Home / Kilometervergoeding betalen: complete gids [2024]

Kilometervergoeding betalen: complete gids [2024]

- Laatst bijgewerkt:

- Blog

Growth Marketing Manager

When it comes to business travel, there are many times when you want to make sure your mileage allowance covers the distance of your journey.

This guide will explain how to calculate and track your mileage allowance so that you can manage your journey in the most effective way possible.

First off, let’s explain what ‘mileage allowance’ is.

What is mileage allowance and why is it important?

Mileage allowance is essentially a sum of money that employees receive based on the number of miles they drive for work-related purposes using their personal vehicle.

This allowance is important because it helps cover the cost of gas, wear and tear on the vehicle, and other expenses incurred during travel. Without this allowance, they would have to bear these costs out of their own pocket.

What qualifies as business mileage?

Business mileage refers to the distance you travel for work-related purposes using a personal vehicle. It’s an essential aspect of financial tracking for businesses, ensuring that travel expenses related to vehicle use are accurately recorded.

Business mileage includes travel to various locations, such as client meetings, site visits, conferences, and other job-related tasks.

These business expenses are distinct from personal mileage, which pertains to trips made using your own vehicle but for personal reasons, like grocery shopping or commuting to and from your primary workplace.

To qualify as business mileage, a trip must meet certain criteria:

Work-related destination: The trip’s primary purpose must be business-related. This could involve visiting clients, attending work meetings, or making deliveries.

No personal detours: While en route to a business-related destination, any stops or detours for personal activities are not considered business mileage. For instance, if you drive to a client meeting but stop at a coffee shop for personal reasons, that portion of the trip isn’t business mileage.

Home office to work site: If you work from a home office and need to travel to another location for work purposes, the mileage from your home to the work site is typically considered business mileage.

Temporary work sites: If your job requires you to travel between temporary work sites, the mileage between these locations qualifies as business mileage.

Voordat je gaat …

Mis het niet

Doe mee met 12’000+ finance professionals en ontvang de laatste inzichten over de transformatie van finance direct in je inbox.

How is mileage allowance calculated?

There are generally two methods for calculating mileage allowance:

Standard mileage rate: Many countries offer a standard mileage rate set by tax authorities. This rate is designed to simplify the reimbursement process. Employees track their business mileage, and the employer reimburses them at the specified rate per mile. The standard rate considers various expenses, including fuel, maintenance, insurance, and depreciation.

Actual expenses: Alternatively, some employers opt for a more detailed approach, where employees track and report their actual expenses associated with business mileage. This includes costs such as fuel, maintenance, insurance, registration, and depreciation. Employers then reimburse the employee based on these documented expenses.

Mileage allowances can differ depending on the industry, company policy, and location, among other things. A good approach is to calculate the average distance you travel for business and multiply it by the applicable mileage rate.

Organizations often provide a standard rate, but you can also find various government websites that list the current rates, so you’re not left guessing.

Mileage tracking methods

Accurate mileage tracking is essential for businesses to reimburse employees and claim tax deductions. There are various methods to track business mileage:

Manual logs: Maintain a physical logbook where you record trip details, including the starting and ending odometer readings, destination, and purpose.

- Odometer readings: Simply record the starting and ending odometer readings for each trip. Keep a record of the purpose and destination.

Mobile apps: Many mobile apps allow you to track mileage automatically using GPS. These apps can record trip details and provide comprehensive reports.

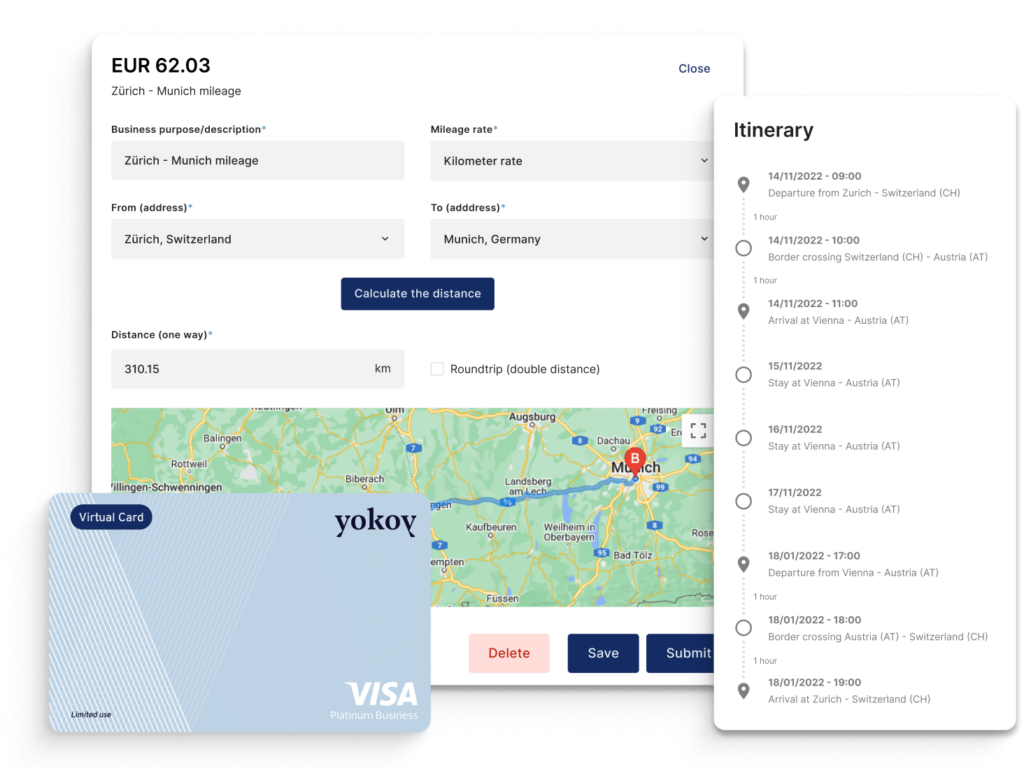

For example, Yokoy’s travel and expense module makes it very easy to track mileage. You only have to add your starting address and destination place, and the rest is calculated for you automatically.

Who pays mileage reimbursements?

Businesses often reimburse employees for business mileage to cover the cost of fuel and vehicle maintenance costs. The approved amounts for reimbursement rates may vary and can be based on factors like company policy or government guidelines.

The standard mileage rate set by tax authorities can be a reference for businesses when determining reimbursement rates.

What are official mileage allowance rates?

Mileage allowance rates vary by country, and it’s essential to stay updated with the latest rates to ensure accurate reimbursement. Here are the official mileage allowance rates for several countries.

Mileage allowance in the UK

In the UK, mileage claims and reimbursement are calculated and paid according to HMRC rules. Whether you’re an employee or self-employed, understanding these rules is essential to ensure you receive accurate mileage reimbursement for your business-related mileage.

If you use your personal vehicle for business-related driving, your employer can reimburse you for your business miles.

This reimbursement, known as Mileage Allowance Payment (MAP), covers expenses like fuel, servicing, maintenance, insurance, and road tax for business-related driving. This HMRC mileage allowance is typically provided on a monthly basis and can be a per-mile rate or a lump sum.

In simple terms, if your trip is for business purposes, it qualifies for mileage reimbursement according to HMRC. Business trips include:

Travel between your permanent workplace and temporary work locations (e.g., visiting clients or suppliers).

Travel between temporary workplaces.

Travel between two workplaces within the same employment.

Travel from your home to another workplace if your home is your permanent workplace due to job requirements.

Commuting from home to work or personal trips unrelated to business do not qualify for reimbursement.

As of the 2023/2024 tax year, the the approved mileage rates are as follows:

Car mileage, which covers cars and vans:

45p for the first 10,000 business miles.

25p for each business mile after 10,000 miles.

For motorcycles:

24p per business mile.

For bicycles:

20p per business mile.

It’s important to note that these approved mileage allowance payment rates have remained unchanged since 2011.

HMRC mileage rates cover various vehicle expenses for your business miles, including fuel, servicing, repairs, maintenance, depreciation, insurance, and road tax. However, they do not cover road tolls, parking fees, congestion charges, speeding or parking fines, or other road-related offenses.

If your employer does not reimburse you, you can claim a mileage allowance from HMRC, known as Mileage Allowance Relief, provided you meet the requirements for business-related driving and maintain an HMRC-compliant mileage log.

Mileage allowance in Austria

Austrian government recognises the below mileage allowances as a flat-rate for all costs incurred for the usage of private vehicles for a business trip. This amount can be recognised for a maximum of 30,000 kilometre per calendar year.

Car – 0.42€/Kilometer

Motorbikes – 0.24€/Kilometer

Passengers – 0.05€/Kilometer

Bicycle – 0.38€/Kilometer

If the company decides to pay more than the government rates (see table above), the difference in amount is considered as taxable income and needs to be accounted for as such (different accounting booking needed for the excess mileage rates).

Mileage allowance in Germany

Mileage expenses are aimed to cover the employee’s commute cost for business trips when using a private vehicle apart from the daily allowance/Per Diem. The German government recognises the below mileage allowances as a flat-rate for all costs incurred for the usage of private vehicles for a business trip.

0.30€ per Kilometer for Car

0.20€ per Kilometer for a Motorcycle

If the employee receives the amount more than what’s recommended by the government, the additional amount falls under income tax.

For example: The government recommends 0.30€ Per kilometer; however,if the employee receives 0.50€ per kilomoter, the difference of 0.20€ per kilometer would be subjected to income tax and needs to be accounted differently.

Mileage allowance in Spain

Companies can reimburse employees to compensate expenses incurred for the usage of private vehicle for a business trip. In such cases, the employees are entitled to receive 0.19€ per kilometer as “Mileage allowance” recommended by the government.

Mileage allowance in Switzerland

According to Swiss code of obligations, employees are entitled to receive mileage allowances for using their private vehicles for business purpose. The official mileage rates set by the Swiss government are:

For Car

CHF 0.72 per kilometer (upto 10,000 Kilometer per year)

CHF 0.60 per kilometer (more than 10,000 Kilometer per year)

For Motorcycle the employees are entitled to receive CHF 0.40 per Kilometer

For Bicycle the employees are entitled to receive CHF 0.30 per Kilometer

Is mileage allowance tax deductible?

Business mileage can have tax implications. In some countries you can deduct business mileage expenses from your taxable income.

To do this, you must maintain accurate records of your business mileage. The tax authorities typically provide guidelines on how to claim these deductions.

- For example, in the United Kingdom, mileage allowance can be tax-deductible. As shown above, HMRC provides mileage rates that employers can use as guidance for the amount of allowance they should provide to employees. If your employer reimburses you at or below these approved rates, your mileage allowance is not taxed as income. However, if your reimbursement exceeds these rates, the excess amount is considered taxable income.

- In Austria, mileage allowance is tax-deductible for self-employed individuals and employees who use their private vehicles for business purposes. It’s important to maintain accurate records of your business-related mileage and the associated expenses to claim this deduction.

- In Germany, mileage allowance can be tax-deductible for self-employed individuals and employees. The tax authority in Germany provides specific mileage rates for tax deductions. To qualify for the deduction, you need to keep detailed records of your business-related mileage, including the purpose of each trip and associated expenses.

- In Spain, mileage allowance is tax-deductible for self-employed individuals and employees who use their private vehicles for business purposes. The tax authority in Spain provides specific mileage rates for tax deductions. To claim this deduction, maintain accurate records of your business-related mileage and the associated expenses.

Best practices for mileage allowance calculation

To ensure fair and accurate mileage allowance calculation, consider these best practices.

Use reliable mileage tracking tools: Employers and employees should use reliable mileage tracking tools or apps to record and report business mileage. This reduces errors and ensures accuracy.

Compliance with tax regulations: Stay compliant with tax regulations and adhere to the standard mileage rates established by tax authorities.

Regular reimbursement: Aim to reimburse employees promptly for their business mileage expenses. Timely reimbursement is a sign of respect and appreciation.

Yokoy’s travel and expense management can help simplify mileage tracking business expense management by automating the entire process, from expense submission and claim to employee reimbursement.

Moreover, through its built-in compliance checks, the Yokoy app ensures all expenses are within company policy, preventing fraud in mileage reimbursements.

If you’d like to see what Yokoy can do for your travel and expense management, book a demo below.

Vereenvoudig je uitgavenbeheer

Boek een demoGerelateerde inhoud

Als je dit artikel leuk vond, vind je de informatiebronnen hieronder misschien nuttig.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.