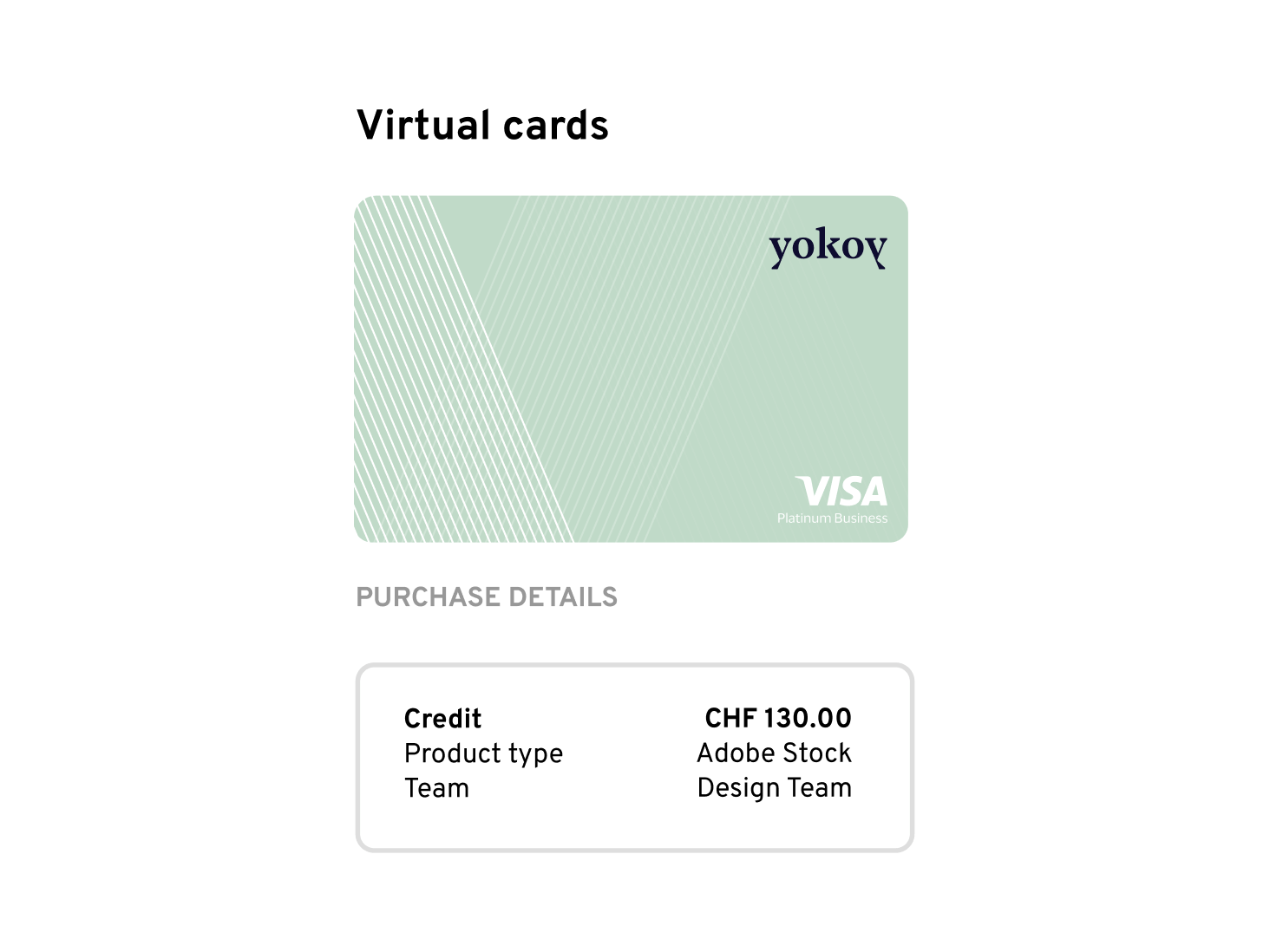

Yokoy Platinum Visa Card (Virtual)

Get more flexibility without compromising on security or compliance with the virtual Yokoy Platinum Visa Card. Start using it right away and customize the card for one-time payments or merchant-specific transactions, directly in the app.

-

Order cards in seconds

-

Reduce the risk of fraud

-

Track spend in real time

-

Suitable for online and offline transactions

-

Ideal for contract workers and non-frequent travellers

Planted keeps spend under control with Yokoy

“A corporate card should be secure and uncomplicated – and this is exactly what the Yokoy Mastercard offers. In addition, the card is smart, saving us significant time.”

Christoph Jenny, Co-founder Planted

Yokoy Mobile Payments

No wallet? No problem.

With Apple Pay, you can pay quickly and easily with your Yokoy Platinum Visa card right from your iPhone or Apple Watch.

Yokoy Mobile Payments

Pay securely with

your mobile

Tap to pay everywhere contactless payments are accepted. Just add your Yokoy Platinum Visa card to Google Wallet to make fast, secure business payments no matter where you go.

Yokoy Smart Lodge Card

One card for all your

travel bookings

Securely pay for flights, rail, hotels*, and business travel services with one central Smart Lodge Card, fully integrated with your travel management provider. No transaction fees, no foreign exchange fees, no card fees*.

What our customers say

Main features

Get to know our Smart Corporate Cards.

Automated reconciliation

Yokoy automatically imports card transactions and matches them with expenses, speeding up expense reporting, approval, and reimbursement.

Granular spend controls

Allocate funds when and where they’re needed and define employee spending limits and controls for individual employee cards.

Built-in compliance

Decide what types of business purchases your employees can spend money on and Yokoy flags policy breaches automatically to ensure compliance with corporate and regulatory guidelines.

Secure spending

Freeze and terminate cards in a few clicks. Push notifications for authorisations and detect potential fraud in real time, to prevent unapproved card spending.

Real-time data

Gain real-time visibility into business expenses and analyze all your card transactions in one central platform with Yokoy’s analytics solution.

Easy card administration

No more lengthy processes – Yokoy makes card ordering and administration a breeze. Issue as many cards as you need and manage them effortlessly through the web or mobile app.

Global card acceptance

Manage your company spending safely across geographies and entities. Our cards are accepted globally thanks to the card network of VISA and Mastercard.

Cashback on every transaction

No card fees, no transaction fees, no foreign exchange fees. Plus, you receive cash back on every transaction.*

Multi entity support

Streamline complex AP and T&E processes across entities and subsidiaries, and standardize your workflows for increased efficiency and control with a central spend management platform.

World-class service and support

Get answers to your questions right away, troubleshoot issues with help from our experts, and improve your knowledge with in-depth live and self-guided Academy trainings.

Simplify your invoice management

Book a demoThe Yokoy impact

See how we contribute to our customers’ success stories.

Frequently asked questions

Yes, you can buy each Yokoy module separately. However, using the full suite provides greater benefits, as you can manage your expenses, invoices, and card payments in one central platform, and you can reduce system and data silos by simplifying ERP integrations.

Yes, Yokoy integrates with more than 50 solutions, automating your entire spend management process from end to end. At the same time, our API makes it easy to build custom integrations, if you can’t find what you’re looking for. Check our Integrations page for more details.

Yes, although we serve both midsize and large customers, Yokoy’s added value is best experience by global enterprise customers. Our suite is built for complex, global multi-entity configurations, and integrates with most enterprise ERP & HRM tools such as SAP R3/S4 and Successfactors, among others.

This depends on your IT landscape and the required configurations and integrations. For example, a global implementation with 2 legal entities, an ERP system integration, credit card integrations, and SSO setup takes about 2 months. The projects are carried out either by the Yokoy Services team or a certified Implementation Partner.

Yes, our Implementation team will lead the project from planning to implementation and testing, and will coordinate training workshops for your team. Global enterprise customers benefit from a dedicated Key Account Manager and financial process consulting from our in-house finance experts.

We use modern data encryption standards for both stored data and data in transit. Additionally, we work with external penetration testers (hackers) to constantly challenge our platform’s vulnerabilities. We adhere to local regulations such as GDPR in the EU or the Swiss Data Protection Act, to deliver the best data protection standards.

Given that no two setups are the same, we’ll discuss your specific needs during the sales process, and provide you with a tailored offer that ensures you’ll get the most out of our spend management suite.

* Yokoy customers receive up to 1% cashback (depending on the chosen plan) on every payment made with a Yokoy Platinum Visa Card up to a maximum cashback amount corresponding to the value of the recurring annual licence fees for Yokoy products. The cashback program is only valid for Yokoy Platinum Visa Cards. The following transactions are excluded from cashback payments: 1. Incoming transfers to your Yokoy account made by you or a third party. 2. Outgoing transfers from your Yokoy account. 3. Withdrawals from ATMs. 4. Chargebacks.

Yokoy explicitly reserves the right to change the cashback percentages paid on transactions with a Yokoy Platinum Visa Card at any time.

** No card fees, card account fees, foreign currency surcharges or transaction fees (in foreign currency/abroad) are charged. Cash withdrawals at ATMs cost 10 Euros per withdrawal. Negative interest: 0.0%.

For our complete cardholder terms, please refer to our Cardholder terms page.

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo