Home / Automatic Receipt Extraction: Remove Manual Data Entry with OCR and AI Technology

Automatic Receipt Extraction: Remove Manual Data Entry with OCR and AI Technology

- Last updated:

- Blog

Growth Marketing Manager

Manual data entry for processing receipts is time-consuming and prone to errors, leading to significant challenges in accounts payable and expense management.

However, there’s a solution that can streamline this process and save valuable time: receipt processing automation using OCR technology and artificial intelligence.

In this article, we’ll dive into the receipt automation process, how it works in the Yokoy spend management suite, and its benefits for finance professionals.

What is receipt OCR?

As its name implies, receipt OCR is a technology that uses OCR technology (Optical Character Recognition) to extract text and data from scanned or photographed receipts.

OCR algorithms are trained to recognize and convert printed or handwritten text on receipts into machine-readable data.

In the context of spend management and finance, this technology plays a crucial role in automating the tedious task of manually inputting receipt information into expense reports or accounting systems.

How receipt data extraction works

Receipt data extraction involves a series of steps that harness the power of AI and OCR technology to convert receipt images into structured data. Here’s a breakdown of the process:

1. Image capture

Receipts can be captured using various devices, including smartphones, scanners, or dedicated receipt capture tools.

High-quality images are essential for accurate OCR results.

2. Image preprocessing

Prior to OCR, images may undergo preprocessing to enhance clarity and remove any background noise or distortion.

This step ensures optimal OCR accuracy.

3. Optical Character Recognition (OCR)

- OCR algorithms analyze the image, recognizing text characters and patterns.

- Handwritten or printed text on the receipt is converted into machine-readable data.

4. Data extraction

Extracted data includes key receipt details such as date, merchant name, transaction amount, and more.

Advanced OCR systems can also categorize expenses based on predefined criteria.

5. Data validation

- Extracted data is validated against predefined rules and formats to ensure accuracy.

- Any discrepancies or errors can be flagged for review.

6. Integration

Extracted receipt data is seamlessly integrated into expense management or accounting software.

This integration minimizes manual data entry and ensures data consistency.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Why OCR is not enough for receipt digitization

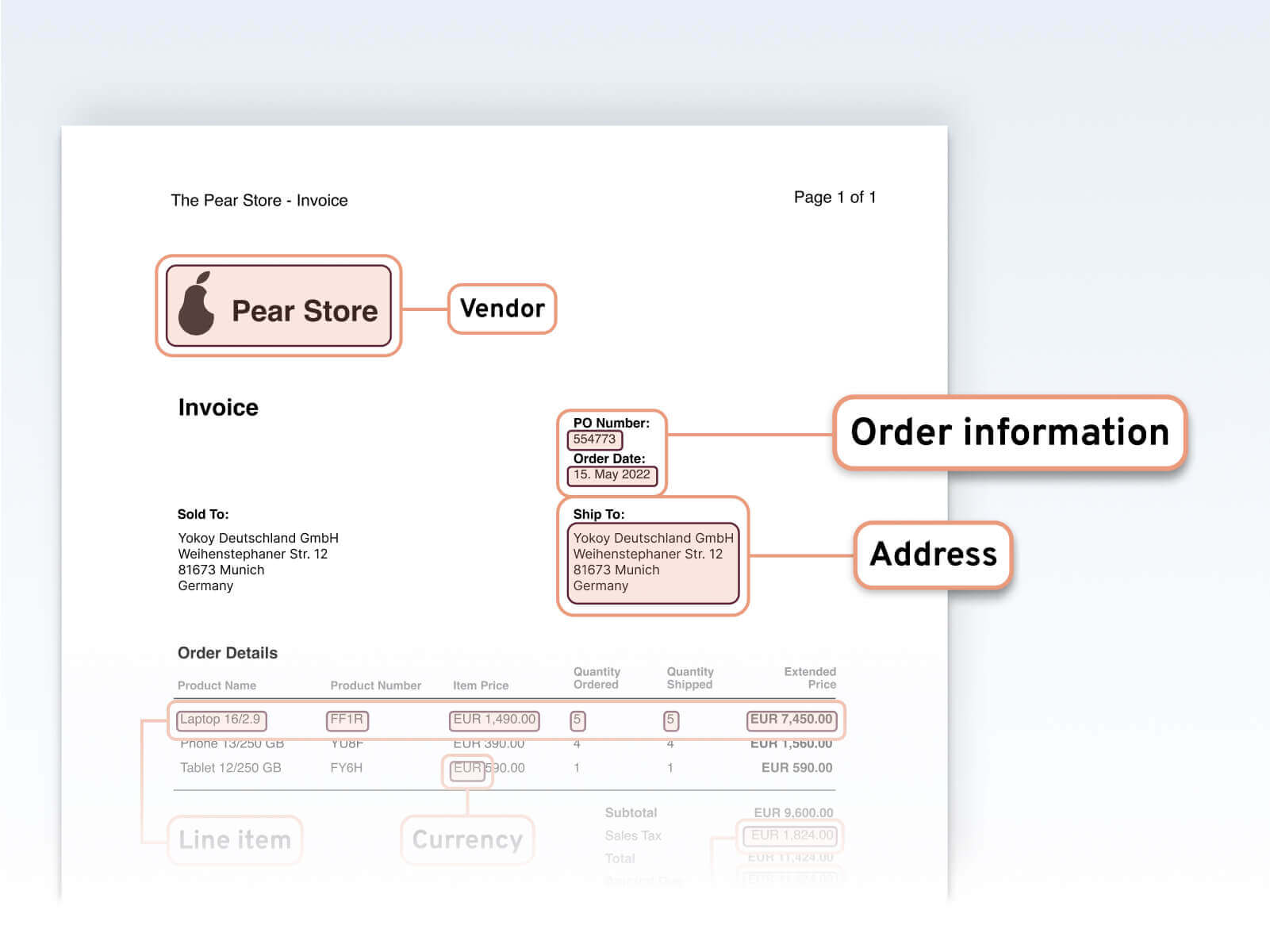

While an OCR can read out data such as the amount on the receipt, the receipt number, or the date, this technology cannot automatically recognize more sophisticated and unstructured data. Thus, receipt scanners that use receipt OCR APIs can only go so far.

This limitation is why many receipt digitization processes incorporate additional technologies like AI to improve accuracy and handle more sophisticated data extraction tasks. But before we look into the advantages of using artificial intelligence, let’s quickly look at the limitations of OCR software.

1. Lack of contextual understanding

OCR primarily focuses on text recognition. It is good for simple document processing, as it can read most of the relevant information, but may struggle to understand the context in which the text appears on a receipt.

For example, it may read “5” as a quantity without knowing if it’s a quantity of products or the number of items on a menu.

2. Handwriting recognition challenges

The effectiveness of this technology is strongly dependent on the document type. For example, purchase orders, invoices, and handwritten receipts can be challenging for OCR. Handwriting styles vary widely, and OCR may misinterpret characters or words.

This can lead to inaccuracies in digitized data. When total amounts, unit prices, line items and other key information is read incorrectly, this introduces errors into the receipt processing workflow.

3. Receipt layout variability

Receipts come in various formats and layouts. OCR may have difficulty extracting data consistently from receipts with non-standard layouts. Thus, this technology may not be the best choice for complex use cases and business needs – for example, receipts from different countries, in different languages and currencies, or with stamps on them.

Complex formatting, logos, or decorative elements can further complicate OCR processing.

As you can see, while OCR is a powerful technology, it has inherent limitations that make it insufficient for complete receipt digitization.

To overcome the limitations of OCR in the receipt scanning process, finance professionals should consider incorporating Artificial Intelligence (AI) into their receipt digitization processes. AI adds an extra layer of intelligence and context understanding to the digitization process. Here’s how AI complements OCR.

Automating receipt data extraction with AI

Imagine a multinational corporation with employees spread across the globe. Without receipt OCR and AI technology, processing expenses from different regions would be a logistical nightmare.

However, by implementing AI-powered automation, they can effortlessly collect, validate, and integrate receipt data from various sources, ensuring consistency and compliance on a global scale.

This is all possible with Yokoy’s spend management suite. Here’s a breakdown of how the automation of receipt processing works in Yokoy.

How Yokoy's receipt AI works

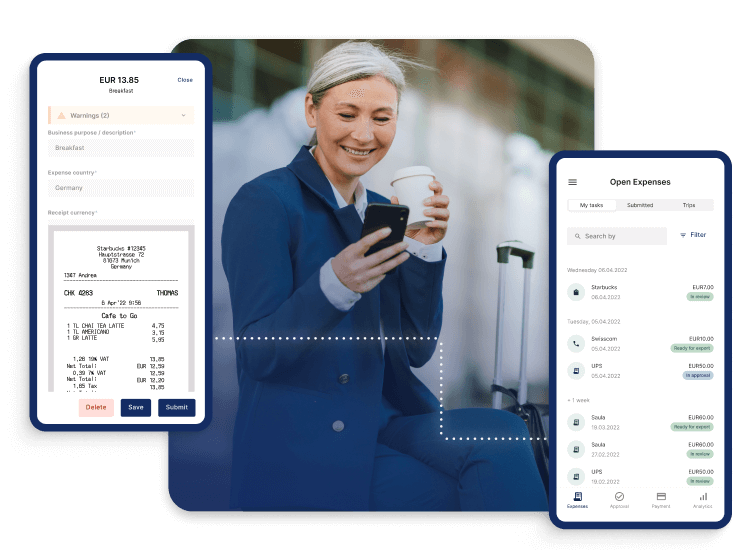

In the Yokoy app, AI can recognize the category of an expense, while automatically converting the currency, running compliance checks to ensure that the receipt doesn’t violate company policies, and check the submitted receipt for duplicates.

Here’s how the process works:

First, the employee pays for an expense using their private card or a Yokoy Smart Corporate Card. The latter option ensures that the 3rd step in this process – the auto-matching – can happen instantly with no additional integrations required.

- Once the transaction happens, the employee takes a picture of the receipt with their phone or the Yokoy app. The picture is then uploaded to the Yokoy mobile or web app – both options are possible.

- The AI algorithms kick in, reading the receipt, extracting the data, and structuring the receipt data for further processing. As said, Yokoy’s AI can recognize not only the amount and date of the receipt, but also the category of an expense, the currency, the VAT amount, and so on.

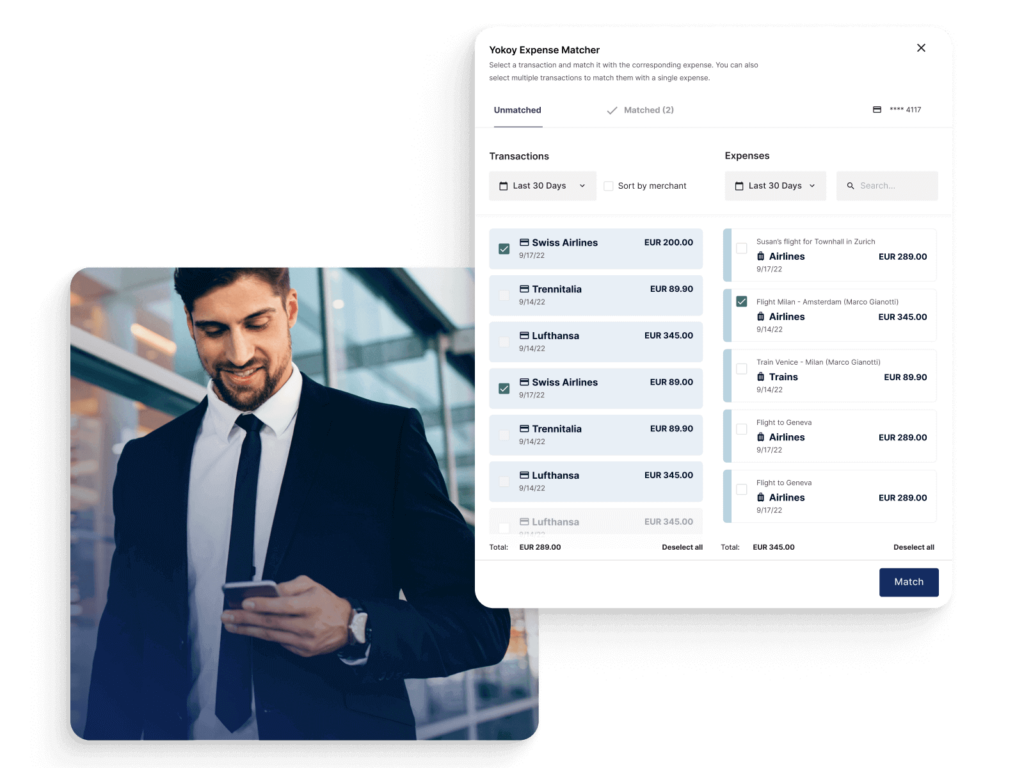

- Once the receipt is read, the artificial intelligence proceeds to automatically match the transaction with the receipt. This happens within seconds, on the go and in the background, so the employee doesn’t have to do anything.

- If, for some reason, you prefer to not have all your matching automated, or in case of errors and breaches, you can manually match the card transactions with expenses.

If you opt for full automation, depending on your setup, custom workflows and approval flows will begin. These go all the way to auto-exporting the expenses to your ERP system for correct and automated accounting booking.

The artificial intelligence algorithms can trigger warnings and real-time notifications in case of policy breaches, so that no faulty receipts go through. This enables higher workflow automation while guaranteeing a reduction in errors and revision safety.

Only edge cases that cannot be validated by the AI model or are outside of company policies have to be double checked, saving the finance team a significant amount of time.

This is, however, up to your team. If you prefer to have a lower level of automation, that is also possible, although most of our customers prefer to have all their receipts and expenses checked by AI first.

Yokoy reads more than 300 data points on a receipt, and gets smarter with every receipt and expense processed. Moreover, by training the machine learning algorithms on your own data set, you’ll be able to automate most of your expense management process, from receipt submission to booking into the ERP system.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Benefits of digitizing receipts with AI technology

Now that we understand how receipt AI works, let’s explore the tangible benefits it offers to finance professionals.

No more receipt chasing: No losing or searching for receipts, and no missing or chasing of receipts.

Time savings: Receipt artificial intelligence eliminates the need for manual data entry, saving finance teams countless hours. This time can be redirected towards more strategic financial tasks.

Reduced errors: Human error in data entry can lead to costly mistakes. Using a mix of OCR and AI technology significantly reduces the risk of inaccuracies, promoting financial data integrity.

Fraud prevention: OCR and AI technology can help detect suspicious receipts or expenses, aiding in fraud prevention and compliance efforts.

Improved visibility: Automated data extraction provides real-time visibility into expenses, enabling better financial decision-making and budget management.

Scalability: As your company grows, artificial intelligence technology scales with you. It can handle a high volume of receipts without compromising accuracy.

Compliance: Receipt data can be stored and managed in compliance with regulatory requirements, reducing compliance-related headaches.

Next steps

While OCR is a valuable technology for receipt digitization, it has limitations related to context understanding, handwriting recognition, and receipt layout variability. To achieve comprehensive and error-free digitization, finance professionals should complement OCR with AI technology.

By doing so, they can harness the full potential of automation and intelligence, enabling more accurate, efficient, and context-aware receipt digitization processes.

If you’d like to see how Yokoy can help automate the receipt extraction process and the matching of expenses with transactions, for a fully automated expense management process, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.