Home / Pay Securely Online with Virtual Cards

Pay Securely Online with Virtual Cards

- Last updated:

- Blog

Online payments are a huge convenience, but on the other hand, let’s face it: Keeping your business’s financial details safe is a growing concern. Imagine setting up a subscription for your team, but you’re worried about using the main business credit card for this transaction. But rest assured, a solution is on the horizon: Virtual cards!

Unlike physical cards, which are always at risk if details get stolen, a virtual corporate card can be generated instantly, with a unique card number, that can also expire right after its use so that even hackers cannot use the card again.

Of course, you can also use this virtual credit card for more than one purchase and use it like a virtual debit card to handle recurring subscriptions. It’s simple to create a new corporate card tailored exactly to what you need. Plus, with customisable spending limits and real-time tracking, you can keep a close eye on your business expenditures, giving your financial leaders extra peace of mind and control. Introducing virtual cards lets you skip the worry while keeping your online transactions secure and flexible.

How virtual cards work for secure online payments

Virtual cards function by generating unique card details, such as a card number, security codes (CVC or CVV), and expiration date. They are similar to physical cards but with one major difference: these details can be temporary. Cards can expire after a single use or a specific transaction, which comes in very handy for online payments. Additionally, they are stored digitally, which eliminates the need for a physical card and reduces the risk of loss or theft.

Since virtual company cards can be used with Google Pay, Apple Pay, and other digital wallets, they simplify online and in-app purchases by integrating them with existing payment methods.

Another benefit of virtual cards is that they offer real-time tracking, allowing businesses to monitor transactions instantly. Spending limits can be customised for each card, giving companies full control over how much is spent and where. Plus, since the card information is stored in a digital wallet, virtual cards eliminate the risk of losing a physical card, adding another layer of security.

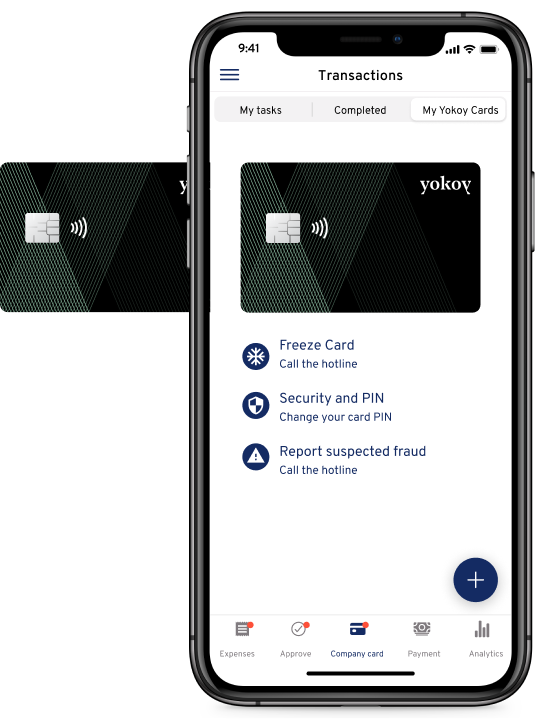

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Fraud prevention and security benefits of virtual cards

Virtual cards come equipped with advanced security features that help businesses significantly reduce the risk of fraud. Fraudsters and hackers have no easy game stealing and misusing virtual credit card information.

Let’s look at other security features:

Fraud prevention

Virtual cards are designed to prevent fraud by limiting opportunities for unauthorised access and misuse.

One-time use functionality: The most effective feature might be the option to generate a virtual card for one-time use only. This means the virtual card details expire after a single transaction, rendering them useless for future attempts. If card details are exposed through a security breach or hacker attack, they cannot be reused, which drastically lowers the risk of fraud.

Immediate cancellation: Virtual cards can be instantly deactivated or cancelled by the user or finance team’s administrator. This immediate action stops any further transactions, helping businesses quickly shut down any suspicious activity and protect their accounts from threats or losing money.

Customisable security settings: Businesses can tailor each virtual card’s security settings to meet their specific needs. This includes setting custom spending limits, restricting use to certain merchant categories, or limiting the card’s validity period. These settings provide an extra layer of control over who can access and use the card, reducing the likelihood of unauthorised payments.

Minimised exposure

With virtual cards, businesses minimise the exposure of their financial information. Single-use cards may be restricted to a single transaction, lowering the risk of sensitive financial information being intercepted or misused in the event of a data breach. The use of virtual credit card numbers can be cut short, greatly reducing the window of opportunity for fraud.

Controlled spending

Virtual cards allow businesses to define precise spending limits for each card, ensuring that only authorised budgets are spent. This level of control helps prevent both accidental overspending and fraudulent use. Transactions with virtual corporate cards can be monitored in real time, giving finance teams full visibility over digital payments.

By integrating virtual card payments with real-time notifications, finance teams can act quickly if any unusual or fraudulent spending occurs.

The flexibility of virtual cards for online payments

Virtual cards offer the flexibility that modern businesses need, with fast card issuance, custom controls, and seamless tracking and analytics capabilities.

Let’s dive deeper into these key aspects:

Instant issuance: Virtual cards can be issued with just one click, making the new virtual card available in seconds for the next purchase. They can also be used as virtual travel cards for employees who need to make one-time purchases while on a business trip. The card issuer can also predefine expiration dates or spend limits to category restrictions.

Vendor-specific restrictions: Virtual cards give businesses the ability to limit usage to specific merchant categories or categories of spending. This level of control prevents unauthorised purchases, reduces the chances of fraud and makes budgeting much easier.

Expense tracking: With real-time expense tracking, virtual cards provide a clear and immediate overview of all transactions made. Each purchase is recorded instantly, allowing finance teams to monitor spending in real time, simplifying reconciliation and improving transparency. Business expenses can be analysed, which helps businesses maintain an accurate record of spending without waiting for end-of-month statements.

Set spending limits: Smart virtual corporate cards allow businesses to customise spending limits for each card. Spending amounts and spending frequency can be set up from the beginning and adjusted later if needed. This is particularly beneficial for managing team budgets or one-off project expenses, ensuring that employees only spend within approved limits.

Integrations: Another key feature of virtual cards is their ability to integrate with existing business systems such as expense management software, accounting platforms and ERP systems. These integrations streamline the payment and reconciliation process, automatically syncing data between systems. This not only saves time, but reduces manual errors and helps businesses maintain up-to-date financial records.

Blog article

Why Smart Corporate Cards Are a Must for Businesses

Payment methods have been undergoing a massive modernization phase, and the traditional corporate credit card is no exception. But the real question is, are these cards truly smart or just another gimmick?

Francesca Burkhardt,

Product Marketing

Introducing Yokoy Pay and Yokoy’s Virtual Cards

Now that we have learned about the benefits of virtual cards let’s introduce you to an all-in-one solution that can streamline your company’s payments: Yokoy Pay offers your business an easy-to-use virtual card solution. With instant virtual card generation and AI-driven automation, Yokoy helps you manage global online transactions or subscriptions, as well as business travel. By leveraging advanced security features and real-time tracking, Yokoy helps your company minimise exposure to fraud while keeping your spending in check all the time.

But let’s take a closer look at Yokoy’s key features:

Instant virtual card generation

Yokoy’s platform allows your finance team to generate virtual cards with just a few clicks. This gives you the ability to make immediate purchases without waiting for physical cards to arrive or having to go through long approval processes. Whether for a specific transaction or ongoing vendor relationships, Yokoy Pay ensures that your business can respond quickly to purchasing needs. This feature also helps your business manage remote teams or project-based expenses without delay, providing a flexible solution for any spending situation. These virtual cards are designed to work seamlessly with popular payment methods like Visa, Mastercard, and major mobile wallets.

Enhanced security features

The virtual cards come with a variety of enhanced fraud protection features, including one-time-use cards, customisable spending limits and the ability to cancel or deactivate cards if needed instantly. In addition, Yokoy’s zero-touch solution includes an AI-driven fraud detection that flags suspicious transactions. These layers of protection help minimise the risk of unauthorised transactions and ensure that only authorised users can access funds. By not being directly linked to a business bank account and offering only temporary card details, Yokoy’s virtual cards provide a safe and secure way to handle online payments.

Real-time tracking and reporting

Yokoy is a solution that offers real-time visibility into transactions. Your finance team can track every payment instantly, which enhances transparency and simplifies the reconciliation process. With the given analytics, the platform helps monitor spending patterns, identify potential issues early and maintain compliance with internal rules. This level of oversight ensures that your company has complete control over its digital transactions.

Global compatibility

Yokoy’s virtual cards are designed for international use, making them compatible with international vendors across multiple currencies. This global reach enables your firm to manage its payments seamlessly, no matter where employees or partners operate. Whether you’re making online purchases, booking services, or managing expenses across borders, Yokoy Pay and Yokoy’s smart corporate cards offer the flexibility to handle transactions worldwide.

AI-driven automation

One of Yokoy’s standout features is its integration of AI-driven automation. Yokoy’s platform streamlines routine tasks such as expense reconciliation, transaction categorisation and fraud detection. This automation not only saves time for finance teams but also reduces the chances of manual errors or the risk of fraud. AI technology significantly enhances efficiency and optimises your finance team’s workflows. In combination with real-time tracking and analytics, these AI-driven insights give your business a strategic advantage in managing payments more efficiently.

Next steps

Ready to take control of your online payments and protect your business from fraud? Discover how Yokoy’s virtual cards can streamline your payment process with instant card generation, enhanced security features, and real-time tracking. See how Yokoy’s solutions can transform the way you manage digital transactions, and book a demo today!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.