Home / The Impact of Corporate Cards on Finance Transformation

The Impact of Corporate Cards on Finance Transformation

- Last updated:

- Blog

Across the globe, not only fintech companies but businesses of all sizes are embracing new technologies and digital finance solutions, with corporate cards playing a key role in this shift. In fact, organisations are increasingly adopting AI-powered platforms to handle growing complexities in payment processes and expense management. At the heart of this finance transformation is the drive to streamline operations, boost efficiency and improve decision-making through analytics.

Corporate cards, which can help finance leaders manage expenses much more easily and swiftly, are a great leap in these shifts. This payment solution is not just a tool for managing employee expenses; it’s evolved into a crucial instrument for automating financial processes, enhancing visibility into company spending, and making compliance easier.

If you want to learn where and how corporate cards can help your company, this article will show you the significant influence company cards can have on your finance transformation.

The role of corporate cards in finance transformation

Corporate cards have become indispensable in the ongoing digital transformation of finance, playing a pivotal role in automating day-to-day financial operations. These debit or credit cards not only enable transaction automation but also dramatically improve overall efficiency by reducing manual workloads and streamlining complex expense processes. By automating expense reporting, finance teams can transition away from bulky, error-prone manual inputs, freeing up time to focus on value-adding tasks such as strategic planning and forecasting.

Additionally, corporate credit cards provide finance teams with far greater visibility into expenses. Transactions—especially digital payments—are captured in real-time and automatically categorised, giving Chief Financial Officers (CFOs) and finance leaders accurate, up-to-date information. This immediate visibility is critical for managing cash flow, one of the most essential drivers of a business’s competitiveness and financial health. With deeper insights into their business expenses, companies can manage liquidity more effectively, ensuring they have sufficient funds for growth and investments or to optimise their use of business credit.

Furthermore, smart corporate cards offer enhanced control over company spending. Finance teams can set tailored spending limits for individual employees, restrict card usage to specific merchant categories, and deactivate cards instantly if fraud or unauthorised transactions are detected. This level of flexibility and control not only improves risk management but also bolsters security, ensuring that company funds are used responsibly and in compliance with internal policies. By offering these comprehensive controls, corporate cards are transforming the way businesses approach expense management and financial governance.

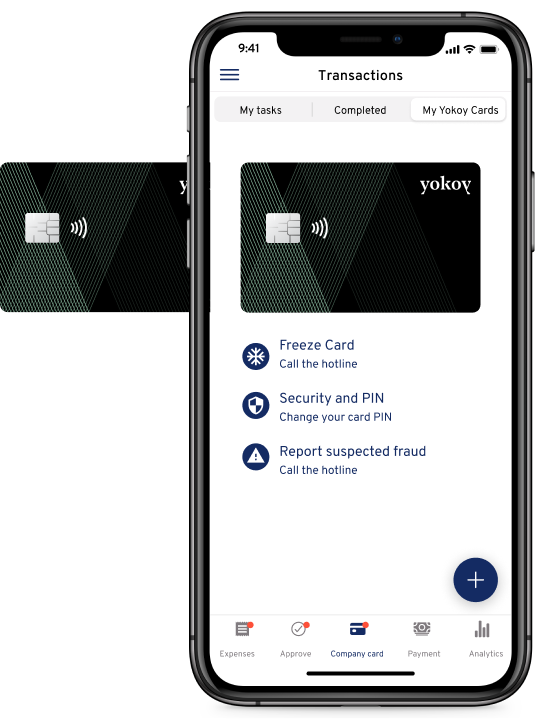

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Challenges of using corporate cards without a unified platform

While corporate cards are powerful tools, they can introduce significant challenges when integrated into legacy finance platforms. Without a seamless connection between card payment and financial systems, companies often lack insight and risk inefficiencies in expense management.

In the hospitality industry, for instance, managing travel expenses for a large number of employees without a unified platform can be highly inefficient. Each transaction needs to be manually tracked and reconciled, leading to delays in reporting and errors in expense categorisation. This can result in increased operational costs, as finance teams need to dedicate more time to auditing transactions, ensuring compliance, and addressing fraud risks. For retail companies that rely on vendor relationships, a fragmented expense management system can slow down payment cycles and create liquidity challenges.

Siloed data: When transactions of a corporate card are processed outside of a unified platform, they are often managed in isolation from other financial data. This fragmentation is called a data silo and it can lead to inaccurate or delayed expense reporting, making it difficult for finance teams to understand company expenditures.

Lack of real-time insights: In a fast-paced, digitalised business environment, real-time insights are critical for making informed decisions. Companies that don’t integrate their corporate card systems with finance platforms lack up-to-date access to transaction data. This can delay responses to cash flow issues or spending anomalies.

Bad user experience: Cardholders often struggle with outdated and inefficient systems for managing their expenses without a unified platform. This can lead to delays in reimbursement or inaccuracies in tracking and may end up ruining the overall user experience.

Control and compliance issues: Managing multiple cards across departments without a centralised platform to have oversight of global payments and other business expenses, makes it difficult for finance leaders to enforce spending policies or ensure compliance with regulatory standards.

The importance of a seamless integration between corporate cards and finance platforms

Now, let’s look into the upsides of seamlessly integrating corporate cards into finance platforms to fully unlock the potential of corporate cards. Such integration streamlines data flow, enhances reporting capabilities, and enables more effective governance.

Streamlined data flow: When corporate cards are integrated into financial platforms, data is exchanged seamlessly between the card provider and the expense management system. This automated process eliminates the need for manual data entry, reducing possible human error.

Capture expenses in real-time: Integrated systems capture expenses in real-time, providing finance teams with up-to-the-minute insights into company spending. This not only ensures that every data of the payment process is immediately available for review but is also critical for managing cash flow effectively.

Real-time reporting and forecasting: The aforementioned real-time insights into current expenses not only support more accurate forecasting but also allow businesses to adapt quickly to changes in financial conditions. By having access to up-to-the-minute data, companies can identify trends, predict future needs and make timely adjustments to their budget plans. This enhanced ability to forecast improves decision-making, ensuring that finance leaders can allocate resources efficiently and mitigate potential financial risks.

Enhanced control and governance: A unified platform allows businesses to set tighter spending controls. Finance teams can set card-specific spending limits, automate approval workflows, and flag suspicious transactions immediately. This level of control helps to stay compliant with internal policies and external regulations.

Blog article

Why Smart Corporate Cards Are a Must for Businesses

Payment methods have been undergoing a massive modernization phase, and the traditional corporate credit card is no exception. But the real question is, are these cards truly smart or just another gimmick?

Francesca Burkhardt,

Product Marketing

Introducing Yokoy Pay: Corporate cards with an AI-driven finance platform

With Yokoy Pay, you can integrate corporate cards—debit cards or virtual cards—with a powerful, AI-driven finance platform. Not only can you handle debit cards or virtual cards, but you can also use a range of advanced features that come in handy to optimise your company’s expense management processes further.

Let’s have a look:

Automated reconciliation

Yokoy Pay dramatically speeds up expense reporting by automatically importing and matching corporate card transactions with corresponding receipts. This cuts down manual labour while ensuring accuracy and eliminating delays. Your finance teams no longer need to chase down missing receipts, as Yokoy’s AI-powered zero-touch system fills in missing details and categorises expenses without human intervention.

AI-driven expense optimisation

Yokoy’s platform uses artificial intelligence and machine learning to analyse spending patterns and identify opportunities for cost savings. Highlighting inefficient spending areas allows your company to optimise its budgets and allocate resources more effectively. The AI also ensures expenses are categorised correctly, and every policy breach is automatically flagged, reducing the risk of non-compliance.

Seamless integration

Yokoy integrates seamlessly with enterprise-resource-planning (ERP) systems and other financial tools, enabling your company to centralise all payments and expenses in one unified platform. This creates real-time visibility into your business’s finances and eliminates the need for multiple disconnected systems, ensuring streamlined operations and reducing the administrative burden. With all financial data in one place, your finance teams can easily access and analyse comprehensive reports, leading to faster decision-making and improved collaboration across departments. Moreover, the integration ensures that compliance and auditing processes are simplified, as all records are automatically tracked and accessible from a centralised source.

Custom controls

With Yokoy Pay, your finance team can create highly customised spending controls for your corporate cards: Every individual card can get a limit or be restricted to purchases only specific categories or rules based on your company’s sustainability policy can be set, such as limiting travel bookings to public transports. This level of granular control helps to ensure that all spending aligns with corporate guidelines and enhances financial governance.

Real-time insights

Yokoy provides real-time data on all transactions, allowing your finance teams to monitor spending as it happens — wherever it happens. This transparency enables better, data-driven decision-making, more accurate forecasting, and immediate action if anomalies are detected. With instant access to real-time financial information, your teams can identify spending patterns, track potential risks, and prevent budget overruns before they occur. You can track budgets globally, adjust spending limits in real time, and ensure that resources are allocated effectively to meet strategic goals. This level of responsiveness improves operational efficiency and strengthens overall financial governance.

Global compatibility

Yokoy’s corporate cards are globally compatible, offering automatic currency conversion and the ability to make payments in multiple currencies without excessive foreign exchange fees. For instance, your employees can use the physical Yokoy Platinum Visa Card or the digital version on their smartwatch. This is crucial for your company if you operate across borders, as it simplifies international payments and reduces the risk of costly errors in currency conversion.

Built-in security with proactive fraud detection

You can rest assured that security is a top priority with Yokoy Pay. The platform offers robust fraud detection mechanisms, including real-time transaction monitoring, AI-driven anomaly detection, and immediate alerts for suspicious activity. Your finance team can block cards or restrict usage instantly to prevent unauthorised transactions, significantly reducing fraud risk.

Next steps

As businesses continue to embrace digital transformation, staying ahead of the curve will be critical for maintaining competitiveness. By adopting solutions like Yokoy Pay, companies not only reduce operational risks and boost efficiency but also empower their finance teams to make smarter, data-driven decisions that contribute to long-term growth. Whether you’re a small business or a large enterprise, investing in the right finance technology will help you future-proof your operations.

Corporate cards have become indispensable tools for driving finance transformation. Yokoy Pay is the future-proof solution to help businesses revolutionise expense management with its AI-powered zero-touch platform.

Find out how adopting an integrated corporate card solution can streamline your finance processes, reduce risk and enhance decision-making.

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.