Home / Card Payments Unlocking Easier Travel Administration

Card Payments Unlocking Easier Travel Administration

- Last updated:

- Blog

The digital-first world keeps businesses managing travel expenses like never before. Managing an endless number of receipts, credit card chargebacks, and cross-border payments can be challenging for every finance team. Modern payment technologies can combine ease of use with financial oversight, while traditional methods that often require time-consuming manual payment processing, tracking, and reconciliation are a thing of the past.

In this maze, smart corporate cards and digital payments offer streamlined travel administration and efficient expense management. Imagine an employee travelling abroad for an important client meeting; they simply use (virtual) corporate cards for all travel expenses. With each transaction recorded in real-time, the employee and the finance team gain instant transparency. Finance leaders no longer wait for end-of-month statements or sift through various bank statements or receipts of debit cards, as each transaction is securely logged and automatically categorised.

The benefits go far beyond convenience in functionality: Real-time visibility into travel expenses allows businesses to maintain tight control over cash flow, adhere to budgets, allow Accounts Payable (AP) managers to oversee spending as it occurs and enforce travel policies.

Let’s find out if they can also empower your company to manage travel expenses efficiently while offering employees flexibility in payment methods and seamless payment experiences!

The importance of company cards in global travel

Managing employee travel across borders presents unique challenges, including varied currencies, complex regulations, secure payment systems, and acceptance issues. Employees frequently cover upfront costs for travel, accommodation, meals or local transport from their private bank account or Mastercard. They must later file detailed expense reports to finance teams, a time-consuming process with long reimbursement timelines that can cause financial strain.

Corporate cards provide a seamless alternative for companies and their employees: Instead of using personal accounts, employees pay directly with a virtual or physical company card, which is instantly recorded. This automated system saves time and hassle for employees and shortens approval timelines, creating an efficient customer experience.

Furthermore, these cards offer universal acceptance across payment platforms and payment gateways, removing barriers associated with cash and currency exchange. This global reach simplifies travel payments for finance teams and enables seamless management across diverse regions.

With virtual corporate cards, real-time oversight of expenses is available, enabling finance leaders to track and control spending as it occurs. Policies are maintained through automated spending limits, pre-set categories and customisable controls, allowing companies to enforce travel policies consistently, reduce the risk of fraud, and eliminate administrative overhead.

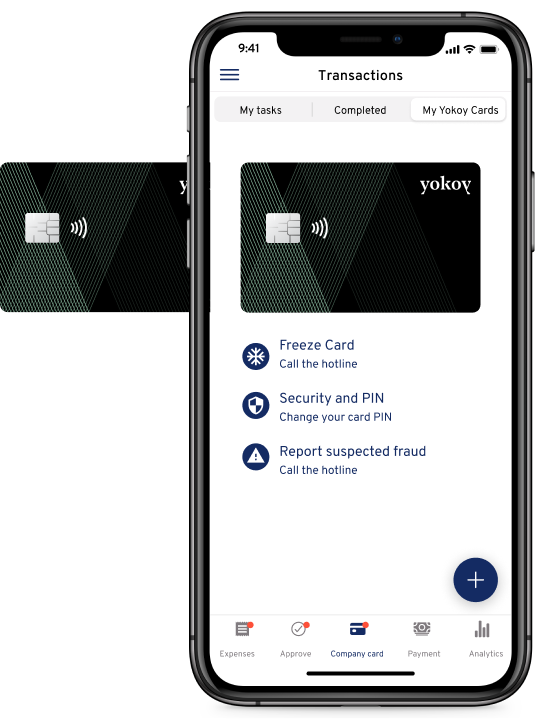

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

The growing need for transparency and oversight in travel administration

Transparency in travel administration provides companies with the clarity and oversight needed to navigate the complexities of business travel. Companies investing in global travel need greater oversight to manage costs effectively.

By enabling real-time tracking and centralised control, this transparent data transforms travel administration into a streamlined, proactive process, helping companies manage expenses more effectively while supporting financial integrity.

Real-time visibility: Real-time visibility into travel expenses is a crucial asset in the travel industry, as it helps travel businesses and companies streamline their cash flow and minimise the risk of overspending. With instant access to payment processing data from credit cards, virtual cards and other digital payments, finance teams can monitor costs as they happen, flagging any out-of-policy purchases immediately. This secure payment feedback loop helps prevent minor discrepancies from snowballing into larger financial issues and helps ensure spending complies with travel policies and budgets.

Data-driven decision-making: Transparent, real-time data empowers companies to make informed, data-driven decisions about travel policies, pricing strategies and budgets. With accurate and timely insights from diverse payment systems and platforms, finance leaders can identify spending trends, such as high costs in specific currencies or vendors with high transaction volumes. This enables them to negotiate better rates with online travel agencies (OTAs) or adjust travel policies proactively. For instance, companies might encourage early online bookings to reduce overall expenses if travel payments show consistently high costs for last-minute online bookings.

Centralised management: Centralised management of travel expenses allows for a streamlined overview of all travel payments, consolidating data from various currencies, payment methods and payment platforms — including credit cards, debit cards or bank transfers. This centralisation is particularly valuable for intermediaries managing complex travel bookings, providing a unified view of the company’s revenue streams and expenses across departments and regions. Centralised management also supports compliance and security features, simplifying audits by ensuring secure payments and expenses align with internal policies and regulatory requirements.

Streamlining travel administration with card payments

Card payments have modernised travel administration by replacing outdated methods or cash payments with streamlined, automated systems. By using company cards for travel expenses, businesses save time, increase efficiency and minimise the need for tedious expense reports.

Here’s how smart card payments help streamline business travel administration:

One consistent method for all expenses: Using a single, consistent payment method for all travel-related expenses simplifies the process for both employees and finance teams. Employees no longer have to juggle multiple payment options or keep track of cash expenses, as they can rely on their company card for everything from flights to meals. This consistency reduces the risk of errors and creates a clear, unified record of all travel spending, making it easier for finance teams to track and manage costs across the board.

Automated reconciliation: Card payments enable automated reconciliation, removing the need for time-consuming, error-prone manual data entry and review. When an employee makes purchases with their corporate card, transaction details are automatically captured and categorised in real-time. This streamlining reduces the administrative burden on finance teams, minimises human error, and provides an up-to-date view of travel expenses. Automated reconciliation also accelerates cash-flow analytics, freeing up finance teams to focus on higher-value tasks instead of painstakingly cross-checking expenses.

More choice and control: Corporate cards give businesses greater control over expenses, allowing finance teams to set spending limits, restrict usage to specific categories, or implement policy guidelines directly. This ensures that spending remains within budget and aligns with company policies without requiring constant oversight. For employees, the flexibility of a company card offers more choices in managing their day-to-day travel expenses, making their trips more seamless and efficient.

No need for expense reports: With modern corporate card payments, traditional expense reports are largely eliminated. Rather than manually compiling a report of their travel expenses, employees simply use their company cards and upload receipts as they go. This reduces the administrative load on employees, speeds up the approval process, and shortens reimbursement timelines. Finance teams can access all relevant data instantly, cutting out the back-and-forth typically involved in verifying and approving expense reports.

Cross-border payments with ease: For international companies, cross-border payments are often a headache due to differences in currencies, banking systems, regulations and payment acceptance. Modern corporate cards like Mastercard or Visa can be used and are widely accepted globally. With automatic currency conversion, they provide a seamless payment experience wherever employees travel. This eliminates the need for currency exchanges or managing multiple payment types and simplifies consolidating expenses from various locations.

Blog article

Why Smart Corporate Cards Are a Must for Businesses

Payment methods have been undergoing a massive modernization phase, and the traditional corporate credit card is no exception. But the real question is, are these cards truly smart or just another gimmick?

Francesca Burkhardt,

Product Marketing

Optimising travel management with Smart Lodge Card and Yokoy Pay

Optimising travel management with solutions like Smart Lodge Card and Yokoy Pay provides your company with an advanced, efficient way to handle travel expenses. You can enhance cost control, help ensure compliance and get real-time oversight. With the modern payment solutions included in Yokoy Pay, your travel expense management can be significantly simplified and deliver accurate, transparent data to meet the needs of both your employees and finance teams.

Let’s show you how Yokoy Pay and our Smart Lodge Cards can make your life easier:

Global Reach

With Smart Lodge Card and Yokoy Pay, your company can easily manage global travel, thanks to universal acceptance and support for multiple currencies. Your employees can use these cards virtually anywhere without worrying about currency exchanges or limited payment options. This seamless cross-border functionality centralises travel expenses in one system, allowing your finance team to gain real-time visibility and a standardised record of international travel costs. This simplifies both reconciliation and overall financial oversight, making global expense management easier than ever.

Customisable limits and controls

Yokoy Pay gives your company the flexibility to set specific spending limits and controls based on department, role, or type of trip. For example, a sales executive attending an international conference may have different spending limits than an associate attending regional training. Your finance team can adjust these controls to align travel spending with corporate budgets and financial goals. This way, your finance team is assisted in policy compliance without having to micromanage every transaction, ensuring efficient and effective oversight.

Compliant with company and regulatory policies

Built-in, automated compliance checks categorise each transaction according to company policy, immediately flagging any out-of-policy expenses. This automation helps your finance team reduce the risk of non-compliance, simplifies audits, and helps with its analytics to keep reporting ready at all times. Your team can access a complete, secure record of travel expenses, making compliance a seamless part of everyday travel management.

Integrated travel expense management

Yokoy Pay’s complete integration with travel expense management platforms gives your finance team a centralised dashboard for managing and approving all travel-related expenses. With API integration from various sources, this unified view reduces administrative workload and ensures transparency, allowing your team to track, categorise, and validate expenses in one place. By streamlining payment processing and expense tracking, these solutions help your company accurately capture every travel expense, supporting efficiency and greater control over spending.

AI-driven cost optimisation

With AI-powered insights, Smart Lodge Card and Yokoy Pay help your finance team identify patterns in travel spending to uncover potential savings. The AI might highlight negotiating opportunities with frequently used vendors, helping you proactively manage costs. These data-driven recommendations align with your company’s financial goals, giving your finance team the tools to reduce expenses, improve adherence to policies and make informed decisions that maximise cost efficiency.

Increased flexibility

Yokoy’s solutions offer employees the flexibility to cover various travel expenses, from flights and hotels to meals and incidentals — all while maintaining financial control. This flexibility minimises the need for out-of-pocket expenses and streamlines expense management for everyone involved. Your employees can adapt to changing travel needs without complication. At the same time, your finance team can monitor spending in a single, secure platform that consolidates all transactions for better transparency and oversight.

Real-time data visibility

Real-time visibility is essential for travel management, and Yokoy provides your finance team with immediate insights into all travel-related expenses. Tracking each transaction as it happens and spotting any policy violations or unusual patterns immediately makes it easier to get an up-to-date overview. With these real-time data insights, your company can ensure all expenses align with financial goals, supporting proactive budgeting and strategic decision-making in a dynamic business environment.

Next steps

Ready to simplify your travel administration and gain real-time control over expenses? Discover how Smart Lodge Card and Yokoy Pay can transform your travel management with customisable controls, global reach, and AI-driven insights.

See for yourself how Yokoy can help streamline your travel expenses and boost your team’s efficiency. Book a demo today!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.